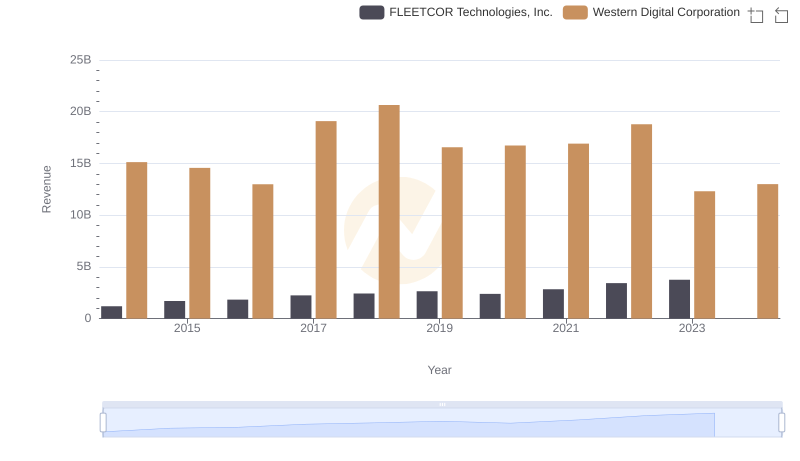

| __timestamp | FLEETCOR Technologies, Inc. | Western Digital Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 377744000 | 761000000 |

| Thursday, January 1, 2015 | 515047000 | 773000000 |

| Friday, January 1, 2016 | 519413000 | 997000000 |

| Sunday, January 1, 2017 | 671544000 | 1445000000 |

| Monday, January 1, 2018 | 571765000 | 1473000000 |

| Tuesday, January 1, 2019 | 612016000 | 1317000000 |

| Wednesday, January 1, 2020 | 567410000 | 1153000000 |

| Friday, January 1, 2021 | 747948000 | 1105000000 |

| Saturday, January 1, 2022 | 893217000 | 1117000000 |

| Sunday, January 1, 2023 | 1034248000 | 970000000 |

| Monday, January 1, 2024 | 997780000 | 828000000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding Selling, General, and Administrative (SG&A) expenses is crucial for effective cost management. Over the past decade, Western Digital Corporation and FLEETCOR Technologies, Inc. have demonstrated contrasting trends in their SG&A expenses.

From 2014 to 2023, FLEETCOR Technologies saw a staggering 174% increase in SG&A expenses, peaking in 2023. This upward trajectory highlights their aggressive expansion and operational scaling. In contrast, Western Digital's SG&A expenses peaked in 2018, with a subsequent decline of approximately 44% by 2024, reflecting strategic cost-cutting measures and efficiency improvements.

These insights underscore the importance of adaptive financial strategies in maintaining competitive advantage. As businesses navigate the complexities of the modern economy, the ability to manage SG&A expenses effectively can be a decisive factor in achieving sustainable growth.

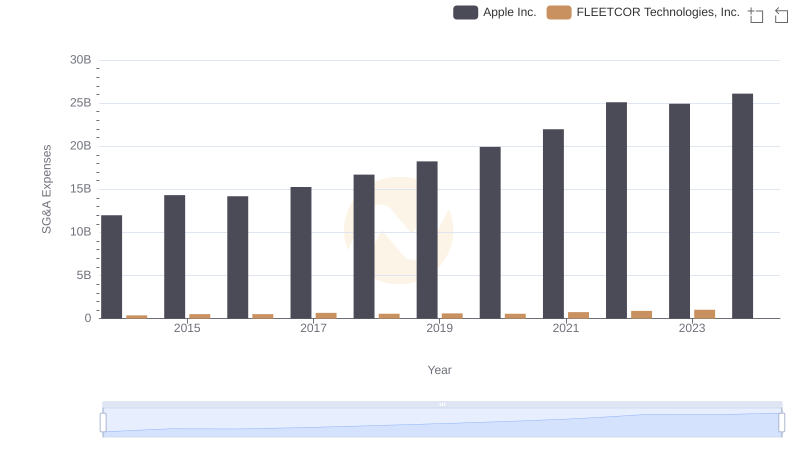

Who Optimizes SG&A Costs Better? Apple Inc. or FLEETCOR Technologies, Inc.

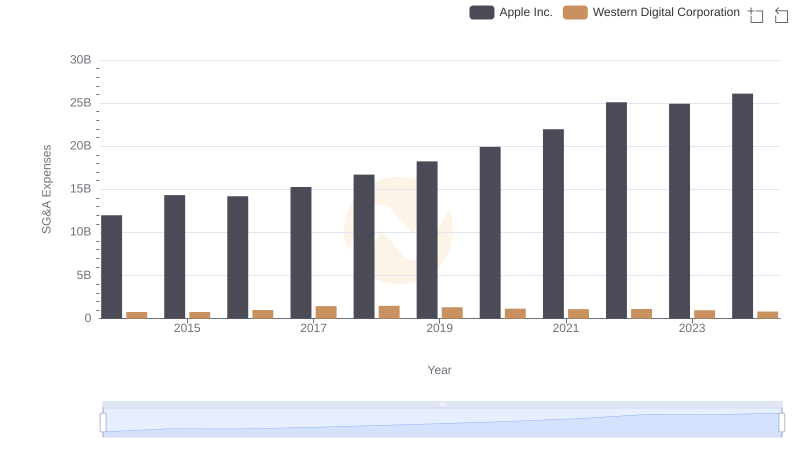

Who Optimizes SG&A Costs Better? Apple Inc. or Western Digital Corporation

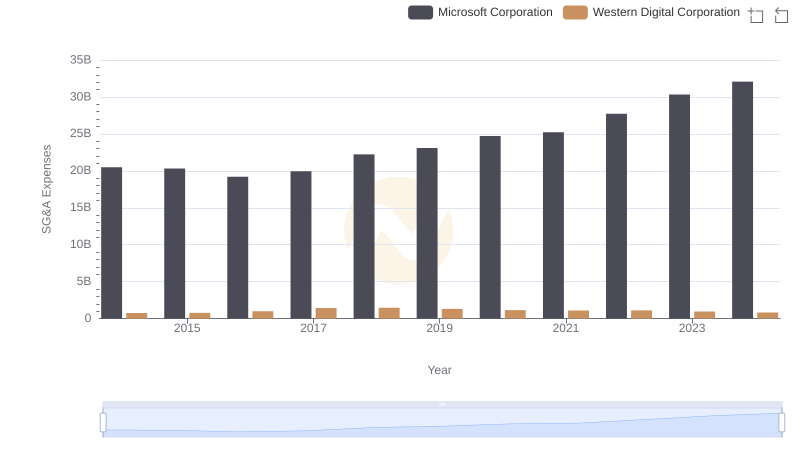

Microsoft Corporation and Western Digital Corporation: SG&A Spending Patterns Compared

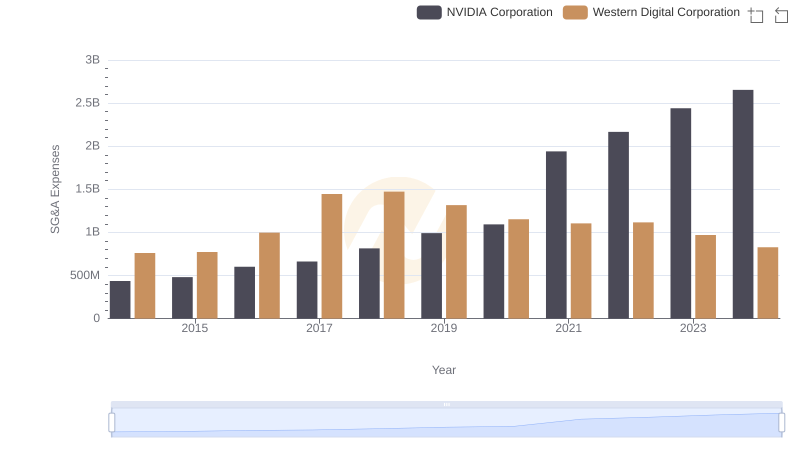

Breaking Down SG&A Expenses: NVIDIA Corporation vs Western Digital Corporation

Taiwan Semiconductor Manufacturing Company Limited vs FLEETCOR Technologies, Inc.: SG&A Expense Trends

Taiwan Semiconductor Manufacturing Company Limited vs Western Digital Corporation: SG&A Expense Trends

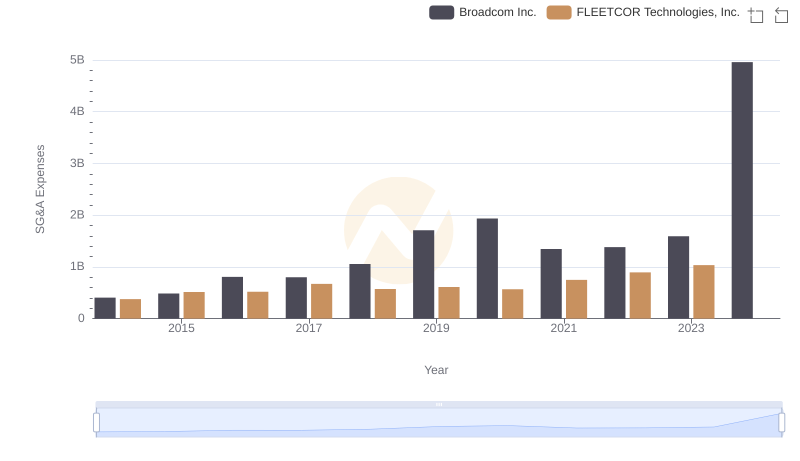

SG&A Efficiency Analysis: Comparing Broadcom Inc. and FLEETCOR Technologies, Inc.

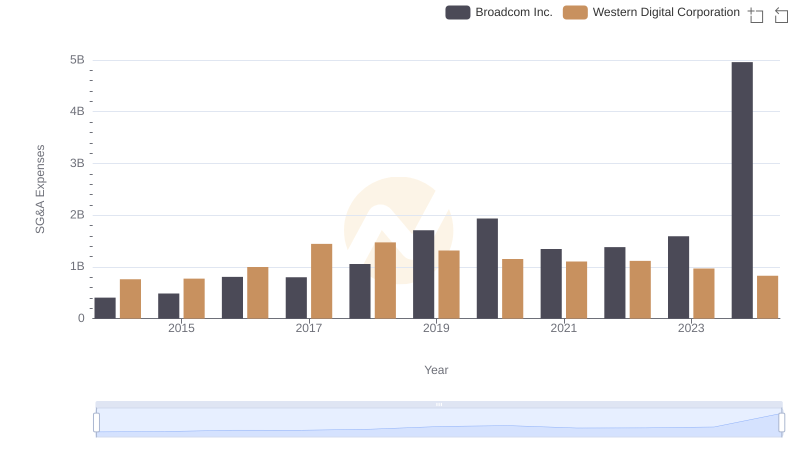

Operational Costs Compared: SG&A Analysis of Broadcom Inc. and Western Digital Corporation

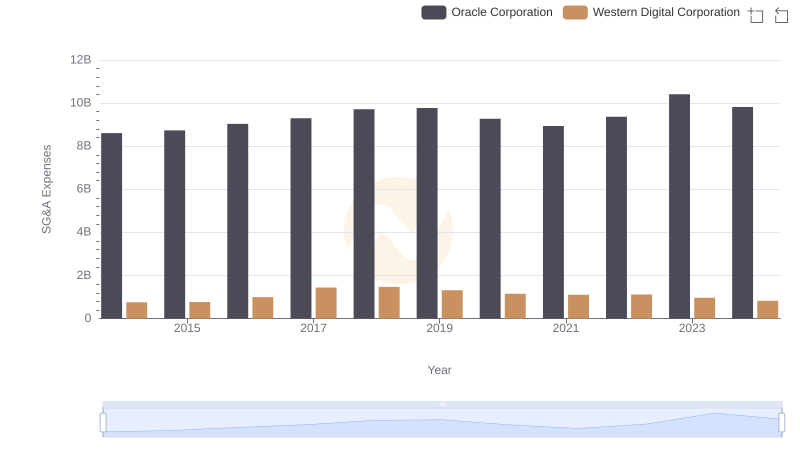

Operational Costs Compared: SG&A Analysis of Oracle Corporation and Western Digital Corporation

Western Digital Corporation vs FLEETCOR Technologies, Inc.: Examining Key Revenue Metrics

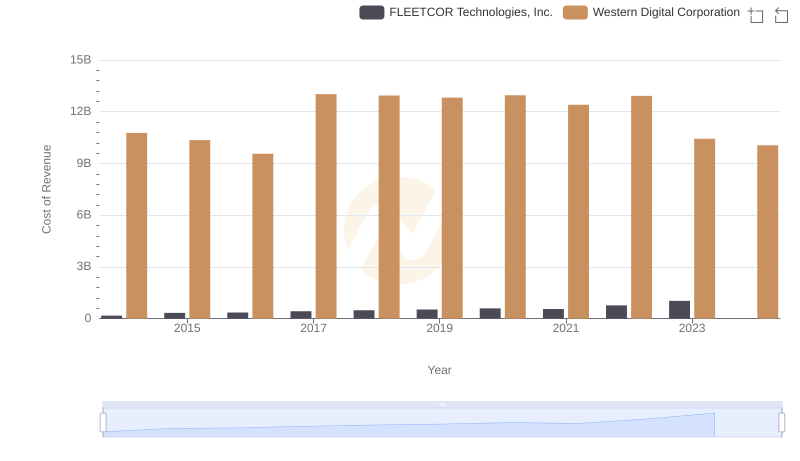

Analyzing Cost of Revenue: Western Digital Corporation and FLEETCOR Technologies, Inc.

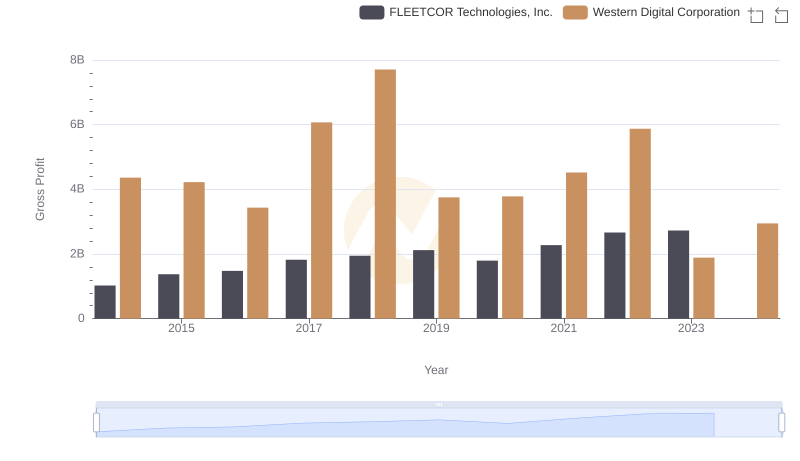

Gross Profit Trends Compared: Western Digital Corporation vs FLEETCOR Technologies, Inc.