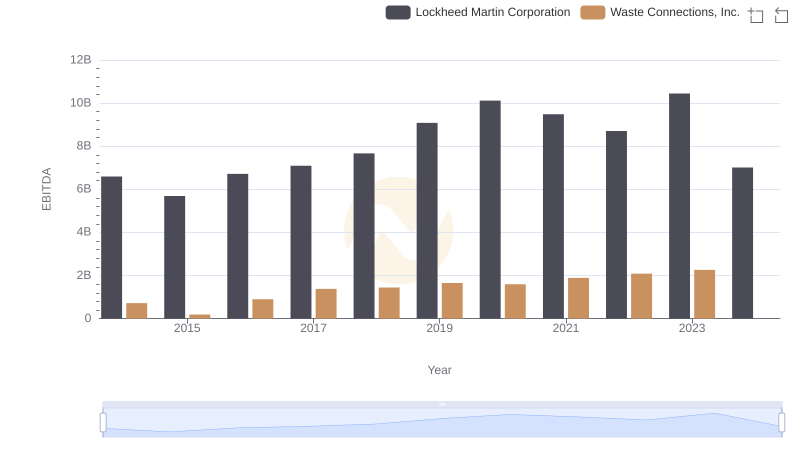

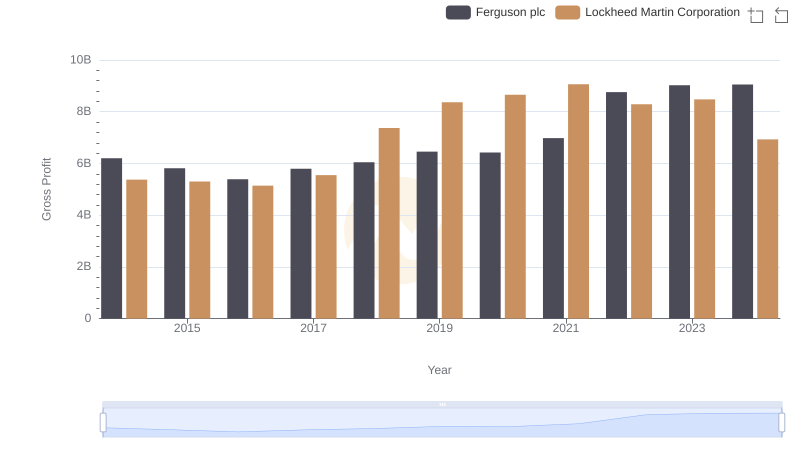

| __timestamp | Ferguson plc | Lockheed Martin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1450623023 | 6592000000 |

| Thursday, January 1, 2015 | 1500920522 | 5687000000 |

| Friday, January 1, 2016 | 1289082542 | 6716000000 |

| Sunday, January 1, 2017 | 1746753588 | 7092000000 |

| Monday, January 1, 2018 | 1487000000 | 7667000000 |

| Tuesday, January 1, 2019 | 1707000000 | 9083000000 |

| Wednesday, January 1, 2020 | 1979000000 | 10116000000 |

| Friday, January 1, 2021 | 2248000000 | 9483000000 |

| Saturday, January 1, 2022 | 3120000000 | 8707000000 |

| Sunday, January 1, 2023 | 3097000000 | 10444000000 |

| Monday, January 1, 2024 | 2978000000 | 8815000000 |

Cracking the code

In the ever-evolving landscape of global business, understanding the financial health of industry giants is crucial. This analysis delves into the EBITDA performance of Lockheed Martin Corporation and Ferguson plc from 2014 to 2024. Over this decade, Lockheed Martin consistently outperformed Ferguson, with an average EBITDA nearly four times higher. Notably, Lockheed Martin's EBITDA peaked in 2023, reaching approximately 10.4 billion, a 58% increase from its 2015 low. Meanwhile, Ferguson's EBITDA saw a significant rise, particularly in 2022, where it surged by 110% compared to 2016. This growth trajectory highlights Ferguson's strategic adaptations in a competitive market. However, 2024 shows a dip for both companies, suggesting potential market challenges. This comparative analysis not only underscores the resilience and strategic prowess of these corporations but also offers insights into their financial trajectories over a transformative decade.

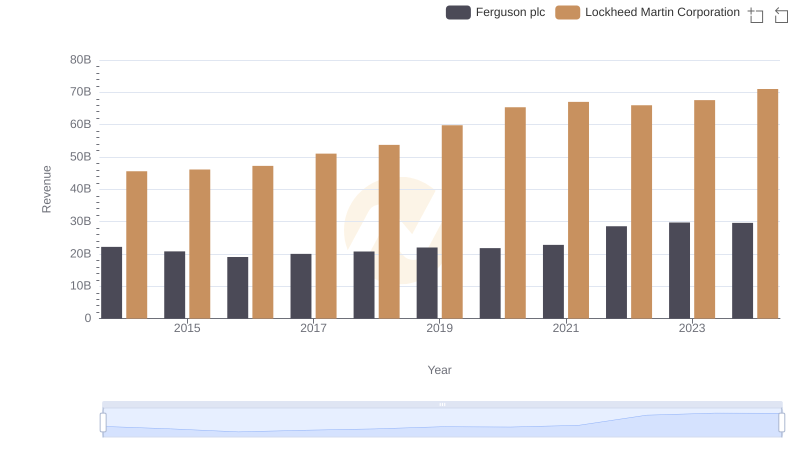

Annual Revenue Comparison: Lockheed Martin Corporation vs Ferguson plc

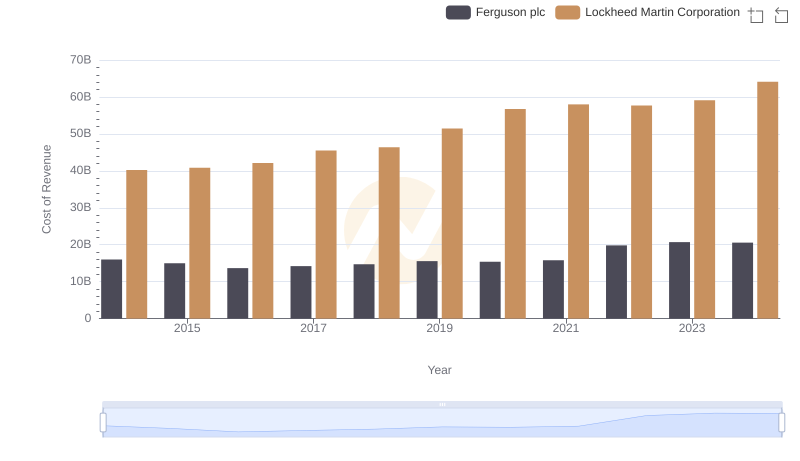

Comparing Cost of Revenue Efficiency: Lockheed Martin Corporation vs Ferguson plc

EBITDA Metrics Evaluated: Lockheed Martin Corporation vs Waste Connections, Inc.

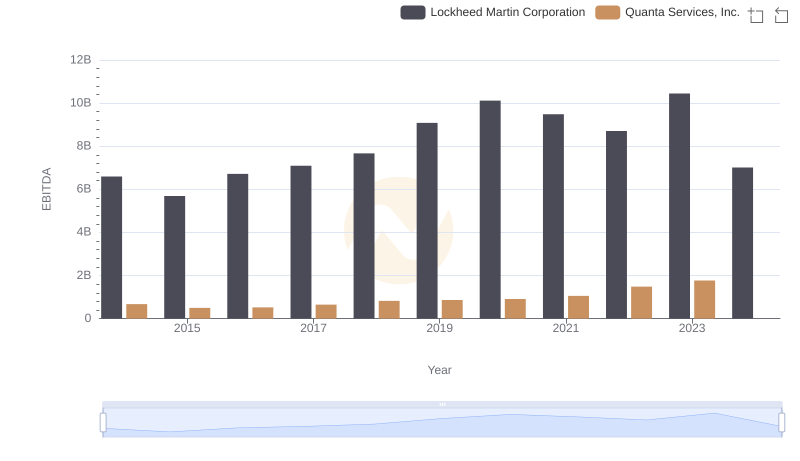

EBITDA Metrics Evaluated: Lockheed Martin Corporation vs Quanta Services, Inc.

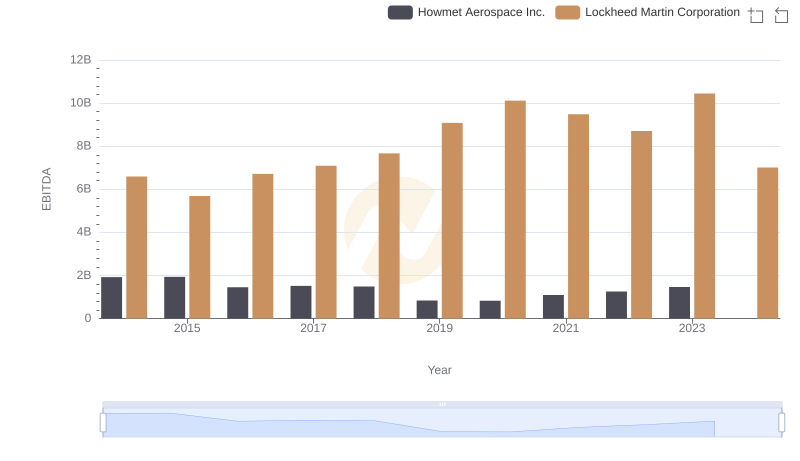

A Professional Review of EBITDA: Lockheed Martin Corporation Compared to Howmet Aerospace Inc.

Gross Profit Comparison: Lockheed Martin Corporation and Ferguson plc Trends

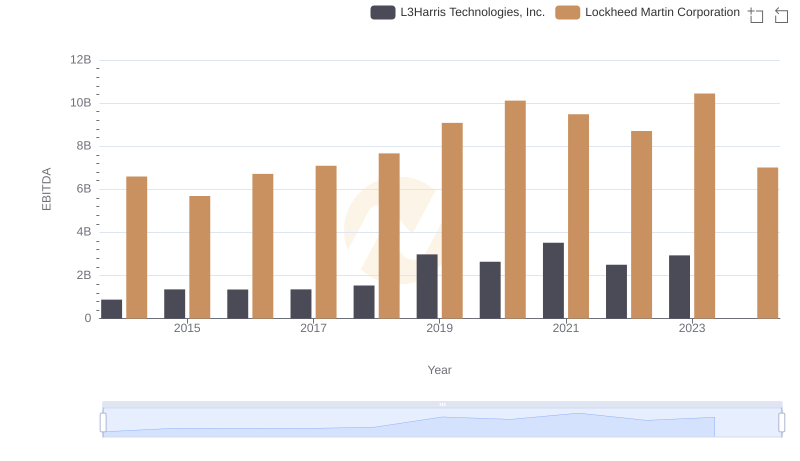

Lockheed Martin Corporation and L3Harris Technologies, Inc.: A Detailed Examination of EBITDA Performance

EBITDA Metrics Evaluated: Lockheed Martin Corporation vs Old Dominion Freight Line, Inc.

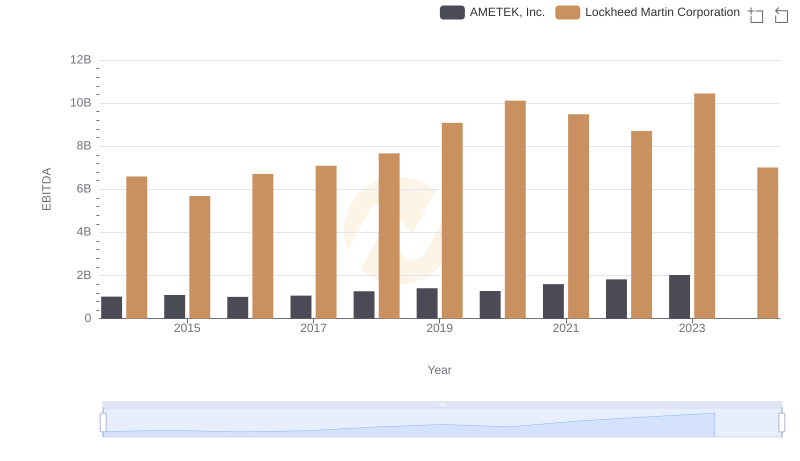

Lockheed Martin Corporation and AMETEK, Inc.: A Detailed Examination of EBITDA Performance

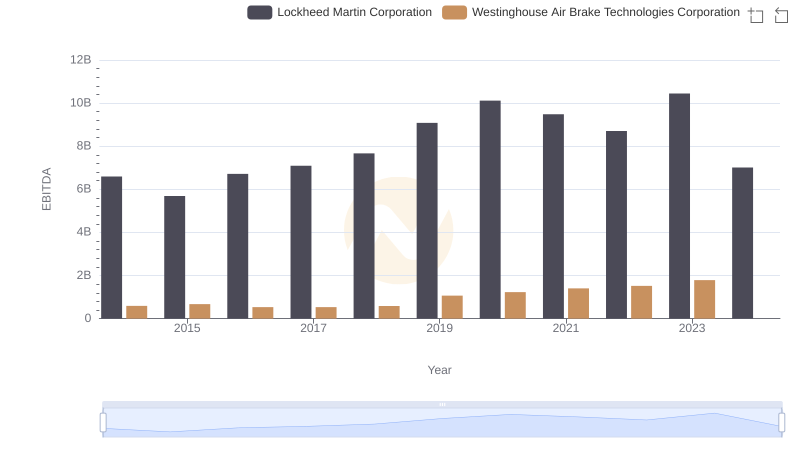

Lockheed Martin Corporation and Westinghouse Air Brake Technologies Corporation: A Detailed Examination of EBITDA Performance

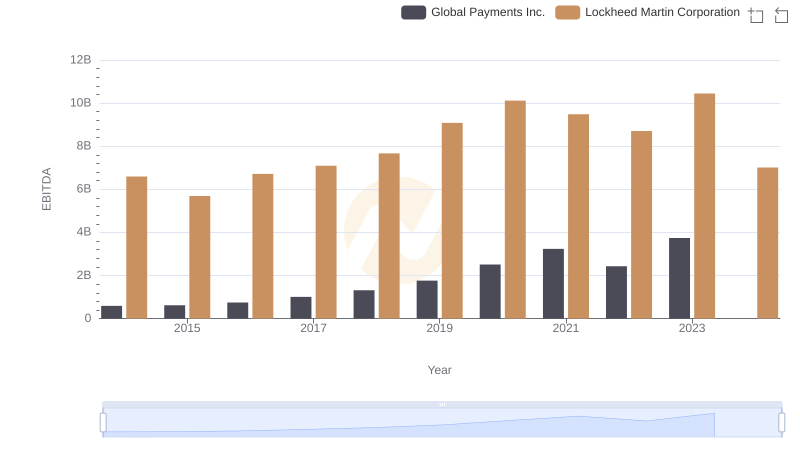

EBITDA Performance Review: Lockheed Martin Corporation vs Global Payments Inc.