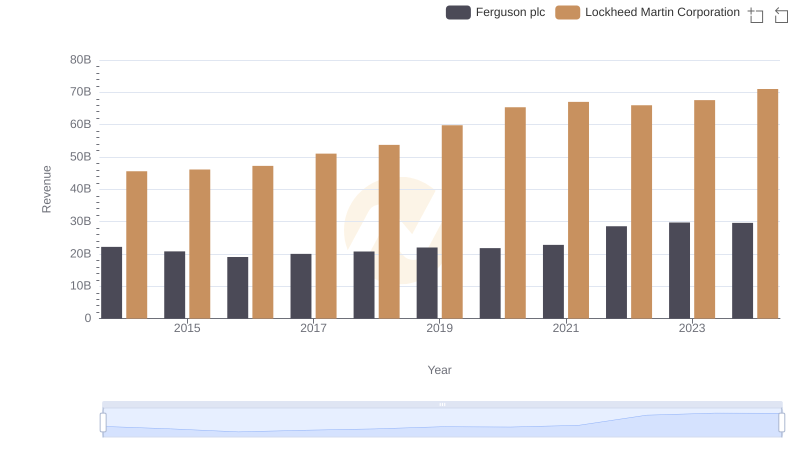

| __timestamp | Ferguson plc | Lockheed Martin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 15995739428 | 40226000000 |

| Thursday, January 1, 2015 | 14984241894 | 40830000000 |

| Friday, January 1, 2016 | 13677144858 | 42106000000 |

| Sunday, January 1, 2017 | 14215866673 | 45500000000 |

| Monday, January 1, 2018 | 14708000000 | 46392000000 |

| Tuesday, January 1, 2019 | 15552000000 | 51445000000 |

| Wednesday, January 1, 2020 | 15398000000 | 56744000000 |

| Friday, January 1, 2021 | 15812000000 | 57983000000 |

| Saturday, January 1, 2022 | 19810000000 | 57697000000 |

| Sunday, January 1, 2023 | 20709000000 | 59092000000 |

| Monday, January 1, 2024 | 20582000000 | 64113000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of global corporations, cost efficiency is a critical metric. Lockheed Martin Corporation and Ferguson plc, two industry titans, have demonstrated contrasting trends in their cost of revenue from 2014 to 2024. Lockheed Martin, a leader in aerospace and defense, has seen its cost of revenue rise by approximately 60%, reaching a peak in 2024. This reflects its expansive operations and increased production costs. Meanwhile, Ferguson plc, a major player in the plumbing and heating sector, has experienced a more modest increase of around 29% over the same period. This suggests a more stable cost management strategy. The data highlights the importance of industry-specific challenges and strategic decisions in shaping financial outcomes. As we look to the future, these trends offer valuable insights into the operational efficiencies of these global leaders.

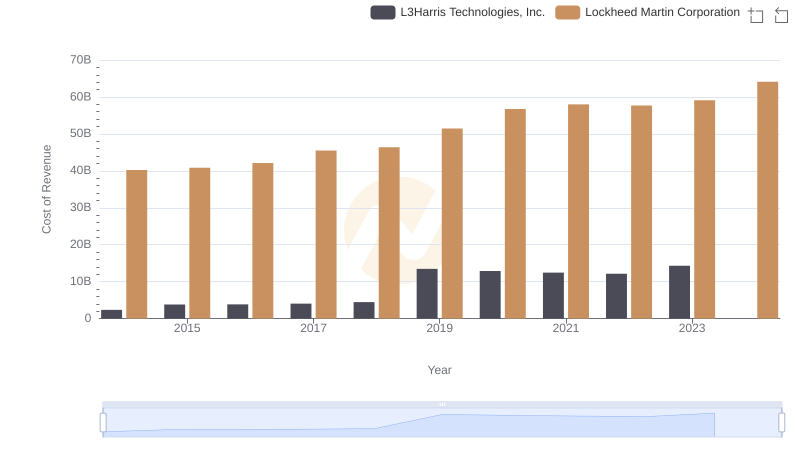

Lockheed Martin Corporation vs L3Harris Technologies, Inc.: Efficiency in Cost of Revenue Explored

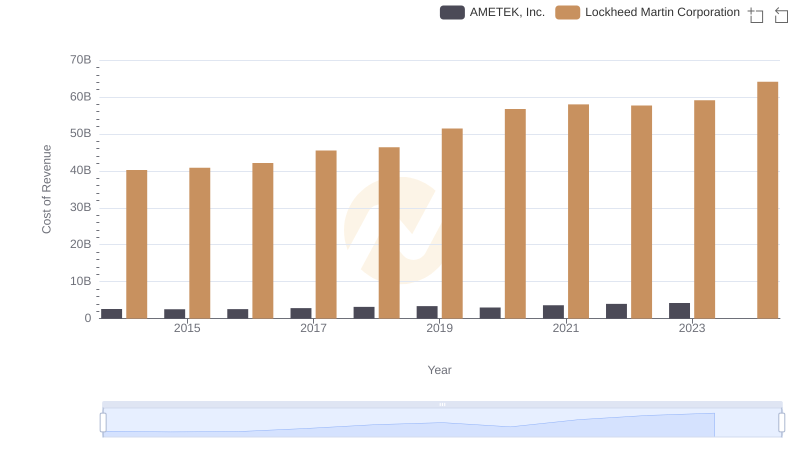

Cost of Revenue: Key Insights for Lockheed Martin Corporation and AMETEK, Inc.

Annual Revenue Comparison: Lockheed Martin Corporation vs Ferguson plc

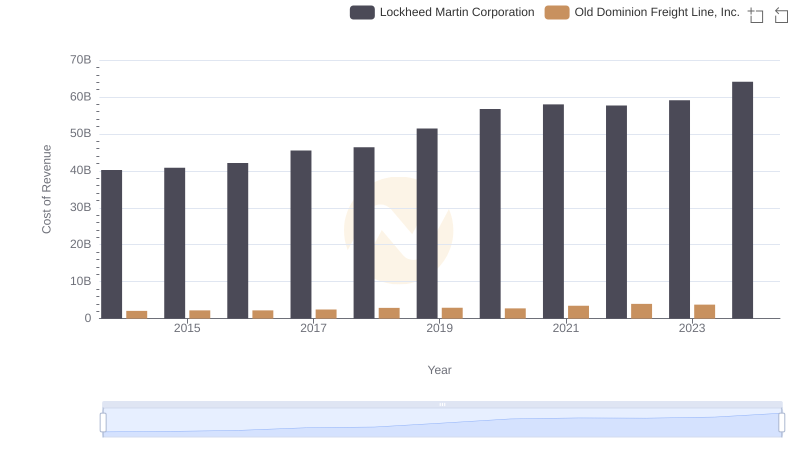

Cost of Revenue: Key Insights for Lockheed Martin Corporation and Old Dominion Freight Line, Inc.

Lockheed Martin Corporation vs Ingersoll Rand Inc.: Efficiency in Cost of Revenue Explored

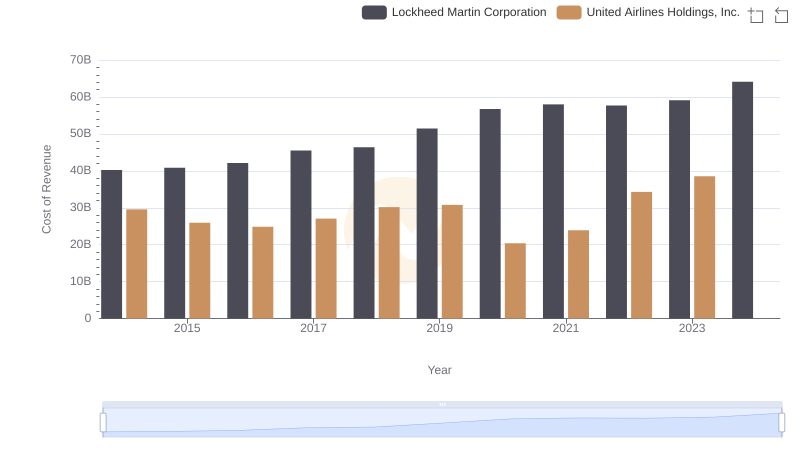

Cost of Revenue Comparison: Lockheed Martin Corporation vs United Airlines Holdings, Inc.

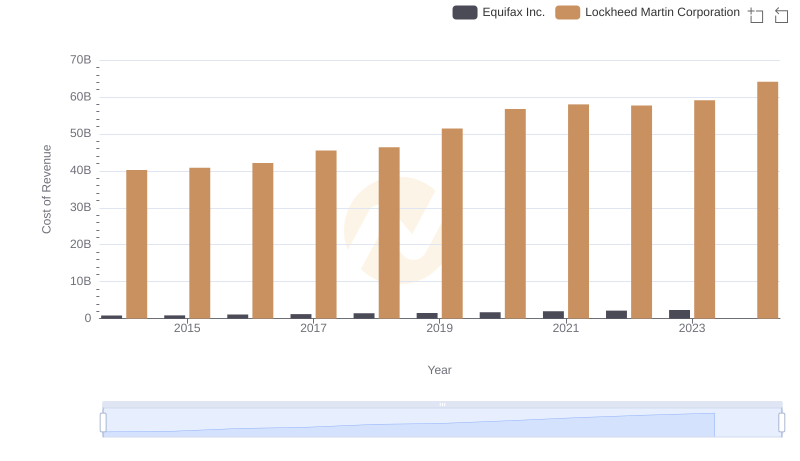

Comparing Cost of Revenue Efficiency: Lockheed Martin Corporation vs Equifax Inc.

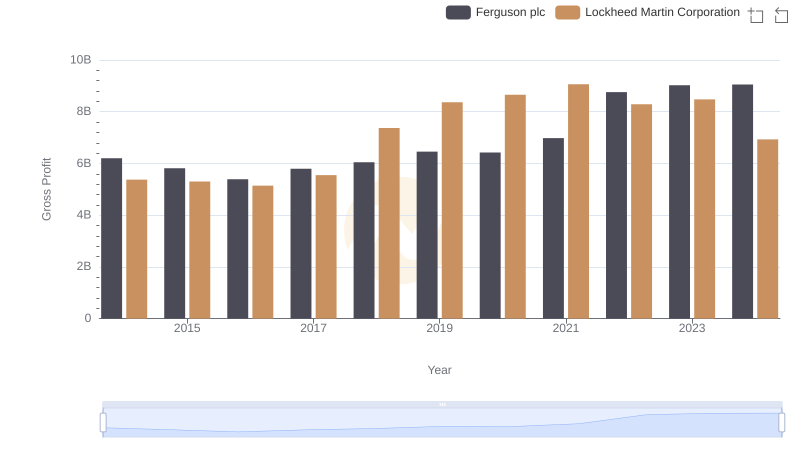

Gross Profit Comparison: Lockheed Martin Corporation and Ferguson plc Trends

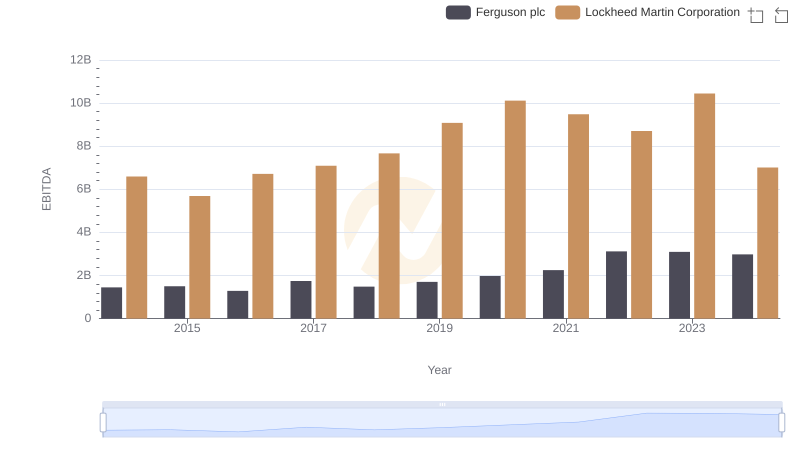

Comprehensive EBITDA Comparison: Lockheed Martin Corporation vs Ferguson plc