| __timestamp | Lockheed Martin Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6592000000 | 585590000 |

| Thursday, January 1, 2015 | 5687000000 | 660570000 |

| Friday, January 1, 2016 | 6716000000 | 671786000 |

| Sunday, January 1, 2017 | 7092000000 | 783749000 |

| Monday, January 1, 2018 | 7667000000 | 1046059000 |

| Tuesday, January 1, 2019 | 9083000000 | 1078007000 |

| Wednesday, January 1, 2020 | 10116000000 | 1168149000 |

| Friday, January 1, 2021 | 9483000000 | 1651501000 |

| Saturday, January 1, 2022 | 8707000000 | 2118962000 |

| Sunday, January 1, 2023 | 10444000000 | 1972689000 |

| Monday, January 1, 2024 | 8815000000 |

Data in motion

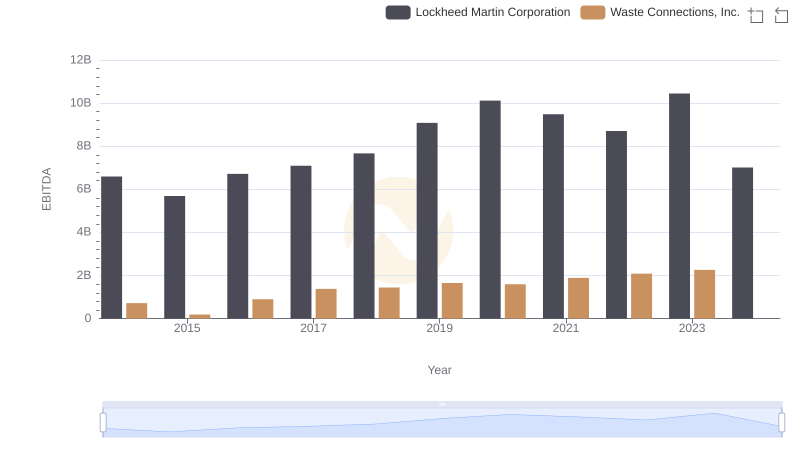

In the ever-evolving landscape of American industry, Lockheed Martin Corporation and Old Dominion Freight Line, Inc. stand as titans in their respective fields. Over the past decade, from 2014 to 2023, these companies have showcased remarkable financial resilience and growth, as evidenced by their EBITDA performance.

Lockheed Martin, a leader in aerospace and defense, has consistently demonstrated robust financial health, with EBITDA peaking in 2023 at approximately 10.4 billion USD, a 58% increase from 2014. Meanwhile, Old Dominion Freight Line, a powerhouse in the freight and logistics sector, saw its EBITDA grow by an impressive 237% over the same period, reaching around 2.1 billion USD in 2022.

While Lockheed Martin's EBITDA dipped slightly in 2024, Old Dominion's data for that year remains elusive, leaving room for speculation on its continued trajectory. This comparison highlights the dynamic nature of these industries and the strategic maneuvers that drive their success.

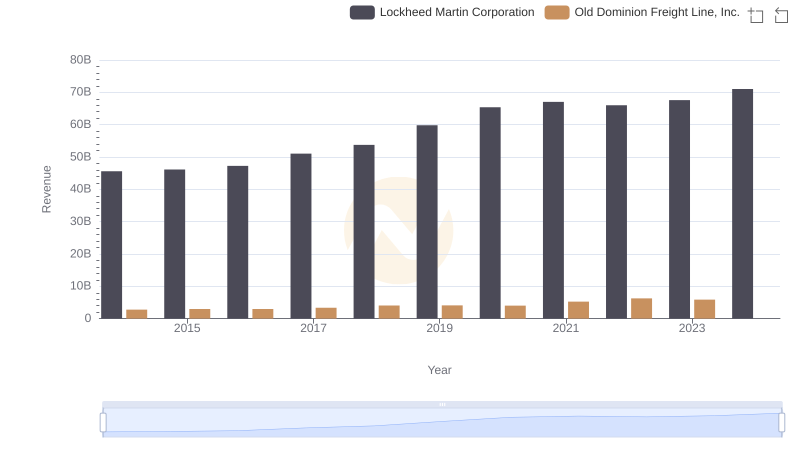

Who Generates More Revenue? Lockheed Martin Corporation or Old Dominion Freight Line, Inc.

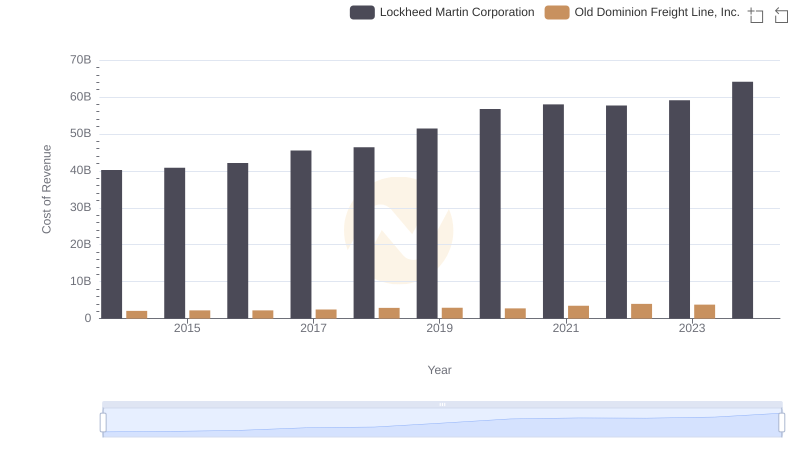

Cost of Revenue: Key Insights for Lockheed Martin Corporation and Old Dominion Freight Line, Inc.

Professional EBITDA Benchmarking: Lockheed Martin Corporation vs Paychex, Inc.

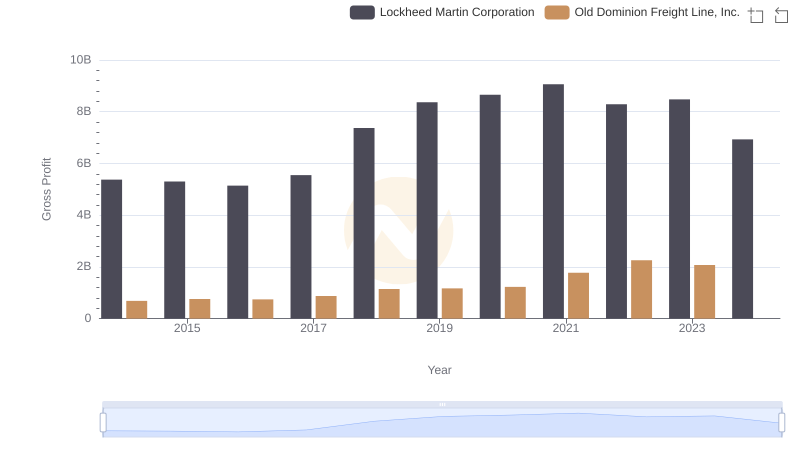

Key Insights on Gross Profit: Lockheed Martin Corporation vs Old Dominion Freight Line, Inc.

EBITDA Metrics Evaluated: Lockheed Martin Corporation vs Waste Connections, Inc.

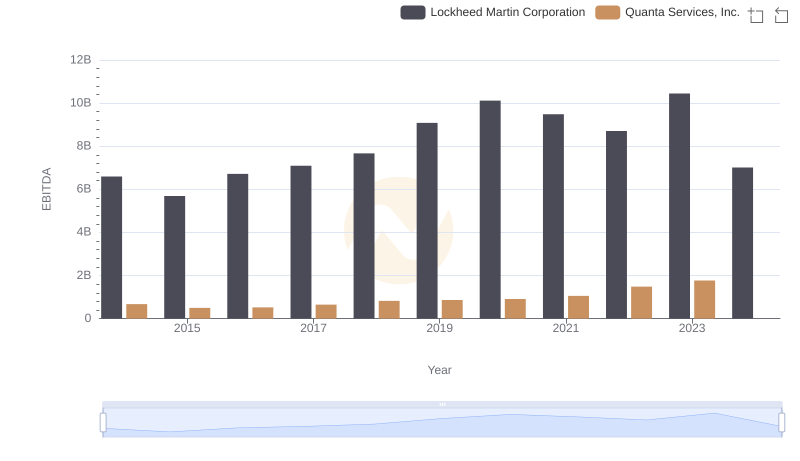

EBITDA Metrics Evaluated: Lockheed Martin Corporation vs Quanta Services, Inc.

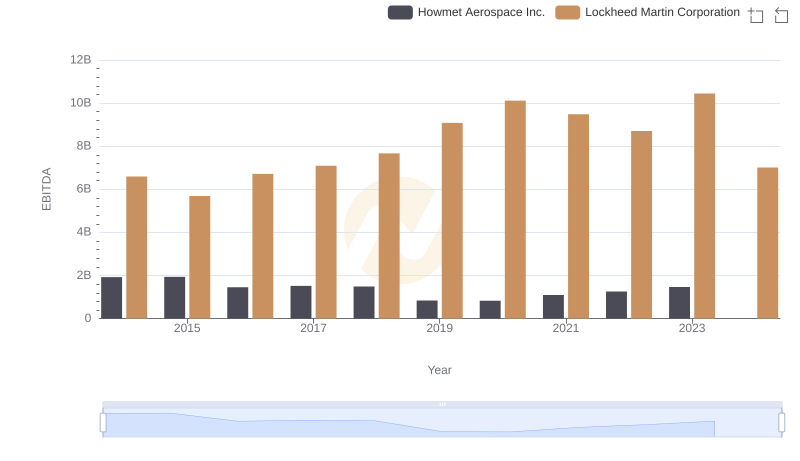

A Professional Review of EBITDA: Lockheed Martin Corporation Compared to Howmet Aerospace Inc.

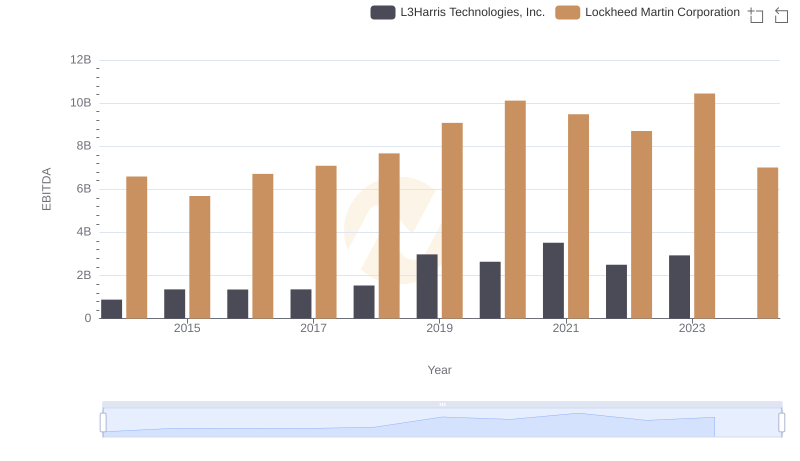

Lockheed Martin Corporation and L3Harris Technologies, Inc.: A Detailed Examination of EBITDA Performance

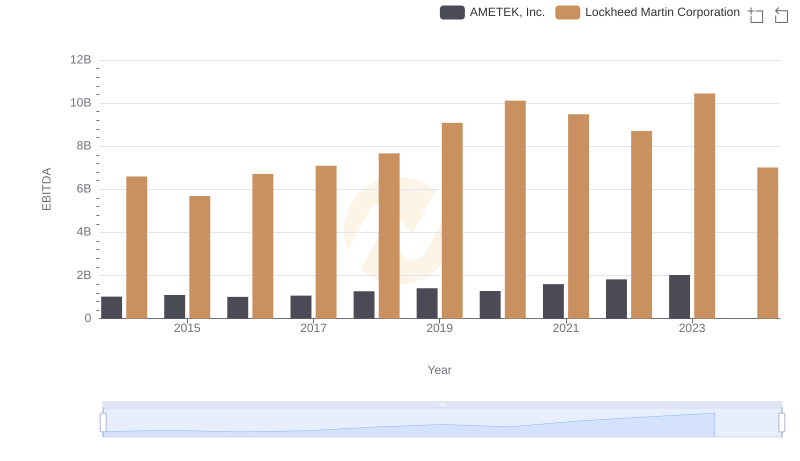

Lockheed Martin Corporation and AMETEK, Inc.: A Detailed Examination of EBITDA Performance

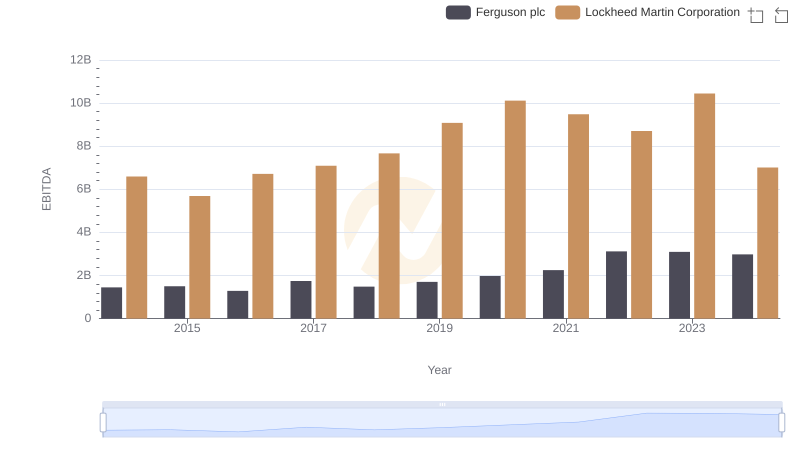

Comprehensive EBITDA Comparison: Lockheed Martin Corporation vs Ferguson plc

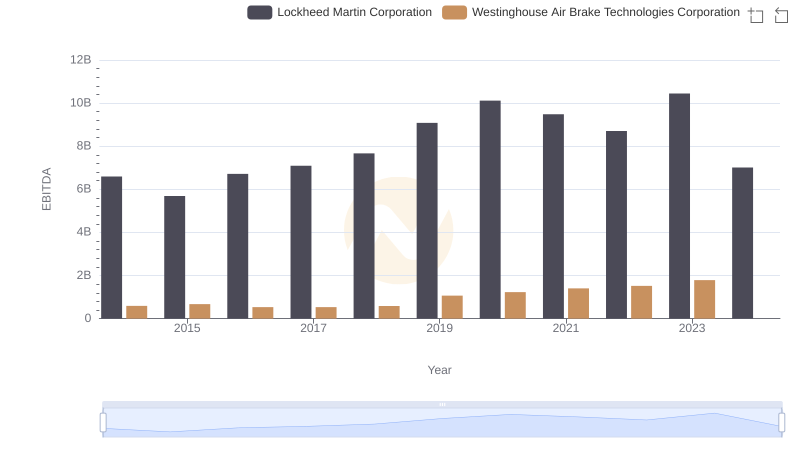

Lockheed Martin Corporation and Westinghouse Air Brake Technologies Corporation: A Detailed Examination of EBITDA Performance