| __timestamp | Booz Allen Hamilton Holding Corporation | Canadian National Railway Company |

|---|---|---|

| Wednesday, January 1, 2014 | 531144000 | 5674000000 |

| Thursday, January 1, 2015 | 520410000 | 6424000000 |

| Friday, January 1, 2016 | 506120000 | 6537000000 |

| Sunday, January 1, 2017 | 561524000 | 6839000000 |

| Monday, January 1, 2018 | 577061000 | 7124000000 |

| Tuesday, January 1, 2019 | 663731000 | 7999000000 |

| Wednesday, January 1, 2020 | 745424000 | 7652000000 |

| Friday, January 1, 2021 | 834449000 | 7607000000 |

| Saturday, January 1, 2022 | 826865000 | 9067000000 |

| Sunday, January 1, 2023 | 958150000 | 9027000000 |

| Monday, January 1, 2024 | 1199992000 |

Unleashing the power of data

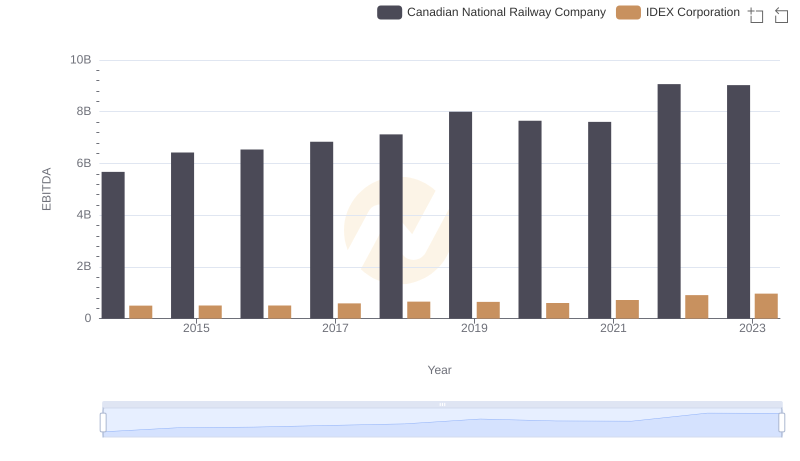

In the ever-evolving landscape of North American business, the financial performance of industry giants like Canadian National Railway Company and Booz Allen Hamilton Holding Corporation offers a fascinating glimpse into their strategic prowess. Over the past decade, from 2014 to 2023, Canadian National Railway has consistently outperformed Booz Allen Hamilton in terms of EBITDA, with figures peaking at approximately $9 billion in 2022. This represents a robust growth of around 60% from 2014. Meanwhile, Booz Allen Hamilton has shown a commendable upward trajectory, with EBITDA nearly doubling to $1.2 billion by 2024.

The data highlights a significant trend: while Canadian National Railway's EBITDA growth has been steady, Booz Allen Hamilton's recent surge suggests a strategic pivot or market expansion. However, the absence of data for Canadian National Railway in 2024 leaves room for speculation on its future performance.

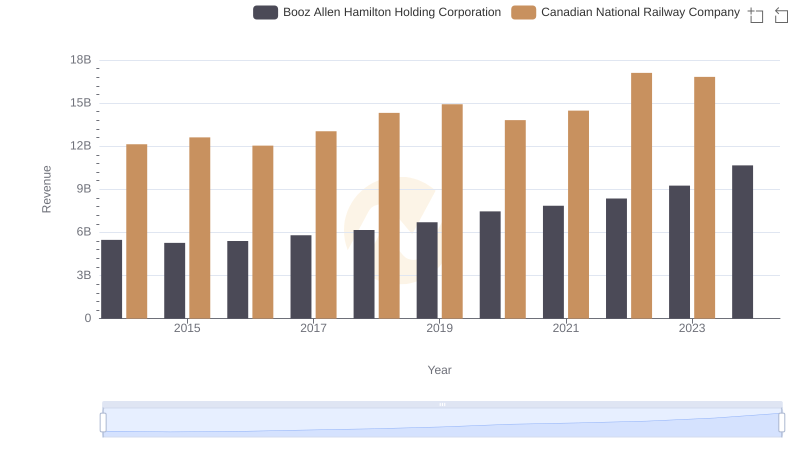

Revenue Showdown: Canadian National Railway Company vs Booz Allen Hamilton Holding Corporation

Comprehensive EBITDA Comparison: Canadian National Railway Company vs Pentair plc

A Professional Review of EBITDA: Canadian National Railway Company Compared to RB Global, Inc.

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and IDEX Corporation