| __timestamp | Canadian National Railway Company | Norfolk Southern Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 12134000000 | 11624000000 |

| Thursday, January 1, 2015 | 12611000000 | 10511000000 |

| Friday, January 1, 2016 | 12037000000 | 9888000000 |

| Sunday, January 1, 2017 | 13041000000 | 10551000000 |

| Monday, January 1, 2018 | 14321000000 | 11458000000 |

| Tuesday, January 1, 2019 | 14917000000 | 11296000000 |

| Wednesday, January 1, 2020 | 13819000000 | 9789000000 |

| Friday, January 1, 2021 | 14477000000 | 11142000000 |

| Saturday, January 1, 2022 | 17107000000 | 12745000000 |

| Sunday, January 1, 2023 | 16828000000 | 12156000000 |

| Monday, January 1, 2024 | 12123000000 |

Igniting the spark of knowledge

In the world of North American railways, Canadian National Railway Company (CNR) and Norfolk Southern Corporation (NSC) have long been titans of industry. Over the past decade, these two giants have showcased intriguing revenue trajectories. From 2014 to 2023, CNR's revenue grew by approximately 39%, peaking in 2022, while NSC saw a more modest increase of around 10% over the same period.

These trends highlight the resilience and adaptability of these rail giants in a dynamic economic landscape.

Revenue Insights: Canadian National Railway Company and CSX Corporation Performance Compared

Canadian National Railway Company vs PACCAR Inc: Examining Key Revenue Metrics

Canadian National Railway Company or Roper Technologies, Inc.: Who Leads in Yearly Revenue?

Canadian National Railway Company vs W.W. Grainger, Inc.: Annual Revenue Growth Compared

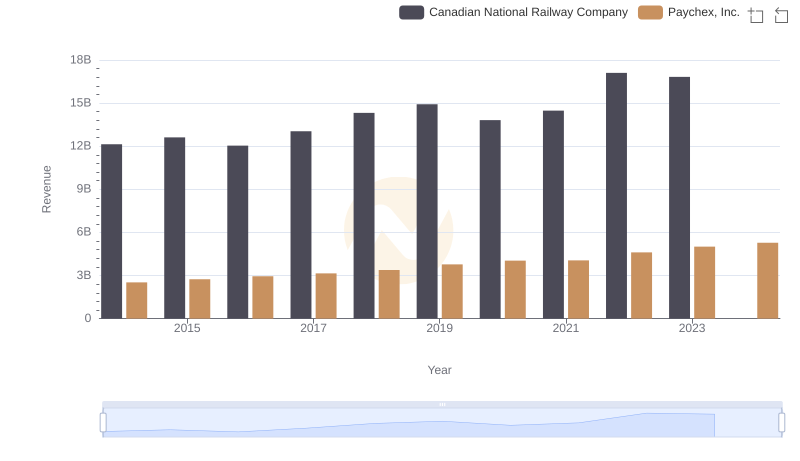

Breaking Down Revenue Trends: Canadian National Railway Company vs Paychex, Inc.

Cost of Revenue Trends: Canadian National Railway Company vs Norfolk Southern Corporation

Revenue Insights: Canadian National Railway Company and Johnson Controls International plc Performance Compared

Who Generates More Revenue? Canadian National Railway Company or United Rentals, Inc.

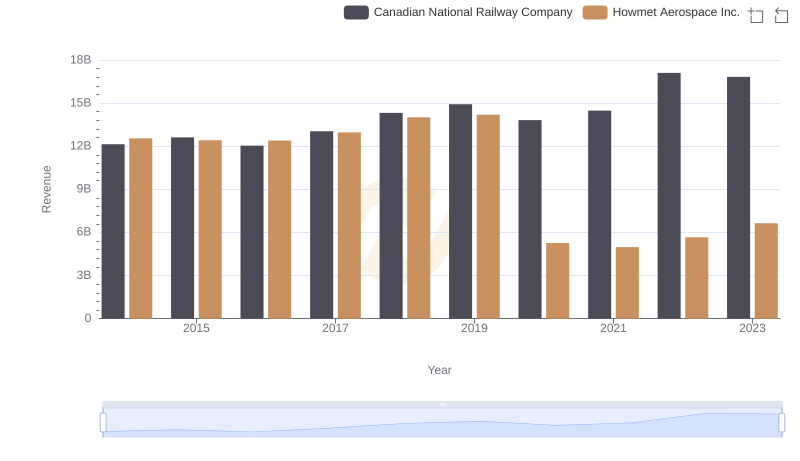

Canadian National Railway Company and Howmet Aerospace Inc.: A Comprehensive Revenue Analysis

Revenue Showdown: Canadian National Railway Company vs Cummins Inc.

EBITDA Performance Review: Canadian National Railway Company vs Norfolk Southern Corporation