| __timestamp | Canadian National Railway Company | Norfolk Southern Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 4531000000 |

| Thursday, January 1, 2015 | 6424000000 | 3943000000 |

| Friday, January 1, 2016 | 6537000000 | 4212000000 |

| Sunday, January 1, 2017 | 6839000000 | 4733000000 |

| Monday, January 1, 2018 | 7124000000 | 5128000000 |

| Tuesday, January 1, 2019 | 7999000000 | 5233000000 |

| Wednesday, January 1, 2020 | 7652000000 | 4632000000 |

| Friday, January 1, 2021 | 7607000000 | 5705000000 |

| Saturday, January 1, 2022 | 9067000000 | 6043000000 |

| Sunday, January 1, 2023 | 9027000000 | 4340000000 |

| Monday, January 1, 2024 | 4071000000 |

Igniting the spark of knowledge

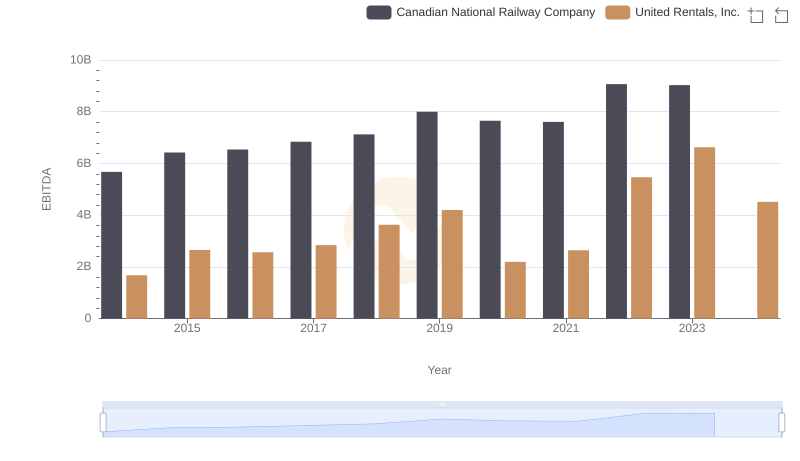

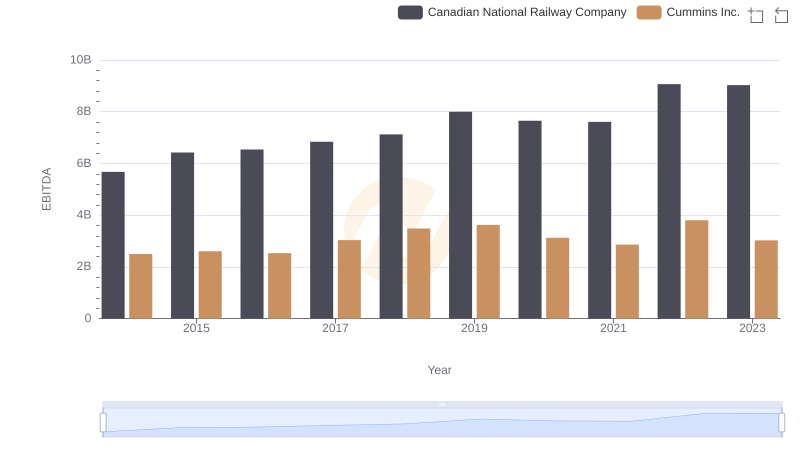

In the competitive world of rail transport, Canadian National Railway Company (CNR) and Norfolk Southern Corporation (NSC) have been pivotal players. Over the past decade, CNR has consistently outperformed NSC in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, CNR's EBITDA surged by approximately 59%, peaking in 2022 with a remarkable 9.07 billion USD. In contrast, NSC's EBITDA growth was more modest, with a 33% increase over the same period, reaching its zenith in 2022 at 6.04 billion USD.

The data highlights CNR's strategic advantage, possibly due to its expansive network and efficient operations. Meanwhile, NSC faced fluctuations, particularly in 2023, where its EBITDA dropped by 28% from the previous year. This analysis underscores the dynamic nature of the rail industry and the importance of strategic planning in maintaining financial health.

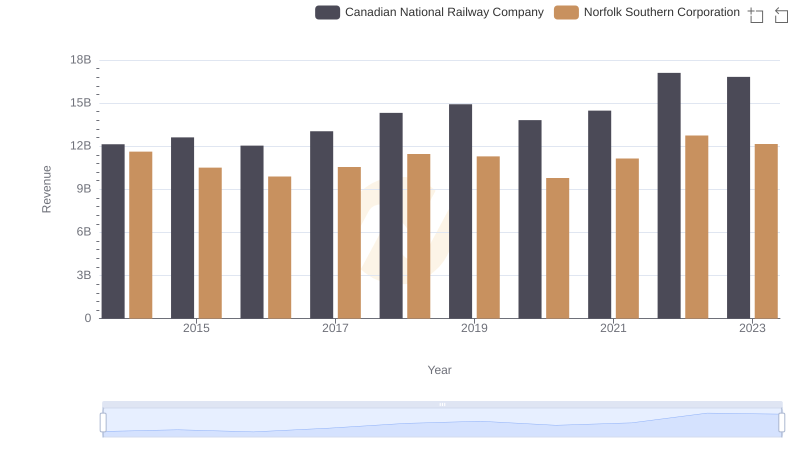

Canadian National Railway Company and Norfolk Southern Corporation: A Comprehensive Revenue Analysis

Cost of Revenue Trends: Canadian National Railway Company vs Norfolk Southern Corporation

A Professional Review of EBITDA: Canadian National Railway Company Compared to Roper Technologies, Inc.

A Professional Review of EBITDA: Canadian National Railway Company Compared to United Rentals, Inc.

Comparative EBITDA Analysis: Canadian National Railway Company vs Cummins Inc.