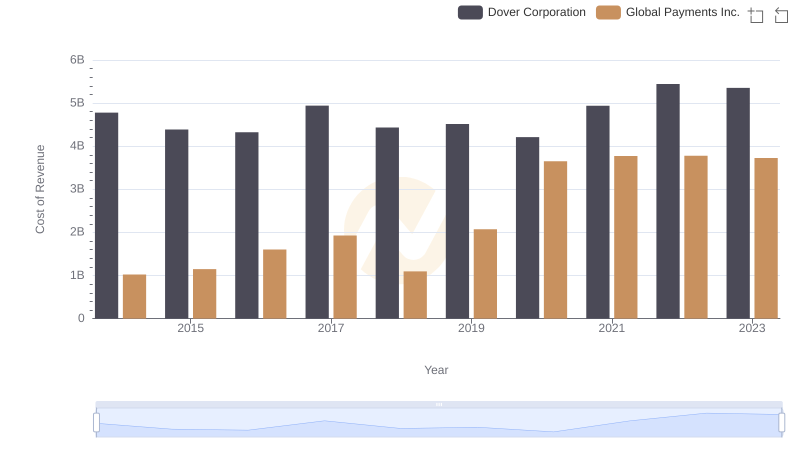

| __timestamp | Dover Corporation | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7752728000 | 2773718000 |

| Thursday, January 1, 2015 | 6956311000 | 2898150000 |

| Friday, January 1, 2016 | 6794342000 | 3370976000 |

| Sunday, January 1, 2017 | 7830436000 | 3975163000 |

| Monday, January 1, 2018 | 6992118000 | 3366366000 |

| Tuesday, January 1, 2019 | 7136397000 | 4911892000 |

| Wednesday, January 1, 2020 | 6683760000 | 7423558000 |

| Friday, January 1, 2021 | 7907081000 | 8523762000 |

| Saturday, January 1, 2022 | 8508088000 | 8975515000 |

| Sunday, January 1, 2023 | 8438134000 | 9654419000 |

| Monday, January 1, 2024 | 7745909000 | 10105894000 |

Data in motion

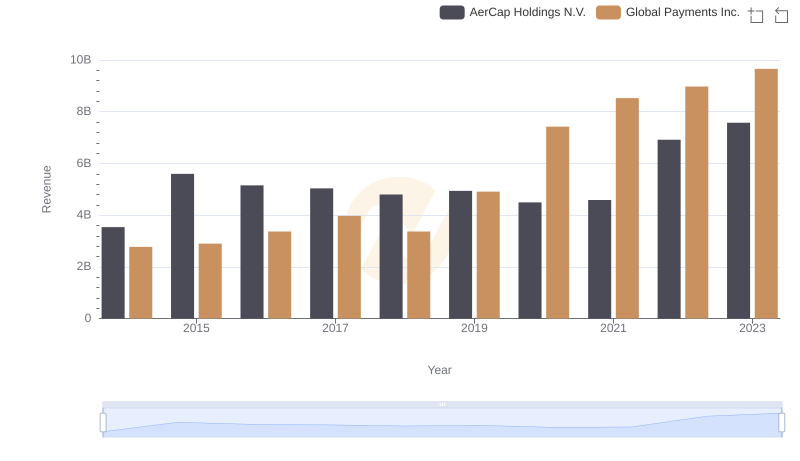

In the ever-evolving landscape of global commerce, understanding revenue trends is crucial for investors and stakeholders. This analysis delves into the financial trajectories of two industry giants: Global Payments Inc. and Dover Corporation, from 2014 to 2023.

Global Payments Inc. has demonstrated a remarkable growth trajectory, with revenue surging by approximately 248% over the decade. This growth is particularly notable from 2019 onwards, where revenues nearly doubled, reflecting the company's strategic expansions and technological advancements in payment solutions.

Conversely, Dover Corporation, a diversified global manufacturer, has shown a steadier revenue pattern, with a modest increase of around 9% over the same period. Despite fluctuations, Dover's revenue peaked in 2022, showcasing resilience amidst global economic challenges.

This comparative analysis highlights the dynamic nature of revenue generation in different sectors, offering valuable insights for strategic decision-making.

Revenue Showdown: Global Payments Inc. vs Lennox International Inc.

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs Dover Corporation

Gross Profit Trends Compared: Global Payments Inc. vs Dover Corporation

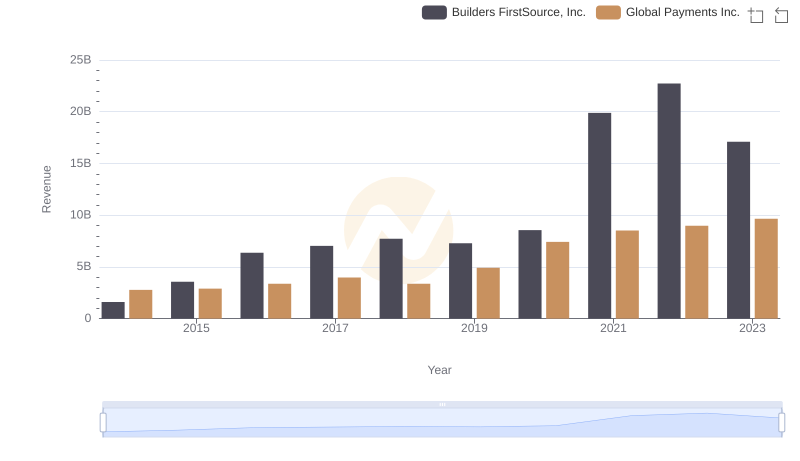

Global Payments Inc. or Builders FirstSource, Inc.: Who Leads in Yearly Revenue?

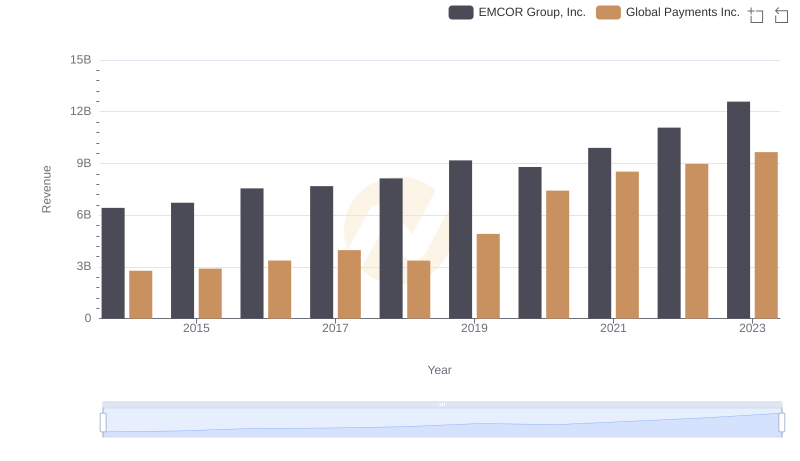

Comparing Revenue Performance: Global Payments Inc. or EMCOR Group, Inc.?

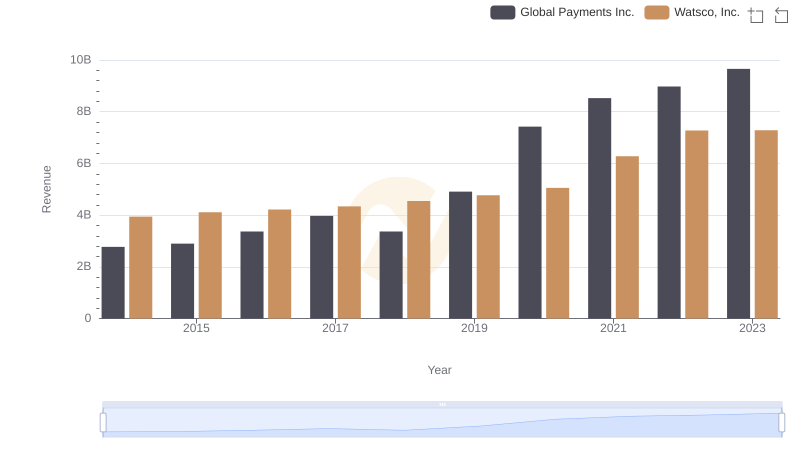

Revenue Showdown: Global Payments Inc. vs Watsco, Inc.

Global Payments Inc. vs AerCap Holdings N.V.: Examining Key Revenue Metrics