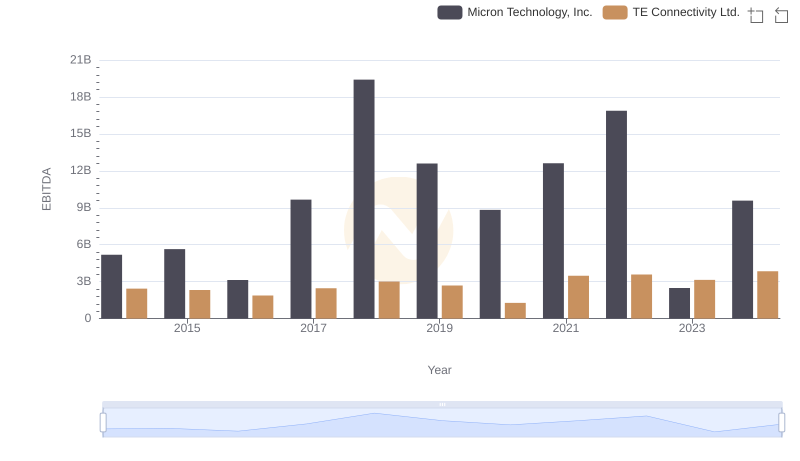

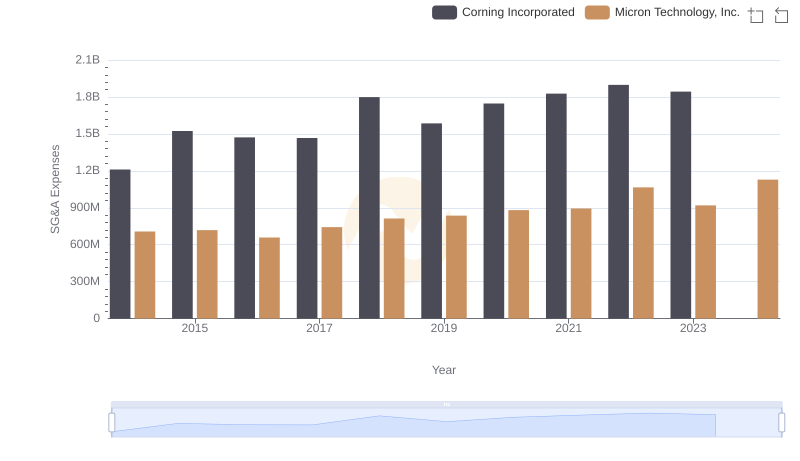

| __timestamp | Corning Incorporated | Micron Technology, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3046000000 | 5188000000 |

| Thursday, January 1, 2015 | 2517000000 | 5647000000 |

| Friday, January 1, 2016 | 2640000000 | 3136000000 |

| Sunday, January 1, 2017 | 2766000000 | 9658000000 |

| Monday, January 1, 2018 | 2897000000 | 19408000000 |

| Tuesday, January 1, 2019 | 3163000000 | 12600000000 |

| Wednesday, January 1, 2020 | 2865000000 | 8827000000 |

| Friday, January 1, 2021 | 3774000000 | 12615000000 |

| Saturday, January 1, 2022 | 3357000000 | 16876000000 |

| Sunday, January 1, 2023 | 2514000000 | 2486000000 |

| Monday, January 1, 2024 | 2492000000 | 9582000000 |

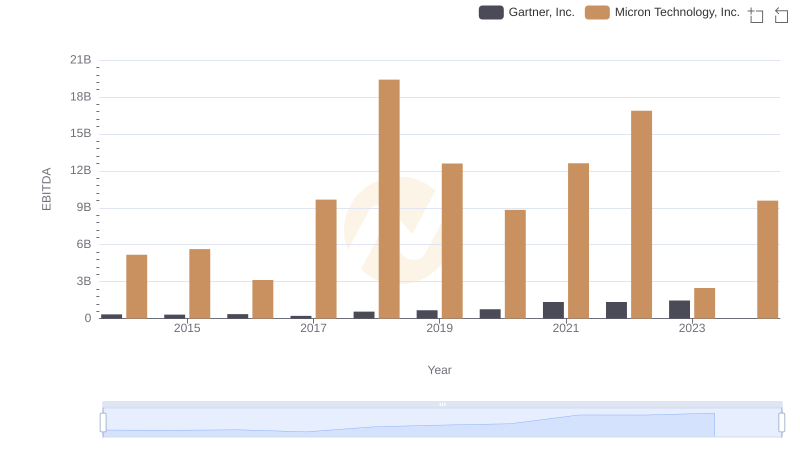

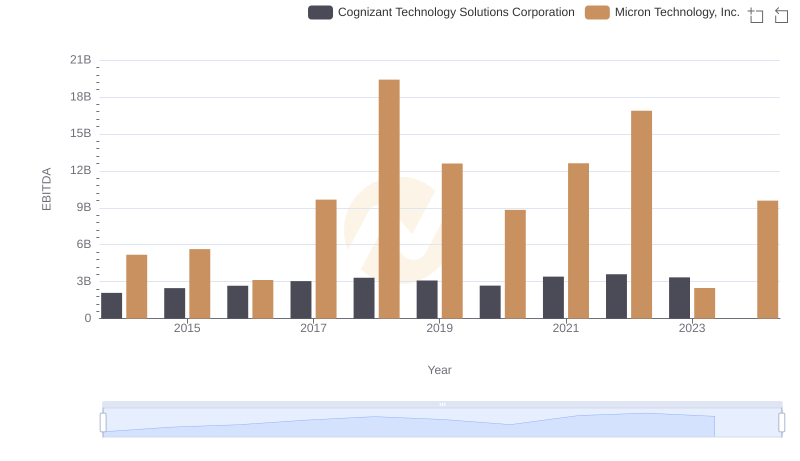

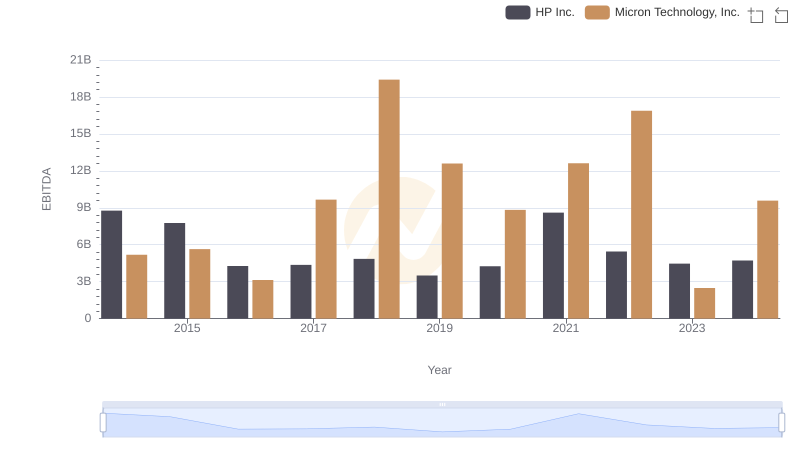

Unleashing insights

In the ever-evolving landscape of technology and materials, Micron Technology, Inc. and Corning Incorporated stand as titans. Over the past decade, Micron has consistently outperformed Corning in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Micron's EBITDA surged by approximately 380%, peaking in 2018 with a remarkable 1,940% increase compared to Corning's modest 27% rise in the same period. This stark contrast highlights Micron's aggressive expansion and strategic market positioning.

Corning, while stable, experienced fluctuations, with its highest EBITDA recorded in 2021. The data for 2024 remains incomplete, but Micron's projected figures suggest continued dominance. This analysis underscores the dynamic nature of the tech industry, where innovation and strategic foresight are key to financial success. Investors and industry watchers should keep a keen eye on these trends as they shape the future of technology and materials.

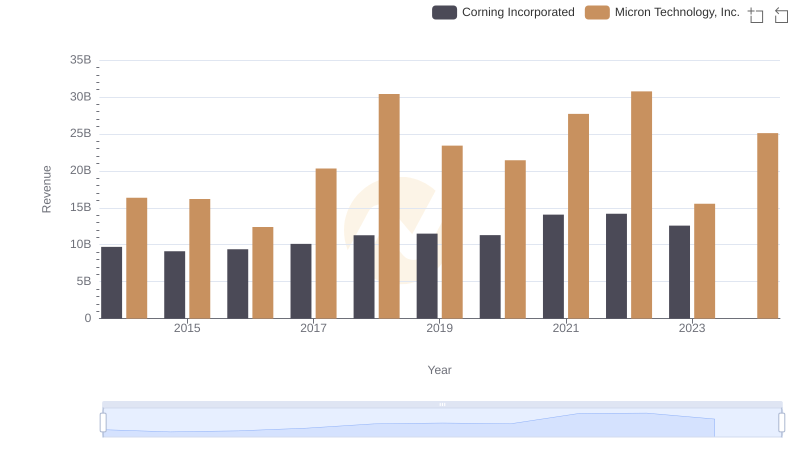

Breaking Down Revenue Trends: Micron Technology, Inc. vs Corning Incorporated

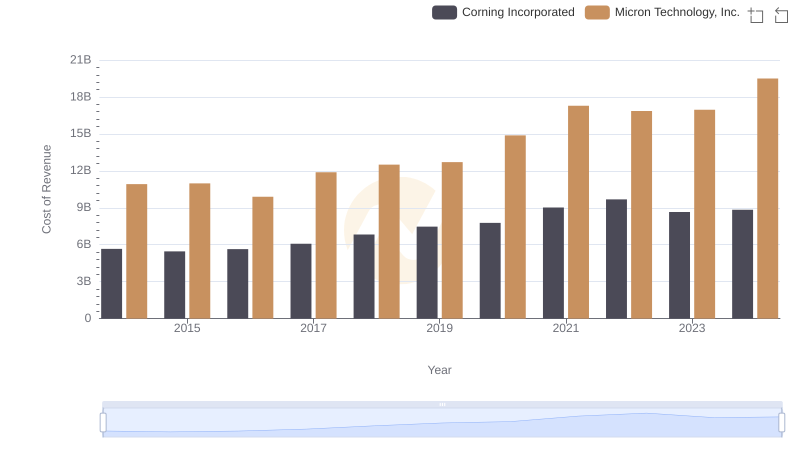

Micron Technology, Inc. vs Corning Incorporated: Efficiency in Cost of Revenue Explored

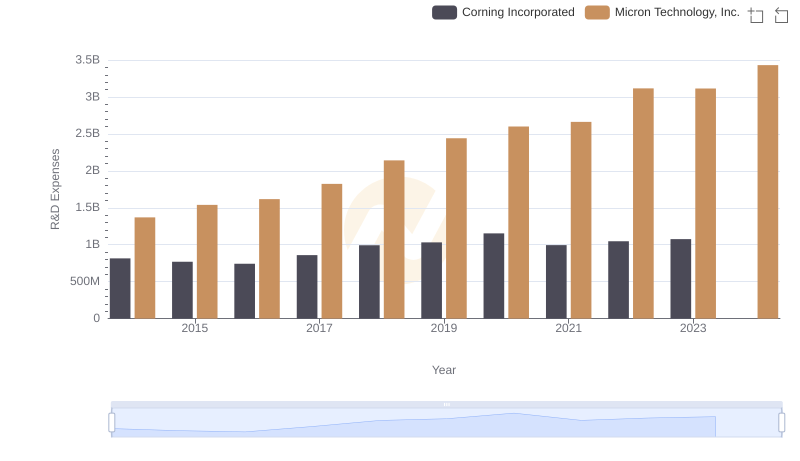

Comparing Innovation Spending: Micron Technology, Inc. and Corning Incorporated

Micron Technology, Inc. and TE Connectivity Ltd.: A Detailed Examination of EBITDA Performance

SG&A Efficiency Analysis: Comparing Micron Technology, Inc. and Corning Incorporated

Micron Technology, Inc. vs Gartner, Inc.: In-Depth EBITDA Performance Comparison

Professional EBITDA Benchmarking: Micron Technology, Inc. vs Cognizant Technology Solutions Corporation

A Professional Review of EBITDA: Micron Technology, Inc. Compared to HP Inc.

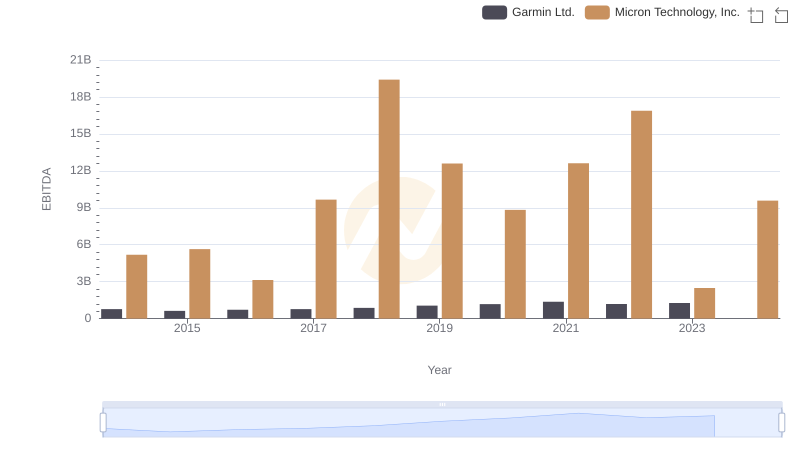

Comparative EBITDA Analysis: Micron Technology, Inc. vs Garmin Ltd.

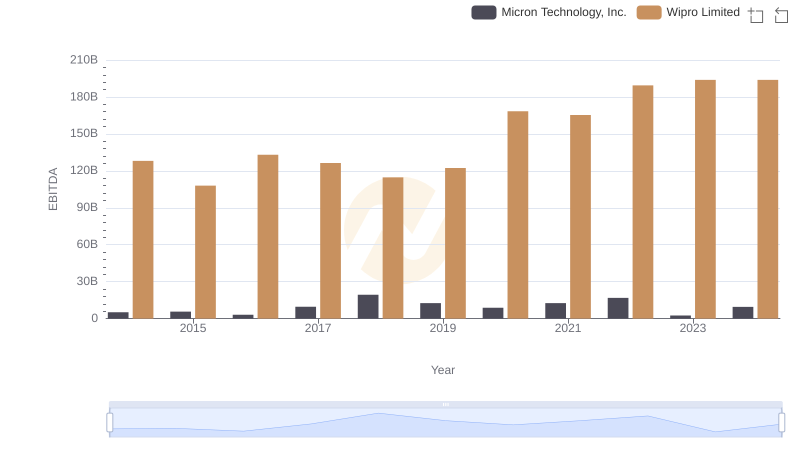

EBITDA Performance Review: Micron Technology, Inc. vs Wipro Limited

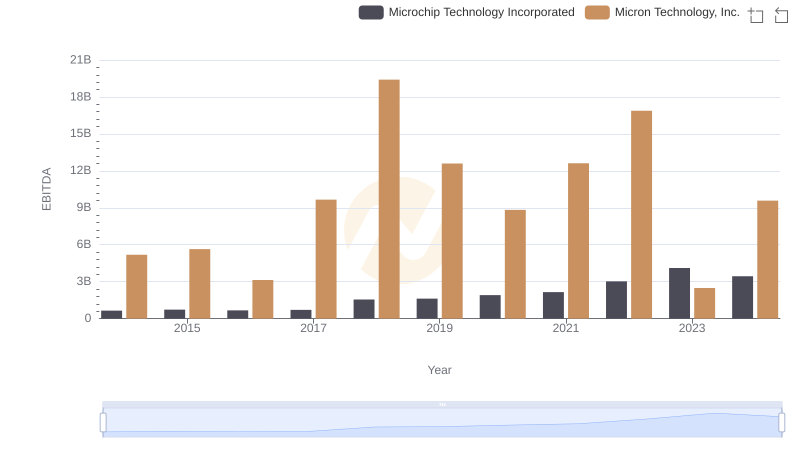

Micron Technology, Inc. vs Microchip Technology Incorporated: In-Depth EBITDA Performance Comparison

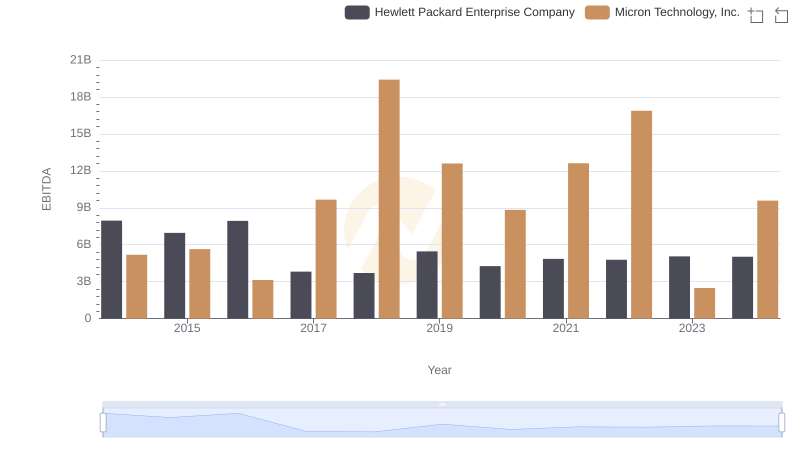

EBITDA Analysis: Evaluating Micron Technology, Inc. Against Hewlett Packard Enterprise Company