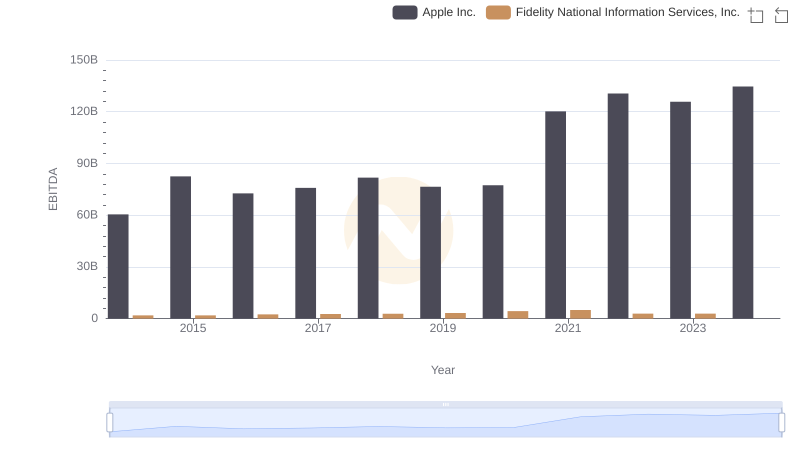

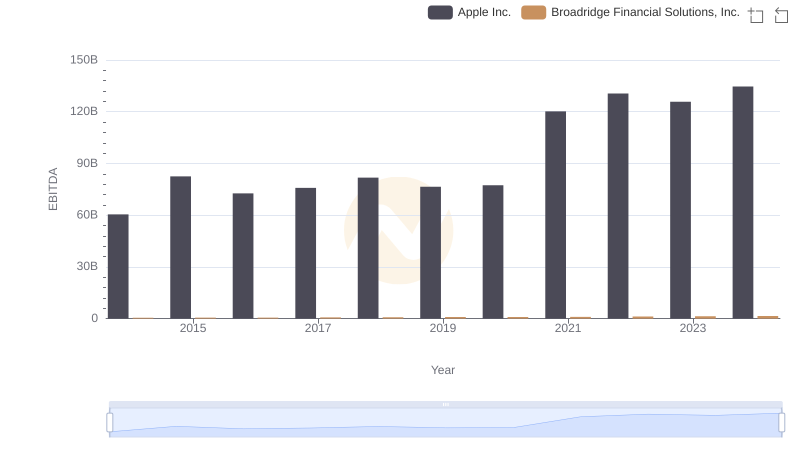

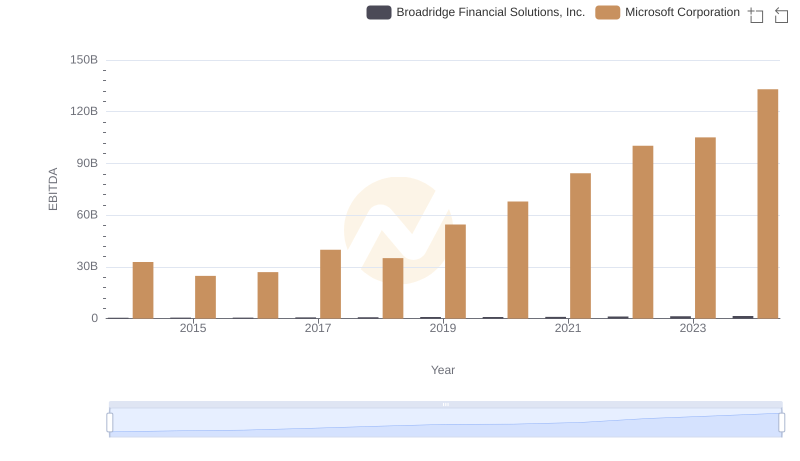

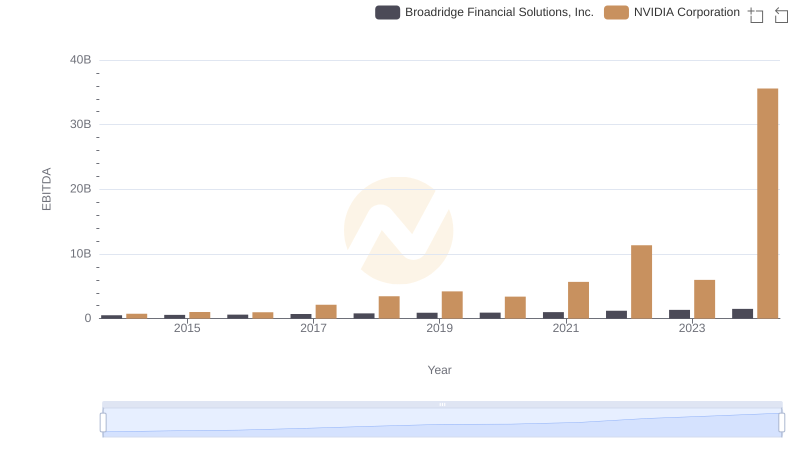

| __timestamp | Broadridge Financial Solutions, Inc. | Fidelity National Information Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 515600000 | 1846200000 |

| Thursday, January 1, 2015 | 571200000 | 1901000000 |

| Friday, January 1, 2016 | 608400000 | 2474000000 |

| Sunday, January 1, 2017 | 706000000 | 2700000000 |

| Monday, January 1, 2018 | 815500000 | 2837000000 |

| Tuesday, January 1, 2019 | 912800000 | 3244000000 |

| Wednesday, January 1, 2020 | 924200000 | 4319000000 |

| Friday, January 1, 2021 | 1013300000 | 5021000000 |

| Saturday, January 1, 2022 | 1223900000 | 2875000000 |

| Sunday, January 1, 2023 | 1361400000 | 2906000000 |

| Monday, January 1, 2024 | 1505500000 | 1709000000 |

In pursuit of knowledge

In the ever-evolving landscape of financial services, Fidelity National Information Services, Inc. (FIS) and Broadridge Financial Solutions, Inc. have emerged as key players. Over the past decade, FIS has consistently outperformed Broadridge in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, FIS's EBITDA surged by approximately 57%, peaking in 2021. In contrast, Broadridge demonstrated a steady climb, with a remarkable 192% increase over the same period, reaching its zenith in 2024.

While FIS experienced a dip post-2021, Broadridge continued its upward momentum, highlighting its resilience and adaptability in a competitive market. The absence of data for FIS in 2024 leaves room for speculation, but Broadridge's consistent growth paints a promising picture for its future. This analysis underscores the dynamic nature of the financial services sector and the strategic maneuvers of its leading entities.

EBITDA Analysis: Evaluating Apple Inc. Against Fidelity National Information Services, Inc.

Apple Inc. and Broadridge Financial Solutions, Inc.: A Detailed Examination of EBITDA Performance

EBITDA Metrics Evaluated: Microsoft Corporation vs Broadridge Financial Solutions, Inc.

A Side-by-Side Analysis of EBITDA: NVIDIA Corporation and Broadridge Financial Solutions, Inc.

Taiwan Semiconductor Manufacturing Company Limited and Fidelity National Information Services, Inc.: A Detailed Examination of EBITDA Performance

Comprehensive EBITDA Comparison: Taiwan Semiconductor Manufacturing Company Limited vs Broadridge Financial Solutions, Inc.

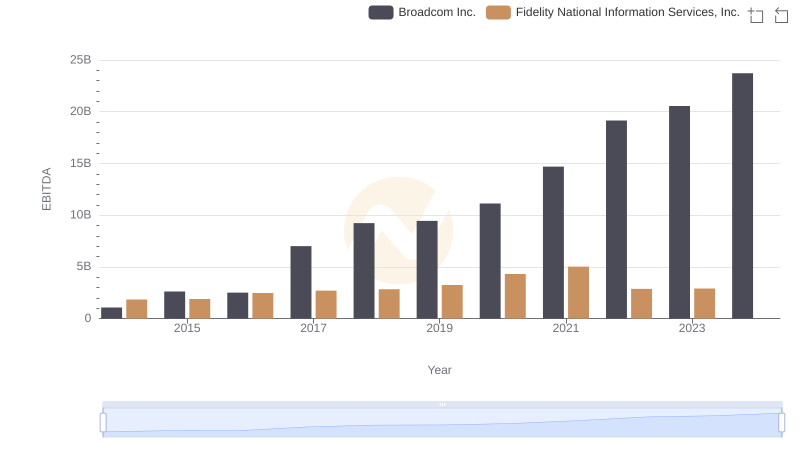

EBITDA Analysis: Evaluating Broadcom Inc. Against Fidelity National Information Services, Inc.

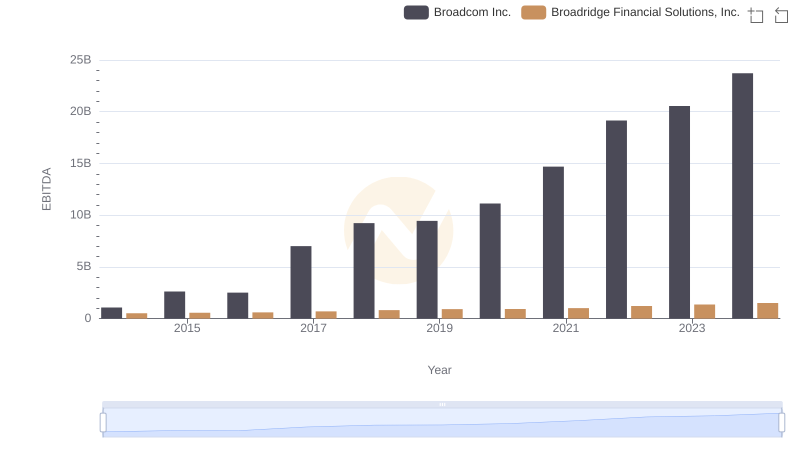

EBITDA Metrics Evaluated: Broadcom Inc. vs Broadridge Financial Solutions, Inc.

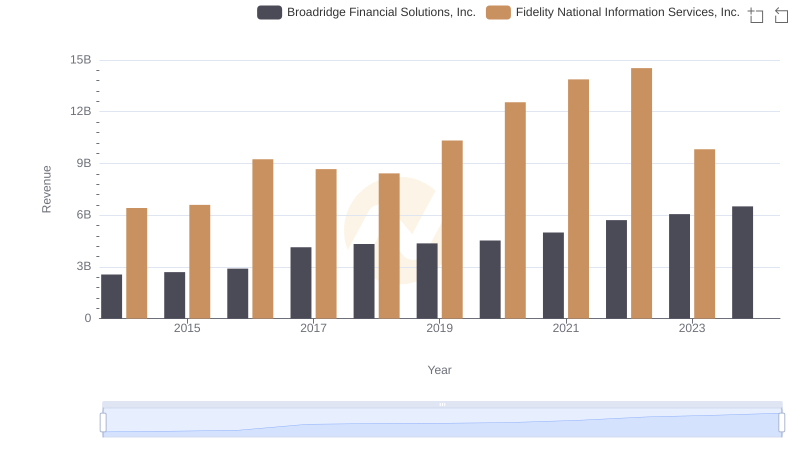

Revenue Insights: Fidelity National Information Services, Inc. and Broadridge Financial Solutions, Inc. Performance Compared

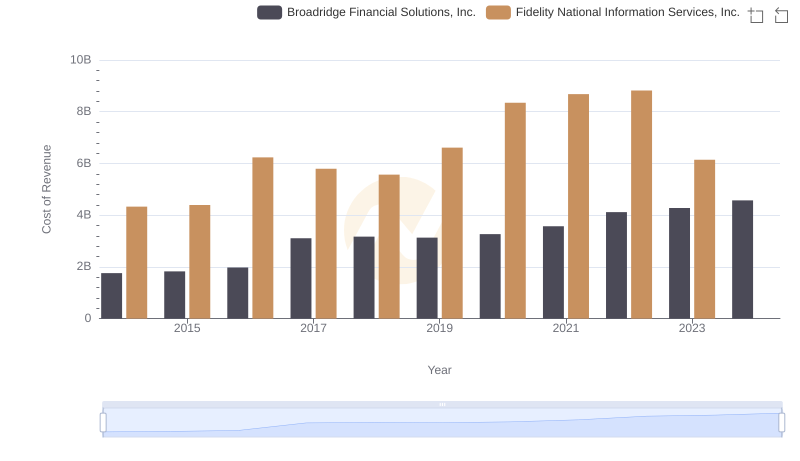

Analyzing Cost of Revenue: Fidelity National Information Services, Inc. and Broadridge Financial Solutions, Inc.

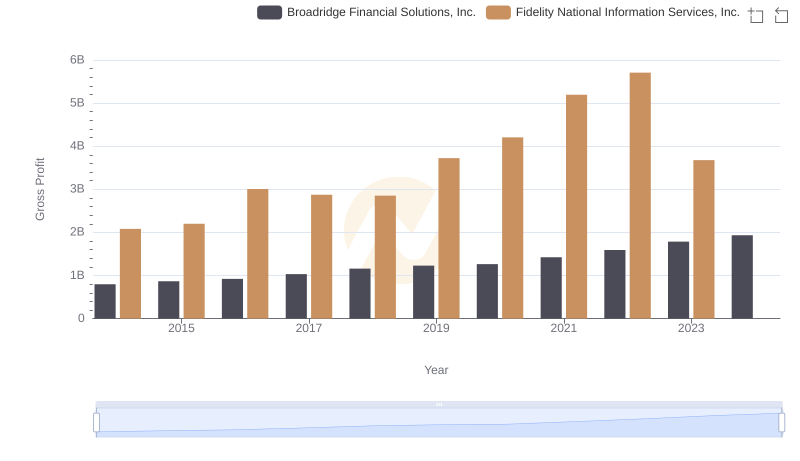

Gross Profit Analysis: Comparing Fidelity National Information Services, Inc. and Broadridge Financial Solutions, Inc.

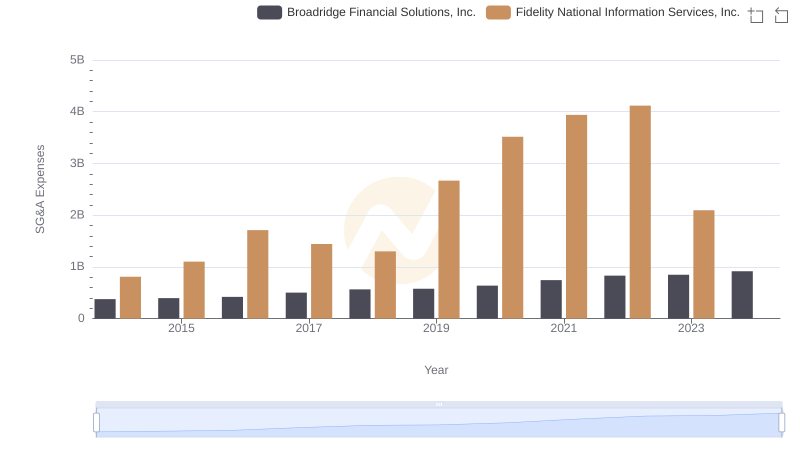

Fidelity National Information Services, Inc. vs Broadridge Financial Solutions, Inc.: SG&A Expense Trends