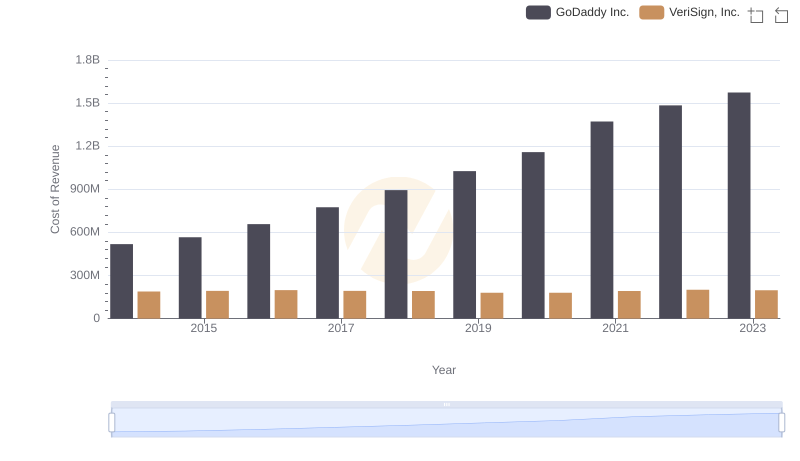

| __timestamp | GoDaddy Inc. | VeriSign, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 333054000 | 189488000 |

| Thursday, January 1, 2015 | 421900000 | 196914000 |

| Friday, January 1, 2016 | 450000000 | 198253000 |

| Sunday, January 1, 2017 | 535600000 | 211705000 |

| Monday, January 1, 2018 | 625400000 | 197559000 |

| Tuesday, January 1, 2019 | 707700000 | 184262000 |

| Wednesday, January 1, 2020 | 762300000 | 186003000 |

| Friday, January 1, 2021 | 849700000 | 188311000 |

| Saturday, January 1, 2022 | 797800000 | 195400000 |

| Sunday, January 1, 2023 | 1019300000 | 204200000 |

| Monday, January 1, 2024 | 751100000 | 211100000 |

In pursuit of knowledge

In the competitive world of tech, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, GoDaddy Inc. and VeriSign, Inc. have taken different paths in optimizing these costs. From 2014 to 2023, GoDaddy's SG&A expenses surged by over 200%, peaking in 2023. This reflects their aggressive expansion strategy, investing heavily in marketing and administrative capabilities. In contrast, VeriSign maintained a more stable approach, with SG&A expenses fluctuating only slightly, showcasing their focus on operational efficiency.

GoDaddy's expenses grew from approximately 33% of their 2023 levels in 2014, while VeriSign's expenses remained relatively constant, highlighting a strategic divergence. This comparison offers a fascinating insight into how two industry leaders manage their financial strategies, balancing growth and efficiency in a rapidly evolving market.

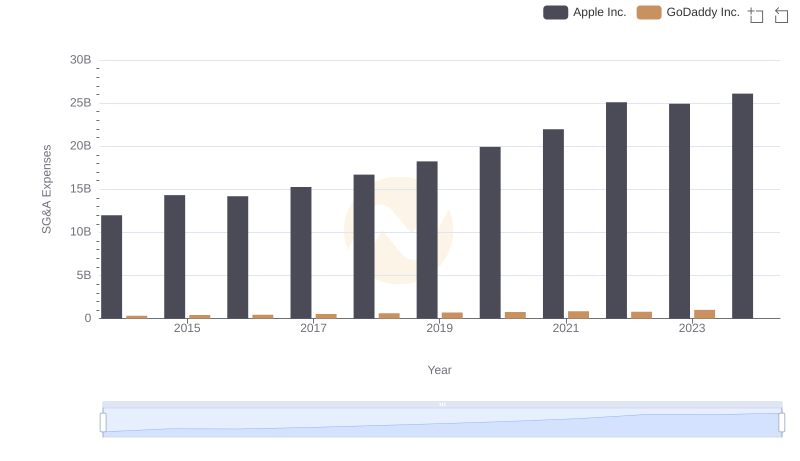

Selling, General, and Administrative Costs: Apple Inc. vs GoDaddy Inc.

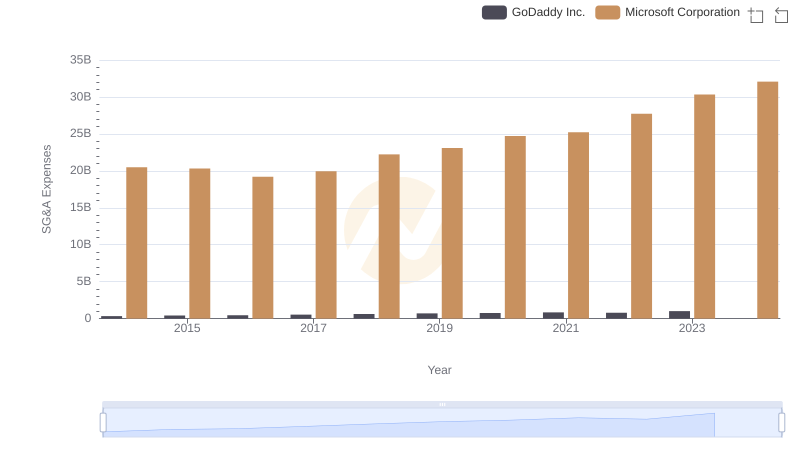

Microsoft Corporation vs GoDaddy Inc.: SG&A Expense Trends

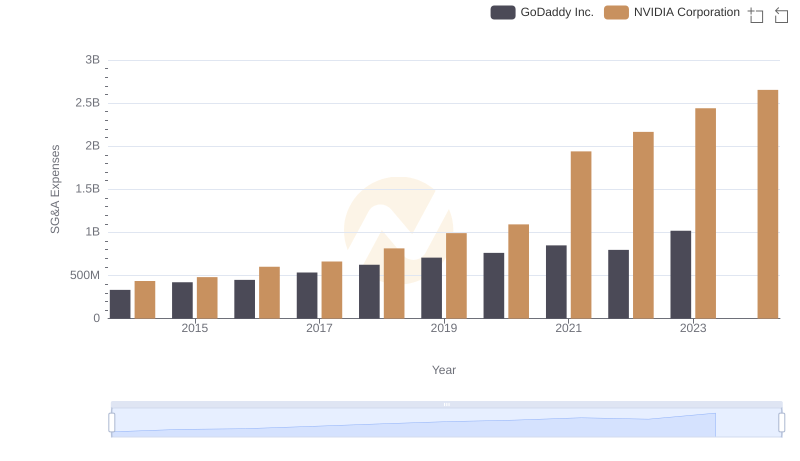

Comparing SG&A Expenses: NVIDIA Corporation vs GoDaddy Inc. Trends and Insights

Cost Management Insights: SG&A Expenses for Taiwan Semiconductor Manufacturing Company Limited and GoDaddy Inc.

Cost Management Insights: SG&A Expenses for Taiwan Semiconductor Manufacturing Company Limited and VeriSign, Inc.

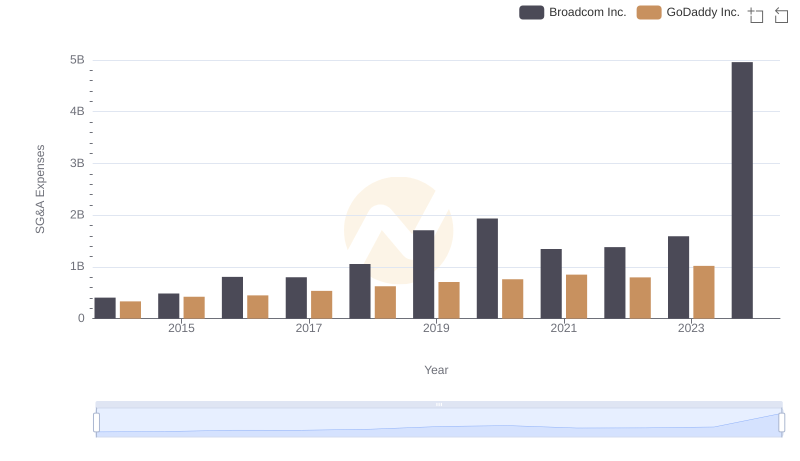

Selling, General, and Administrative Costs: Broadcom Inc. vs GoDaddy Inc.

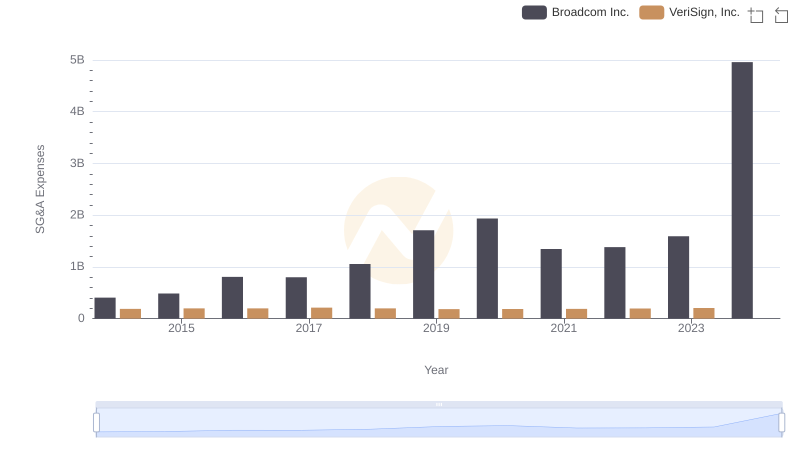

SG&A Efficiency Analysis: Comparing Broadcom Inc. and VeriSign, Inc.

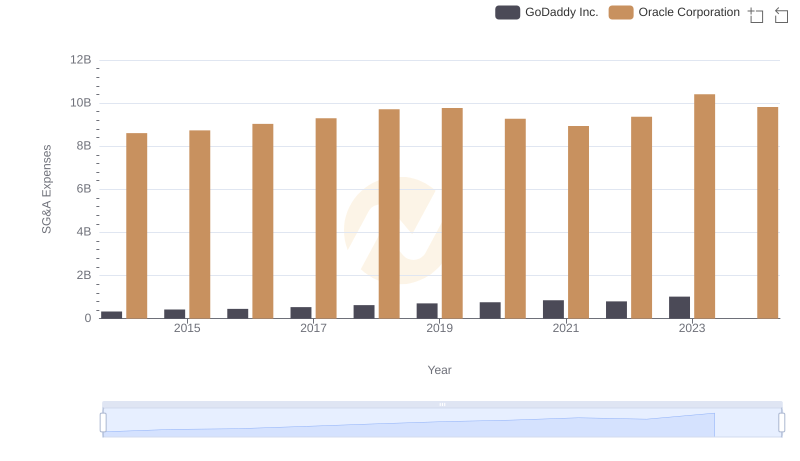

SG&A Efficiency Analysis: Comparing Oracle Corporation and GoDaddy Inc.

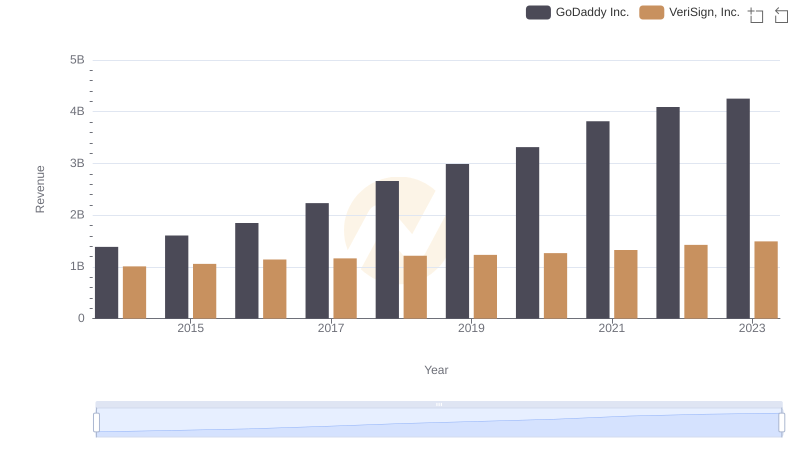

GoDaddy Inc. vs VeriSign, Inc.: Examining Key Revenue Metrics

Comparing Cost of Revenue Efficiency: GoDaddy Inc. vs VeriSign, Inc.

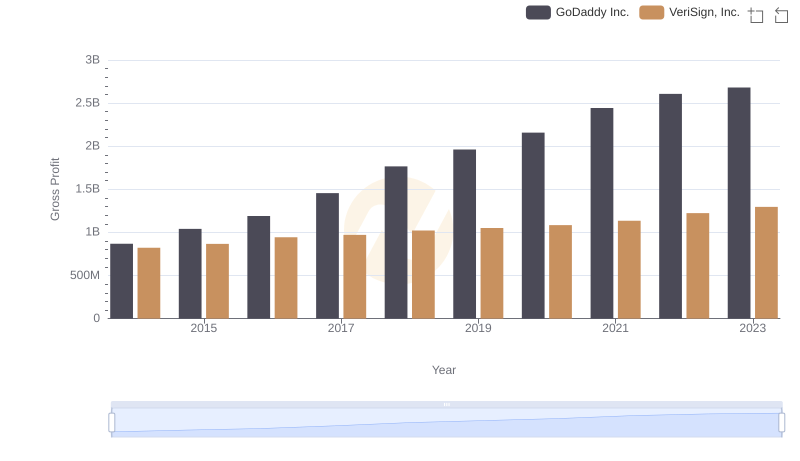

Gross Profit Comparison: GoDaddy Inc. and VeriSign, Inc. Trends

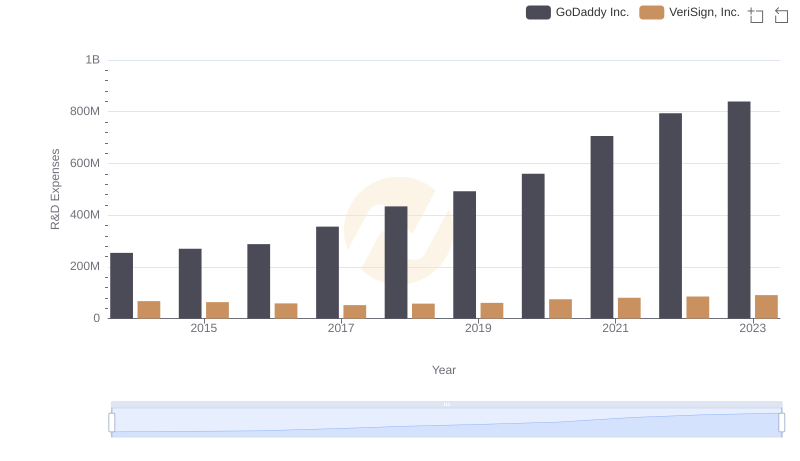

Analyzing R&D Budgets: GoDaddy Inc. vs VeriSign, Inc.