| __timestamp | GoDaddy Inc. | VeriSign, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 518382000 | 188425000 |

| Thursday, January 1, 2015 | 565900000 | 192788000 |

| Friday, January 1, 2016 | 657800000 | 198242000 |

| Sunday, January 1, 2017 | 775500000 | 193326000 |

| Monday, January 1, 2018 | 893900000 | 192134000 |

| Tuesday, January 1, 2019 | 1026800000 | 180467000 |

| Wednesday, January 1, 2020 | 1158600000 | 180177000 |

| Friday, January 1, 2021 | 1372200000 | 191933000 |

| Saturday, January 1, 2022 | 1484500000 | 200700000 |

| Sunday, January 1, 2023 | 1573600000 | 197300000 |

| Monday, January 1, 2024 | 1652000000 | 191400000 |

Cracking the code

In the ever-evolving tech landscape, cost efficiency is a critical metric for success. Over the past decade, GoDaddy Inc. and VeriSign, Inc. have showcased contrasting strategies in managing their cost of revenue. From 2014 to 2023, GoDaddy's cost of revenue surged by approximately 204%, reflecting its aggressive expansion and service diversification. In contrast, VeriSign maintained a more stable trajectory, with only a 5% increase, underscoring its focus on operational efficiency and niche market dominance.

GoDaddy's cost of revenue peaked in 2023, reaching nearly eight times that of VeriSign, highlighting its expansive growth strategy. Meanwhile, VeriSign's consistent cost management has allowed it to maintain a lean operational model. This comparison not only illustrates the diverse approaches of these tech giants but also offers insights into their strategic priorities over the years.

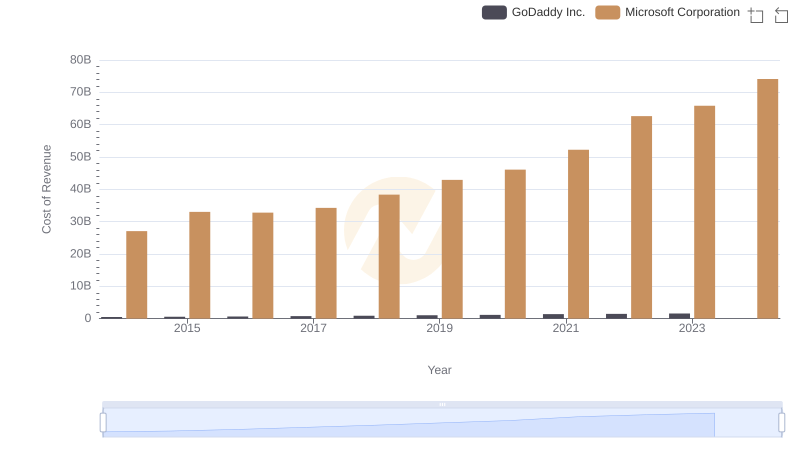

Cost Insights: Breaking Down Microsoft Corporation and GoDaddy Inc.'s Expenses

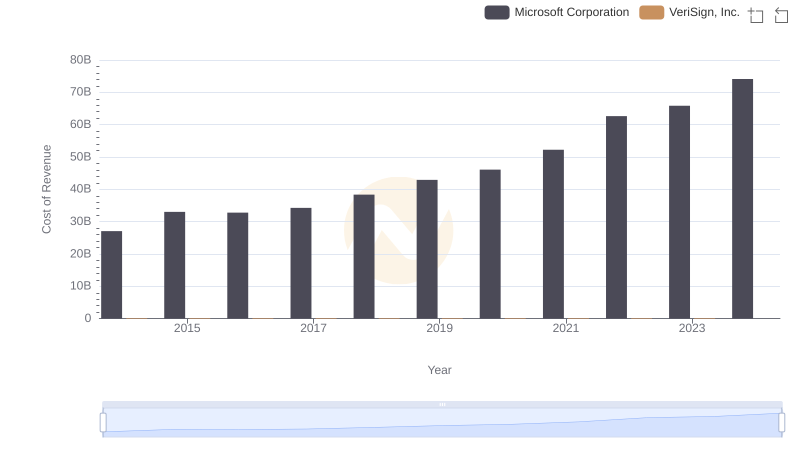

Microsoft Corporation vs VeriSign, Inc.: Efficiency in Cost of Revenue Explored

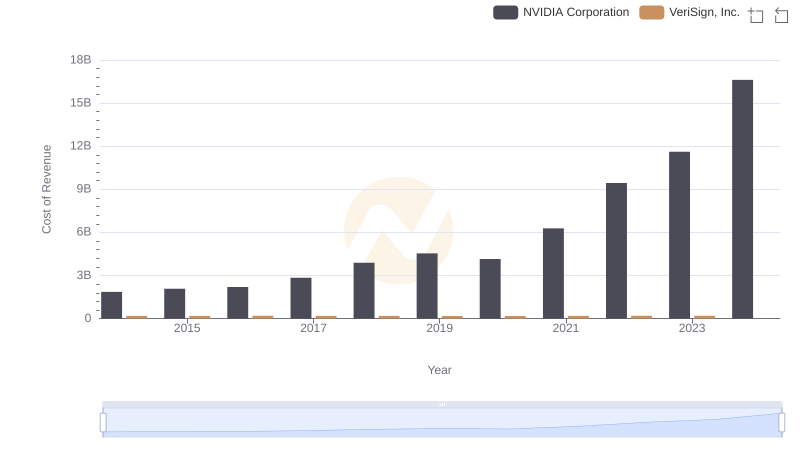

Cost of Revenue Comparison: NVIDIA Corporation vs VeriSign, Inc.

Cost Insights: Breaking Down Taiwan Semiconductor Manufacturing Company Limited and GoDaddy Inc.'s Expenses

Cost of Revenue Trends: Taiwan Semiconductor Manufacturing Company Limited vs VeriSign, Inc.

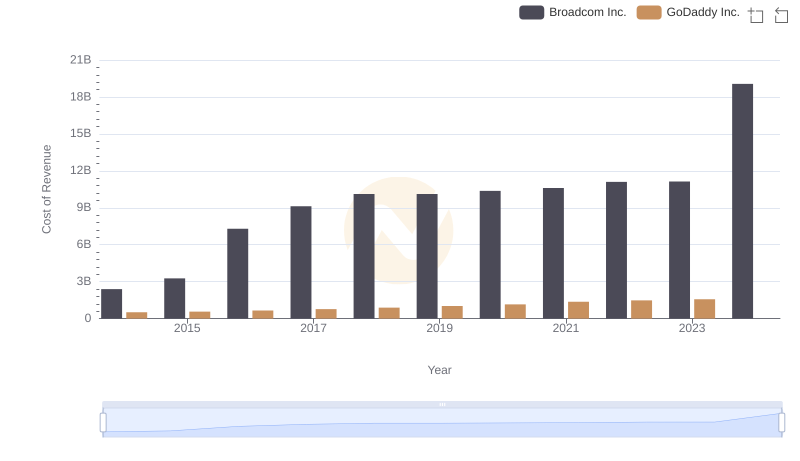

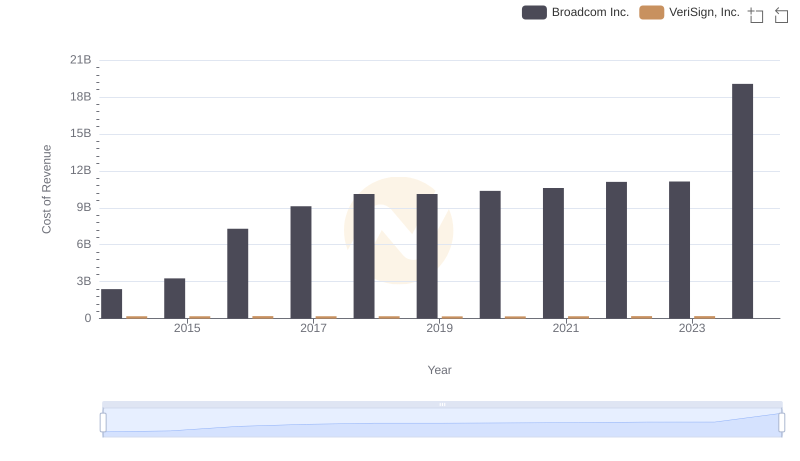

Comparing Cost of Revenue Efficiency: Broadcom Inc. vs GoDaddy Inc.

Cost of Revenue: Key Insights for Broadcom Inc. and VeriSign, Inc.

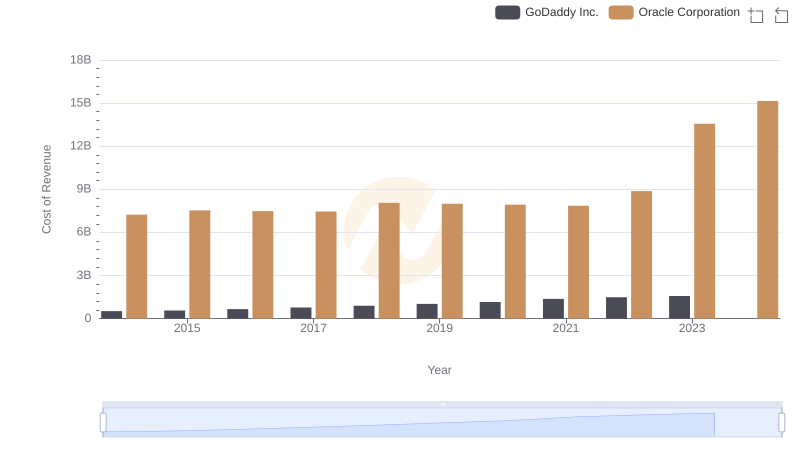

Cost of Revenue: Key Insights for Oracle Corporation and GoDaddy Inc.

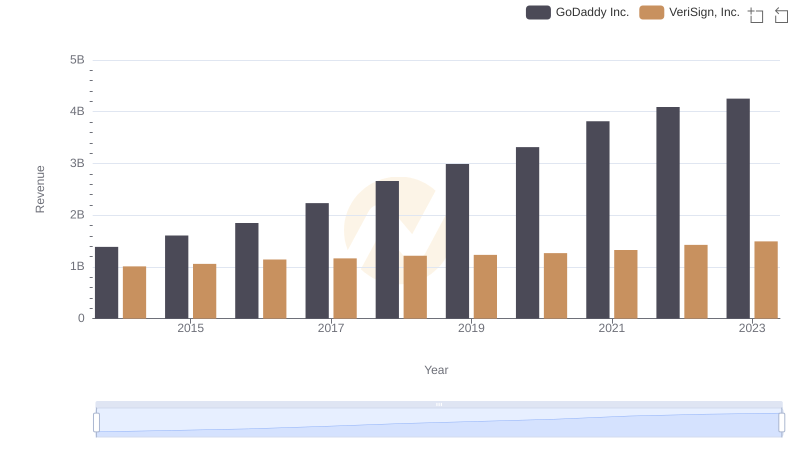

GoDaddy Inc. vs VeriSign, Inc.: Examining Key Revenue Metrics

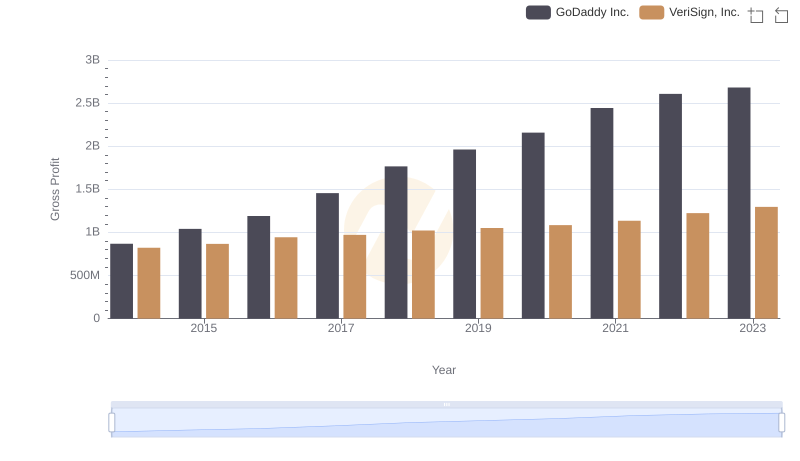

Gross Profit Comparison: GoDaddy Inc. and VeriSign, Inc. Trends

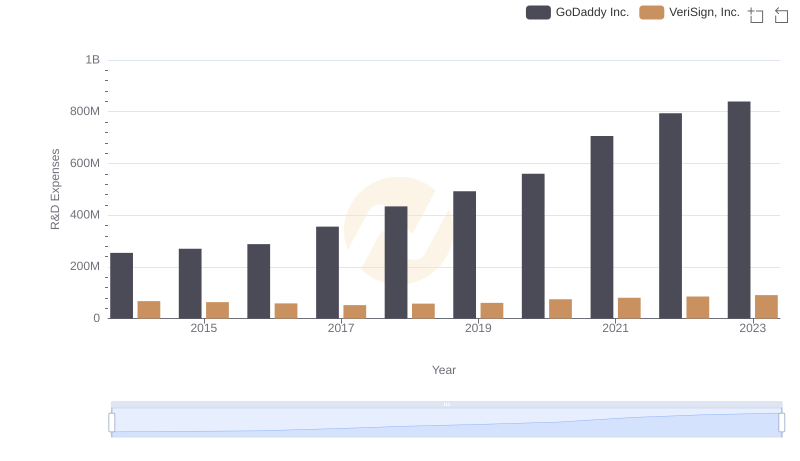

Analyzing R&D Budgets: GoDaddy Inc. vs VeriSign, Inc.

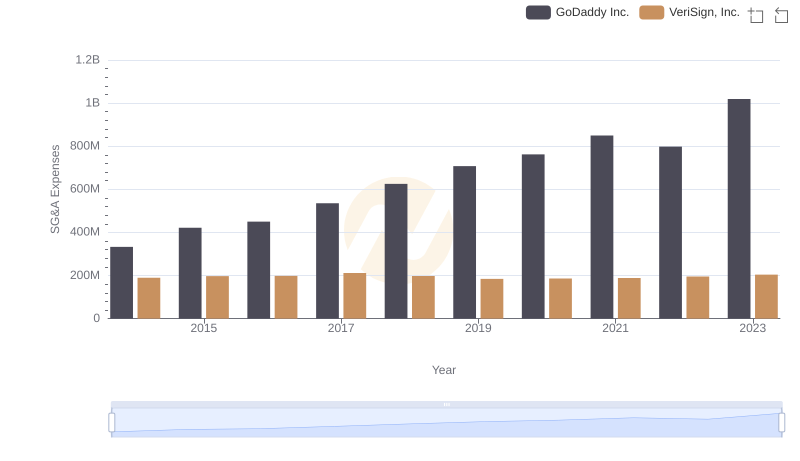

Who Optimizes SG&A Costs Better? GoDaddy Inc. or VeriSign, Inc.