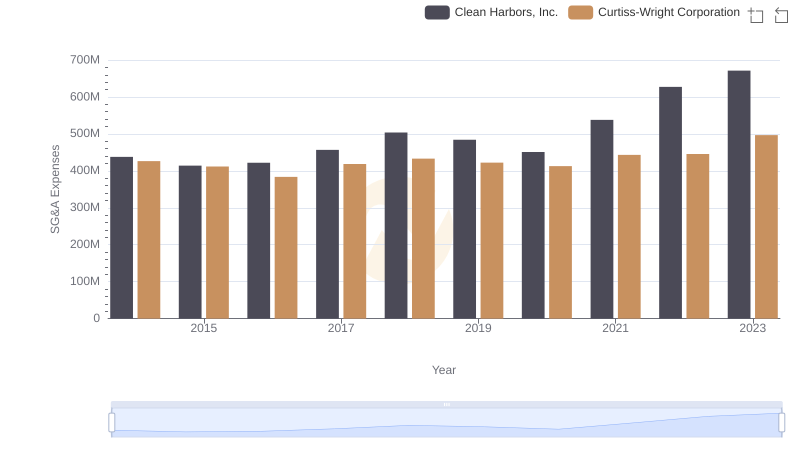

| __timestamp | Curtiss-Wright Corporation | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 426301000 | 935700000 |

| Thursday, January 1, 2015 | 411801000 | 965700000 |

| Friday, January 1, 2016 | 383793000 | 1197600000 |

| Sunday, January 1, 2017 | 418544000 | 1329600000 |

| Monday, January 1, 2018 | 433110000 | 1364000000 |

| Tuesday, January 1, 2019 | 422272000 | 322500000 |

| Wednesday, January 1, 2020 | 412825000 | 352000000 |

| Friday, January 1, 2021 | 443096000 | 348600000 |

| Saturday, January 1, 2022 | 445679000 | 479000000 |

| Sunday, January 1, 2023 | 496812000 | 2870000000 |

| Monday, January 1, 2024 | 518857000 |

Data in motion

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Curtiss-Wright Corporation and Rentokil Initial plc, two industry giants, have taken different paths in optimizing these costs over the past decade.

From 2014 to 2023, Curtiss-Wright Corporation maintained a relatively stable SG&A expense, averaging around $429 million annually. This consistency reflects a disciplined approach, with fluctuations of less than 10% year-over-year. In contrast, Rentokil Initial plc experienced more volatility, with expenses peaking at nearly $2.87 billion in 2023, a staggering 200% increase from its 2019 low.

Curtiss-Wright's steady expense management suggests a focus on operational efficiency, while Rentokil's fluctuations may indicate strategic investments or restructuring efforts. Understanding these trends offers valuable insights into each company's financial health and strategic priorities.

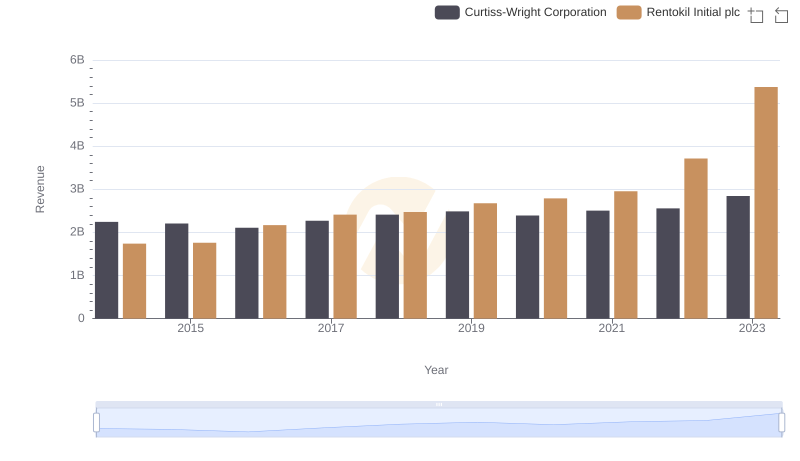

Curtiss-Wright Corporation vs Rentokil Initial plc: Examining Key Revenue Metrics

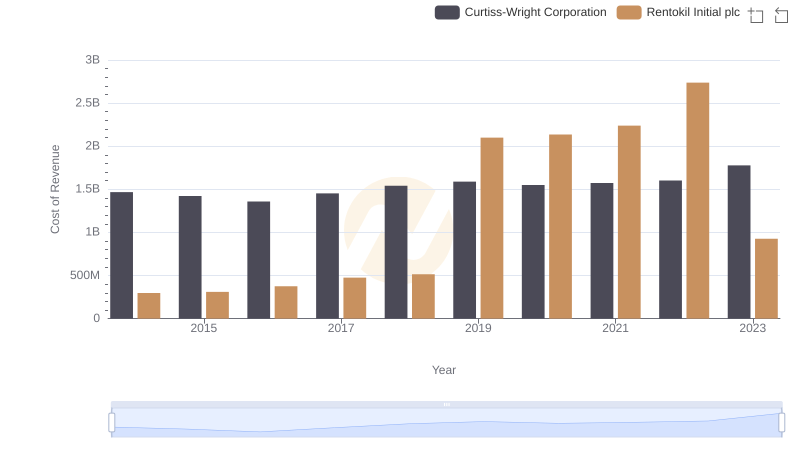

Analyzing Cost of Revenue: Curtiss-Wright Corporation and Rentokil Initial plc

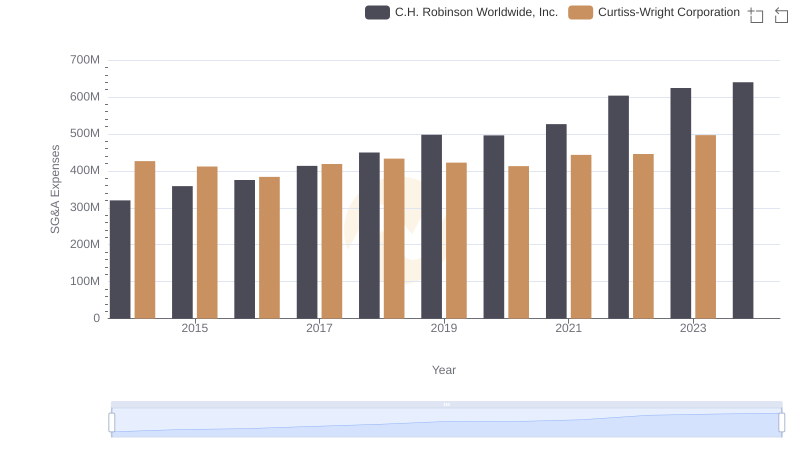

Cost Management Insights: SG&A Expenses for Curtiss-Wright Corporation and C.H. Robinson Worldwide, Inc.

Curtiss-Wright Corporation and Clean Harbors, Inc.: SG&A Spending Patterns Compared

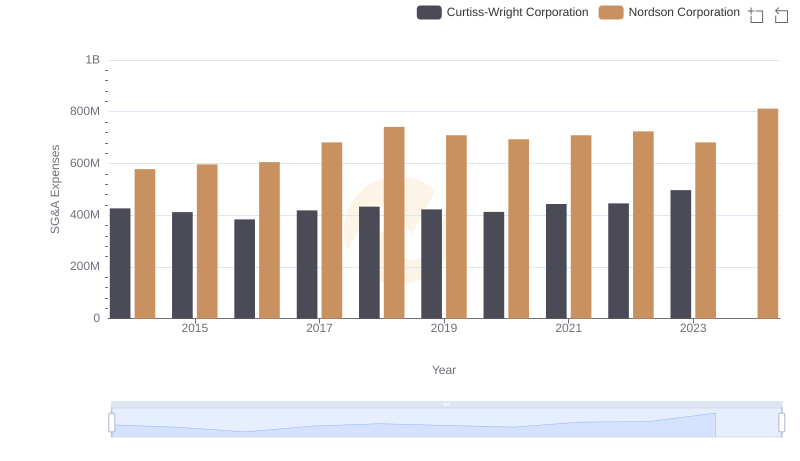

Selling, General, and Administrative Costs: Curtiss-Wright Corporation vs Nordson Corporation

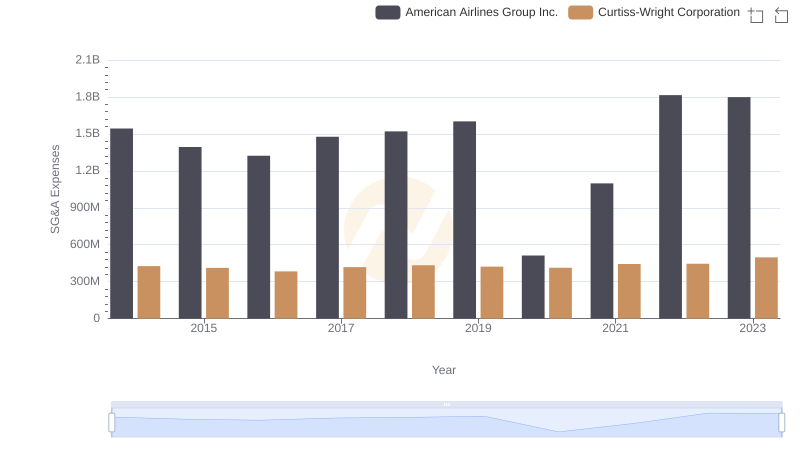

Curtiss-Wright Corporation vs American Airlines Group Inc.: SG&A Expense Trends

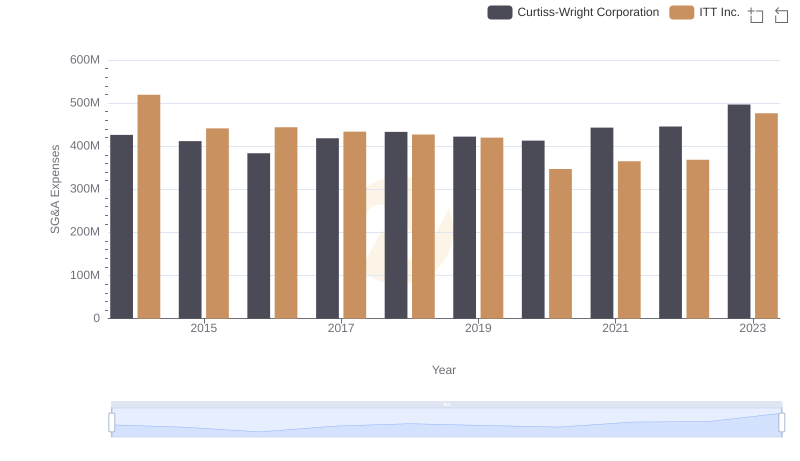

Selling, General, and Administrative Costs: Curtiss-Wright Corporation vs ITT Inc.

Cost Management Insights: SG&A Expenses for C.H. Robinson Worldwide, Inc. and Rentokil Initial plc

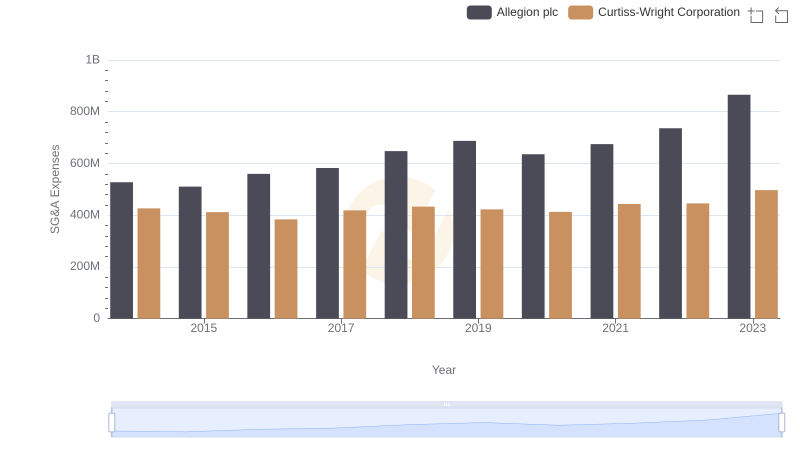

Cost Management Insights: SG&A Expenses for Curtiss-Wright Corporation and Allegion plc