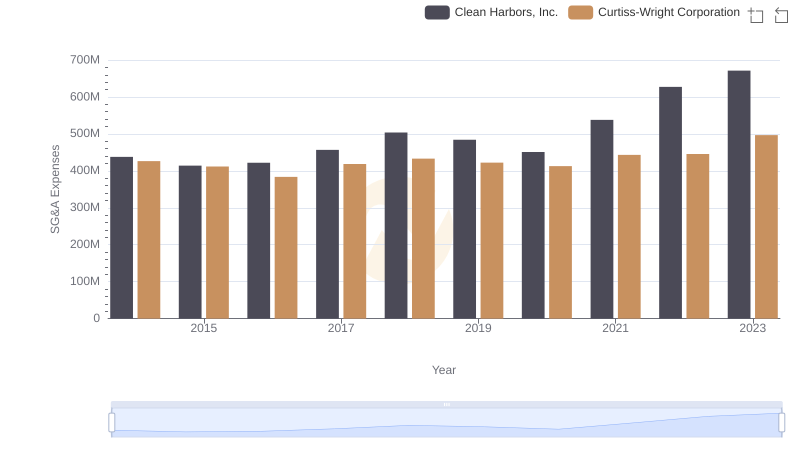

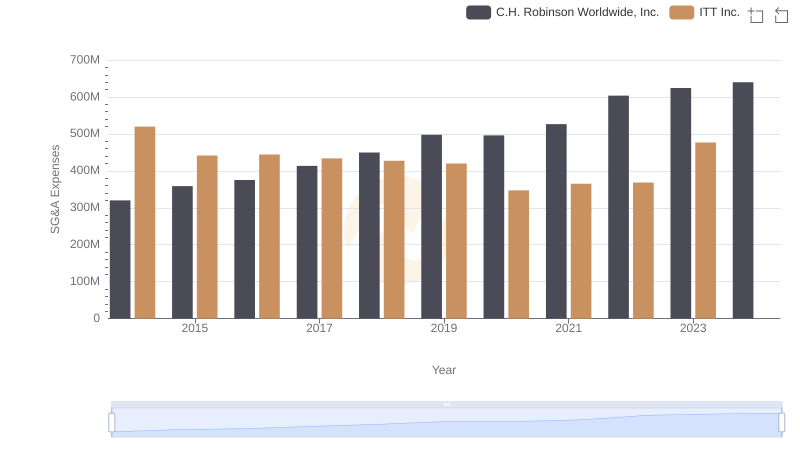

| __timestamp | C.H. Robinson Worldwide, Inc. | Curtiss-Wright Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 320213000 | 426301000 |

| Thursday, January 1, 2015 | 358760000 | 411801000 |

| Friday, January 1, 2016 | 375061000 | 383793000 |

| Sunday, January 1, 2017 | 413404000 | 418544000 |

| Monday, January 1, 2018 | 449610000 | 433110000 |

| Tuesday, January 1, 2019 | 497806000 | 422272000 |

| Wednesday, January 1, 2020 | 496122000 | 412825000 |

| Friday, January 1, 2021 | 526371000 | 443096000 |

| Saturday, January 1, 2022 | 603415000 | 445679000 |

| Sunday, January 1, 2023 | 624266000 | 496812000 |

| Monday, January 1, 2024 | 639624000 | 518857000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, effective cost management remains a cornerstone of success. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Curtiss-Wright Corporation and C.H. Robinson Worldwide, Inc., from 2014 to 2023.

C.H. Robinson Worldwide, Inc. has seen a steady increase in SG&A expenses, rising approximately 100% over the decade, peaking in 2023. This growth reflects strategic investments in operational efficiency and market expansion. In contrast, Curtiss-Wright Corporation maintained a more stable SG&A trajectory, with a notable 16% increase in 2023, indicating a focus on streamlined operations.

The data highlights the distinct financial strategies of these corporations, offering valuable insights into their cost management approaches. As we look to the future, understanding these trends is crucial for stakeholders aiming to navigate the complexities of corporate finance.

Annual Revenue Comparison: Curtiss-Wright Corporation vs C.H. Robinson Worldwide, Inc.

Elbit Systems Ltd. vs C.H. Robinson Worldwide, Inc.: SG&A Expense Trends

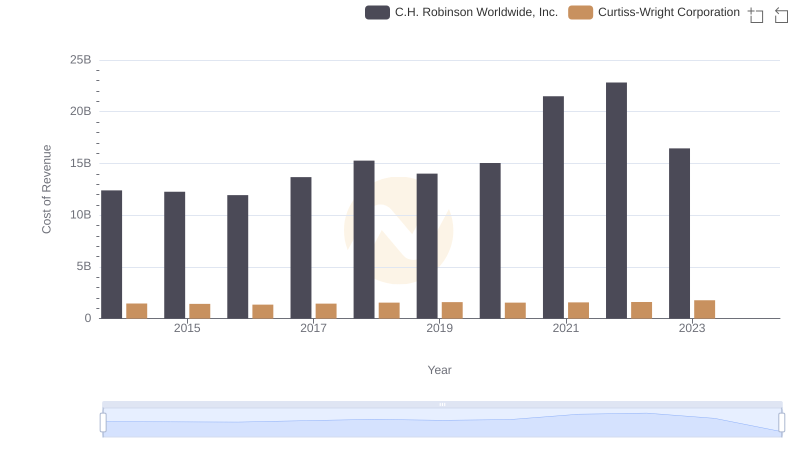

Cost of Revenue Comparison: Curtiss-Wright Corporation vs C.H. Robinson Worldwide, Inc.

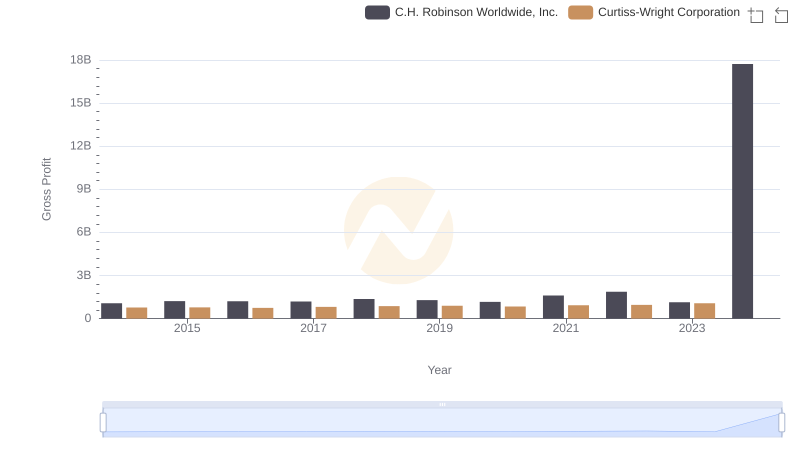

Key Insights on Gross Profit: Curtiss-Wright Corporation vs C.H. Robinson Worldwide, Inc.

Curtiss-Wright Corporation and Clean Harbors, Inc.: SG&A Spending Patterns Compared

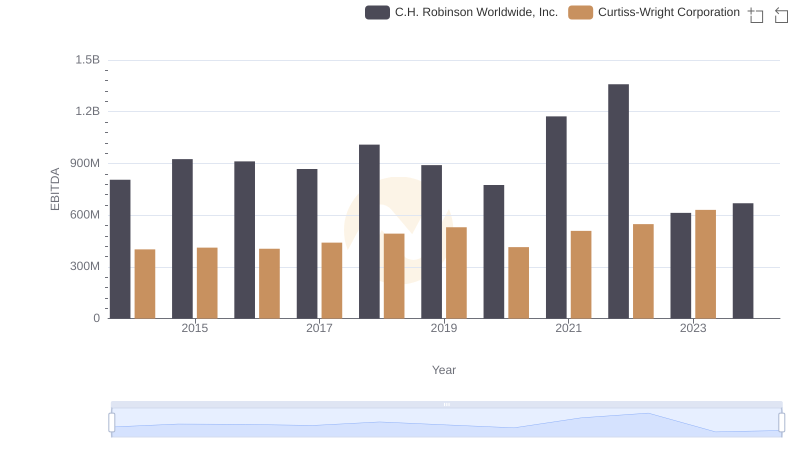

Comparative EBITDA Analysis: Curtiss-Wright Corporation vs C.H. Robinson Worldwide, Inc.

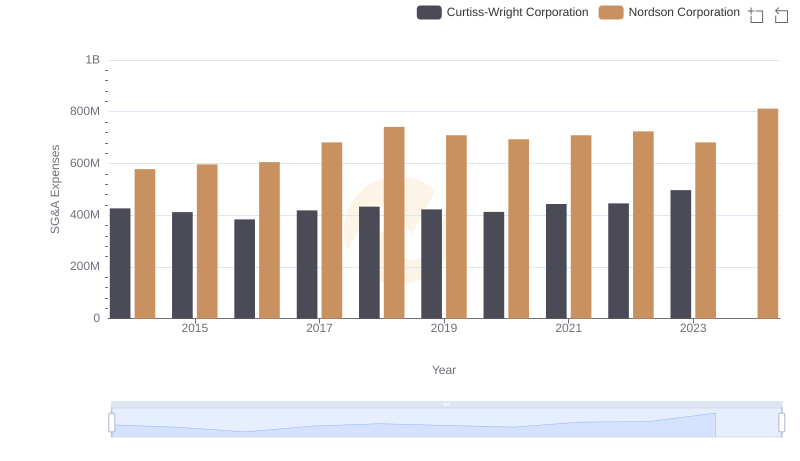

Selling, General, and Administrative Costs: Curtiss-Wright Corporation vs Nordson Corporation

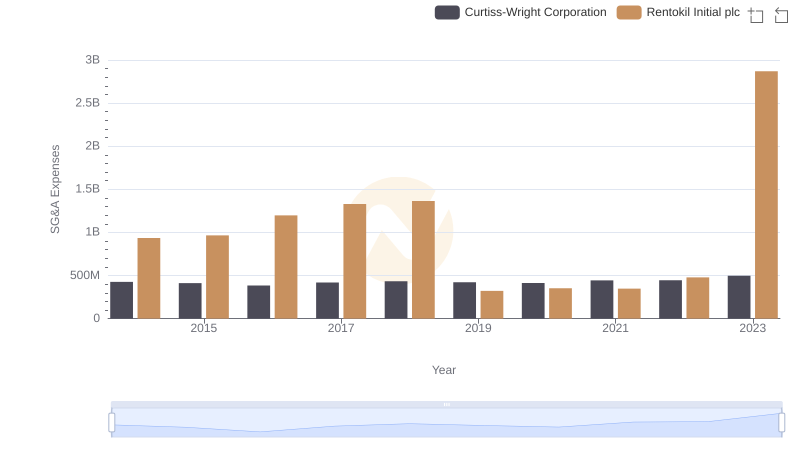

Who Optimizes SG&A Costs Better? Curtiss-Wright Corporation or Rentokil Initial plc

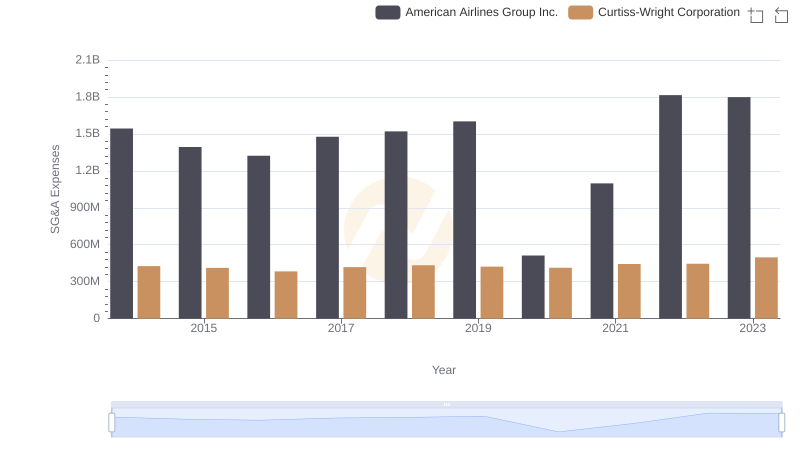

Curtiss-Wright Corporation vs American Airlines Group Inc.: SG&A Expense Trends

C.H. Robinson Worldwide, Inc. and ITT Inc.: SG&A Spending Patterns Compared

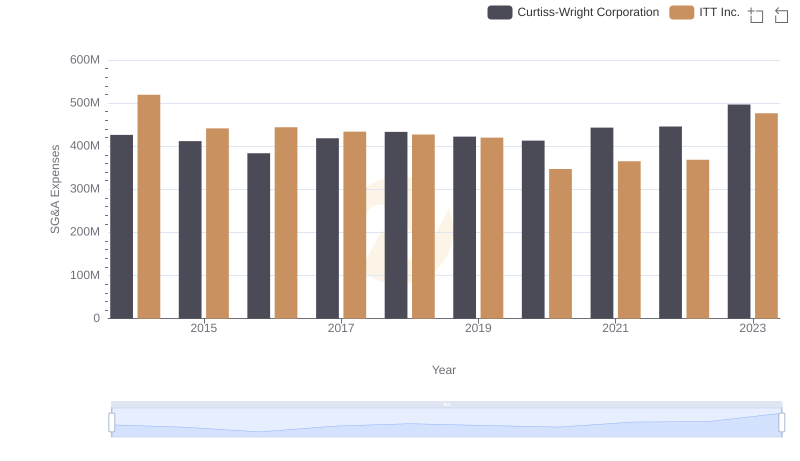

Selling, General, and Administrative Costs: Curtiss-Wright Corporation vs ITT Inc.

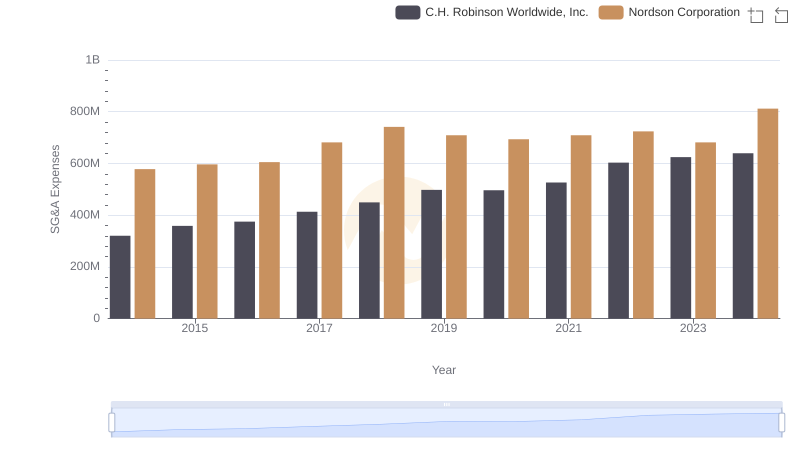

Comparing SG&A Expenses: C.H. Robinson Worldwide, Inc. vs Nordson Corporation Trends and Insights