| __timestamp | Quanta Services, Inc. | United Parcel Service, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 671899000 | 9055000000 |

| Thursday, January 1, 2015 | 497247000 | 9870000000 |

| Friday, January 1, 2016 | 524498000 | 9740000000 |

| Sunday, January 1, 2017 | 647748000 | 9611000000 |

| Monday, January 1, 2018 | 824909000 | 9292000000 |

| Tuesday, January 1, 2019 | 862368000 | 10194000000 |

| Wednesday, January 1, 2020 | 911029000 | 10366000000 |

| Friday, January 1, 2021 | 1052832000 | 15821000000 |

| Saturday, January 1, 2022 | 1483091000 | 17005000000 |

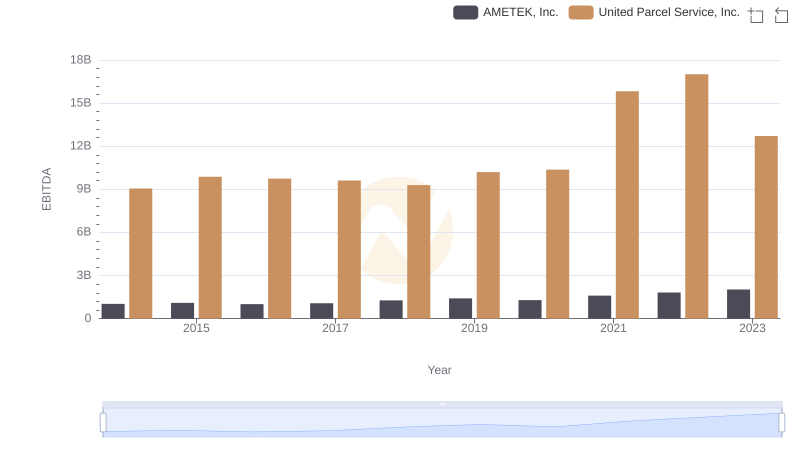

| Sunday, January 1, 2023 | 1770669000 | 12714000000 |

| Monday, January 1, 2024 | 10185000000 |

Data in motion

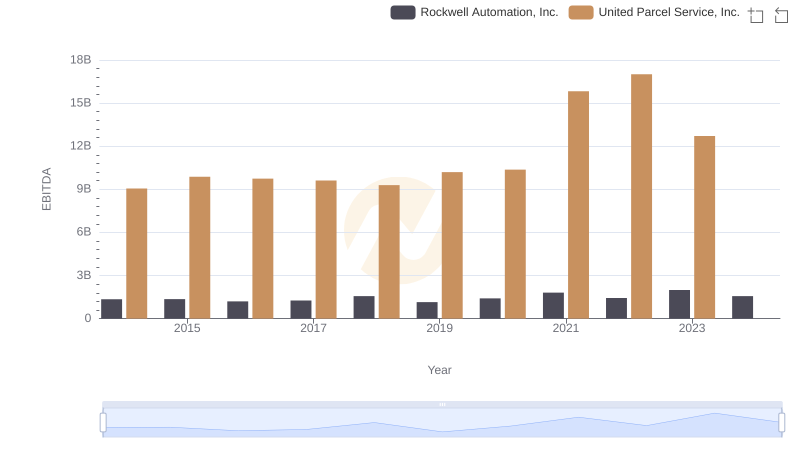

In the ever-evolving landscape of American business, United Parcel Service, Inc. (UPS) and Quanta Services, Inc. have emerged as titans in their respective fields. Over the past decade, from 2014 to 2023, these companies have showcased remarkable EBITDA growth, reflecting their strategic prowess and market adaptability.

UPS, a leader in logistics, has consistently demonstrated robust financial health. From 2014 to 2023, UPS's EBITDA grew by approximately 40%, peaking in 2022. This growth underscores UPS's ability to adapt to global supply chain challenges and capitalize on e-commerce trends.

Quanta Services, specializing in infrastructure solutions, has seen its EBITDA more than double over the same period. This impressive 150% increase highlights Quanta's strategic expansions and its role in supporting the energy and communications sectors.

Both companies exemplify resilience and innovation, setting benchmarks in their industries.

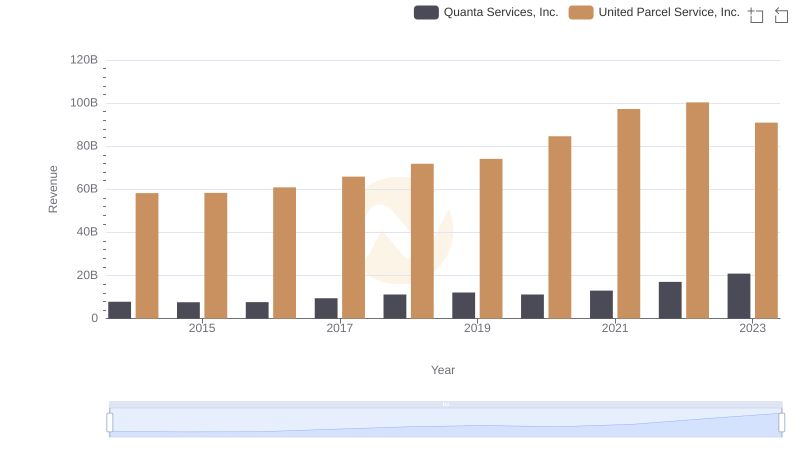

Who Generates More Revenue? United Parcel Service, Inc. or Quanta Services, Inc.

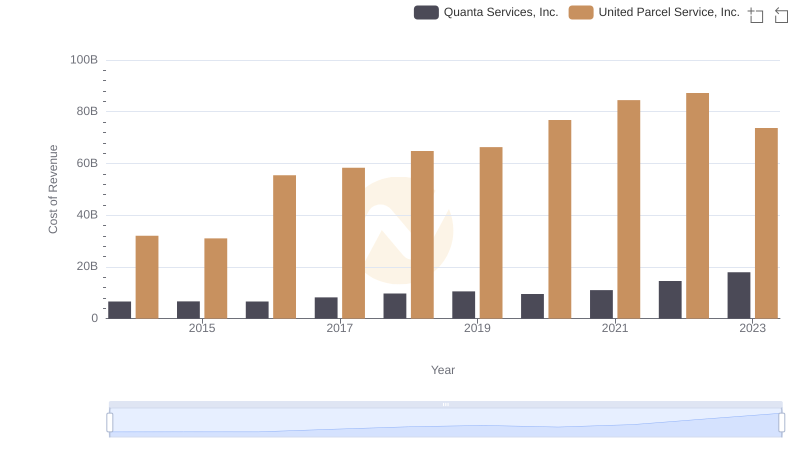

Cost of Revenue: Key Insights for United Parcel Service, Inc. and Quanta Services, Inc.

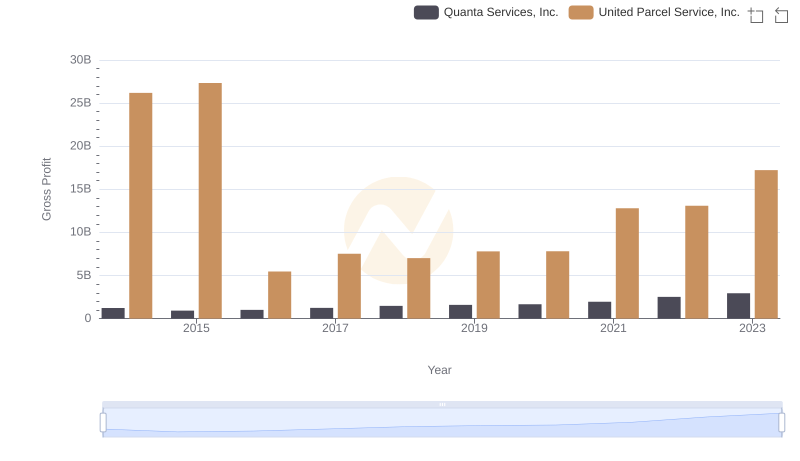

United Parcel Service, Inc. and Quanta Services, Inc.: A Detailed Gross Profit Analysis

United Parcel Service, Inc. and AMETEK, Inc.: A Detailed Examination of EBITDA Performance

Comparative EBITDA Analysis: United Parcel Service, Inc. vs Fastenal Company

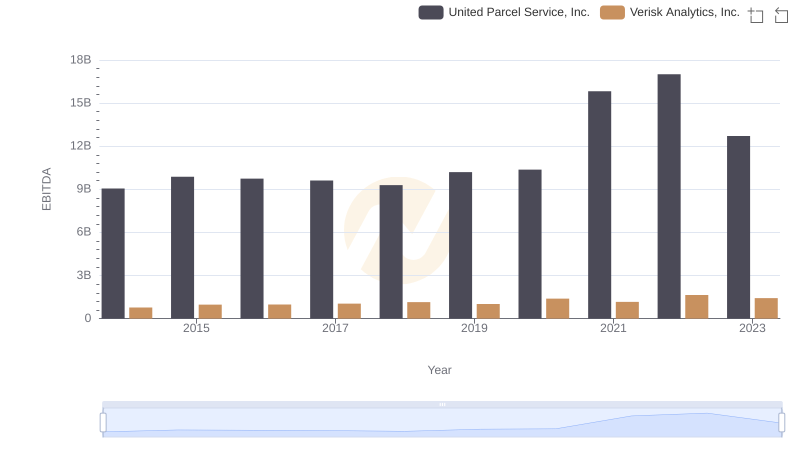

United Parcel Service, Inc. vs Verisk Analytics, Inc.: In-Depth EBITDA Performance Comparison

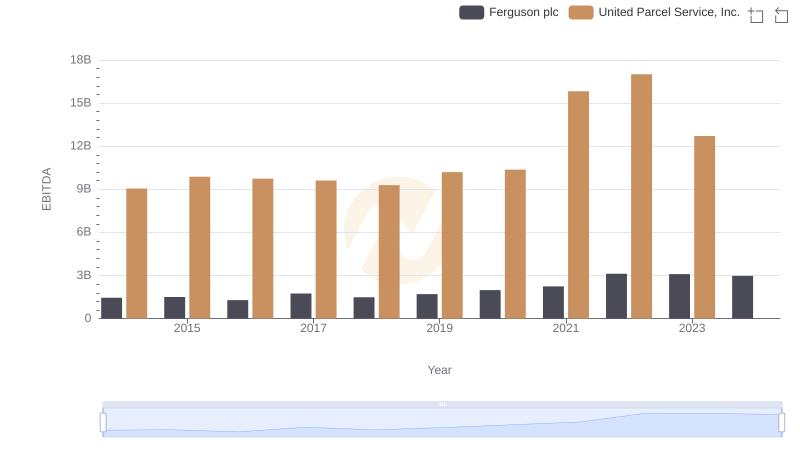

EBITDA Performance Review: United Parcel Service, Inc. vs Ferguson plc

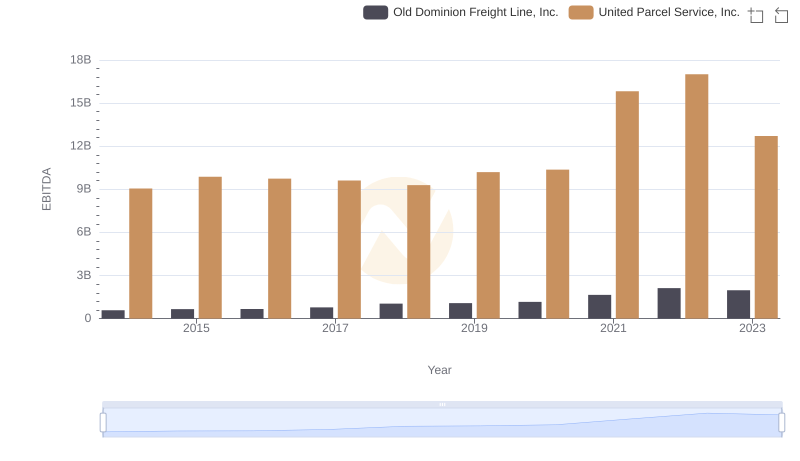

Professional EBITDA Benchmarking: United Parcel Service, Inc. vs Old Dominion Freight Line, Inc.

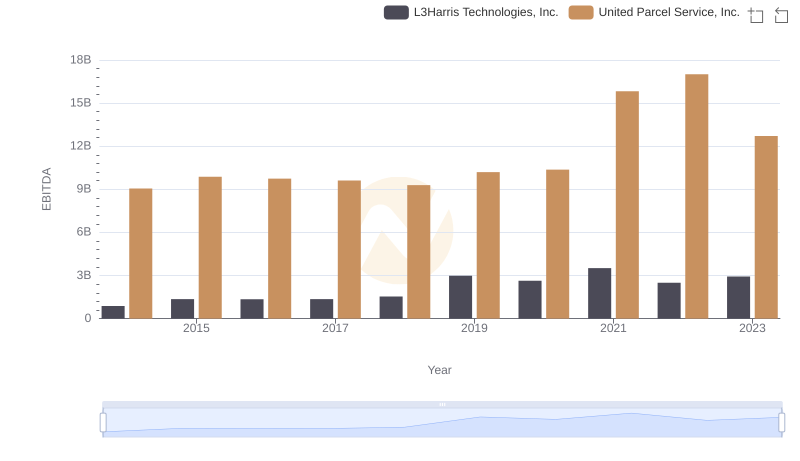

A Side-by-Side Analysis of EBITDA: United Parcel Service, Inc. and L3Harris Technologies, Inc.

United Parcel Service, Inc. and Westinghouse Air Brake Technologies Corporation: A Detailed Examination of EBITDA Performance

Professional EBITDA Benchmarking: United Parcel Service, Inc. vs Rockwell Automation, Inc.