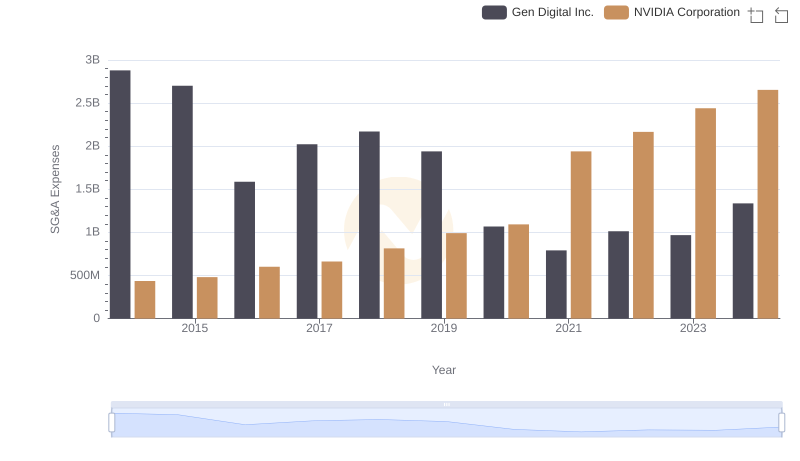

| __timestamp | Gen Digital Inc. | Teledyne Technologies Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2880000000 | 612400000 |

| Thursday, January 1, 2015 | 2702000000 | 588600000 |

| Friday, January 1, 2016 | 1587000000 | 574100000 |

| Sunday, January 1, 2017 | 2023000000 | 656000000 |

| Monday, January 1, 2018 | 2171000000 | 694200000 |

| Tuesday, January 1, 2019 | 1940000000 | 751600000 |

| Wednesday, January 1, 2020 | 1069000000 | 700800000 |

| Friday, January 1, 2021 | 791000000 | 1067800000 |

| Saturday, January 1, 2022 | 1014000000 | 1156600000 |

| Sunday, January 1, 2023 | 968000000 | 1208300000 |

| Monday, January 1, 2024 | 1337000000 |

Unleashing the power of data

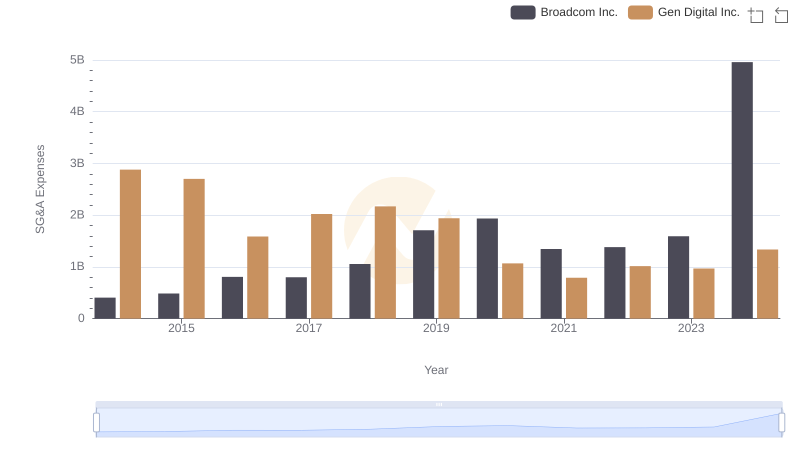

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Gen Digital Inc. and Teledyne Technologies Incorporated have shown contrasting trends in their SG&A management. From 2014 to 2023, Gen Digital's SG&A expenses decreased by approximately 54%, from $2.88 billion to $1.34 billion. This significant reduction highlights their strategic cost management efforts. In contrast, Teledyne Technologies saw a 97% increase in SG&A expenses, peaking at $1.21 billion in 2023. This rise could indicate strategic investments or inefficiencies. Notably, Teledyne's data for 2024 is missing, leaving room for speculation on their future financial strategies. As businesses navigate economic challenges, understanding these trends offers valuable insights into corporate financial health and strategic planning.

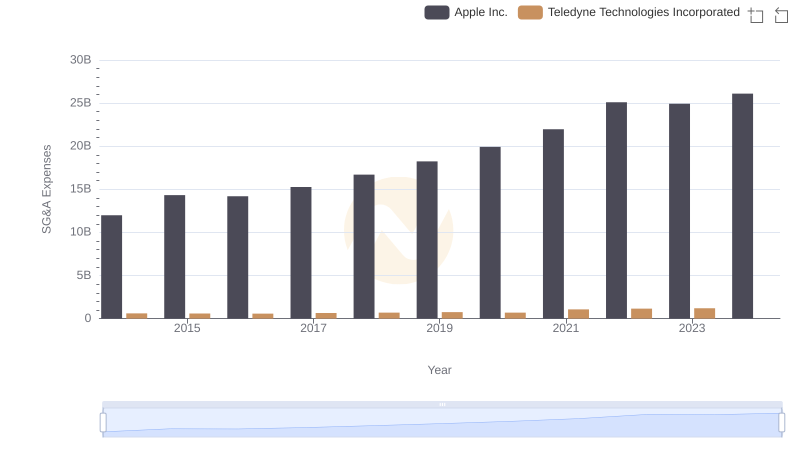

Breaking Down SG&A Expenses: Apple Inc. vs Teledyne Technologies Incorporated

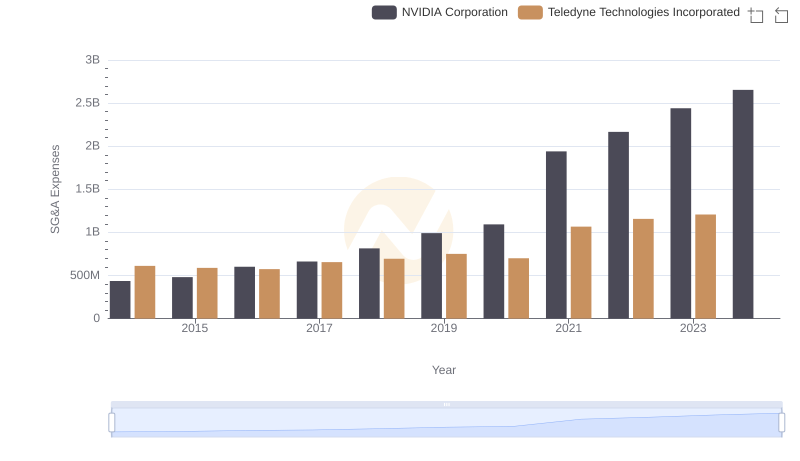

NVIDIA Corporation and Teledyne Technologies Incorporated: SG&A Spending Patterns Compared

Comparing SG&A Expenses: NVIDIA Corporation vs Gen Digital Inc. Trends and Insights

Selling, General, and Administrative Costs: Taiwan Semiconductor Manufacturing Company Limited vs Teledyne Technologies Incorporated

SG&A Efficiency Analysis: Comparing Taiwan Semiconductor Manufacturing Company Limited and Gen Digital Inc.

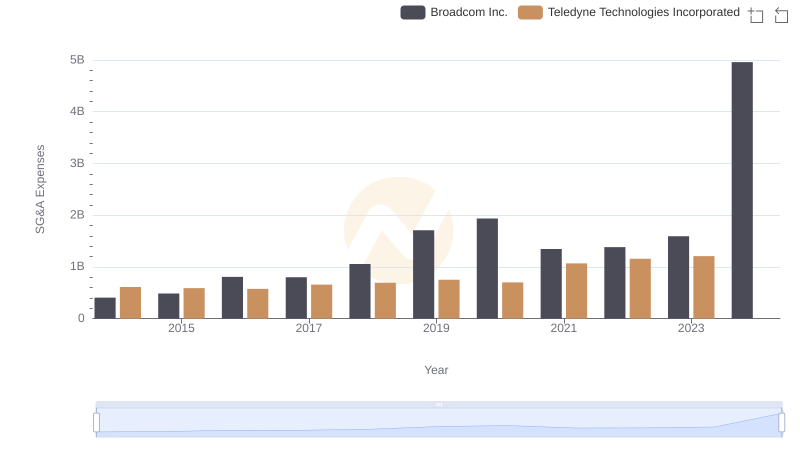

Comparing SG&A Expenses: Broadcom Inc. vs Teledyne Technologies Incorporated Trends and Insights

Selling, General, and Administrative Costs: Broadcom Inc. vs Gen Digital Inc.

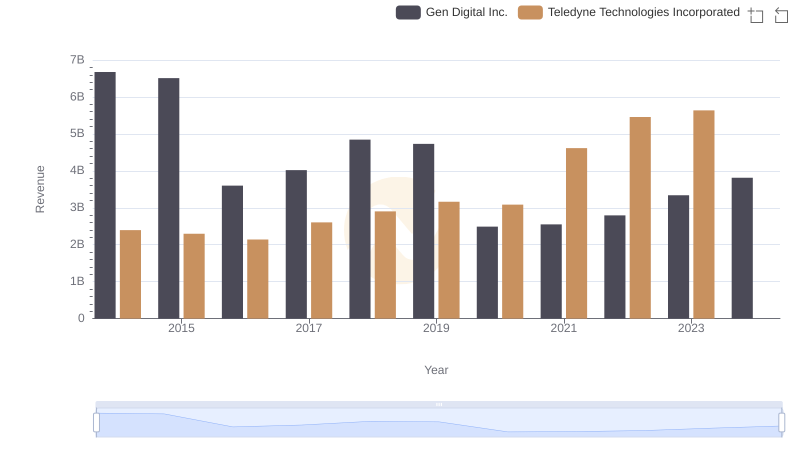

Revenue Showdown: Teledyne Technologies Incorporated vs Gen Digital Inc.

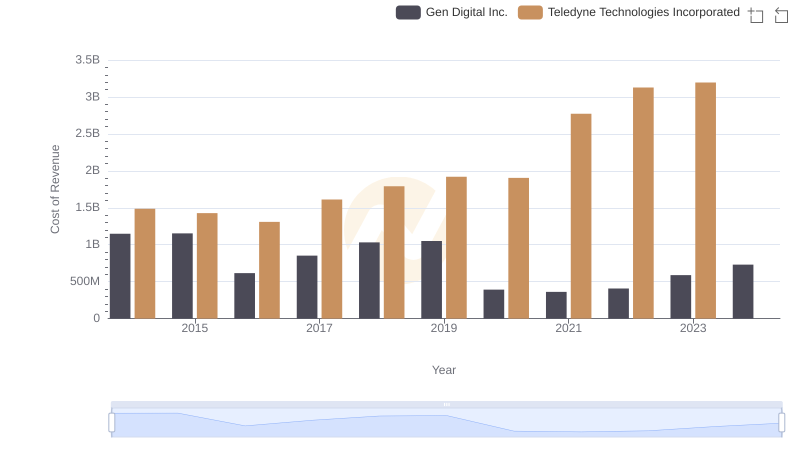

Cost of Revenue Comparison: Teledyne Technologies Incorporated vs Gen Digital Inc.

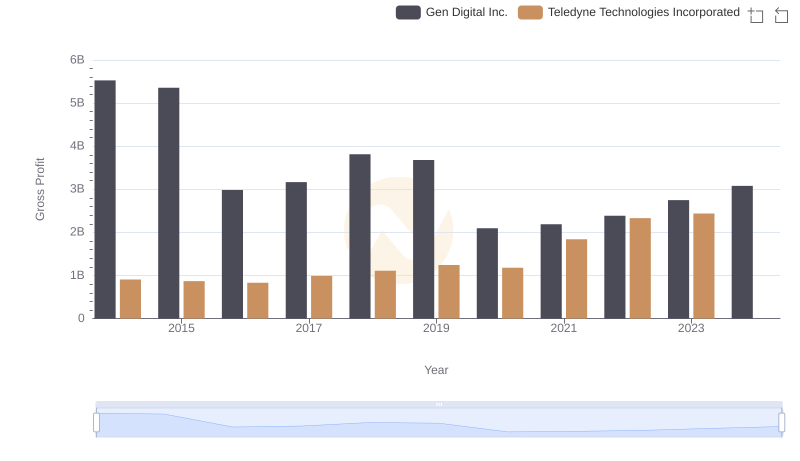

Key Insights on Gross Profit: Teledyne Technologies Incorporated vs Gen Digital Inc.

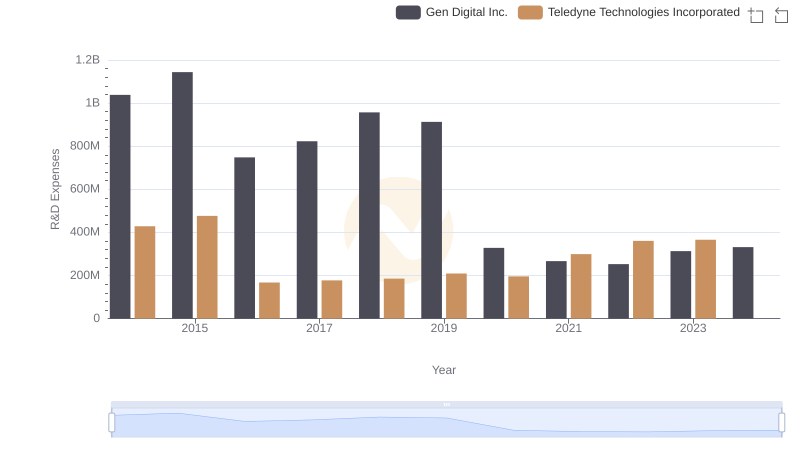

Comparing Innovation Spending: Teledyne Technologies Incorporated and Gen Digital Inc.

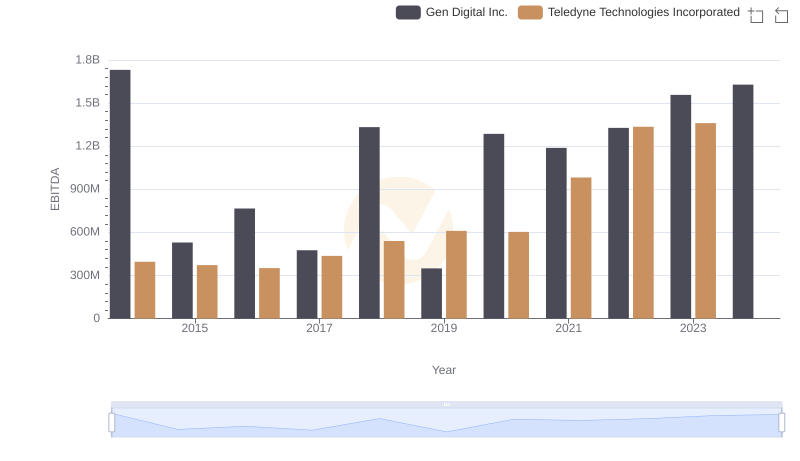

A Professional Review of EBITDA: Teledyne Technologies Incorporated Compared to Gen Digital Inc.