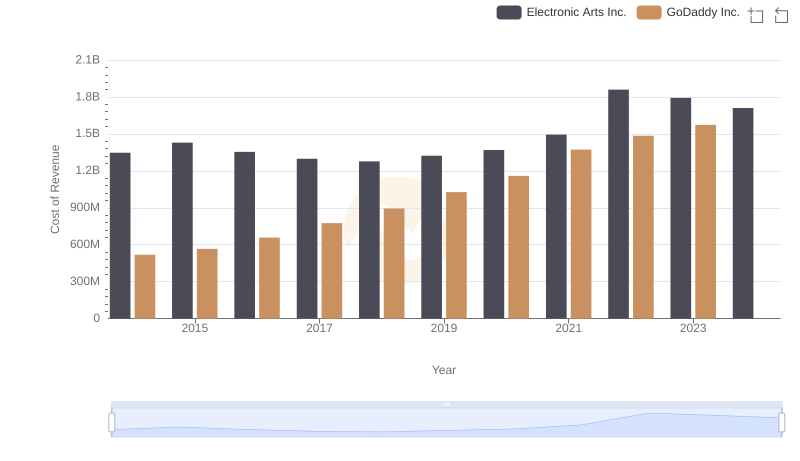

| __timestamp | Electronic Arts Inc. | GoDaddy Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1090000000 | 333054000 |

| Thursday, January 1, 2015 | 1033000000 | 421900000 |

| Friday, January 1, 2016 | 1028000000 | 450000000 |

| Sunday, January 1, 2017 | 1112000000 | 535600000 |

| Monday, January 1, 2018 | 1110000000 | 625400000 |

| Tuesday, January 1, 2019 | 1162000000 | 707700000 |

| Wednesday, January 1, 2020 | 1137000000 | 762300000 |

| Friday, January 1, 2021 | 1281000000 | 849700000 |

| Saturday, January 1, 2022 | 1634000000 | 797800000 |

| Sunday, January 1, 2023 | 1705000000 | 1019300000 |

| Monday, January 1, 2024 | 1710000000 | 751100000 |

Unleashing the power of data

In the dynamic world of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a crucial indicator of a company's operational efficiency. This article delves into the SG&A trends of two industry giants: Electronic Arts Inc. (EA) and GoDaddy Inc., from 2014 to 2023.

EA, a leader in the gaming industry, has seen its SG&A expenses grow by approximately 57% over the past decade, peaking in 2023. This reflects its strategic investments in marketing and administrative capabilities to maintain its competitive edge. Meanwhile, GoDaddy, a prominent player in web hosting, experienced a 206% increase in SG&A expenses, highlighting its aggressive expansion and customer acquisition strategies.

Interestingly, while EA's expenses consistently rose, GoDaddy's expenses showed a more volatile pattern, with a notable surge in 2023. This divergence underscores the distinct operational challenges and growth trajectories faced by these companies.

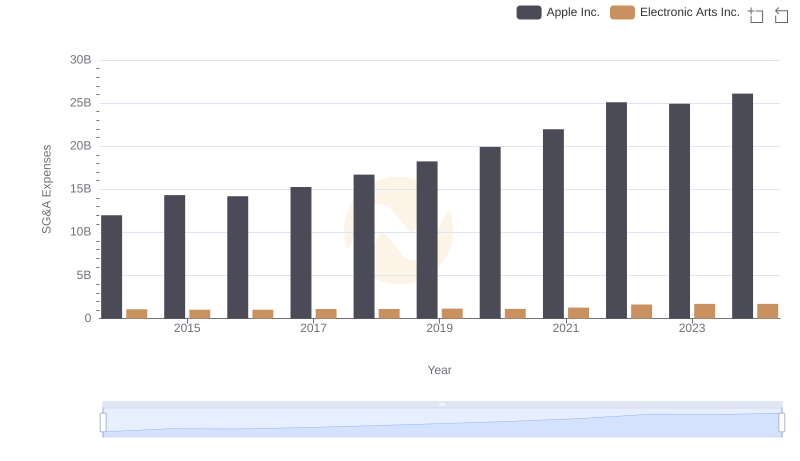

Apple Inc. vs Electronic Arts Inc.: SG&A Expense Trends

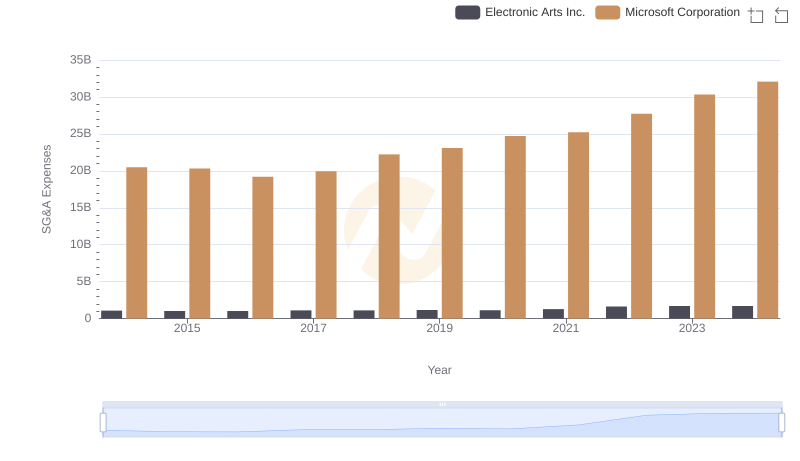

Who Optimizes SG&A Costs Better? Microsoft Corporation or Electronic Arts Inc.

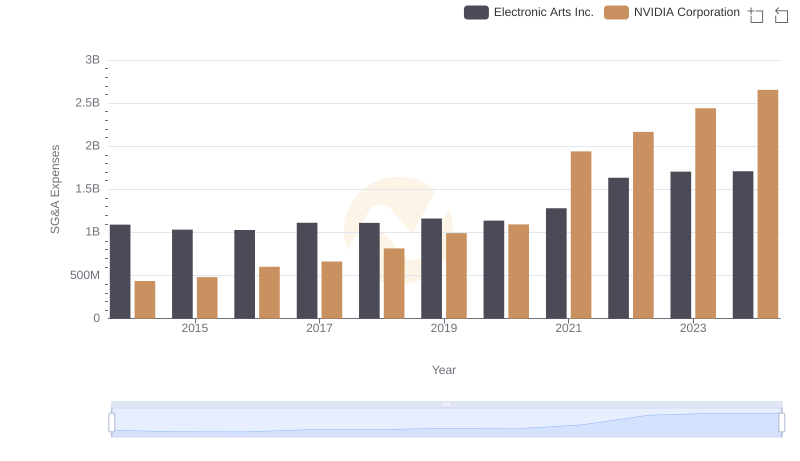

Who Optimizes SG&A Costs Better? NVIDIA Corporation or Electronic Arts Inc.

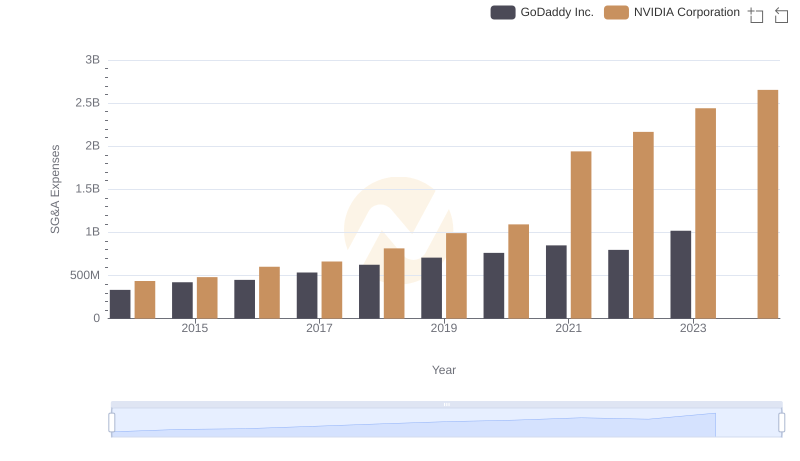

Comparing SG&A Expenses: NVIDIA Corporation vs GoDaddy Inc. Trends and Insights

Taiwan Semiconductor Manufacturing Company Limited vs Electronic Arts Inc.: SG&A Expense Trends

Cost Management Insights: SG&A Expenses for Taiwan Semiconductor Manufacturing Company Limited and GoDaddy Inc.

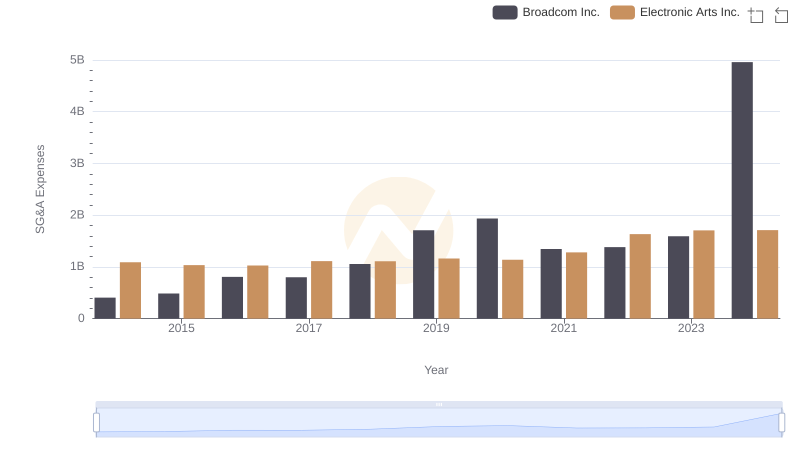

Selling, General, and Administrative Costs: Broadcom Inc. vs Electronic Arts Inc.

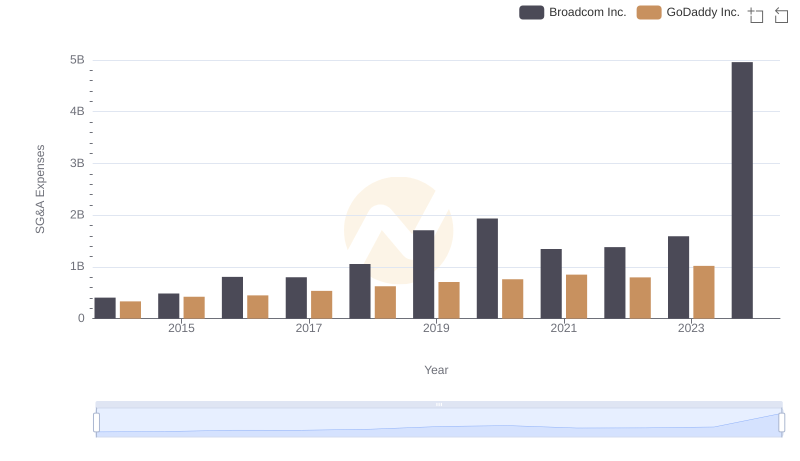

Selling, General, and Administrative Costs: Broadcom Inc. vs GoDaddy Inc.

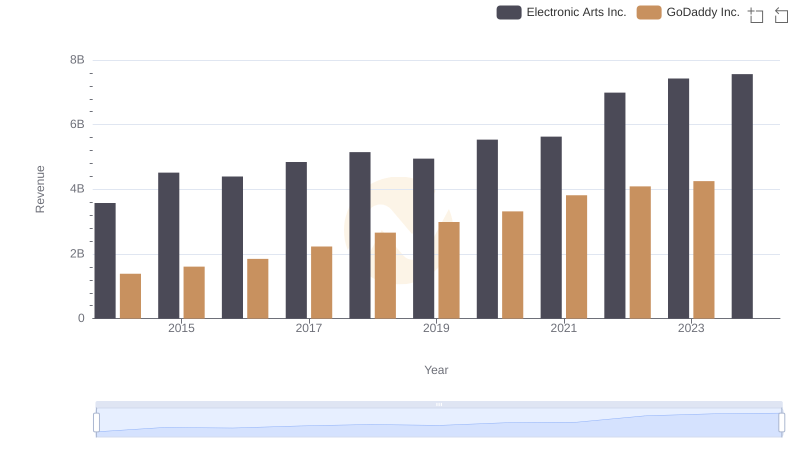

Revenue Showdown: Electronic Arts Inc. vs GoDaddy Inc.

Cost of Revenue: Key Insights for Electronic Arts Inc. and GoDaddy Inc.

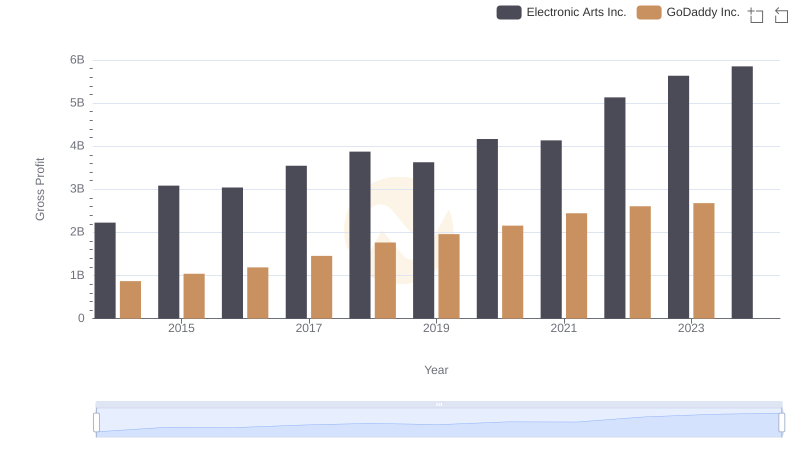

Gross Profit Trends Compared: Electronic Arts Inc. vs GoDaddy Inc.

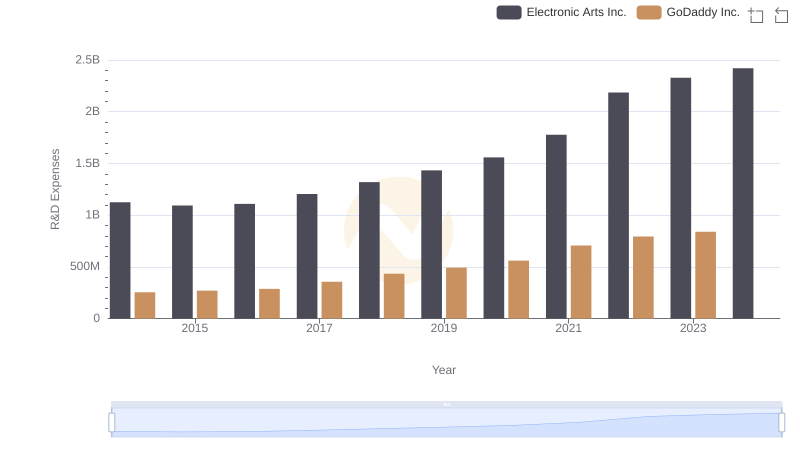

Research and Development Expenses Breakdown: Electronic Arts Inc. vs GoDaddy Inc.