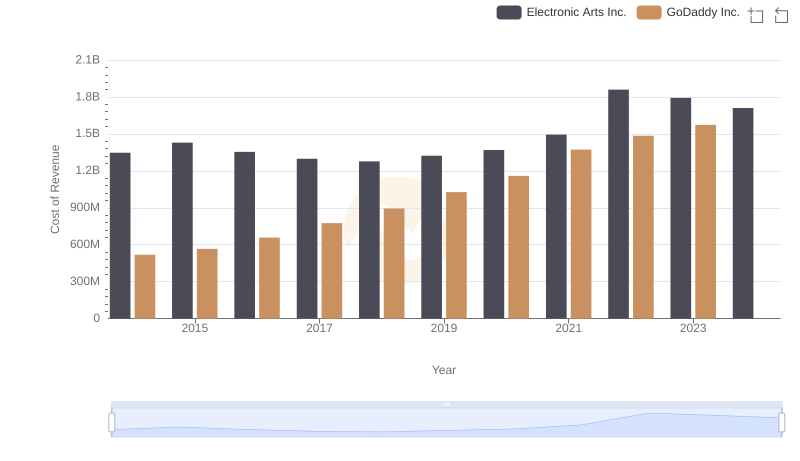

| __timestamp | Electronic Arts Inc. | GoDaddy Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1125000000 | 254440000 |

| Thursday, January 1, 2015 | 1094000000 | 270200000 |

| Friday, January 1, 2016 | 1109000000 | 287800000 |

| Sunday, January 1, 2017 | 1205000000 | 355800000 |

| Monday, January 1, 2018 | 1320000000 | 434000000 |

| Tuesday, January 1, 2019 | 1433000000 | 492600000 |

| Wednesday, January 1, 2020 | 1559000000 | 560400000 |

| Friday, January 1, 2021 | 1778000000 | 706300000 |

| Saturday, January 1, 2022 | 2186000000 | 794000000 |

| Sunday, January 1, 2023 | 2328000000 | 839600000 |

| Monday, January 1, 2024 | 2420000000 | 814400000 |

Unleashing insights

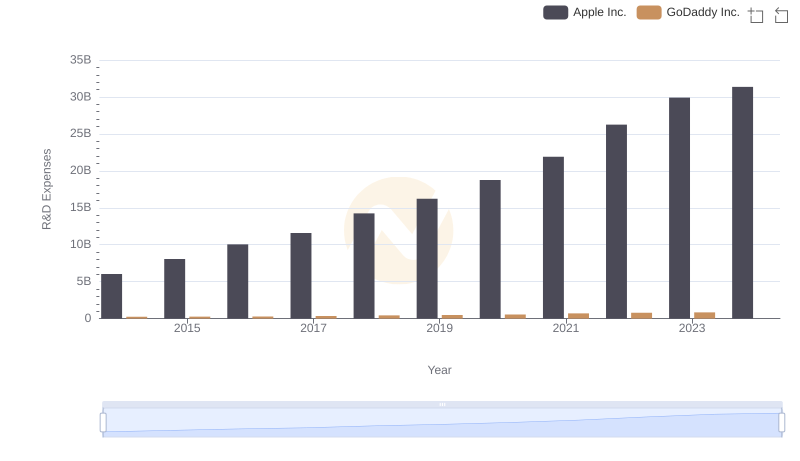

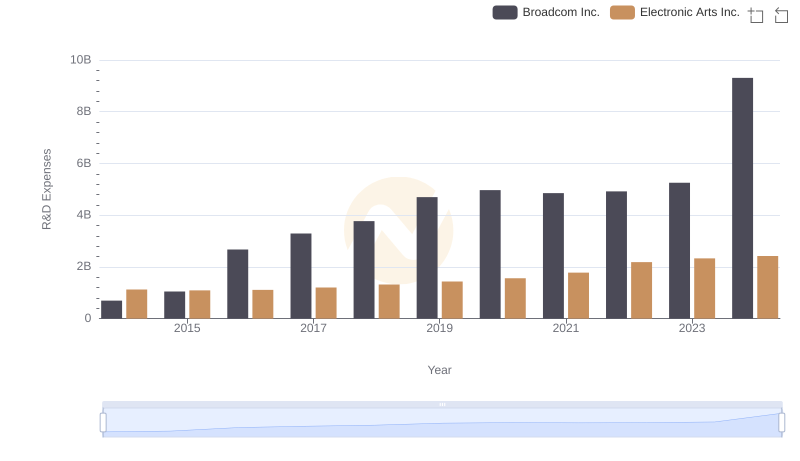

In the ever-evolving landscape of technology, research and development (R&D) expenses are a critical indicator of a company's commitment to innovation. Over the past decade, Electronic Arts Inc. (EA) and GoDaddy Inc. have demonstrated contrasting trajectories in their R&D investments.

Since 2014, EA has consistently increased its R&D spending, reflecting its dedication to maintaining a competitive edge in the gaming industry. By 2023, EA's R&D expenses surged by approximately 107% from 2014, reaching a peak of $2.33 billion. This growth underscores EA's strategic focus on developing cutting-edge gaming experiences.

Conversely, GoDaddy's R&D investments have grown at a steadier pace, with a notable increase of around 230% from 2014 to 2023. This rise highlights GoDaddy's efforts to enhance its web hosting and domain services, catering to a diverse clientele.

While EA's R&D spending is significantly higher, GoDaddy's rapid growth rate in R&D investment is noteworthy. However, data for 2024 is missing for GoDaddy, leaving room for speculation on its future trajectory.

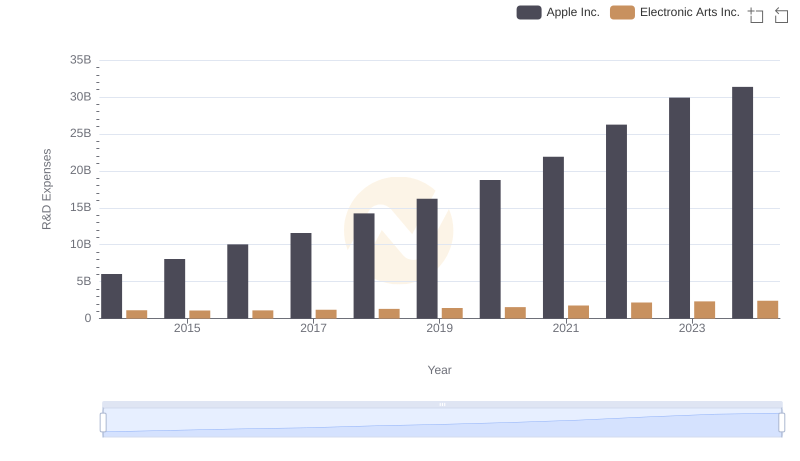

Research and Development: Comparing Key Metrics for Apple Inc. and Electronic Arts Inc.

Apple Inc. vs GoDaddy Inc.: Strategic Focus on R&D Spending

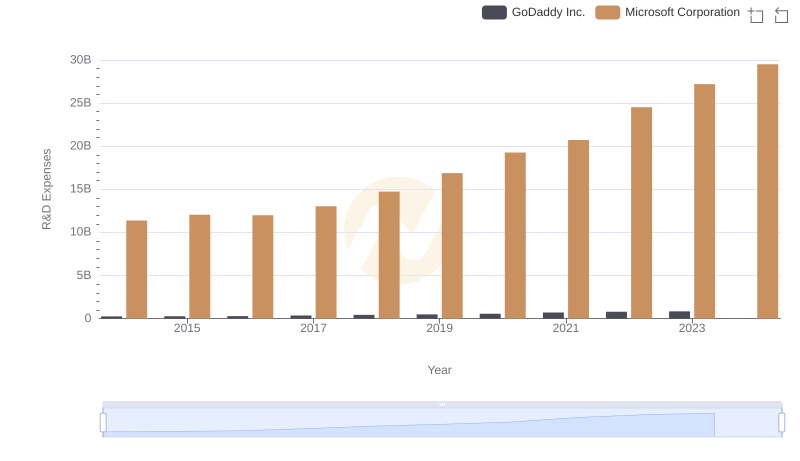

Microsoft Corporation or GoDaddy Inc.: Who Invests More in Innovation?

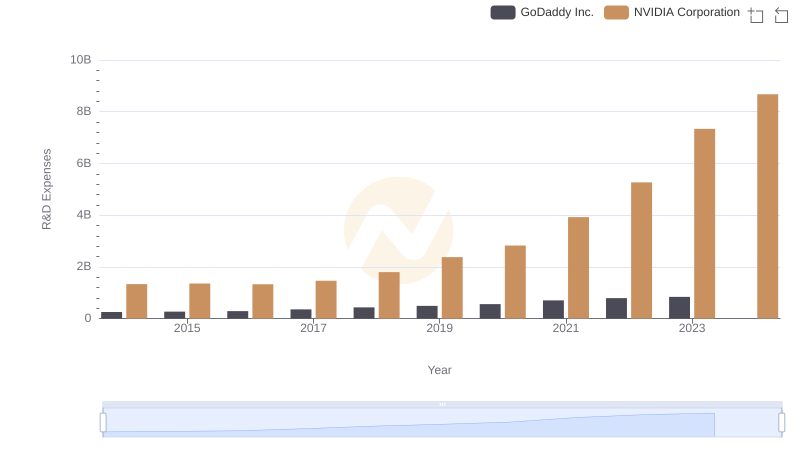

Analyzing R&D Budgets: NVIDIA Corporation vs GoDaddy Inc.

Taiwan Semiconductor Manufacturing Company Limited vs Electronic Arts Inc.: Strategic Focus on R&D Spending

Research and Development Expenses Breakdown: Taiwan Semiconductor Manufacturing Company Limited vs GoDaddy Inc.

Research and Development: Comparing Key Metrics for Broadcom Inc. and Electronic Arts Inc.

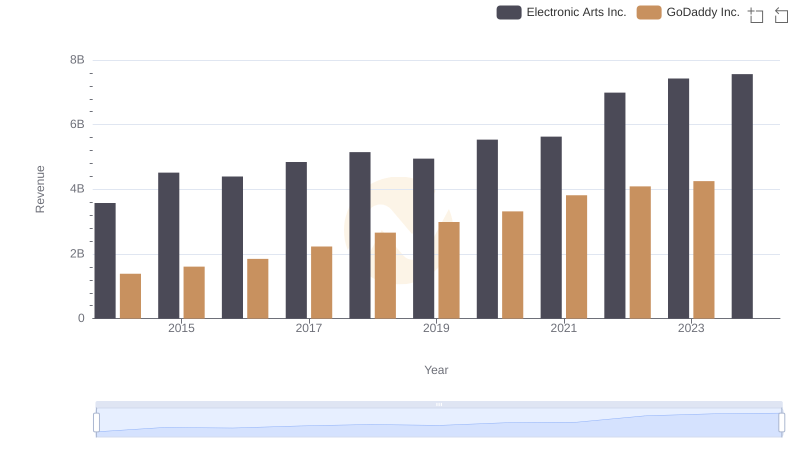

Revenue Showdown: Electronic Arts Inc. vs GoDaddy Inc.

Cost of Revenue: Key Insights for Electronic Arts Inc. and GoDaddy Inc.

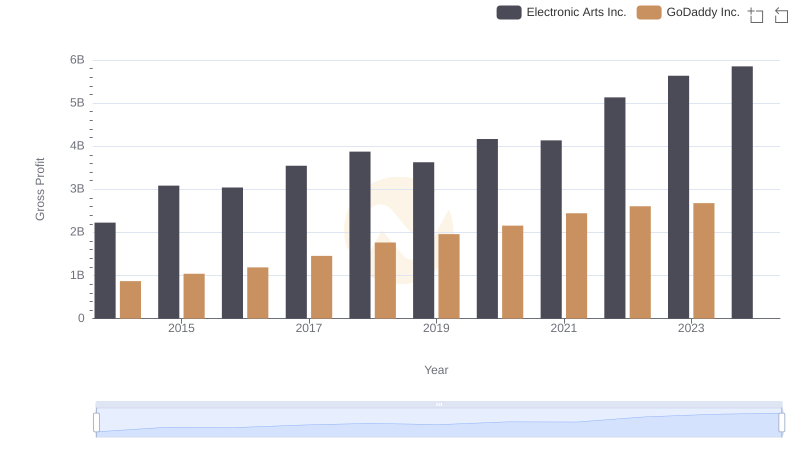

Gross Profit Trends Compared: Electronic Arts Inc. vs GoDaddy Inc.

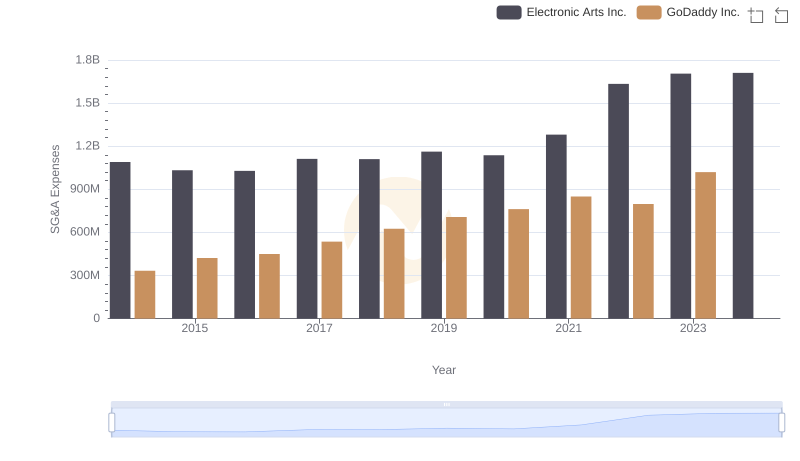

Selling, General, and Administrative Costs: Electronic Arts Inc. vs GoDaddy Inc.