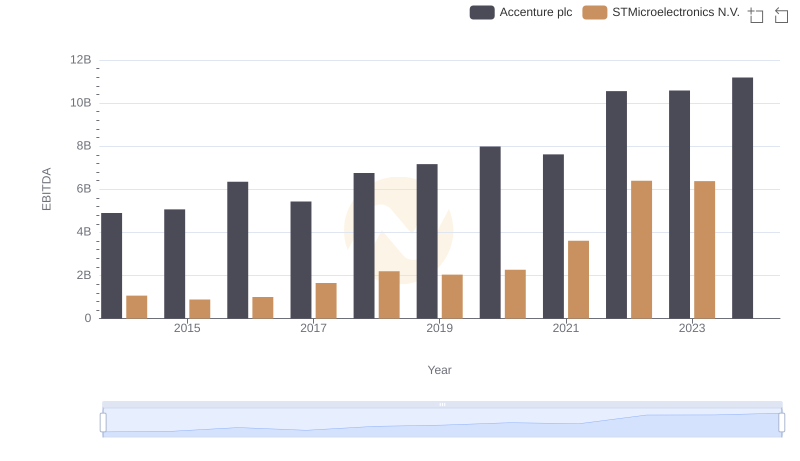

| __timestamp | Accenture plc | STMicroelectronics N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 5401969000 | 940000000 |

| Thursday, January 1, 2015 | 5373370000 | 891000000 |

| Friday, January 1, 2016 | 5466982000 | 933000000 |

| Sunday, January 1, 2017 | 6397883000 | 1001000000 |

| Monday, January 1, 2018 | 6601872000 | 1109000000 |

| Tuesday, January 1, 2019 | 7009614000 | 1093000000 |

| Wednesday, January 1, 2020 | 7462514000 | 1123000000 |

| Friday, January 1, 2021 | 8742599000 | 1319000000 |

| Saturday, January 1, 2022 | 10334358000 | 1428000000 |

| Sunday, January 1, 2023 | 10858572000 | 1650000000 |

| Monday, January 1, 2024 | 11128030000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, understanding the financial strategies of industry leaders is crucial. Selling, General, and Administrative (SG&A) expenses are a key indicator of a company's operational efficiency. Over the past decade, Accenture plc and STMicroelectronics N.V. have demonstrated contrasting trends in their SG&A expenses.

From 2014 to 2023, Accenture's SG&A expenses surged by approximately 106%, reflecting its strategic investments in growth and innovation. In contrast, STMicroelectronics showed a more modest increase of around 75% over the same period, indicating a more conservative approach to cost management.

Interestingly, the data for 2024 is incomplete, highlighting the dynamic nature of financial reporting. As businesses navigate the complexities of the modern economy, these insights offer a glimpse into the strategic priorities of two major players in the tech industry.

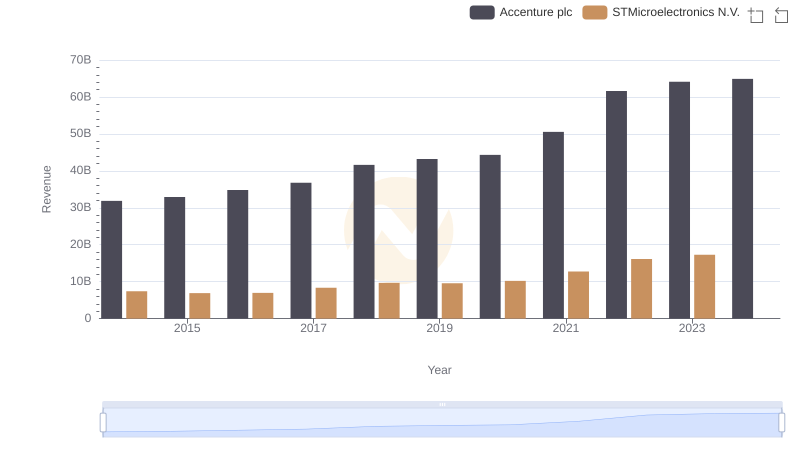

Accenture plc vs STMicroelectronics N.V.: Examining Key Revenue Metrics

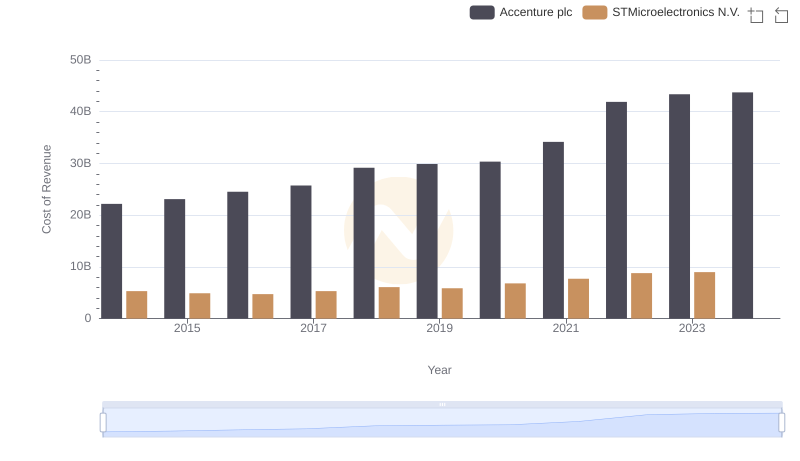

Cost Insights: Breaking Down Accenture plc and STMicroelectronics N.V.'s Expenses

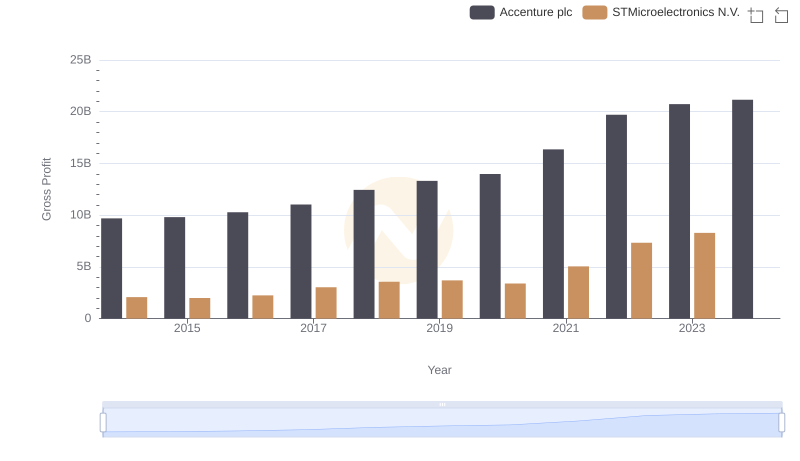

Gross Profit Analysis: Comparing Accenture plc and STMicroelectronics N.V.

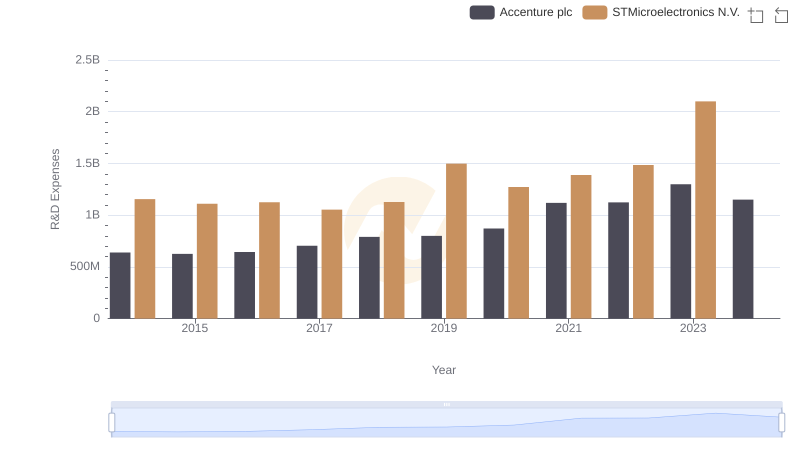

Who Prioritizes Innovation? R&D Spending Compared for Accenture plc and STMicroelectronics N.V.

Cost Management Insights: SG&A Expenses for Accenture plc and ON Semiconductor Corporation

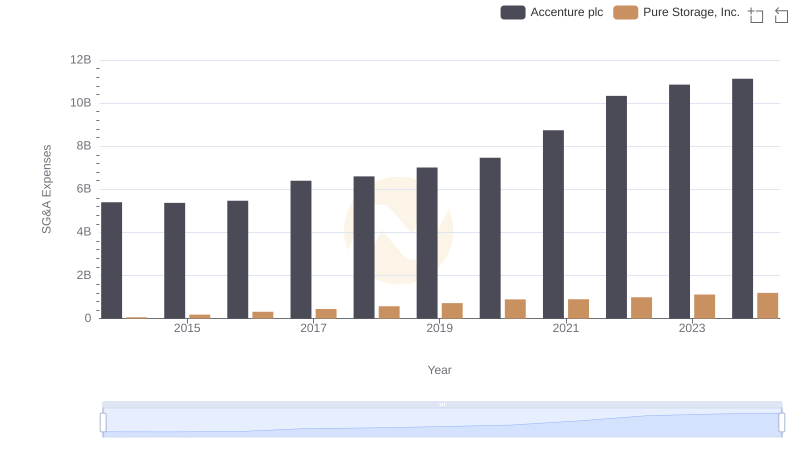

Who Optimizes SG&A Costs Better? Accenture plc or Pure Storage, Inc.

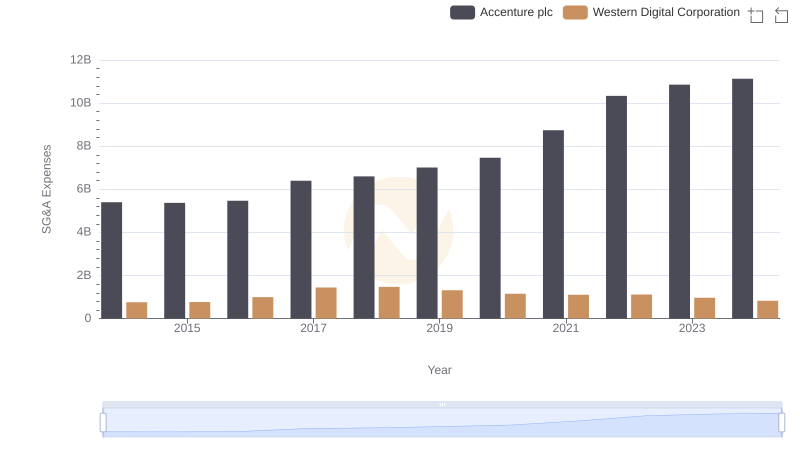

Accenture plc vs Western Digital Corporation: SG&A Expense Trends

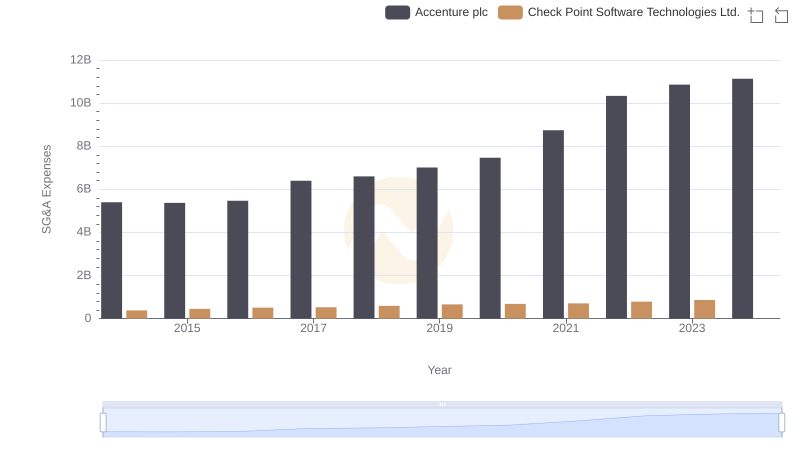

Accenture plc and Check Point Software Technologies Ltd.: SG&A Spending Patterns Compared

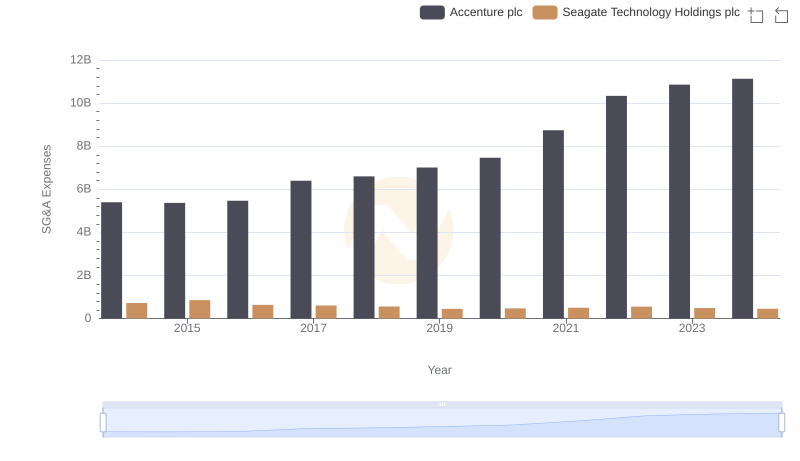

Accenture plc and Seagate Technology Holdings plc: SG&A Spending Patterns Compared

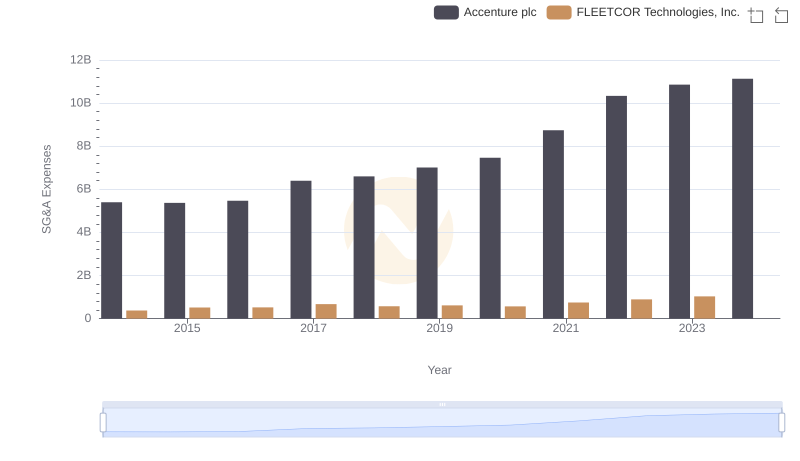

Accenture plc vs FLEETCOR Technologies, Inc.: SG&A Expense Trends

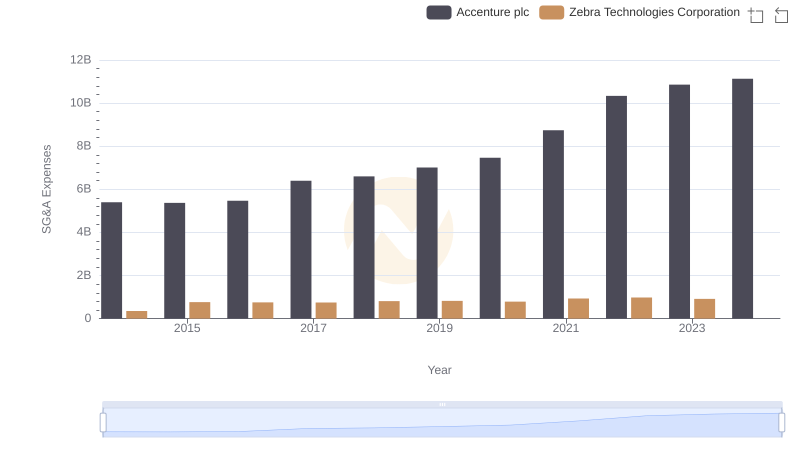

Comparing SG&A Expenses: Accenture plc vs Zebra Technologies Corporation Trends and Insights

A Professional Review of EBITDA: Accenture plc Compared to STMicroelectronics N.V.