| __timestamp | Microchip Technology Incorporated | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 651027000 | 86715000 |

| Thursday, January 1, 2015 | 731158000 | 154994000 |

| Friday, January 1, 2016 | 668482000 | 120773000 |

| Sunday, January 1, 2017 | 705341000 | 111232000 |

| Monday, January 1, 2018 | 1552200000 | 115787000 |

| Tuesday, January 1, 2019 | 1624400000 | 120415000 |

| Wednesday, January 1, 2020 | 1909400000 | 114126000 |

| Friday, January 1, 2021 | 2153100000 | 152132000 |

| Saturday, January 1, 2022 | 3022600000 | 335167000 |

| Sunday, January 1, 2023 | 4112000000 | 796046000 |

| Monday, January 1, 2024 | 3438200000 | 1288409000 |

Unleashing the power of data

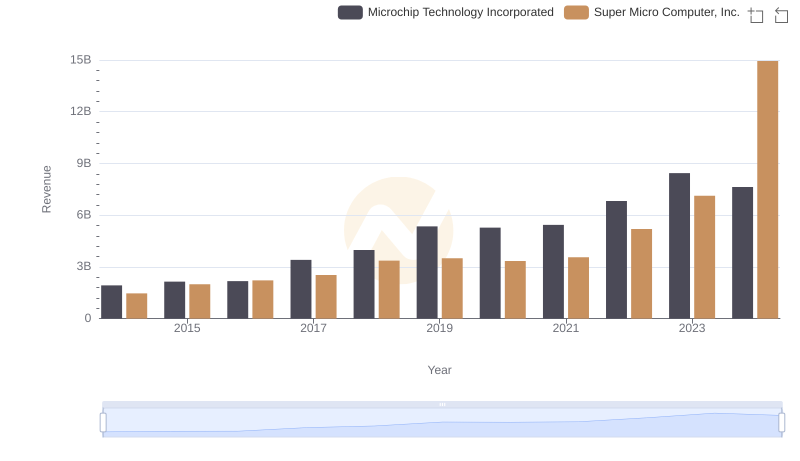

In the ever-evolving landscape of technology, Microchip Technology Incorporated and Super Micro Computer, Inc. have carved distinct paths in the semiconductor and computing sectors, respectively. From 2014 to 2024, Microchip Technology's EBITDA has surged by over 400%, reflecting its robust growth and strategic acquisitions. In contrast, Super Micro Computer, Inc. has experienced a more modest increase of approximately 1,400%, showcasing its steady expansion in the high-performance computing market.

Microchip Technology's EBITDA growth peaked in 2023, with a remarkable 36% increase from the previous year, underscoring its resilience amidst global supply chain challenges. Meanwhile, Super Micro Computer, Inc. saw its most significant leap in 2024, with a 62% rise, driven by the growing demand for data center solutions. This decade-long financial journey highlights the dynamic nature of the tech industry and the strategic maneuvers of these two industry leaders.

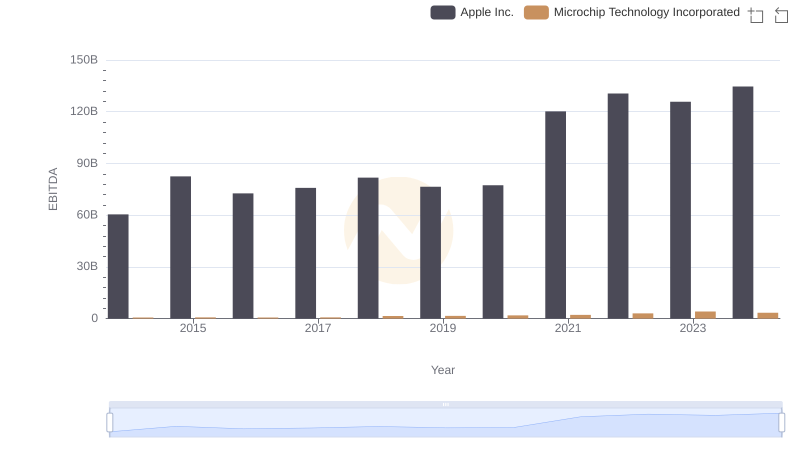

EBITDA Analysis: Evaluating Apple Inc. Against Microchip Technology Incorporated

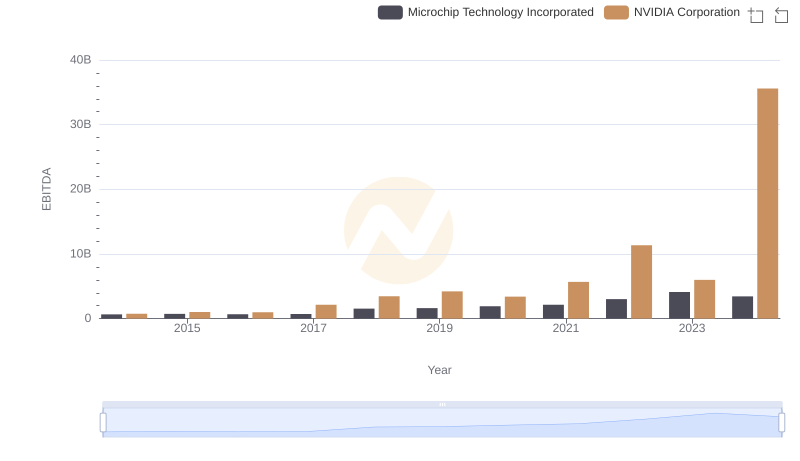

NVIDIA Corporation and Microchip Technology Incorporated: A Detailed Examination of EBITDA Performance

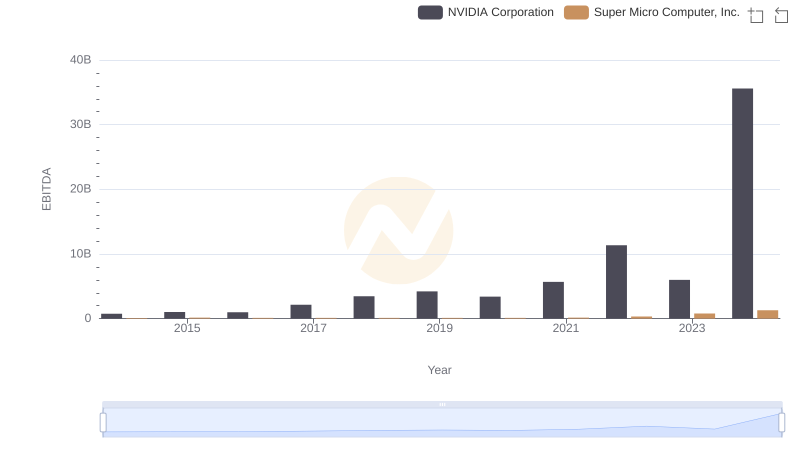

A Professional Review of EBITDA: NVIDIA Corporation Compared to Super Micro Computer, Inc.

EBITDA Analysis: Evaluating Taiwan Semiconductor Manufacturing Company Limited Against Microchip Technology Incorporated

EBITDA Performance Review: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

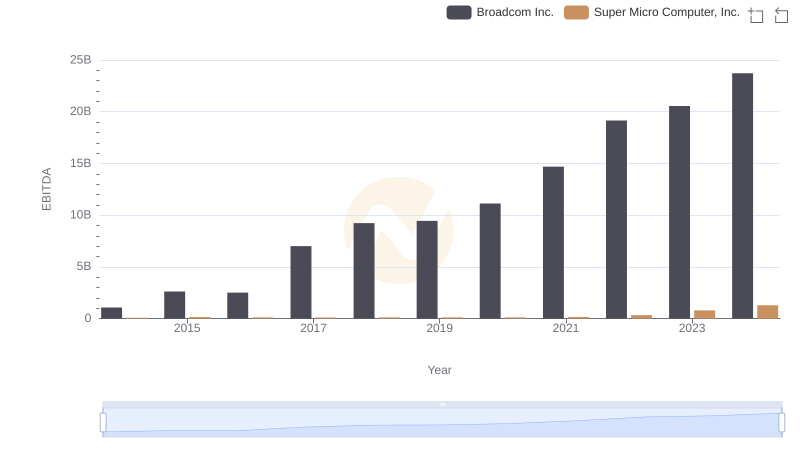

A Side-by-Side Analysis of EBITDA: Broadcom Inc. and Super Micro Computer, Inc.

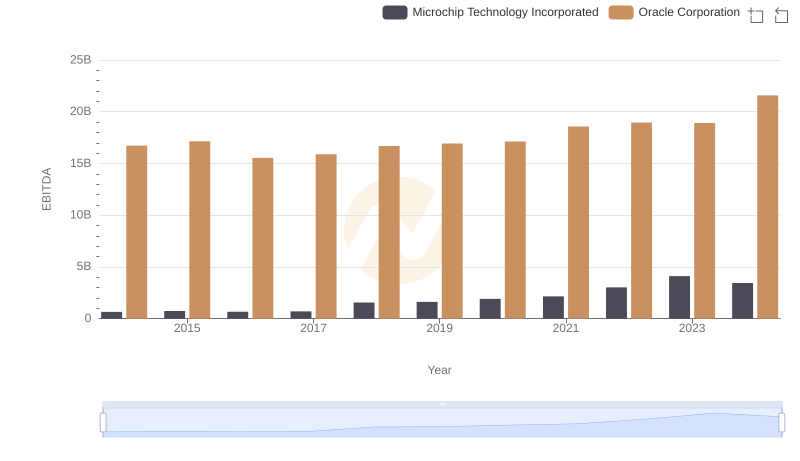

Oracle Corporation and Microchip Technology Incorporated: A Detailed Examination of EBITDA Performance

Who Generates More Revenue? Microchip Technology Incorporated or Super Micro Computer, Inc.

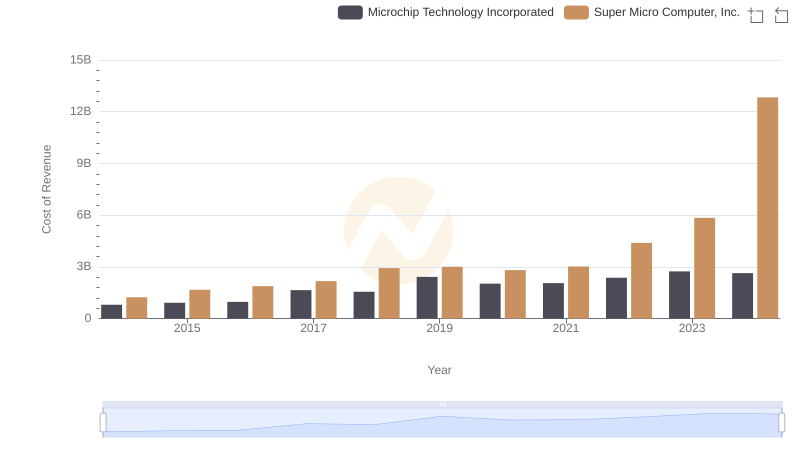

Comparing Cost of Revenue Efficiency: Microchip Technology Incorporated vs Super Micro Computer, Inc.

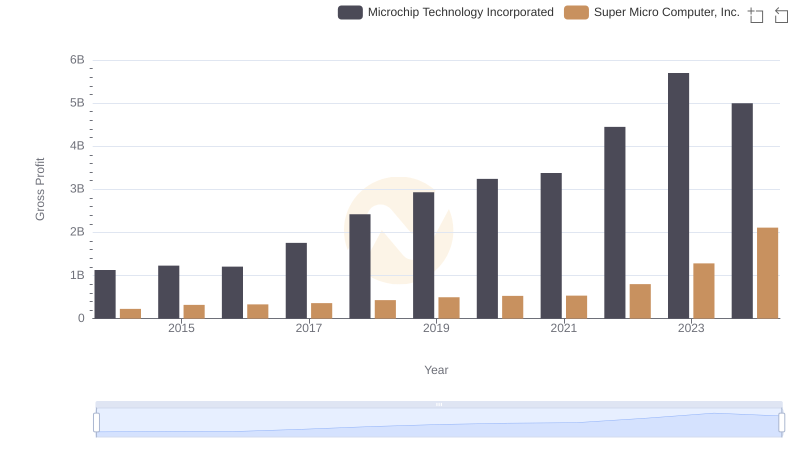

Microchip Technology Incorporated vs Super Micro Computer, Inc.: A Gross Profit Performance Breakdown

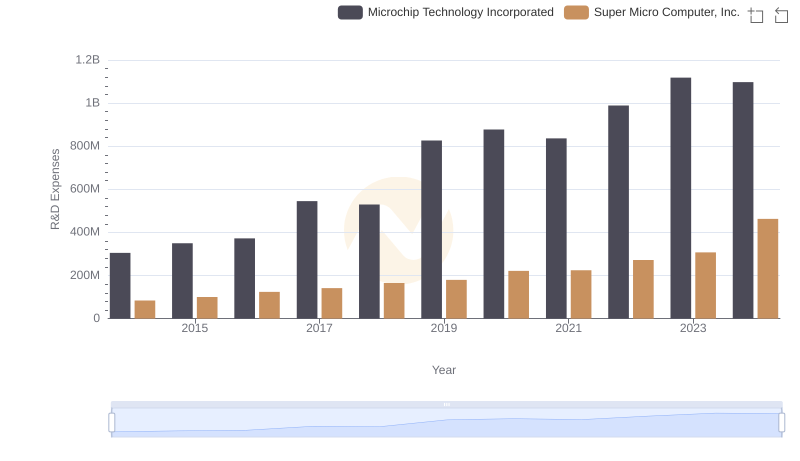

Microchip Technology Incorporated vs Super Micro Computer, Inc.: Strategic Focus on R&D Spending

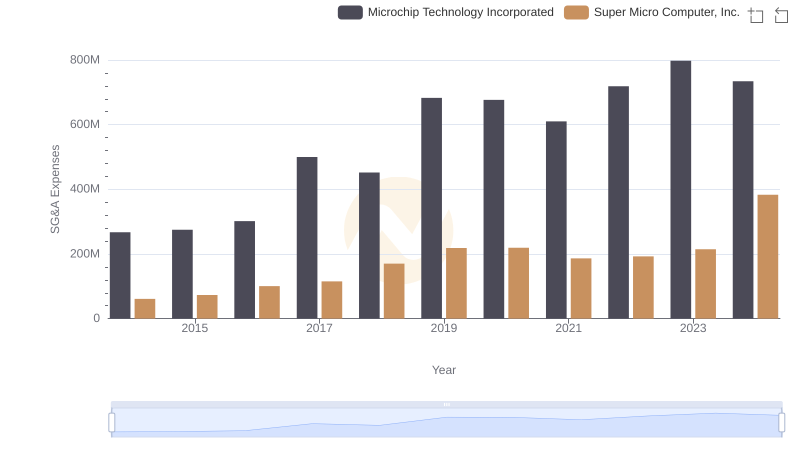

Cost Management Insights: SG&A Expenses for Microchip Technology Incorporated and Super Micro Computer, Inc.