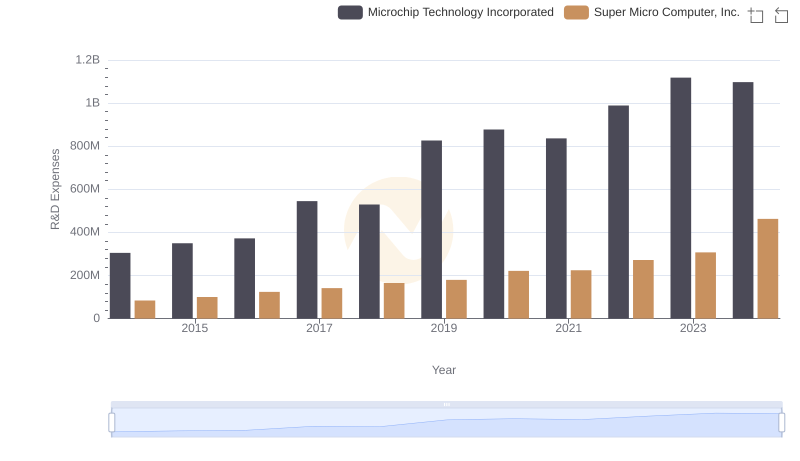

| __timestamp | Microchip Technology Incorporated | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 267278000 | 61029000 |

| Thursday, January 1, 2015 | 274815000 | 73228000 |

| Friday, January 1, 2016 | 301670000 | 100681000 |

| Sunday, January 1, 2017 | 499811000 | 115331000 |

| Monday, January 1, 2018 | 452100000 | 170176000 |

| Tuesday, January 1, 2019 | 682900000 | 218382000 |

| Wednesday, January 1, 2020 | 676600000 | 219078000 |

| Friday, January 1, 2021 | 610300000 | 186222000 |

| Saturday, January 1, 2022 | 718900000 | 192561000 |

| Sunday, January 1, 2023 | 797700000 | 214610000 |

| Monday, January 1, 2024 | 734200000 | 383111000 |

Igniting the spark of knowledge

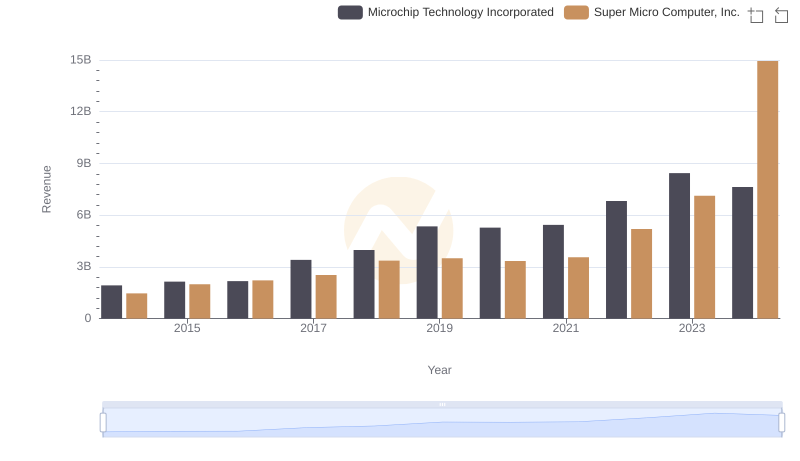

In the ever-evolving landscape of technology, cost management remains a pivotal factor for success. Microchip Technology Incorporated and Super Micro Computer, Inc. have demonstrated contrasting strategies in managing their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2024, Microchip Technology's SG&A expenses surged by approximately 175%, peaking in 2023. This reflects a strategic investment in operational growth and market expansion. In contrast, Super Micro Computer, Inc. exhibited a more conservative approach, with a notable 528% increase in 2024, indicating a potential shift in strategy or market conditions. These trends highlight the dynamic nature of financial management in the tech industry, where companies must balance growth with cost efficiency. As we delve into these insights, it becomes evident that understanding SG&A expenses is crucial for stakeholders aiming to gauge a company's financial health and strategic direction.

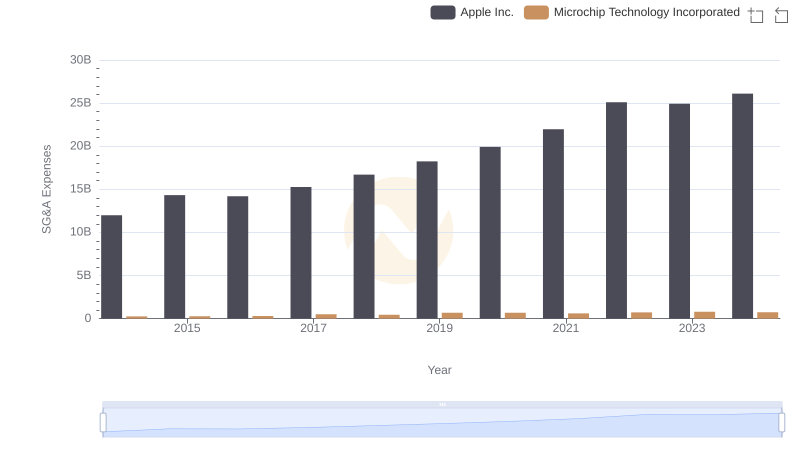

Apple Inc. vs Microchip Technology Incorporated: SG&A Expense Trends

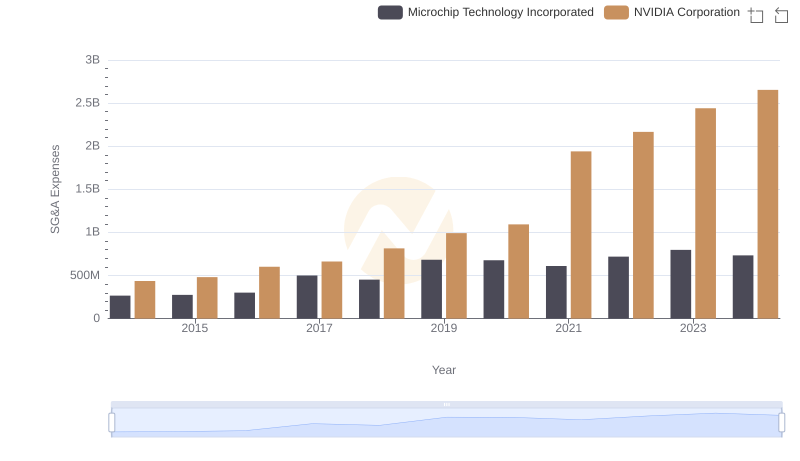

Selling, General, and Administrative Costs: NVIDIA Corporation vs Microchip Technology Incorporated

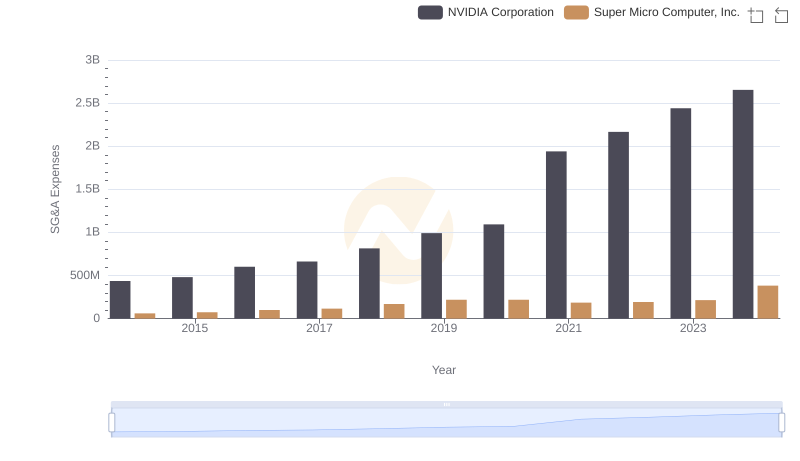

Breaking Down SG&A Expenses: NVIDIA Corporation vs Super Micro Computer, Inc.

Taiwan Semiconductor Manufacturing Company Limited or Microchip Technology Incorporated: Who Manages SG&A Costs Better?

Selling, General, and Administrative Costs: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

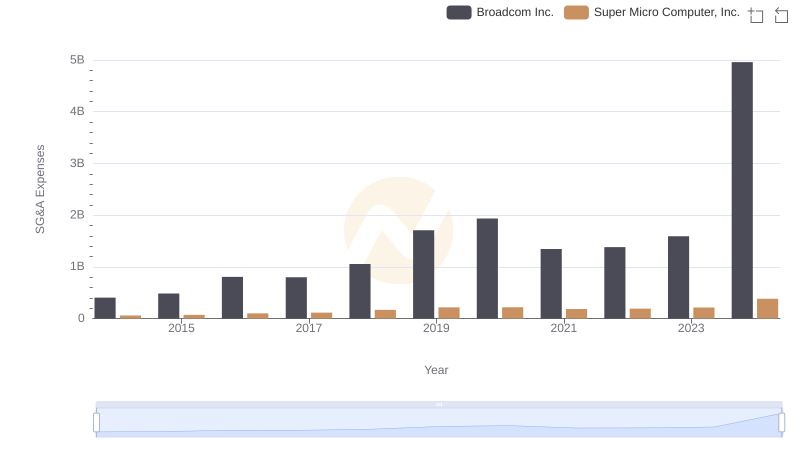

SG&A Efficiency Analysis: Comparing Broadcom Inc. and Super Micro Computer, Inc.

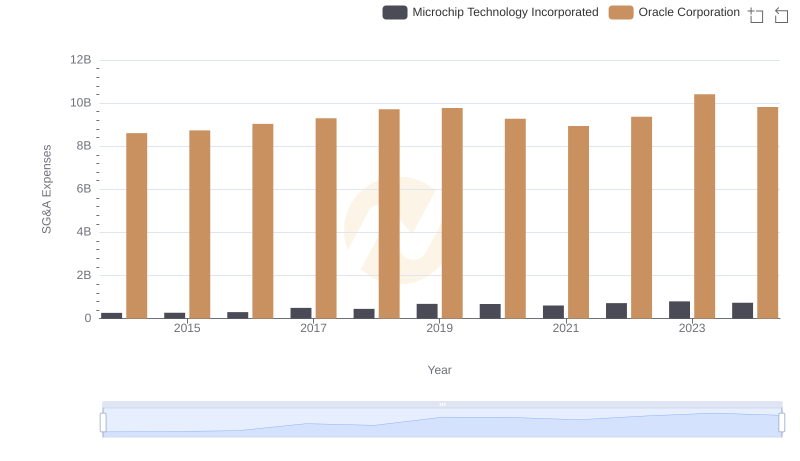

Comparing SG&A Expenses: Oracle Corporation vs Microchip Technology Incorporated Trends and Insights

Who Generates More Revenue? Microchip Technology Incorporated or Super Micro Computer, Inc.

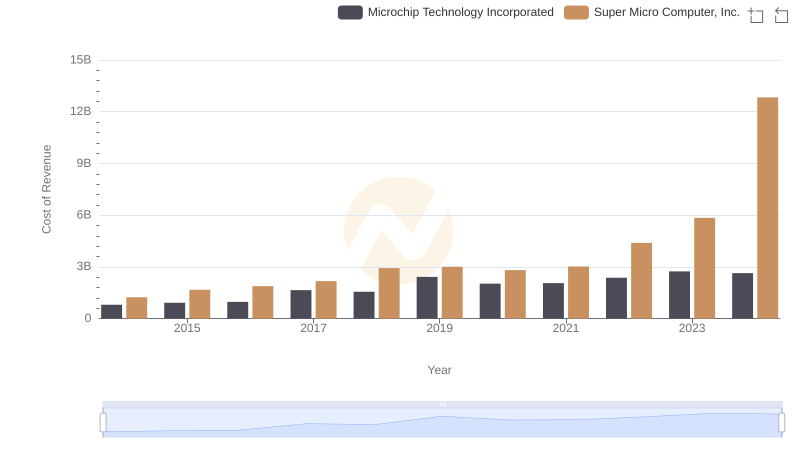

Comparing Cost of Revenue Efficiency: Microchip Technology Incorporated vs Super Micro Computer, Inc.

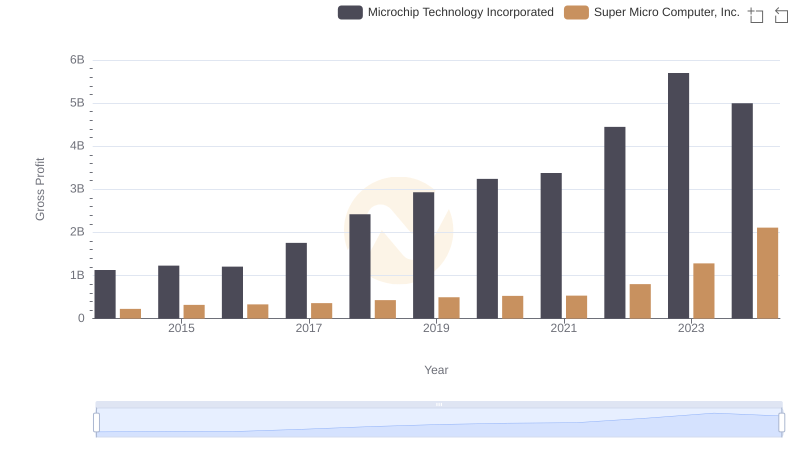

Microchip Technology Incorporated vs Super Micro Computer, Inc.: A Gross Profit Performance Breakdown

Microchip Technology Incorporated vs Super Micro Computer, Inc.: Strategic Focus on R&D Spending

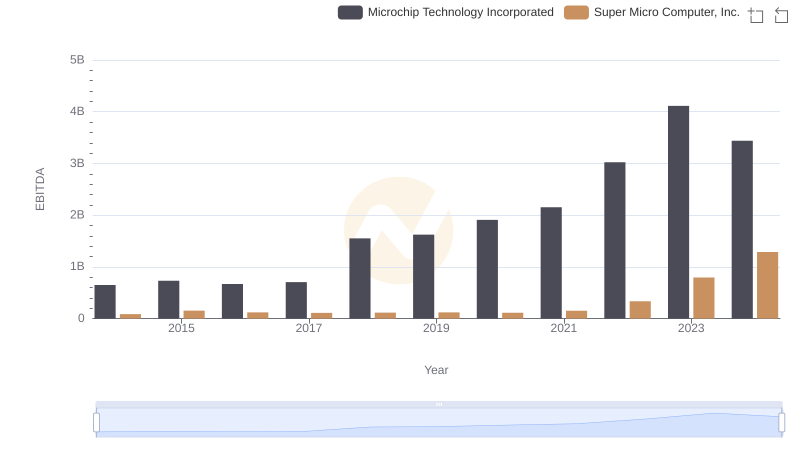

Professional EBITDA Benchmarking: Microchip Technology Incorporated vs Super Micro Computer, Inc.