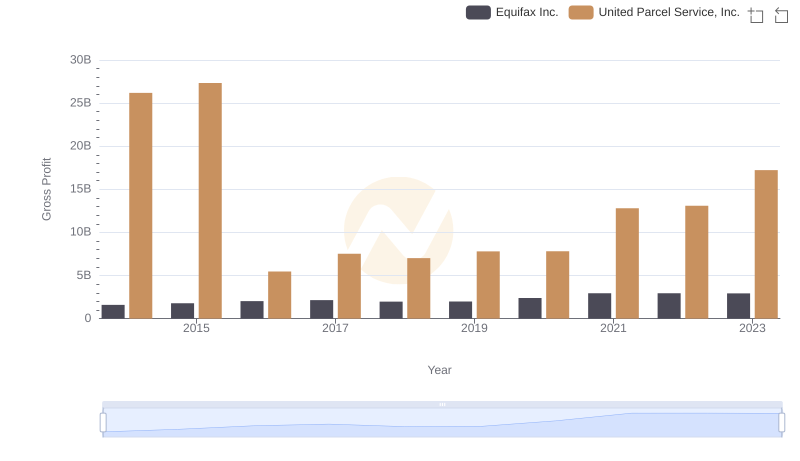

| __timestamp | Equifax Inc. | United Parcel Service, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 842400000 | 9055000000 |

| Thursday, January 1, 2015 | 914600000 | 9870000000 |

| Friday, January 1, 2016 | 1116900000 | 9740000000 |

| Sunday, January 1, 2017 | 1013900000 | 9611000000 |

| Monday, January 1, 2018 | 770200000 | 9292000000 |

| Tuesday, January 1, 2019 | 29000000 | 10194000000 |

| Wednesday, January 1, 2020 | 1217800000 | 10366000000 |

| Friday, January 1, 2021 | 1575200000 | 15821000000 |

| Saturday, January 1, 2022 | 1672800000 | 17005000000 |

| Sunday, January 1, 2023 | 1579100000 | 12714000000 |

| Monday, January 1, 2024 | 1251200000 | 10185000000 |

Unveiling the hidden dimensions of data

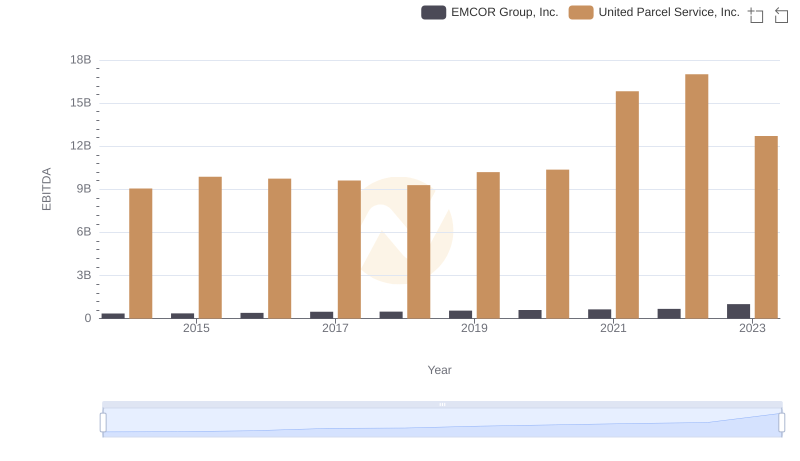

In the ever-evolving landscape of corporate finance, understanding EBITDA trends offers a window into a company's operational efficiency. Over the past decade, United Parcel Service, Inc. (UPS) and Equifax Inc. have showcased contrasting EBITDA trajectories.

From 2014 to 2023, UPS consistently outperformed Equifax, with EBITDA figures peaking at approximately $17 billion in 2022, marking a 50% increase from 2014. This growth underscores UPS's robust operational strategies and adaptability in the logistics sector. In contrast, Equifax's EBITDA journey was more volatile, with a notable dip in 2019, followed by a recovery to around $1.6 billion in 2023. This fluctuation highlights the challenges faced by Equifax in the data analytics industry, particularly in the wake of data breaches and regulatory changes.

These insights not only reflect the companies' financial health but also their resilience in navigating industry-specific challenges.

United Parcel Service, Inc. or Equifax Inc.: Who Leads in Yearly Revenue?

Analyzing Cost of Revenue: United Parcel Service, Inc. and Equifax Inc.

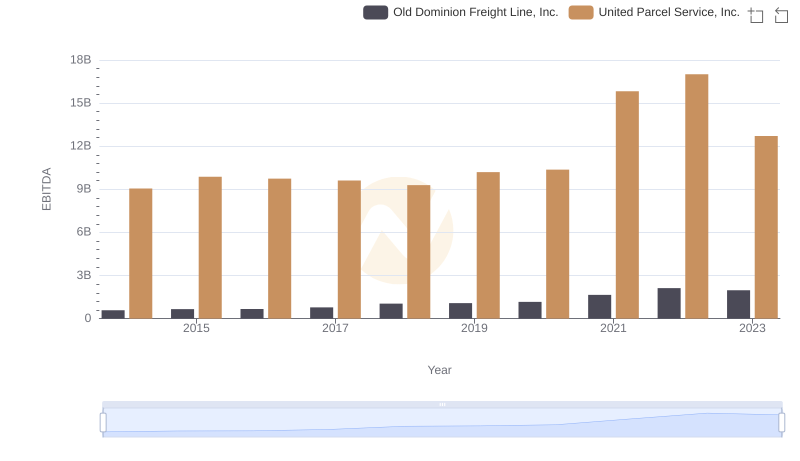

Professional EBITDA Benchmarking: United Parcel Service, Inc. vs Old Dominion Freight Line, Inc.

Gross Profit Comparison: United Parcel Service, Inc. and Equifax Inc. Trends

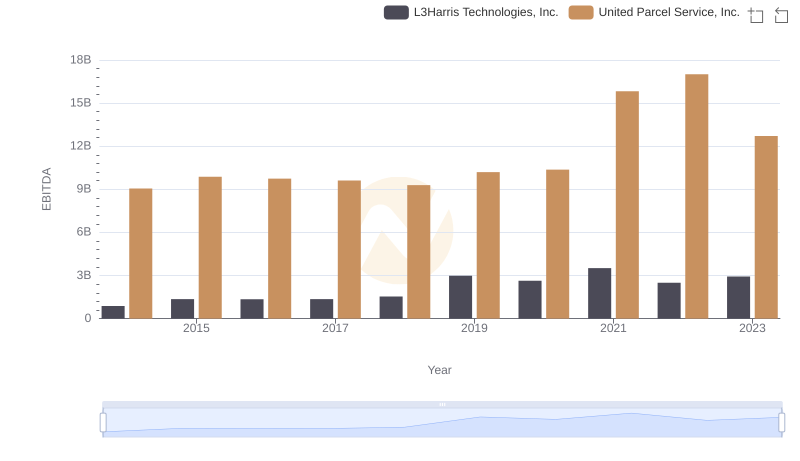

A Side-by-Side Analysis of EBITDA: United Parcel Service, Inc. and L3Harris Technologies, Inc.

United Parcel Service, Inc. and Westinghouse Air Brake Technologies Corporation: A Detailed Examination of EBITDA Performance

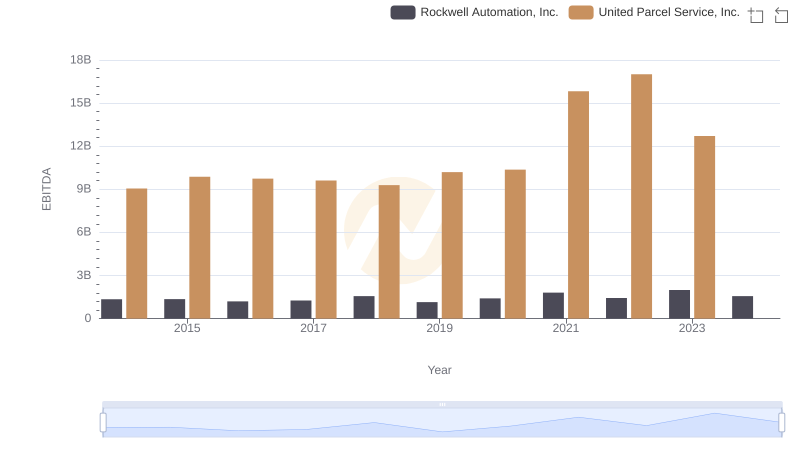

Professional EBITDA Benchmarking: United Parcel Service, Inc. vs Rockwell Automation, Inc.

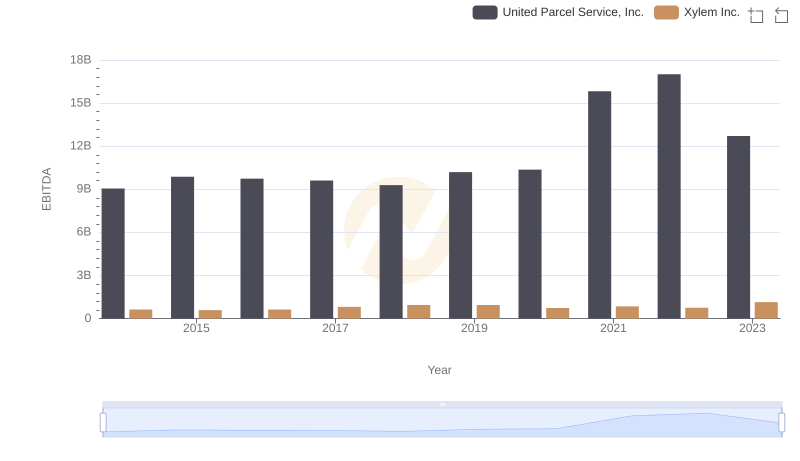

Comprehensive EBITDA Comparison: United Parcel Service, Inc. vs Xylem Inc.

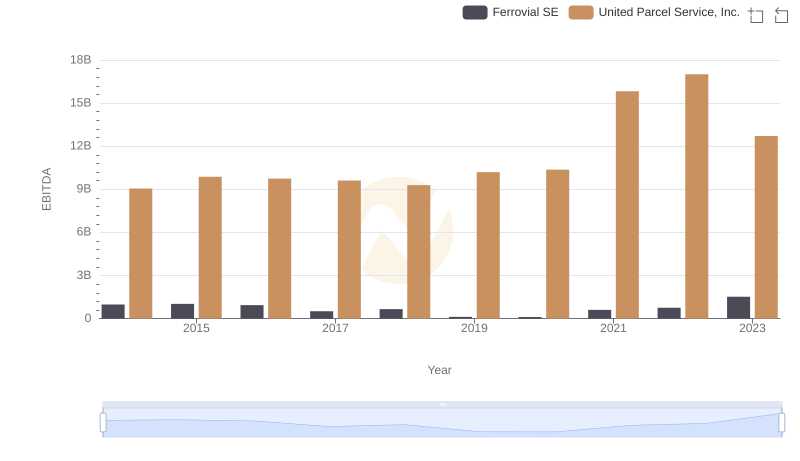

EBITDA Metrics Evaluated: United Parcel Service, Inc. vs Ferrovial SE

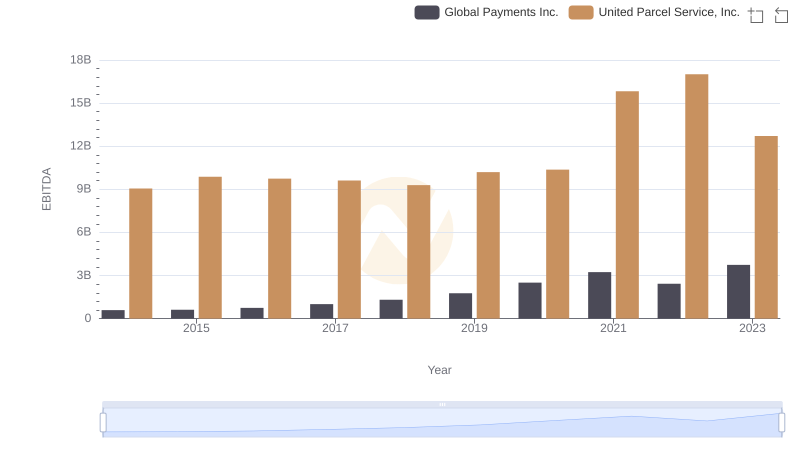

United Parcel Service, Inc. vs Global Payments Inc.: In-Depth EBITDA Performance Comparison

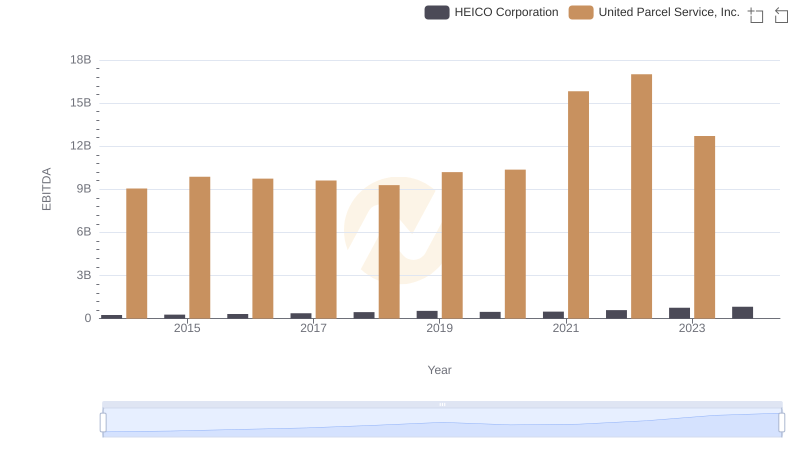

Comparative EBITDA Analysis: United Parcel Service, Inc. vs HEICO Corporation

Comparative EBITDA Analysis: United Parcel Service, Inc. vs EMCOR Group, Inc.