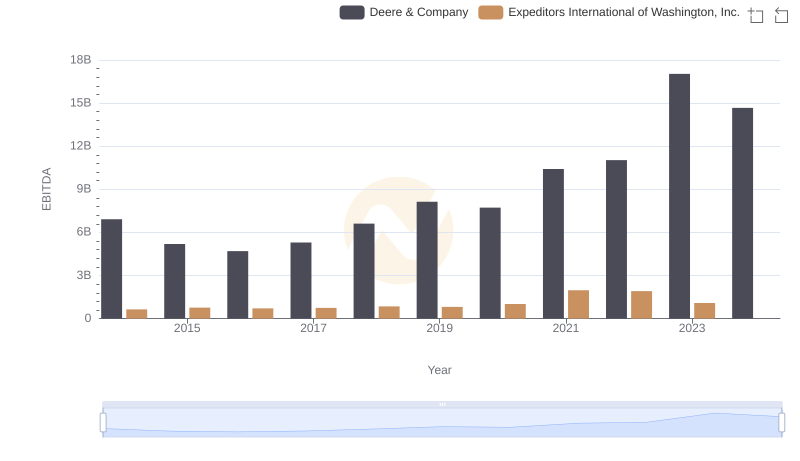

| __timestamp | Avery Dennison Corporation | Deere & Company |

|---|---|---|

| Wednesday, January 1, 2014 | 629200000 | 6912900000 |

| Thursday, January 1, 2015 | 657700000 | 5196500000 |

| Friday, January 1, 2016 | 717000000 | 4697500000 |

| Sunday, January 1, 2017 | 829400000 | 5295800000 |

| Monday, January 1, 2018 | 794300000 | 6613400000 |

| Tuesday, January 1, 2019 | 557500000 | 8135000000 |

| Wednesday, January 1, 2020 | 1062000000 | 7721000000 |

| Friday, January 1, 2021 | 1306900000 | 10410000000 |

| Saturday, January 1, 2022 | 1374100000 | 11030000000 |

| Sunday, January 1, 2023 | 1112100000 | 17036000000 |

| Monday, January 1, 2024 | 1382700000 | 14672000000 |

Cracking the code

In the ever-evolving landscape of industrial giants, Deere & Company and Avery Dennison Corporation have showcased remarkable EBITDA growth over the past decade. Deere & Company, a leader in agricultural machinery, has seen its EBITDA soar by approximately 146% from 2014 to 2023, peaking at an impressive $17 billion in 2023. This growth underscores Deere's strategic advancements and market resilience.

Conversely, Avery Dennison Corporation, a key player in the labeling and packaging industry, has experienced a steady EBITDA increase of around 77% over the same period, reaching $1.37 billion in 2022. Despite a slight dip in 2023, Avery Dennison's consistent performance highlights its robust business model.

This comparative analysis not only reflects the dynamic nature of these industries but also offers insights into the strategic maneuvers that have propelled these companies to the forefront of their respective sectors.

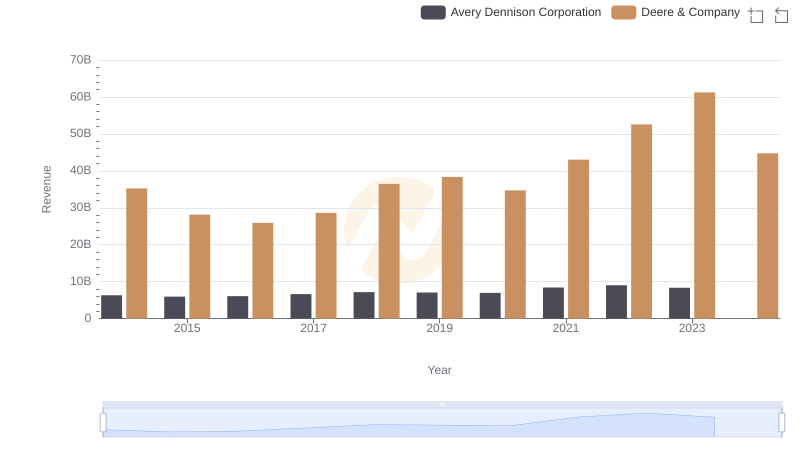

Deere & Company vs Avery Dennison Corporation: Annual Revenue Growth Compared

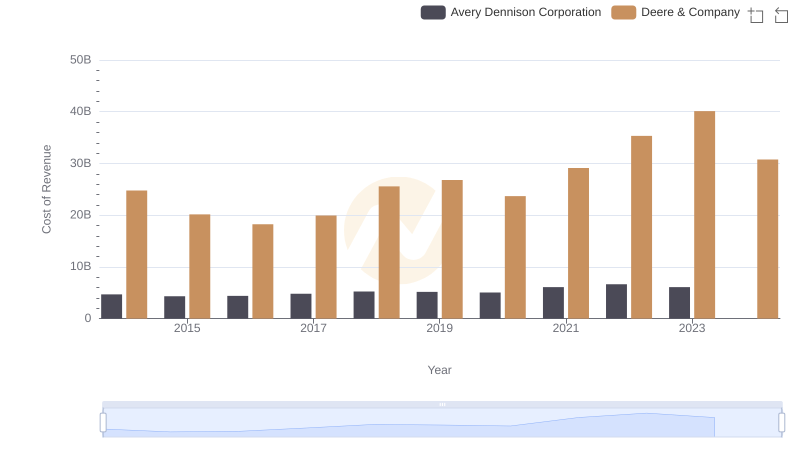

Cost of Revenue: Key Insights for Deere & Company and Avery Dennison Corporation

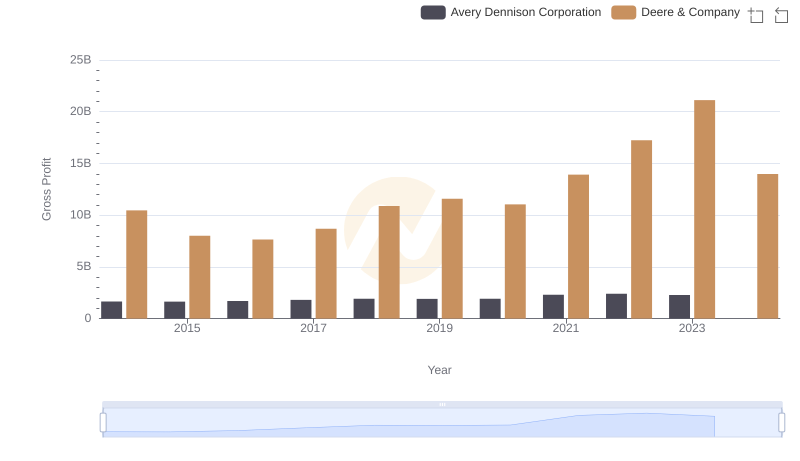

Who Generates Higher Gross Profit? Deere & Company or Avery Dennison Corporation

Professional EBITDA Benchmarking: Deere & Company vs Expeditors International of Washington, Inc.

Comparing Innovation Spending: Deere & Company and Avery Dennison Corporation

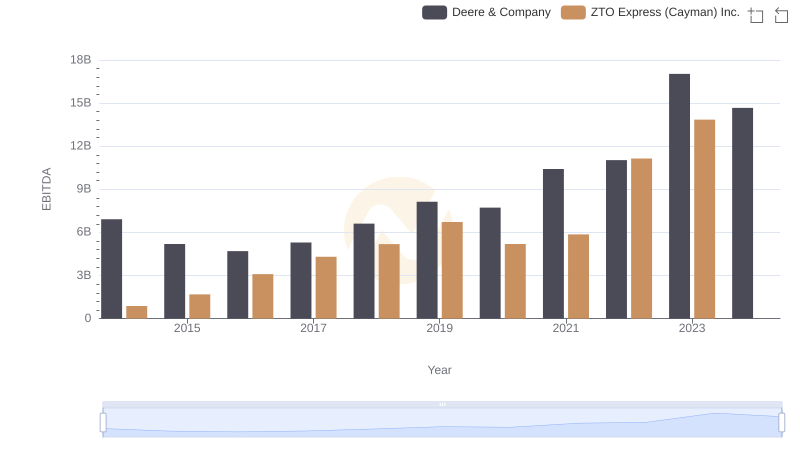

A Side-by-Side Analysis of EBITDA: Deere & Company and ZTO Express (Cayman) Inc.

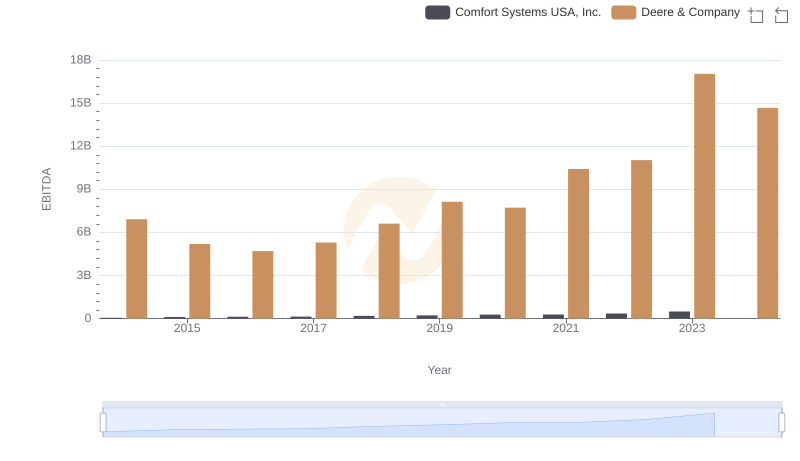

A Side-by-Side Analysis of EBITDA: Deere & Company and Comfort Systems USA, Inc.

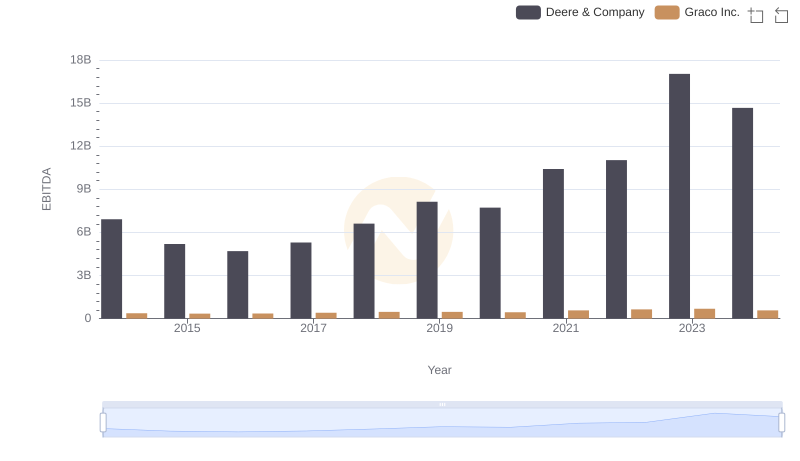

Comparative EBITDA Analysis: Deere & Company vs Graco Inc.