| __timestamp | Deere & Company | Expeditors International of Washington, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6912900000 | 643940000 |

| Thursday, January 1, 2015 | 5196500000 | 767496000 |

| Friday, January 1, 2016 | 4697500000 | 716959000 |

| Sunday, January 1, 2017 | 5295800000 | 749570000 |

| Monday, January 1, 2018 | 6613400000 | 850582000 |

| Tuesday, January 1, 2019 | 8135000000 | 817642000 |

| Wednesday, January 1, 2020 | 7721000000 | 1013523000 |

| Friday, January 1, 2021 | 10410000000 | 1975928000 |

| Saturday, January 1, 2022 | 11030000000 | 1916506000 |

| Sunday, January 1, 2023 | 17036000000 | 1087588000 |

| Monday, January 1, 2024 | 14672000000 | 1154330000 |

Unleashing the power of data

In the world of industrial and logistics giants, Deere & Company and Expeditors International of Washington, Inc. stand as titans. Over the past decade, Deere & Company has consistently outperformed its logistics counterpart, showcasing a remarkable growth trajectory. From 2014 to 2023, Deere's EBITDA surged by approximately 146%, peaking at an impressive $17 billion in 2023. In contrast, Expeditors International experienced a more modest growth, with its EBITDA nearly doubling to $1.9 billion in 2022, before a slight dip in 2023.

This comparison highlights the resilience and strategic prowess of Deere & Company in the industrial sector, while Expeditors International navigates the complexities of global logistics. The data for 2024 remains incomplete, leaving room for speculation on future trends. As these companies continue to evolve, their financial performance will be a key indicator of their adaptability and market leadership.

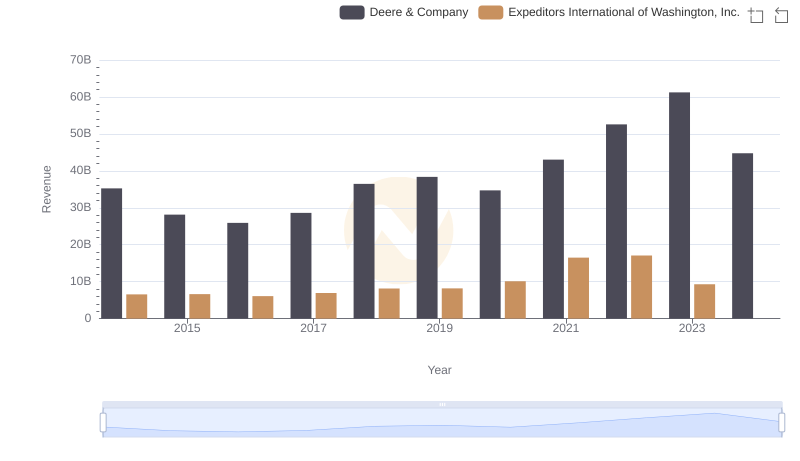

Breaking Down Revenue Trends: Deere & Company vs Expeditors International of Washington, Inc.

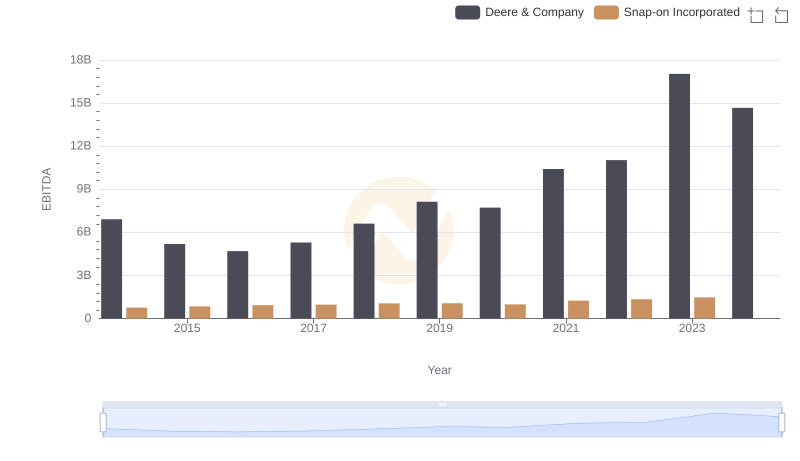

Deere & Company and Snap-on Incorporated: A Detailed Examination of EBITDA Performance

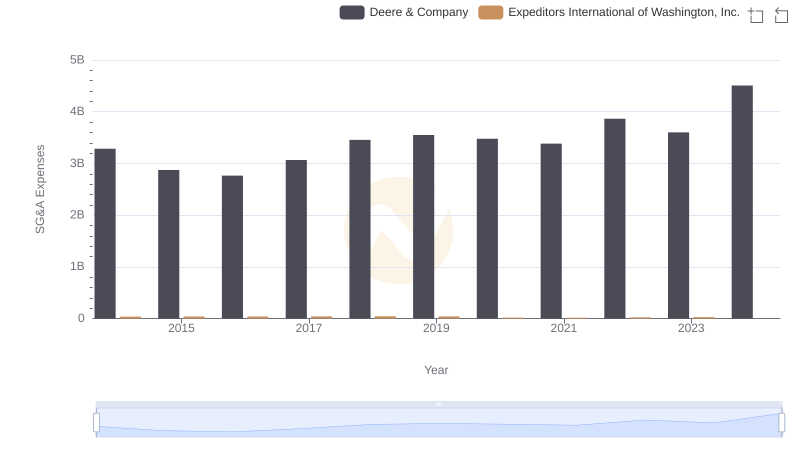

Selling, General, and Administrative Costs: Deere & Company vs Expeditors International of Washington, Inc.

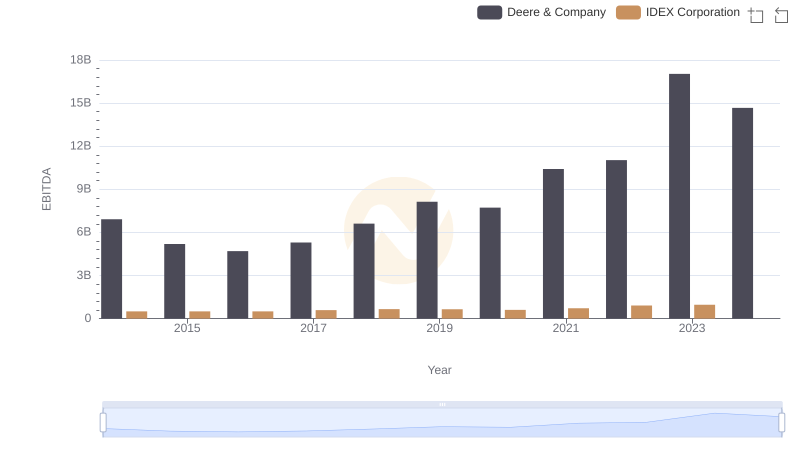

Professional EBITDA Benchmarking: Deere & Company vs IDEX Corporation

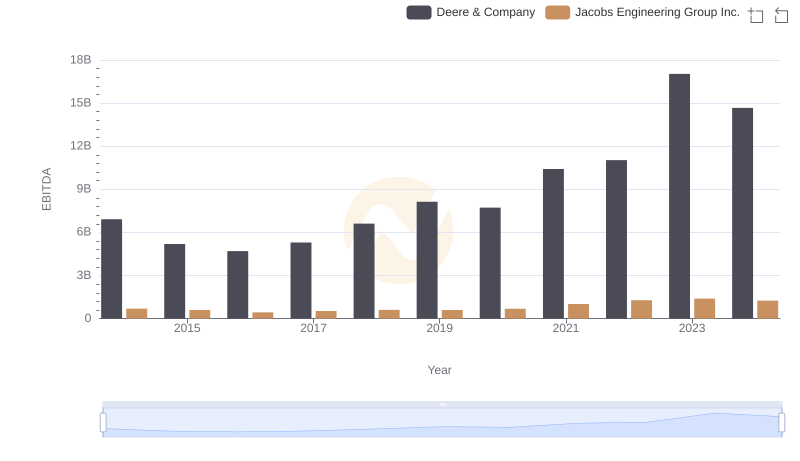

Deere & Company and Jacobs Engineering Group Inc.: A Detailed Examination of EBITDA Performance

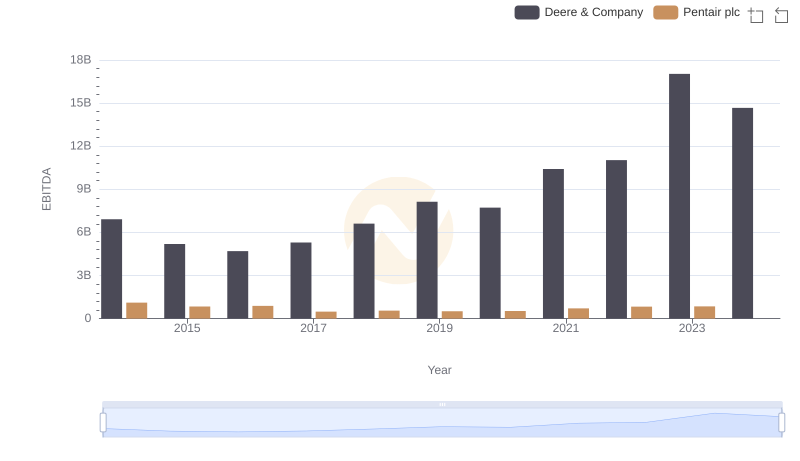

Deere & Company and Pentair plc: A Detailed Examination of EBITDA Performance

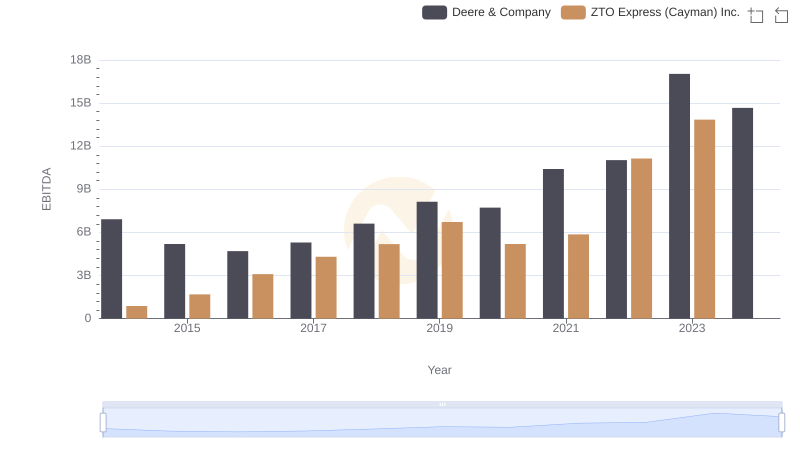

A Side-by-Side Analysis of EBITDA: Deere & Company and ZTO Express (Cayman) Inc.