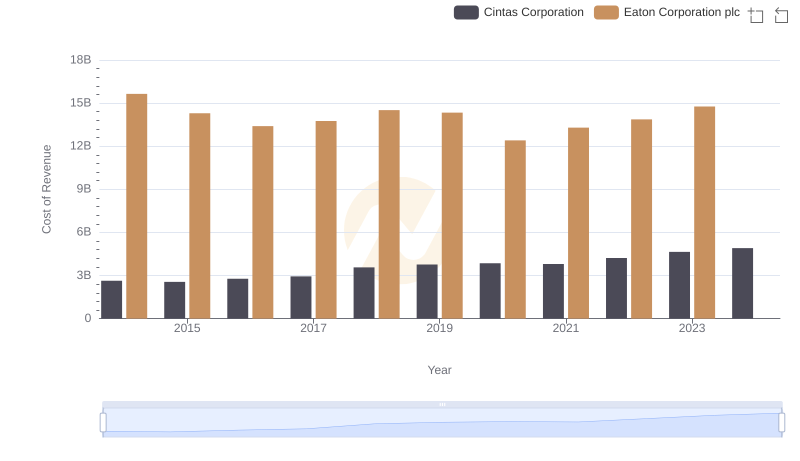

| __timestamp | Cintas Corporation | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4551812000 | 22552000000 |

| Thursday, January 1, 2015 | 4476886000 | 20855000000 |

| Friday, January 1, 2016 | 4905458000 | 19747000000 |

| Sunday, January 1, 2017 | 5323381000 | 20404000000 |

| Monday, January 1, 2018 | 6476632000 | 21609000000 |

| Tuesday, January 1, 2019 | 6892303000 | 21390000000 |

| Wednesday, January 1, 2020 | 7085120000 | 17858000000 |

| Friday, January 1, 2021 | 7116340000 | 19628000000 |

| Saturday, January 1, 2022 | 7854459000 | 20752000000 |

| Sunday, January 1, 2023 | 8815769000 | 23196000000 |

| Monday, January 1, 2024 | 9596615000 | 24878000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of industrial and service sectors, Eaton Corporation plc and Cintas Corporation stand as titans. From 2014 to 2023, Eaton's revenue showcased a steady trajectory, peaking in 2023 with a 15% increase from its 2014 figures. Meanwhile, Cintas demonstrated a remarkable growth story, with its revenue nearly doubling over the same period, reflecting a robust annual growth rate of approximately 10%.

As we look to the future, these trends highlight the dynamic nature of these corporations, offering valuable insights for investors and industry enthusiasts alike.

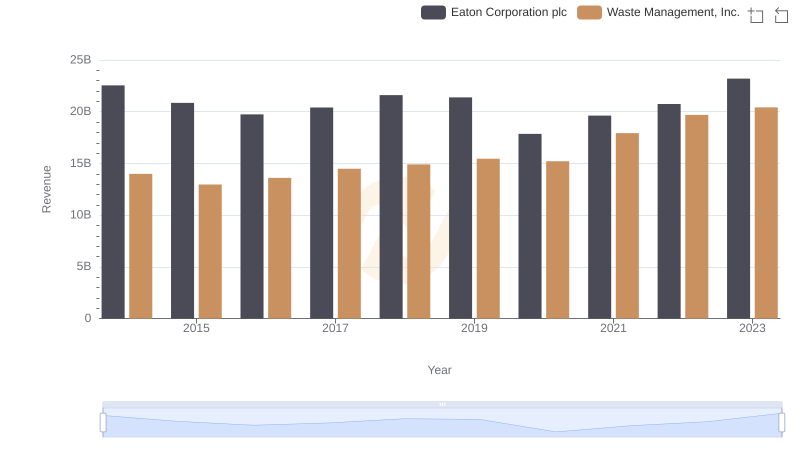

Eaton Corporation plc and Waste Management, Inc.: A Comprehensive Revenue Analysis

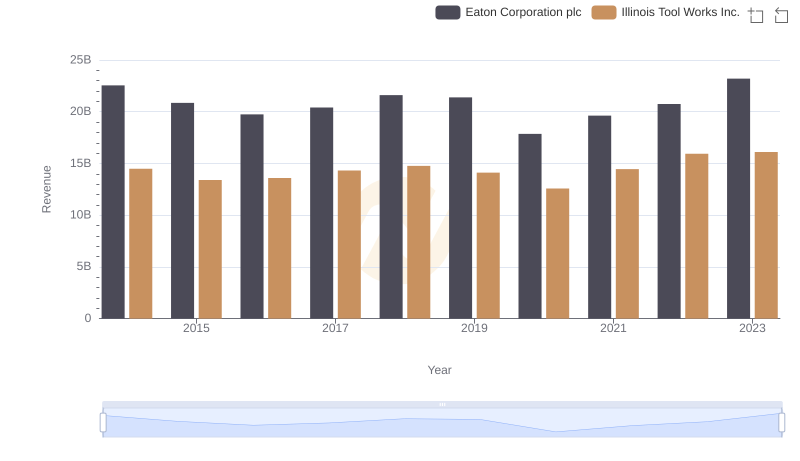

Revenue Showdown: Eaton Corporation plc vs Illinois Tool Works Inc.

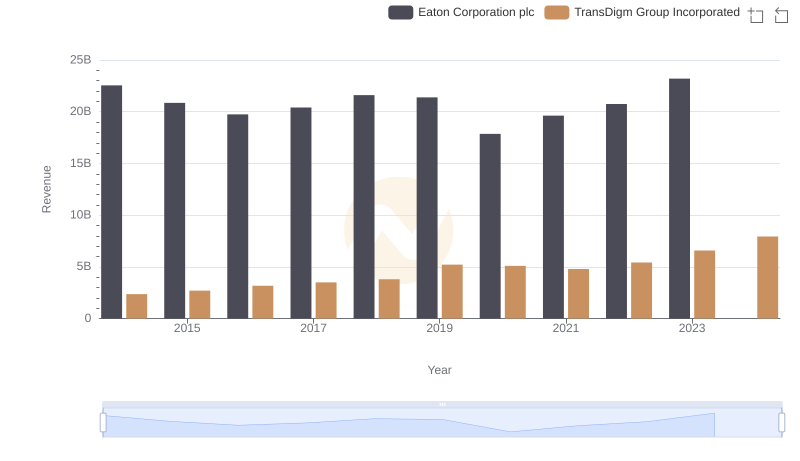

Eaton Corporation plc or TransDigm Group Incorporated: Who Leads in Yearly Revenue?

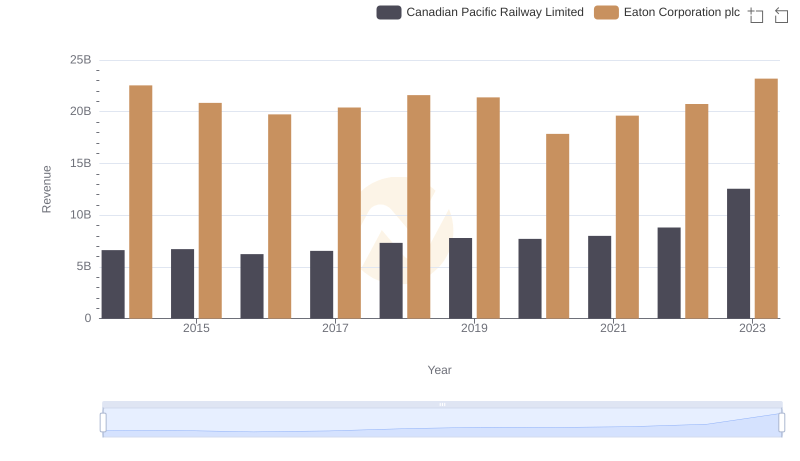

Revenue Showdown: Eaton Corporation plc vs Canadian Pacific Railway Limited

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Cintas Corporation