| __timestamp | China Eastern Airlines Corporation Limited | Deere & Company |

|---|---|---|

| Wednesday, January 1, 2014 | 4120000000 | 3284400000 |

| Thursday, January 1, 2015 | 3651000000 | 2873300000 |

| Friday, January 1, 2016 | 3133000000 | 2763700000 |

| Sunday, January 1, 2017 | 3294000000 | 3066600000 |

| Monday, January 1, 2018 | 3807000000 | 3455500000 |

| Tuesday, January 1, 2019 | 4134000000 | 3551000000 |

| Wednesday, January 1, 2020 | 1570000000 | 3477000000 |

| Friday, January 1, 2021 | 1128000000 | 3383000000 |

| Saturday, January 1, 2022 | 2933000000 | 3863000000 |

| Sunday, January 1, 2023 | 7254000000 | 3601000000 |

| Monday, January 1, 2024 | 4507000000 |

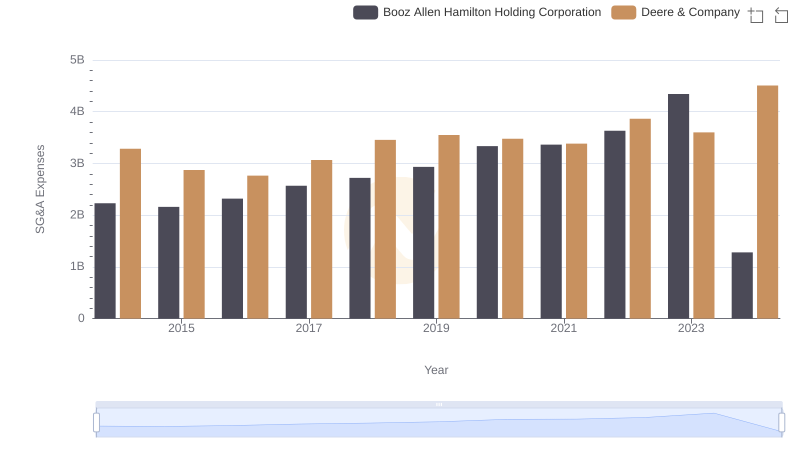

Cracking the code

In the ever-evolving landscape of global business, understanding the financial strategies of industry leaders is crucial. Deere & Company, a stalwart in the agricultural machinery sector, and China Eastern Airlines Corporation Limited, a major player in the aviation industry, offer a fascinating study in contrasts when it comes to Selling, General, and Administrative (SG&A) expenses.

From 2014 to 2023, Deere & Company maintained a relatively stable SG&A spending pattern, with a modest increase of about 10% over the decade. In contrast, China Eastern Airlines experienced significant fluctuations, with a notable dip in 2020 and 2021, likely due to the global pandemic, before a dramatic surge in 2023, reaching a peak that was nearly double its 2021 low.

These trends highlight the resilience and adaptability of these companies in navigating economic challenges and opportunities, offering valuable insights for investors and industry analysts alike.

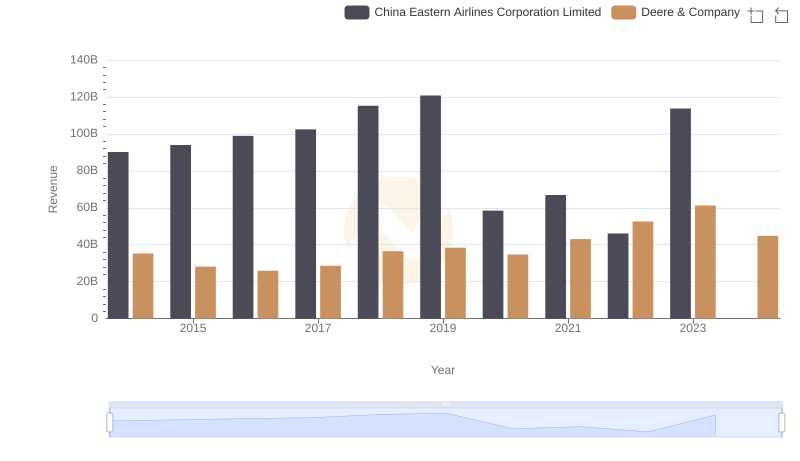

Deere & Company vs China Eastern Airlines Corporation Limited: Examining Key Revenue Metrics

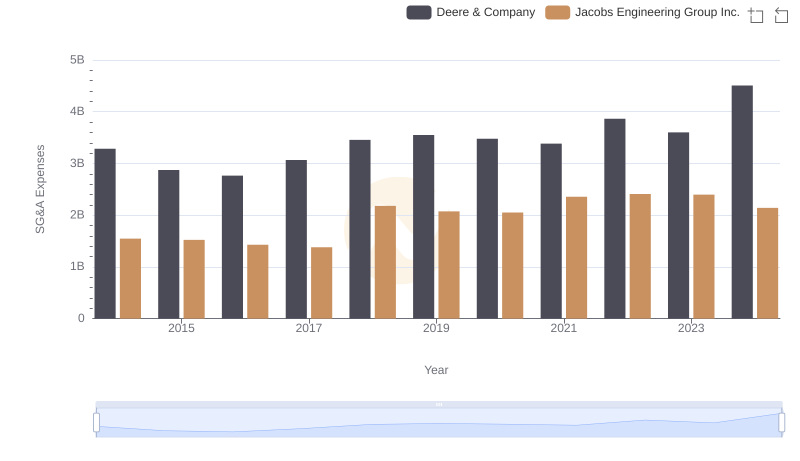

Cost Management Insights: SG&A Expenses for Deere & Company and Jacobs Engineering Group Inc.

Deere & Company and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

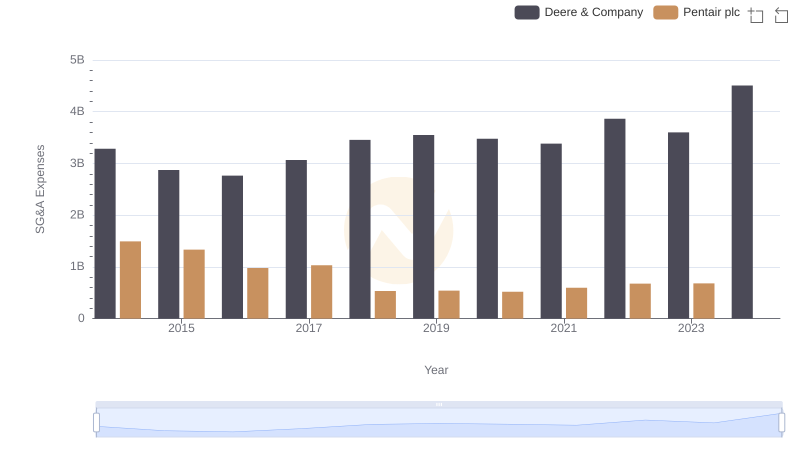

Deere & Company and Pentair plc: SG&A Spending Patterns Compared

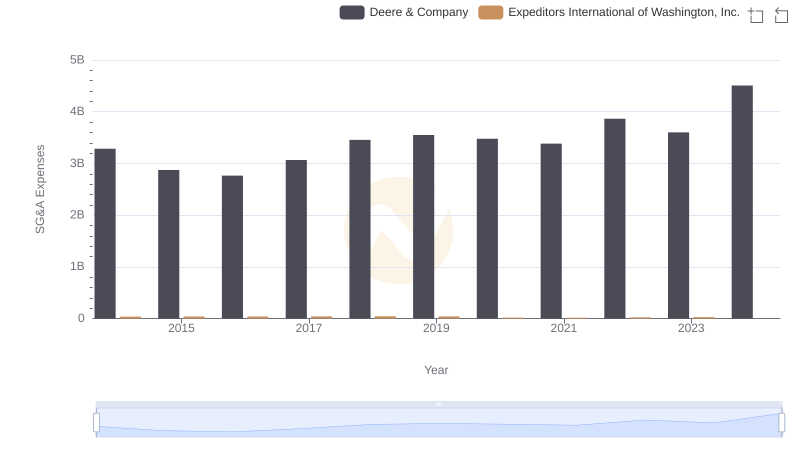

Selling, General, and Administrative Costs: Deere & Company vs Expeditors International of Washington, Inc.

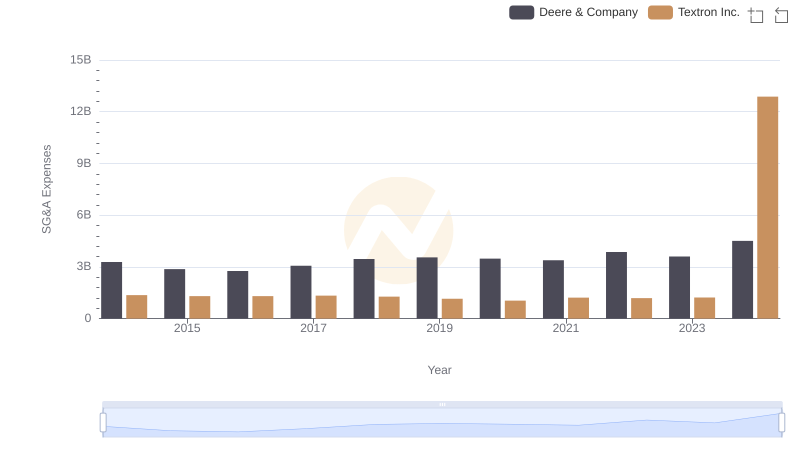

Cost Management Insights: SG&A Expenses for Deere & Company and Textron Inc.