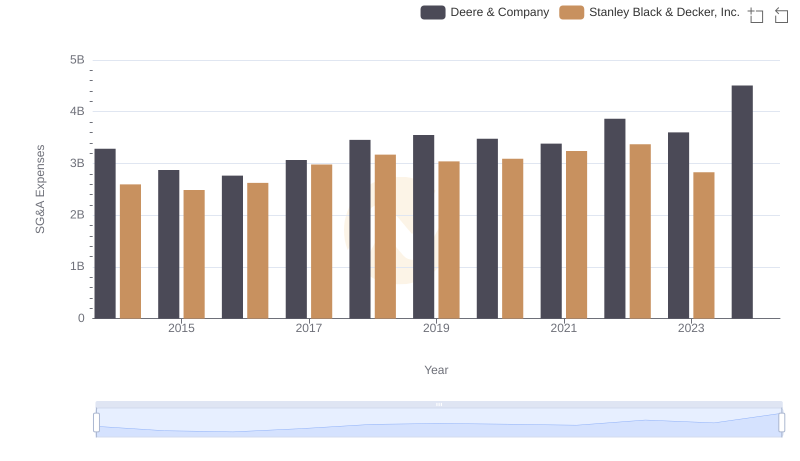

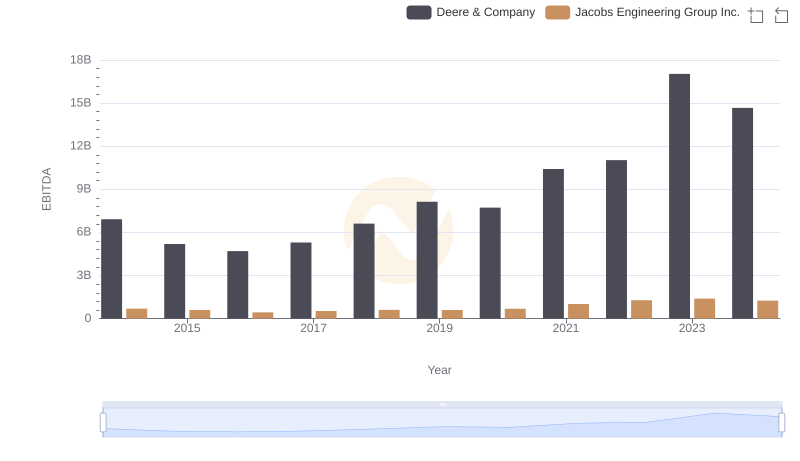

| __timestamp | Deere & Company | Jacobs Engineering Group Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3284400000 | 1545716000 |

| Thursday, January 1, 2015 | 2873300000 | 1522811000 |

| Friday, January 1, 2016 | 2763700000 | 1429233000 |

| Sunday, January 1, 2017 | 3066600000 | 1379983000 |

| Monday, January 1, 2018 | 3455500000 | 2180399000 |

| Tuesday, January 1, 2019 | 3551000000 | 2072177000 |

| Wednesday, January 1, 2020 | 3477000000 | 2050695000 |

| Friday, January 1, 2021 | 3383000000 | 2355683000 |

| Saturday, January 1, 2022 | 3863000000 | 2409190000 |

| Sunday, January 1, 2023 | 3601000000 | 2398078000 |

| Monday, January 1, 2024 | 4507000000 | 2140320000 |

Unleashing insights

In the ever-evolving landscape of industrial and engineering sectors, effective cost management remains a pivotal challenge. Deere & Company and Jacobs Engineering Group Inc. have demonstrated contrasting strategies in managing their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2024, Deere & Company has seen a notable increase of approximately 37% in SG&A expenses, peaking in 2024. This upward trend reflects their strategic investments in innovation and expansion. Conversely, Jacobs Engineering Group Inc. has maintained a more stable trajectory, with a modest 39% increase from 2014 to 2023, showcasing their focus on operational efficiency. The data highlights the importance of balancing growth and cost control, offering valuable insights for stakeholders and industry analysts alike. As these companies continue to adapt to market demands, their cost management strategies will undoubtedly play a crucial role in shaping their future success.

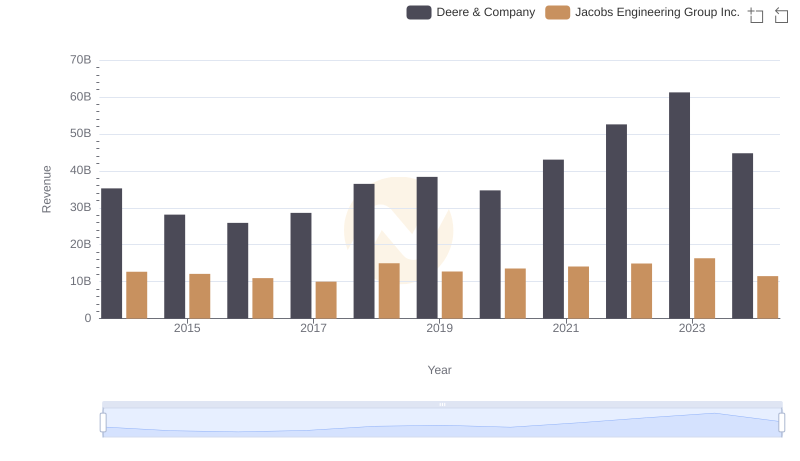

Comparing Revenue Performance: Deere & Company or Jacobs Engineering Group Inc.?

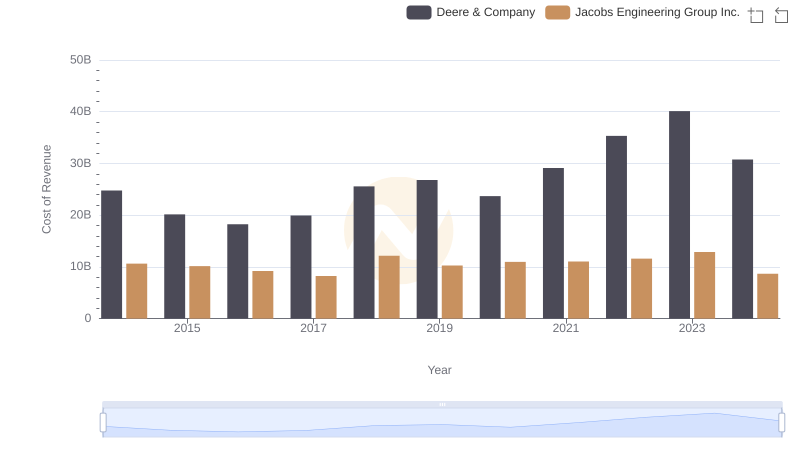

Cost Insights: Breaking Down Deere & Company and Jacobs Engineering Group Inc.'s Expenses

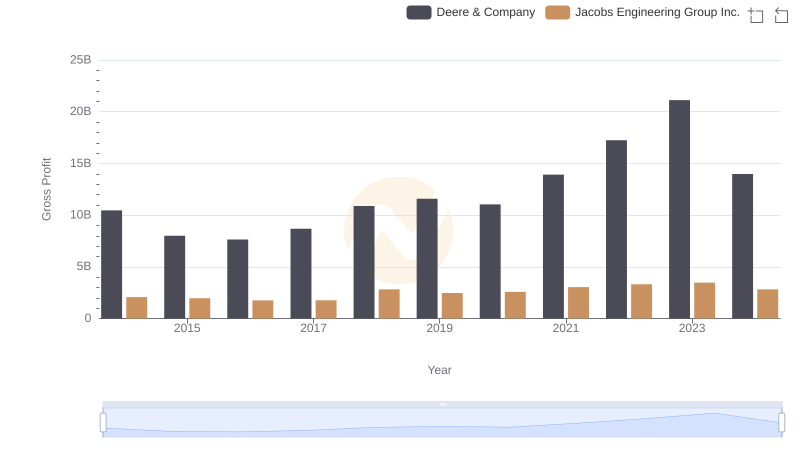

Gross Profit Analysis: Comparing Deere & Company and Jacobs Engineering Group Inc.

Operational Costs Compared: SG&A Analysis of Deere & Company and Stanley Black & Decker, Inc.

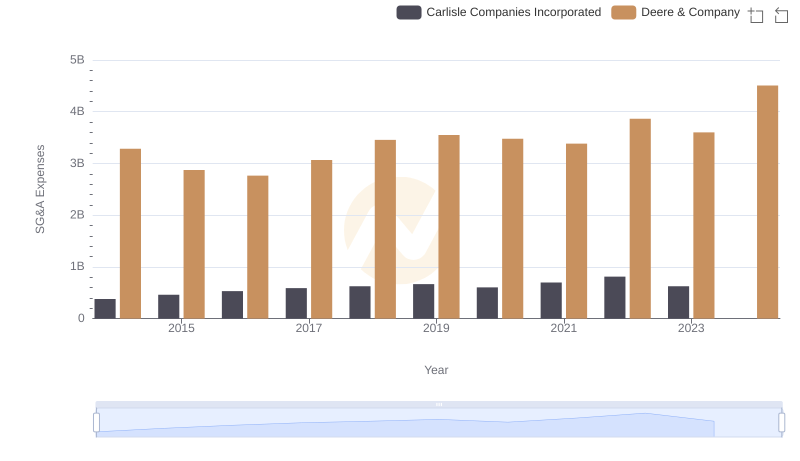

Deere & Company vs Carlisle Companies Incorporated: SG&A Expense Trends

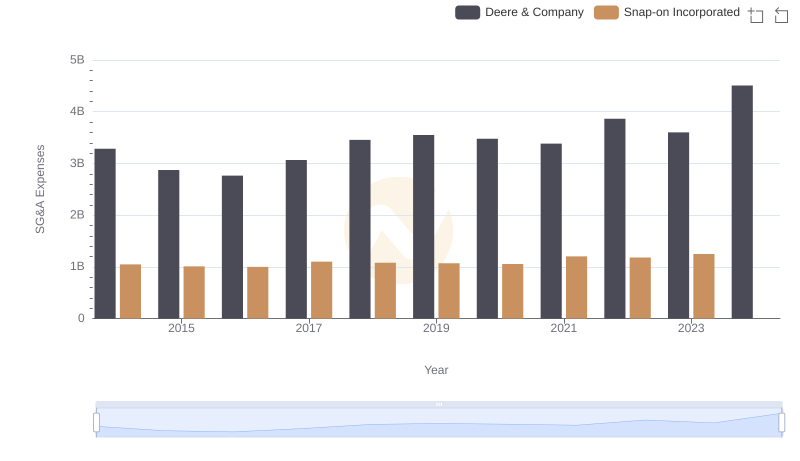

Breaking Down SG&A Expenses: Deere & Company vs Snap-on Incorporated

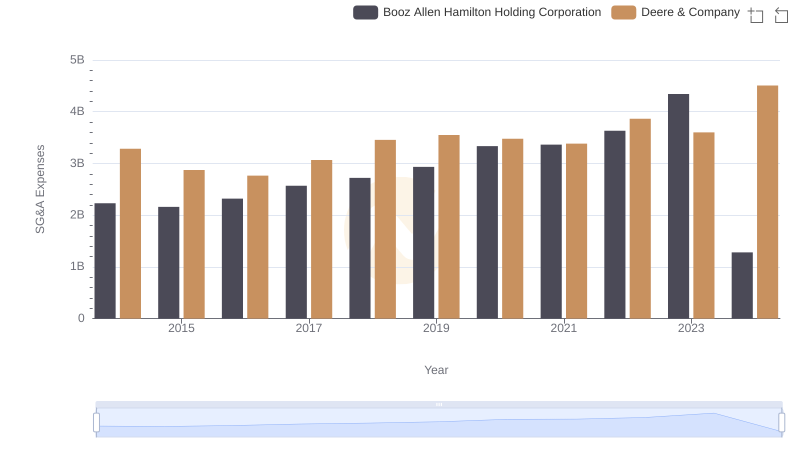

Deere & Company and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

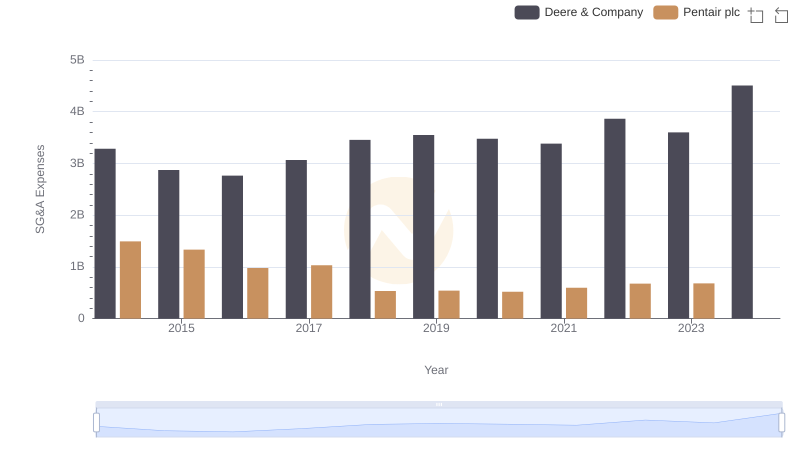

Deere & Company and Pentair plc: SG&A Spending Patterns Compared

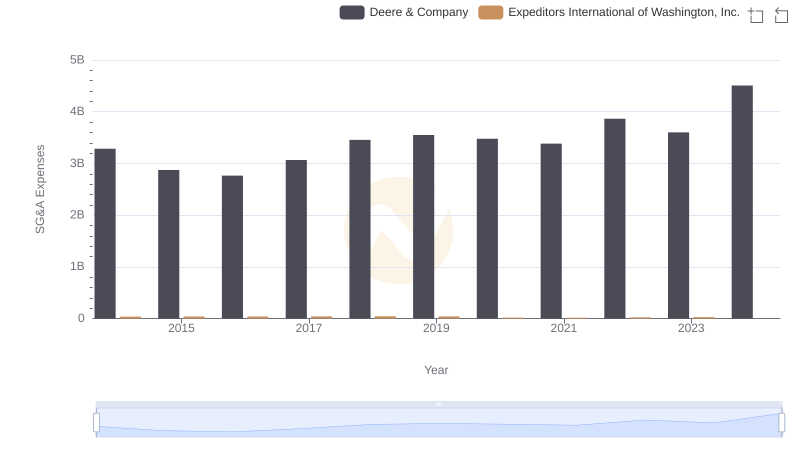

Selling, General, and Administrative Costs: Deere & Company vs Expeditors International of Washington, Inc.

Deere & Company and Jacobs Engineering Group Inc.: A Detailed Examination of EBITDA Performance