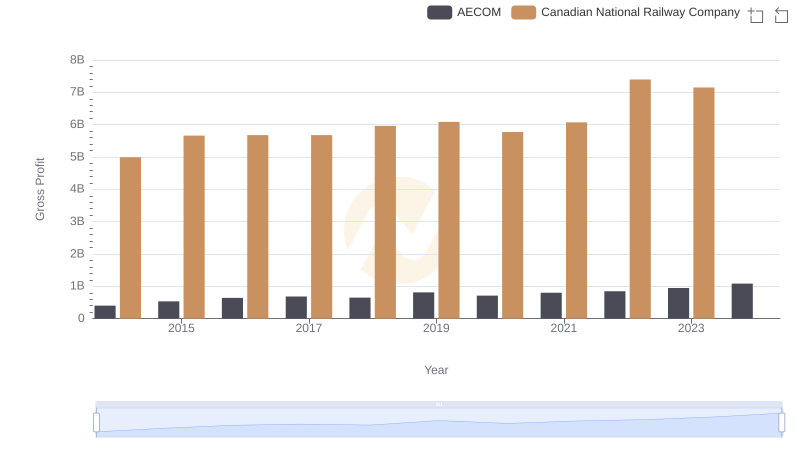

| __timestamp | AECOM | Canadian National Railway Company |

|---|---|---|

| Wednesday, January 1, 2014 | 4452451000 | 7142000000 |

| Thursday, January 1, 2015 | 17454692000 | 6951000000 |

| Friday, January 1, 2016 | 16768001000 | 6362000000 |

| Sunday, January 1, 2017 | 17519682000 | 7366000000 |

| Monday, January 1, 2018 | 19504863000 | 8359000000 |

| Tuesday, January 1, 2019 | 19359884000 | 8832000000 |

| Wednesday, January 1, 2020 | 12530416000 | 8048000000 |

| Friday, January 1, 2021 | 12542431000 | 8408000000 |

| Saturday, January 1, 2022 | 12300208000 | 9711000000 |

| Sunday, January 1, 2023 | 13432996000 | 9677000000 |

| Monday, January 1, 2024 | 15021157000 |

Cracking the code

In the ever-evolving landscape of North American industry, the cost of revenue is a critical metric that reflects operational efficiency and market dynamics. This analysis juxtaposes the financial trajectories of two industry titans: Canadian National Railway Company and AECOM, from 2014 to 2023.

AECOM, a global infrastructure firm, has seen its cost of revenue fluctuate significantly, peaking in 2018 with a 33% increase from 2014. However, a notable dip occurred in 2020, coinciding with global economic disruptions, before rebounding by 20% in 2023. In contrast, Canadian National Railway Company, a leader in rail transportation, maintained a more stable cost of revenue, with a gradual increase of 36% over the same period, reaching its zenith in 2022.

This comparison highlights the resilience and adaptability of these companies in navigating economic challenges, offering valuable insights for investors and industry analysts alike.

Canadian National Railway Company vs AECOM: Examining Key Revenue Metrics

Comparing Cost of Revenue Efficiency: Canadian National Railway Company vs Stanley Black & Decker, Inc.

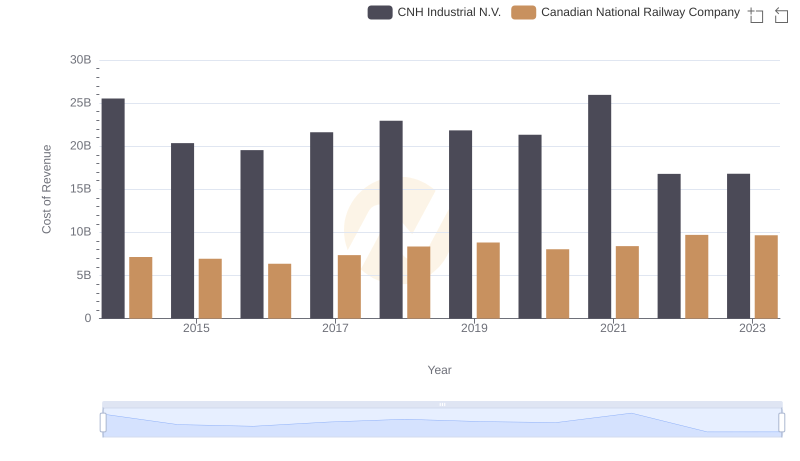

Canadian National Railway Company vs CNH Industrial N.V.: Efficiency in Cost of Revenue Explored

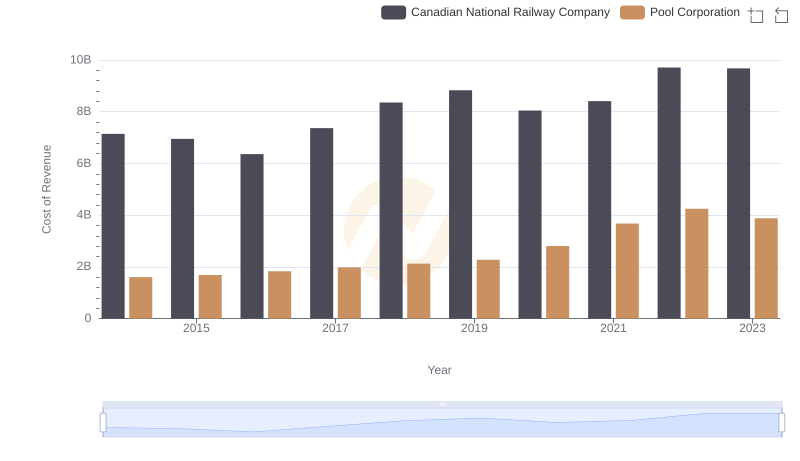

Analyzing Cost of Revenue: Canadian National Railway Company and Pool Corporation

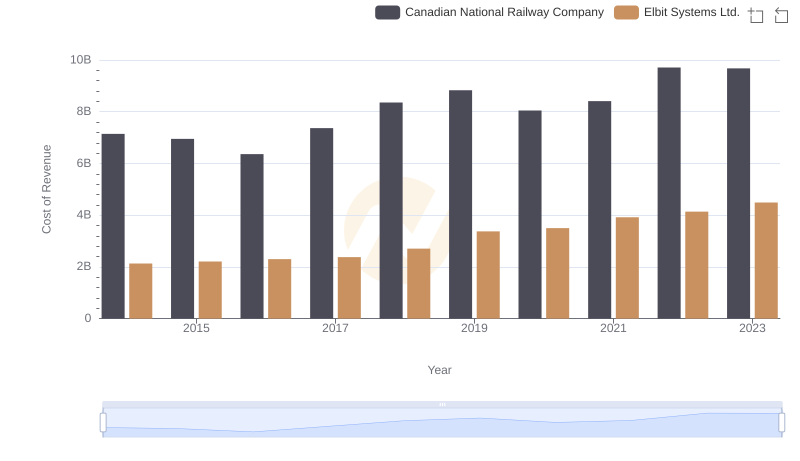

Analyzing Cost of Revenue: Canadian National Railway Company and Elbit Systems Ltd.

Canadian National Railway Company vs AECOM: A Gross Profit Performance Breakdown