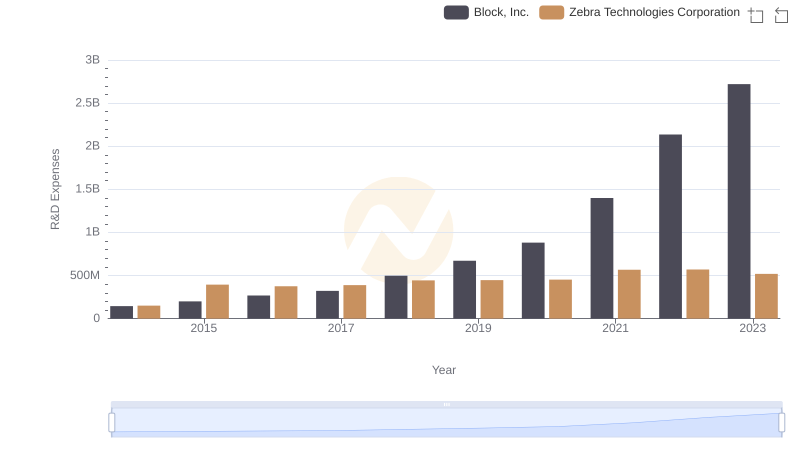

| __timestamp | Block, Inc. | Zebra Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 206797000 | 351518000 |

| Thursday, January 1, 2015 | 289084000 | 763025000 |

| Friday, January 1, 2016 | 425869000 | 751000000 |

| Sunday, January 1, 2017 | 503723000 | 749000000 |

| Monday, January 1, 2018 | 750396000 | 811000000 |

| Tuesday, January 1, 2019 | 1061082000 | 826000000 |

| Wednesday, January 1, 2020 | 1688873000 | 787000000 |

| Friday, January 1, 2021 | 2600515000 | 935000000 |

| Saturday, January 1, 2022 | 3744800000 | 982000000 |

| Sunday, January 1, 2023 | 4228199000 | 915000000 |

| Monday, January 1, 2024 | 981000000 |

Unleashing the power of data

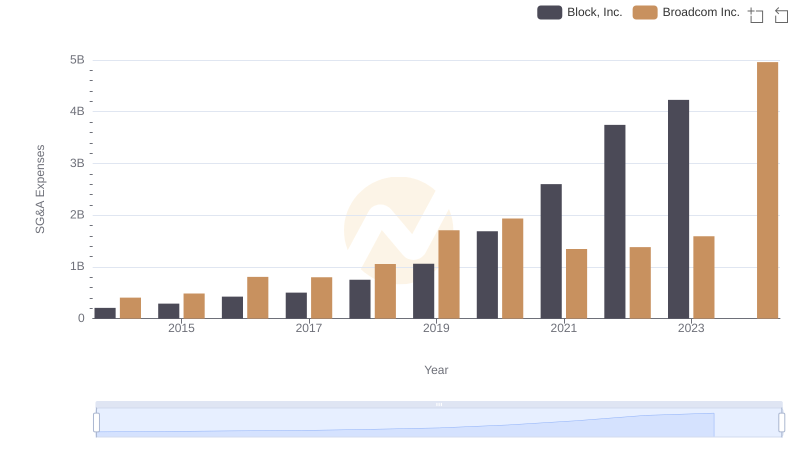

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Block, Inc. and Zebra Technologies Corporation have demonstrated contrasting approaches to SG&A management. From 2014 to 2023, Block, Inc. saw a staggering increase in SG&A expenses, growing by over 1,900%, while Zebra Technologies Corporation maintained a more stable trajectory with a modest 160% increase.

Block, Inc.'s rapid expansion in SG&A costs reflects its aggressive growth strategy, particularly in the tech sector. In contrast, Zebra Technologies Corporation's steady SG&A expenses highlight its focus on operational efficiency. As of 2023, Block, Inc.'s SG&A expenses were nearly four times higher than Zebra's, indicating a significant divergence in cost management strategies. This comparison offers valuable insights into how different companies navigate financial challenges in a competitive market.

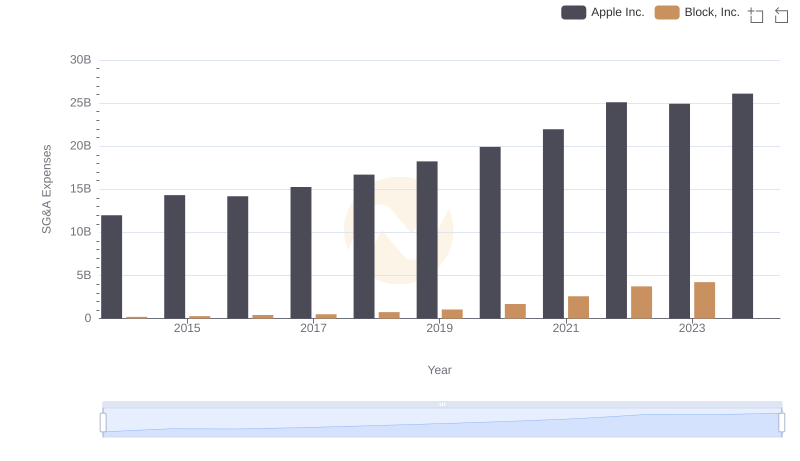

Selling, General, and Administrative Costs: Apple Inc. vs Block, Inc.

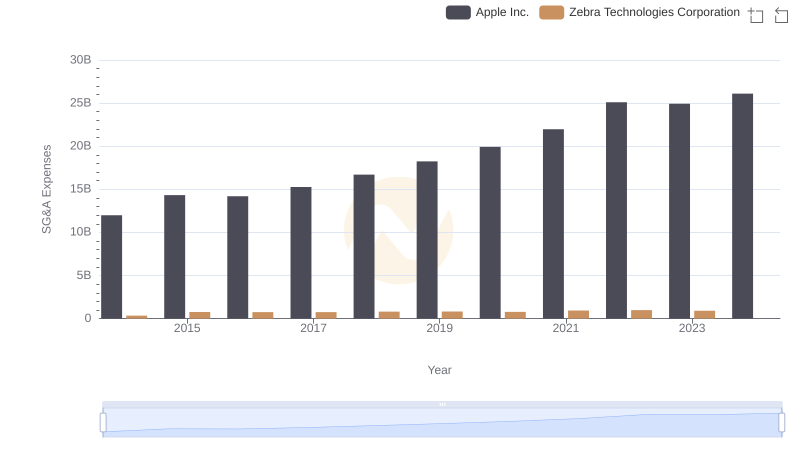

Selling, General, and Administrative Costs: Apple Inc. vs Zebra Technologies Corporation

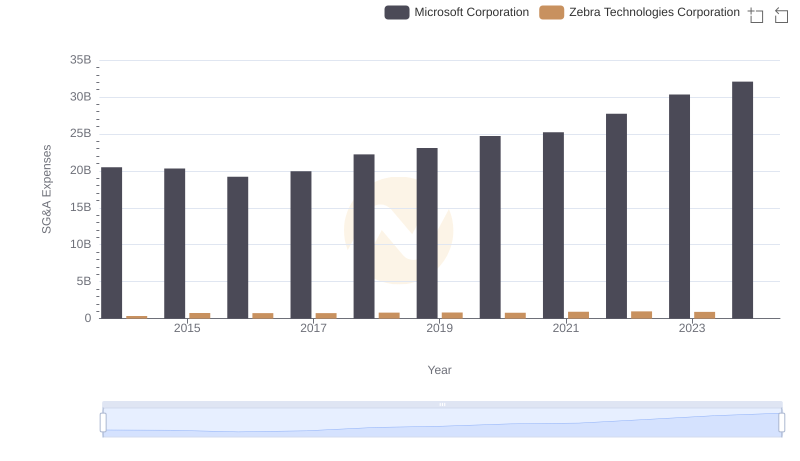

SG&A Efficiency Analysis: Comparing Microsoft Corporation and Zebra Technologies Corporation

Who Optimizes SG&A Costs Better? NVIDIA Corporation or Zebra Technologies Corporation

Taiwan Semiconductor Manufacturing Company Limited or Block, Inc.: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Taiwan Semiconductor Manufacturing Company Limited and Zebra Technologies Corporation

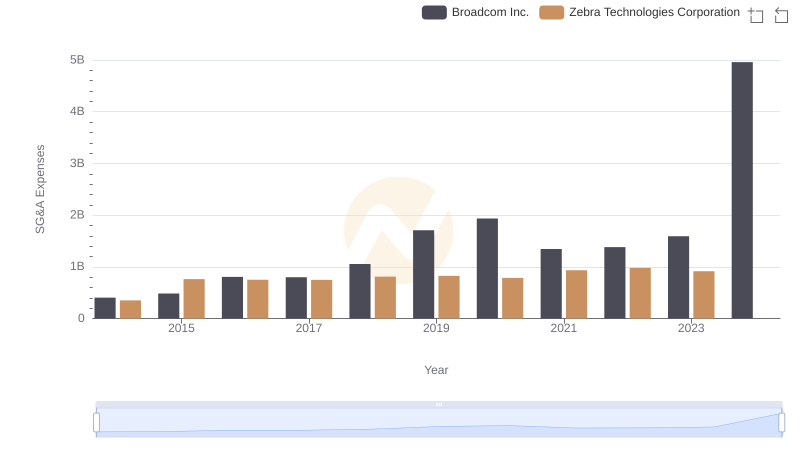

Broadcom Inc. vs Block, Inc.: SG&A Expense Trends

Broadcom Inc. vs Zebra Technologies Corporation: SG&A Expense Trends

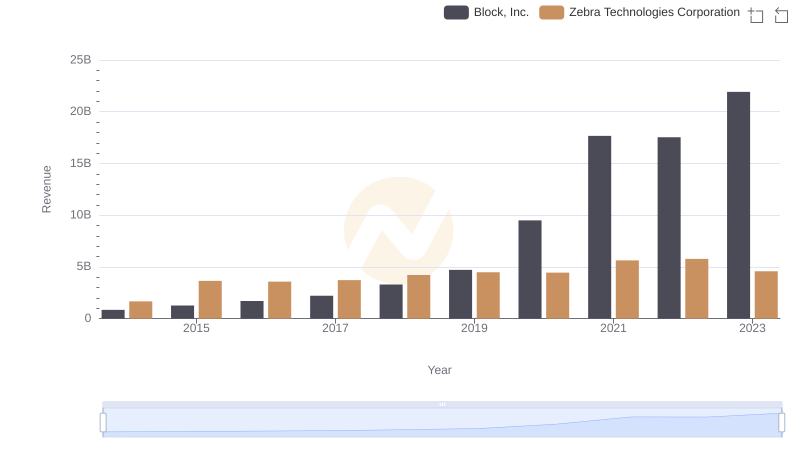

Revenue Showdown: Block, Inc. vs Zebra Technologies Corporation

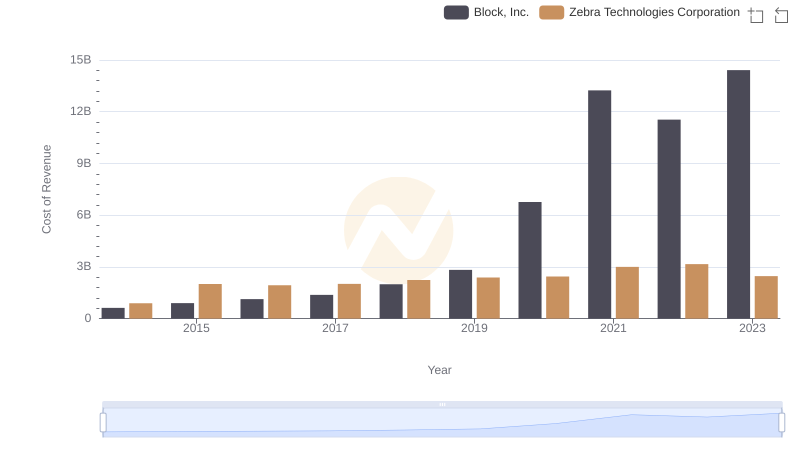

Cost of Revenue Comparison: Block, Inc. vs Zebra Technologies Corporation

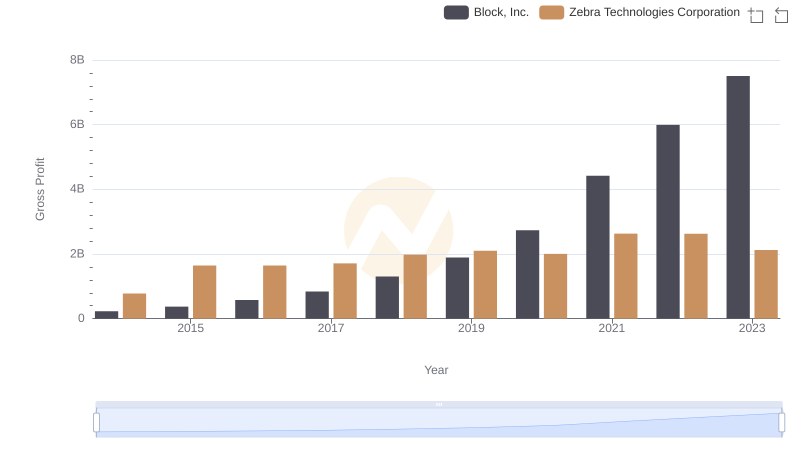

Who Generates Higher Gross Profit? Block, Inc. or Zebra Technologies Corporation

Comparing Innovation Spending: Block, Inc. and Zebra Technologies Corporation