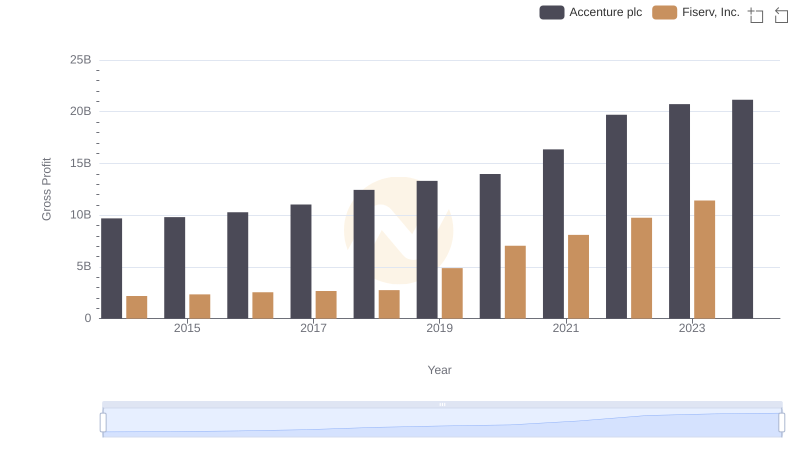

| __timestamp | Accenture plc | Fiserv, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 9684466000 | 2185000000 |

| Thursday, January 1, 2015 | 9809239000 | 2345000000 |

| Friday, January 1, 2016 | 10277427000 | 2546000000 |

| Sunday, January 1, 2017 | 11030492000 | 2672000000 |

| Monday, January 1, 2018 | 12442913000 | 2754000000 |

| Tuesday, January 1, 2019 | 13314688000 | 4878000000 |

| Wednesday, January 1, 2020 | 13976158000 | 7040000000 |

| Friday, January 1, 2021 | 16364128000 | 8098000000 |

| Saturday, January 1, 2022 | 19701539000 | 9745000000 |

| Sunday, January 1, 2023 | 20731607000 | 11423000000 |

| Monday, January 1, 2024 | 21162317000 | 20456000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of global business services, Accenture plc and Fiserv, Inc. have emerged as formidable players. Over the past decade, Accenture has consistently outperformed Fiserv in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2023, Accenture's gross profit surged by approximately 115%, reflecting its strategic prowess and market adaptability. In contrast, Fiserv's gross profit, while impressive, grew by about 423%, indicating a significant catch-up phase, especially post-2019.

This analysis underscores the dynamic nature of the business services sector, where strategic agility and market foresight are key to sustained success.

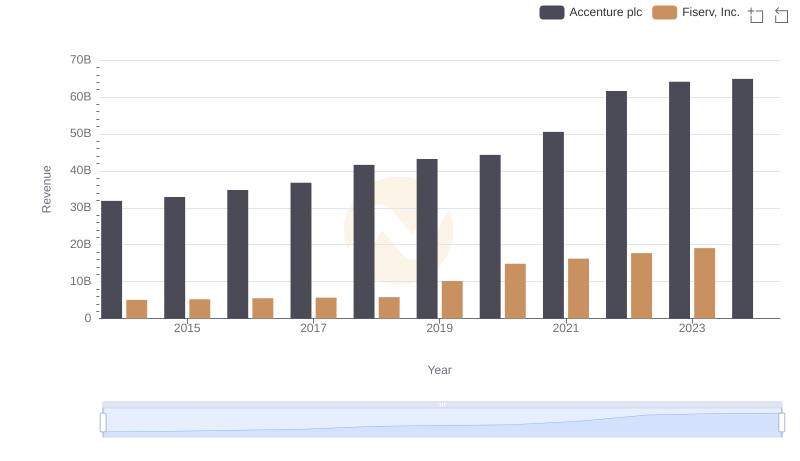

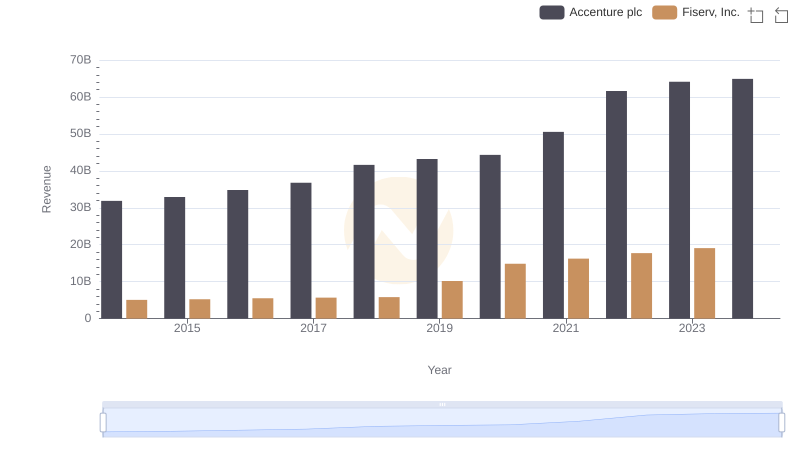

Revenue Showdown: Accenture plc vs Fiserv, Inc.

Revenue Insights: Accenture plc and Fiserv, Inc. Performance Compared

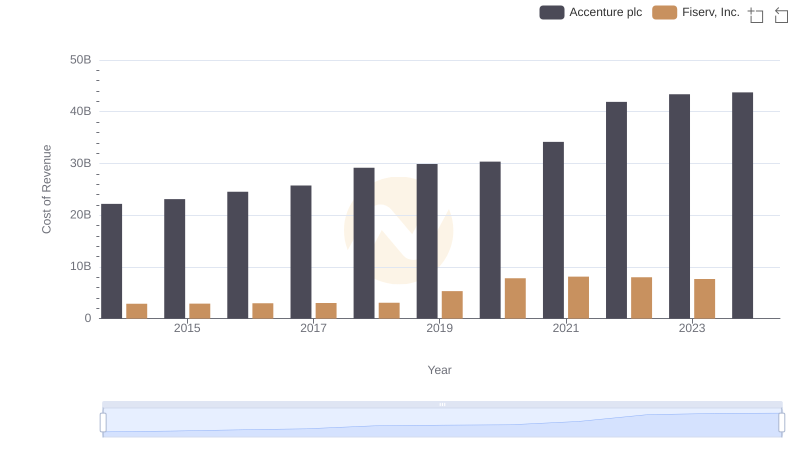

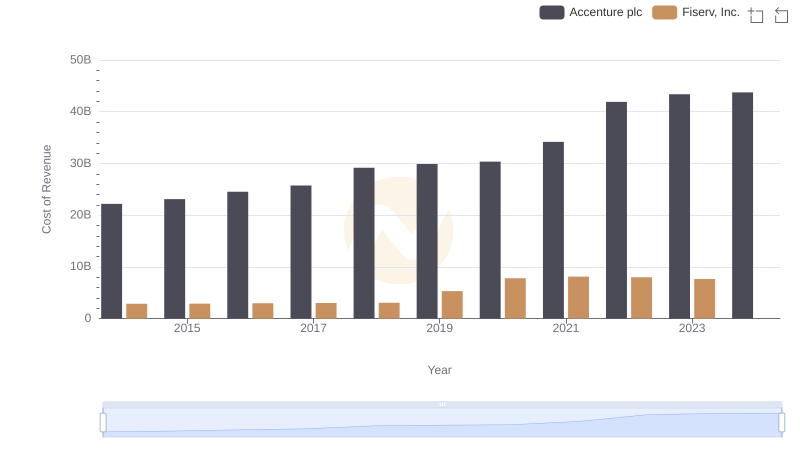

Cost of Revenue: Key Insights for Accenture plc and Fiserv, Inc.

Cost of Revenue Comparison: Accenture plc vs Fiserv, Inc.

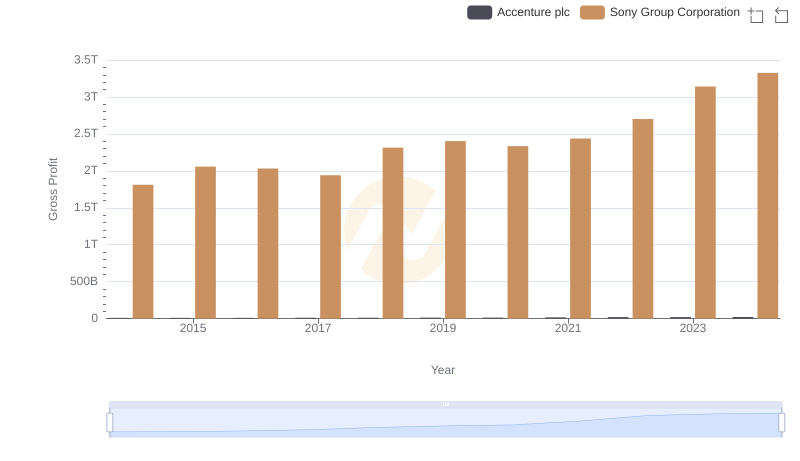

Accenture plc vs Sony Group Corporation: A Gross Profit Performance Breakdown

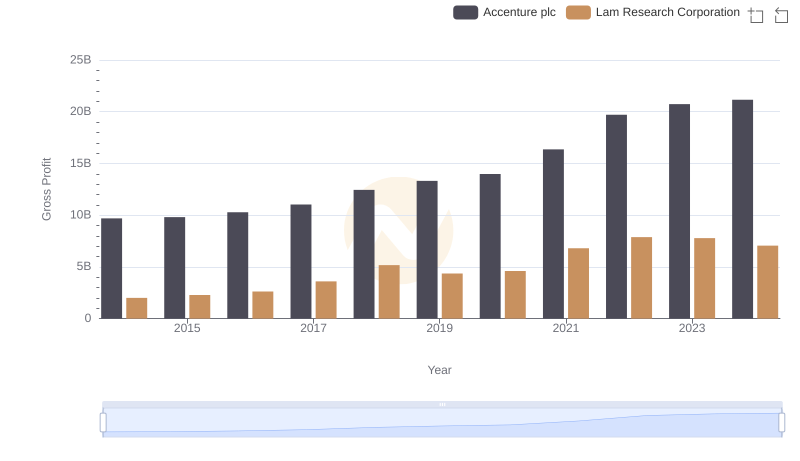

Accenture plc and Lam Research Corporation: A Detailed Gross Profit Analysis

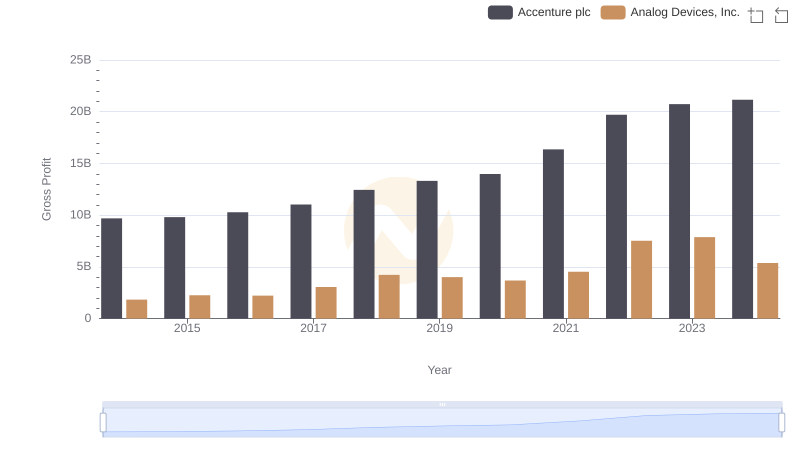

Key Insights on Gross Profit: Accenture plc vs Analog Devices, Inc.

Gross Profit Analysis: Comparing Accenture plc and Fiserv, Inc.

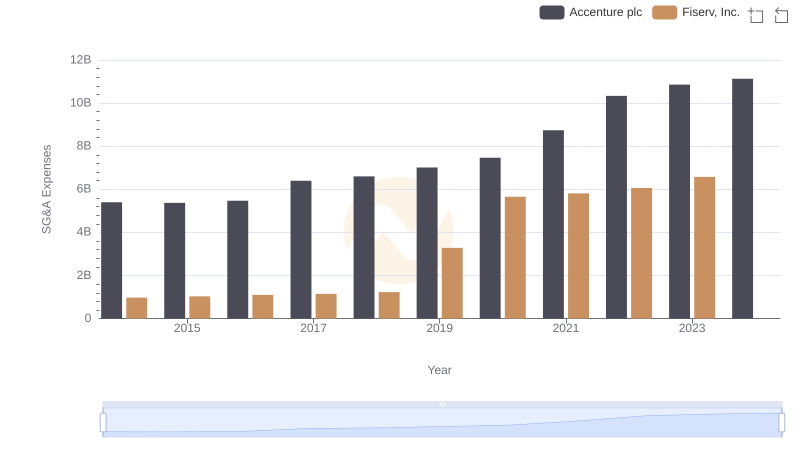

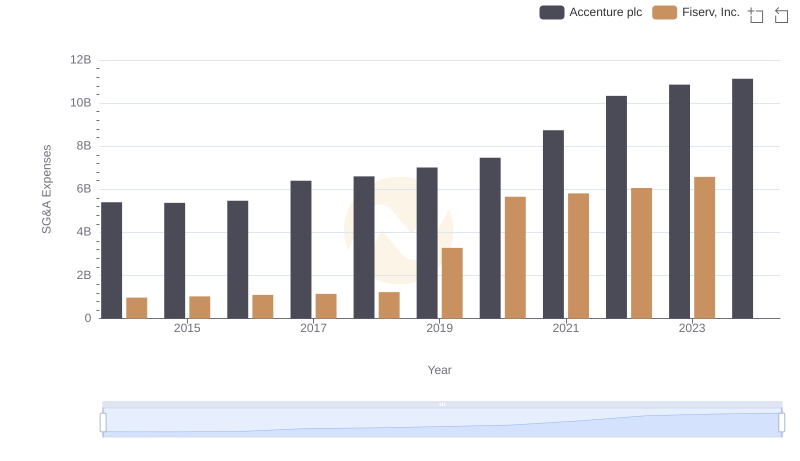

SG&A Efficiency Analysis: Comparing Accenture plc and Fiserv, Inc.

Accenture plc vs Fiserv, Inc.: SG&A Expense Trends

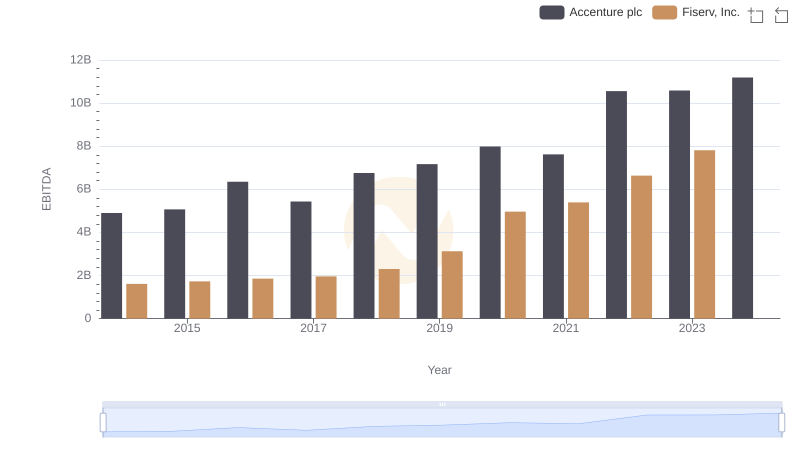

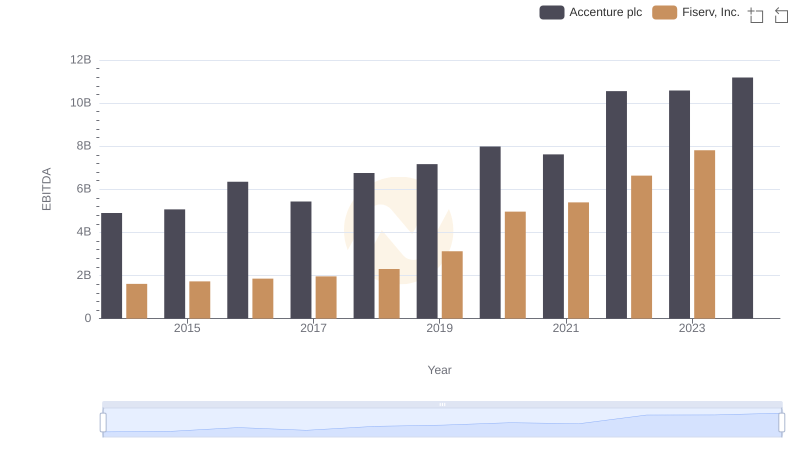

Accenture plc vs Fiserv, Inc.: In-Depth EBITDA Performance Comparison

EBITDA Analysis: Evaluating Accenture plc Against Fiserv, Inc.