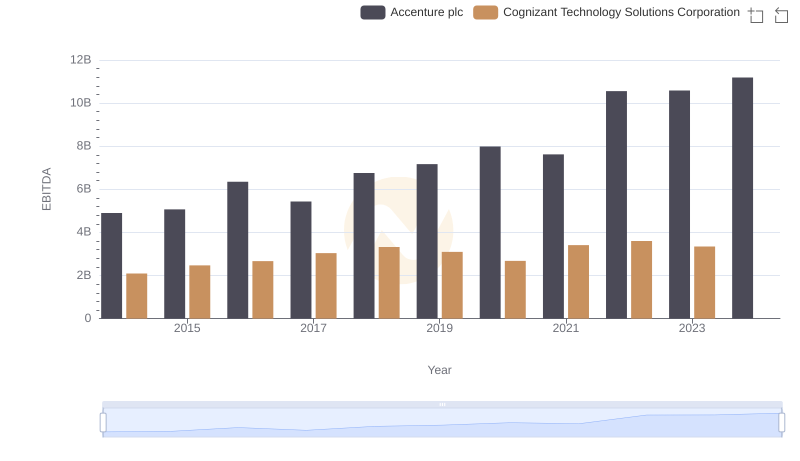

| __timestamp | Accenture plc | Cognizant Technology Solutions Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 5401969000 | 2037021000 |

| Thursday, January 1, 2015 | 5373370000 | 2508600000 |

| Friday, January 1, 2016 | 5466982000 | 2731000000 |

| Sunday, January 1, 2017 | 6397883000 | 2769000000 |

| Monday, January 1, 2018 | 6601872000 | 3026000000 |

| Tuesday, January 1, 2019 | 7009614000 | 2972000000 |

| Wednesday, January 1, 2020 | 7462514000 | 3100000000 |

| Friday, January 1, 2021 | 8742599000 | 3503000000 |

| Saturday, January 1, 2022 | 10334358000 | 3443000000 |

| Sunday, January 1, 2023 | 10858572000 | 3252000000 |

| Monday, January 1, 2024 | 11128030000 | 3223000000 |

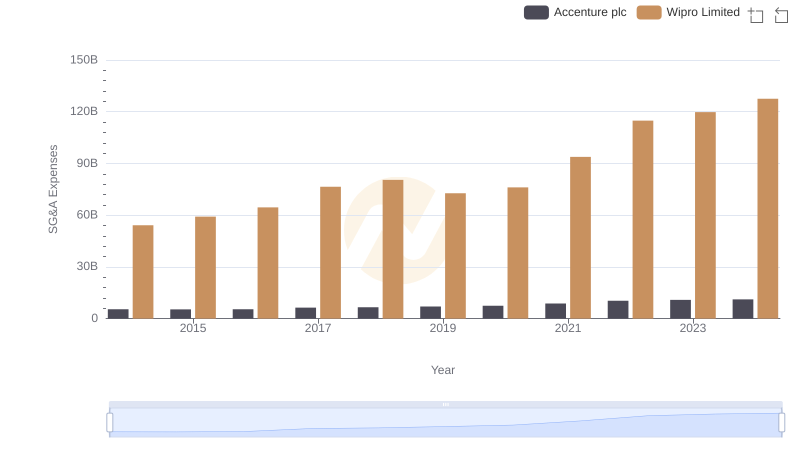

Unleashing insights

In the competitive world of technology consulting, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Accenture plc and Cognizant Technology Solutions Corporation have demonstrated contrasting approaches to SG&A cost management.

From 2014 to 2023, Accenture's SG&A expenses have surged by approximately 100%, reflecting its aggressive expansion strategy. In contrast, Cognizant's SG&A costs have grown by about 60%, indicating a more conservative approach. Notably, Accenture's expenses consistently outpaced Cognizant's, with 2023 figures showing Accenture's costs at over three times those of Cognizant.

While Accenture's higher expenses may suggest robust growth and investment, Cognizant's steadier increase could imply a focus on efficiency. The data for 2024 is incomplete, leaving room for speculation on future trends. As these industry giants continue to evolve, their SG&A strategies will remain a key indicator of their financial health and market positioning.

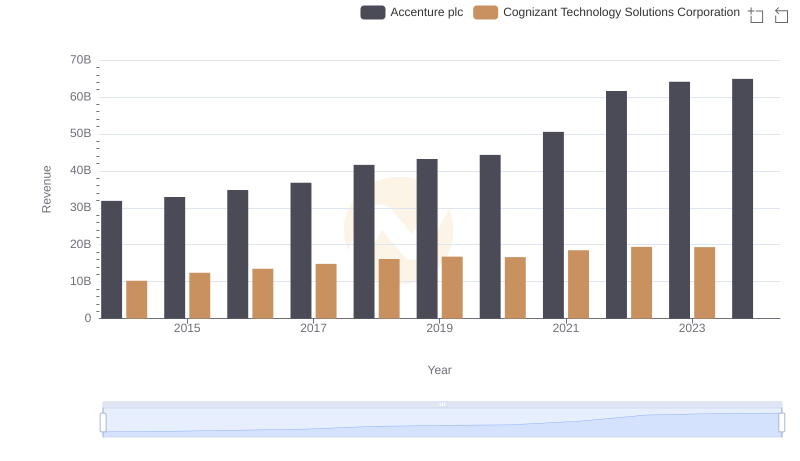

Accenture plc vs Cognizant Technology Solutions Corporation: Examining Key Revenue Metrics

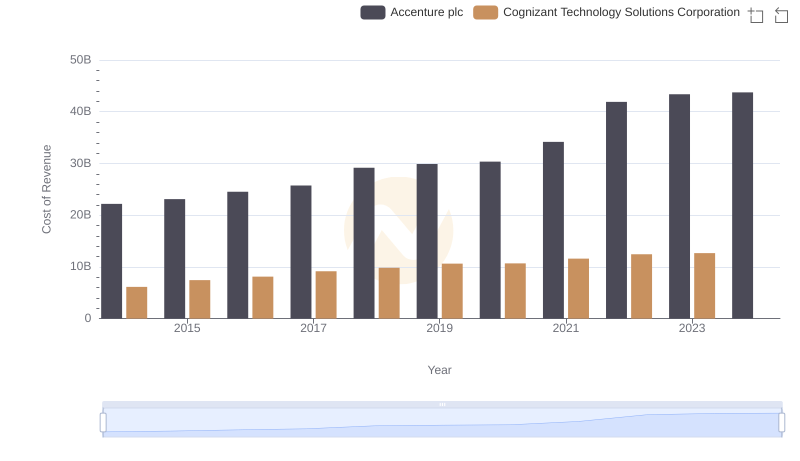

Cost of Revenue: Key Insights for Accenture plc and Cognizant Technology Solutions Corporation

Breaking Down SG&A Expenses: Accenture plc vs Wipro Limited

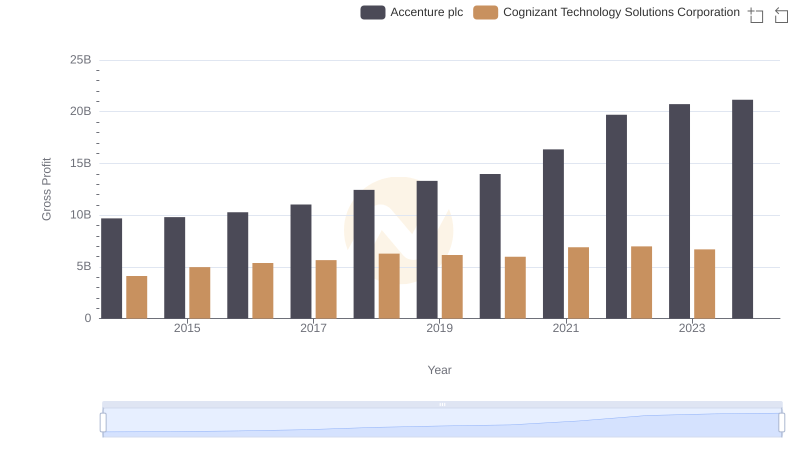

Accenture plc and Cognizant Technology Solutions Corporation: A Detailed Gross Profit Analysis

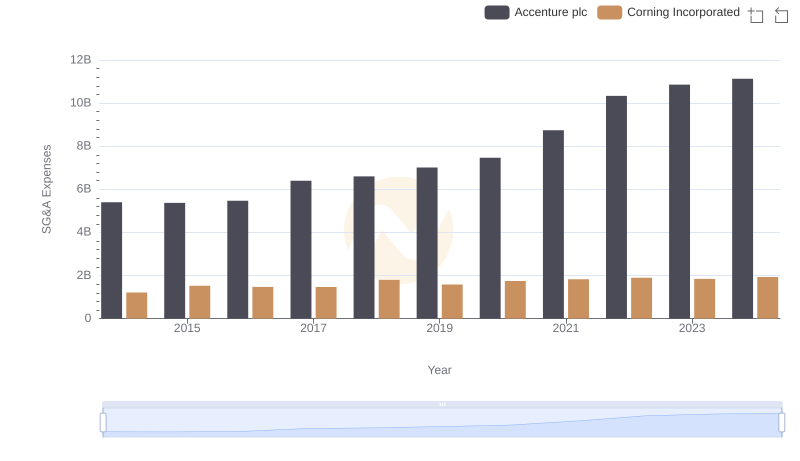

Selling, General, and Administrative Costs: Accenture plc vs Corning Incorporated

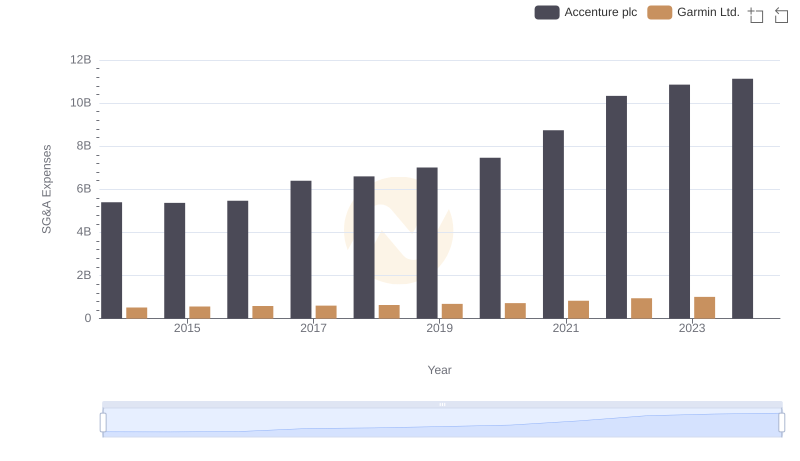

Selling, General, and Administrative Costs: Accenture plc vs Garmin Ltd.

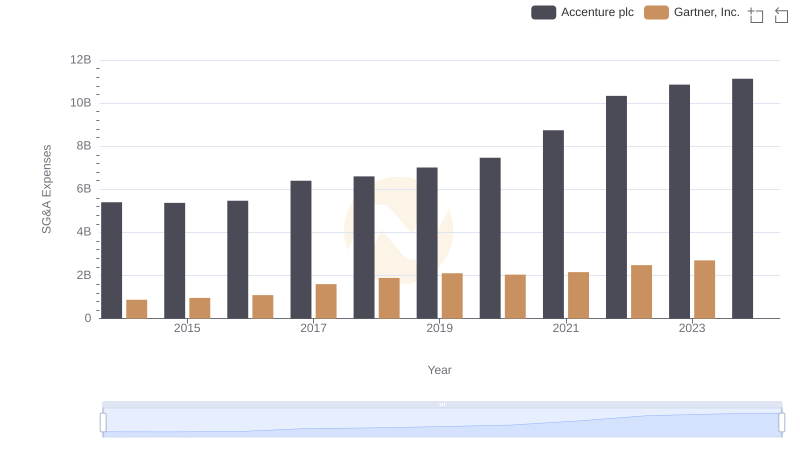

Breaking Down SG&A Expenses: Accenture plc vs Gartner, Inc.

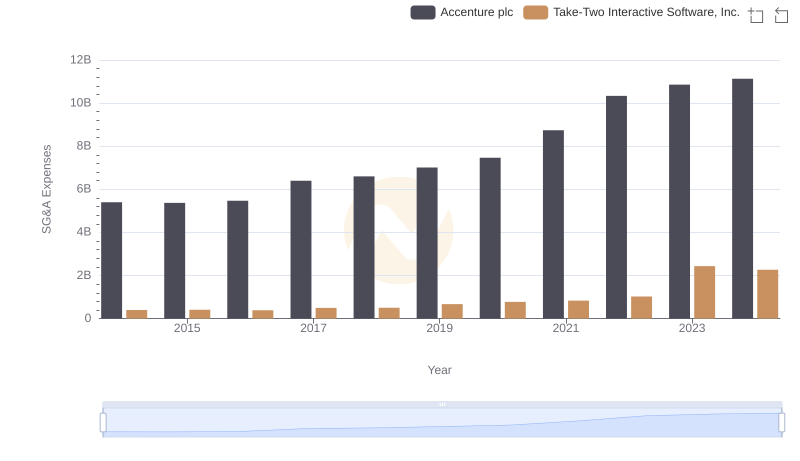

Accenture plc and Take-Two Interactive Software, Inc.: SG&A Spending Patterns Compared

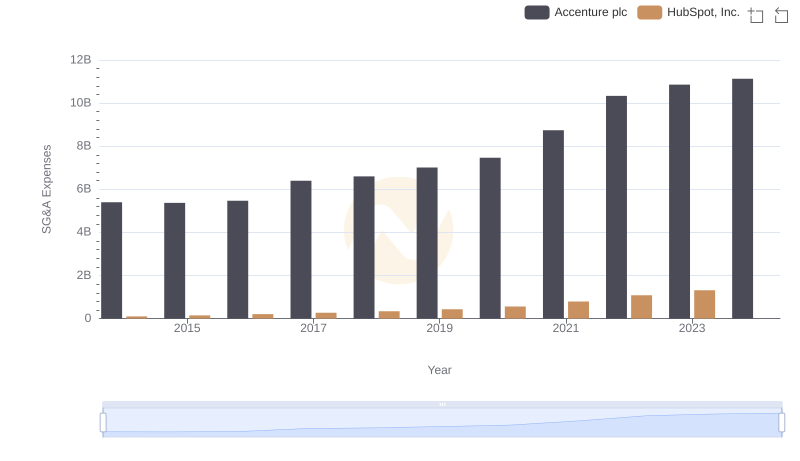

Accenture plc vs HubSpot, Inc.: SG&A Expense Trends

Accenture plc vs Cognizant Technology Solutions Corporation: In-Depth EBITDA Performance Comparison

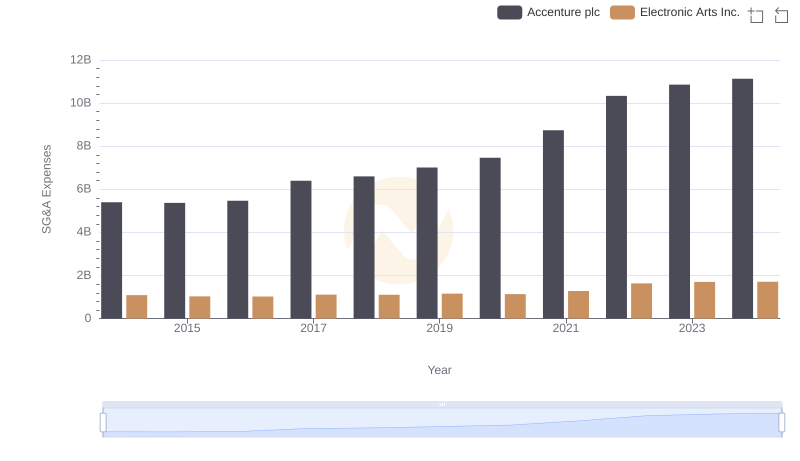

Accenture plc and Electronic Arts Inc.: SG&A Spending Patterns Compared

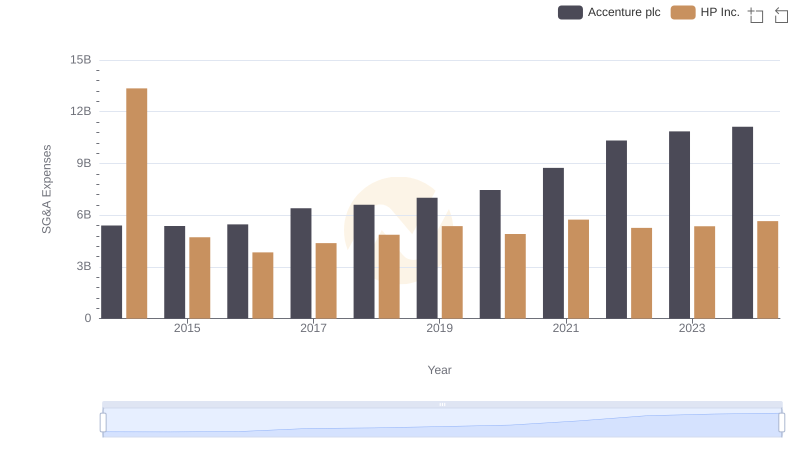

Selling, General, and Administrative Costs: Accenture plc vs HP Inc.