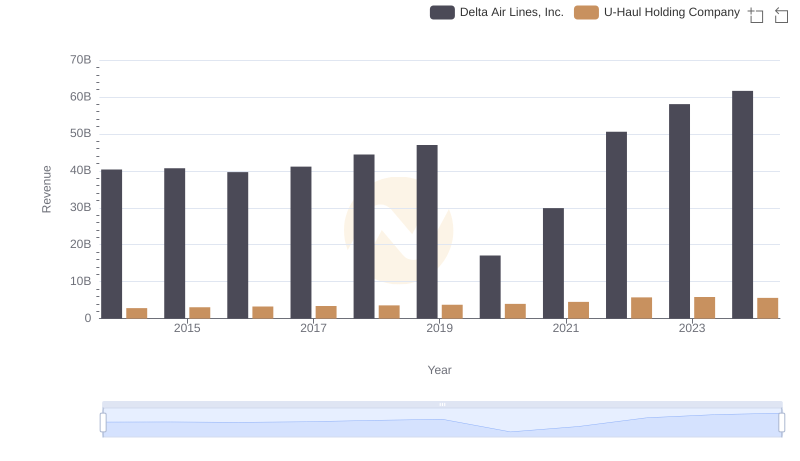

| __timestamp | Delta Air Lines, Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 2785000000 | 257168000 |

| Thursday, January 1, 2015 | 3162000000 | 238558000 |

| Friday, January 1, 2016 | 2825000000 | 217216000 |

| Sunday, January 1, 2017 | 2892000000 | 220053000 |

| Monday, January 1, 2018 | 3242000000 | 219271000 |

| Tuesday, January 1, 2019 | 3636000000 | 133435000 |

| Wednesday, January 1, 2020 | 582000000 | 201718000 |

| Friday, January 1, 2021 | 1061000000 | 207982000 |

| Saturday, January 1, 2022 | 2454000000 | 216557000 |

| Sunday, January 1, 2023 | 2334000000 | 58753000 |

| Monday, January 1, 2024 | 2485000000 | 32654000 |

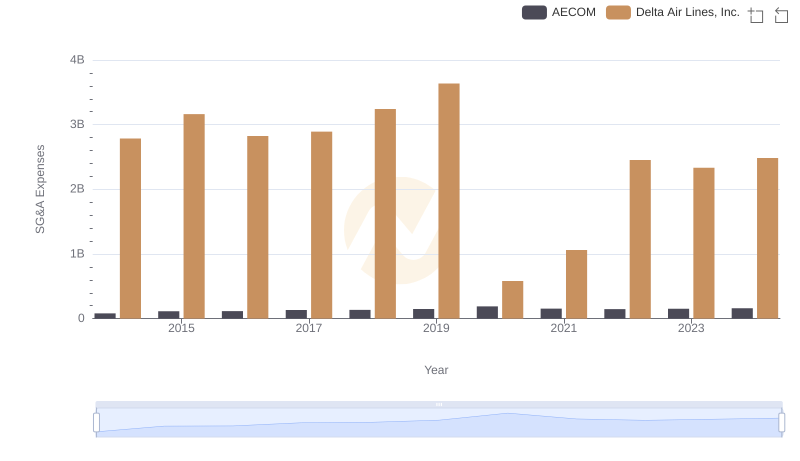

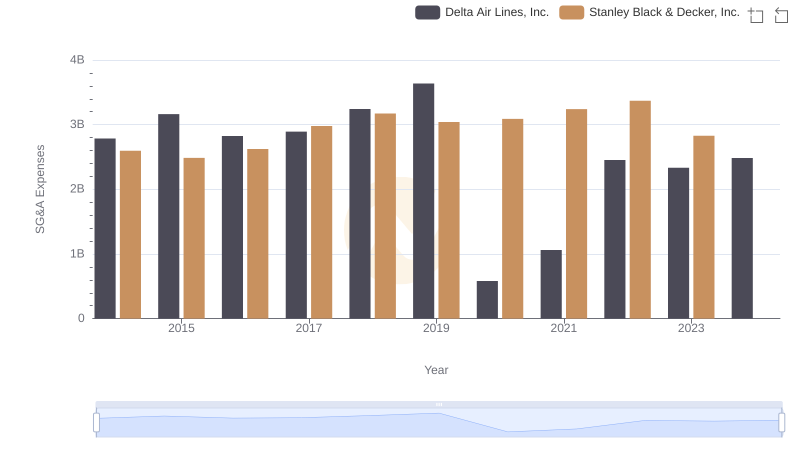

Unveiling the hidden dimensions of data

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Delta Air Lines, Inc. and U-Haul Holding Company, two giants in their respective industries, have shown contrasting trends in SG&A optimization over the past decade.

From 2014 to 2024, Delta Air Lines experienced a significant fluctuation in SG&A expenses, peaking in 2019 with a 30% increase from 2014, followed by a sharp decline in 2020. This volatility reflects the airline industry's sensitivity to external factors like fuel prices and global events.

Conversely, U-Haul Holding Company maintained a more stable SG&A trajectory, with a modest 15% decrease over the same period. This stability highlights U-Haul's consistent cost management strategies, crucial for a company reliant on steady consumer demand.

Understanding these trends offers valuable insights into how different industries navigate financial challenges.

Delta Air Lines, Inc. vs U-Haul Holding Company: Examining Key Revenue Metrics

Breaking Down SG&A Expenses: Delta Air Lines, Inc. vs AECOM

Delta Air Lines, Inc. or CNH Industrial N.V.: Who Manages SG&A Costs Better?

Selling, General, and Administrative Costs: Delta Air Lines, Inc. vs Stanley Black & Decker, Inc.

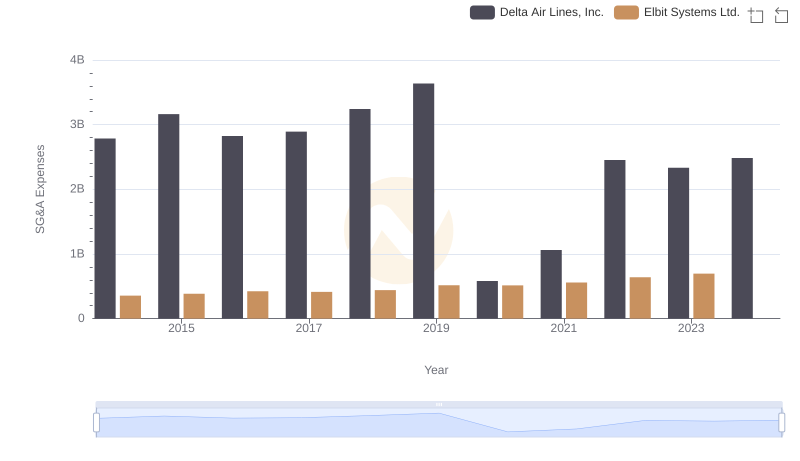

Cost Management Insights: SG&A Expenses for Delta Air Lines, Inc. and Elbit Systems Ltd.

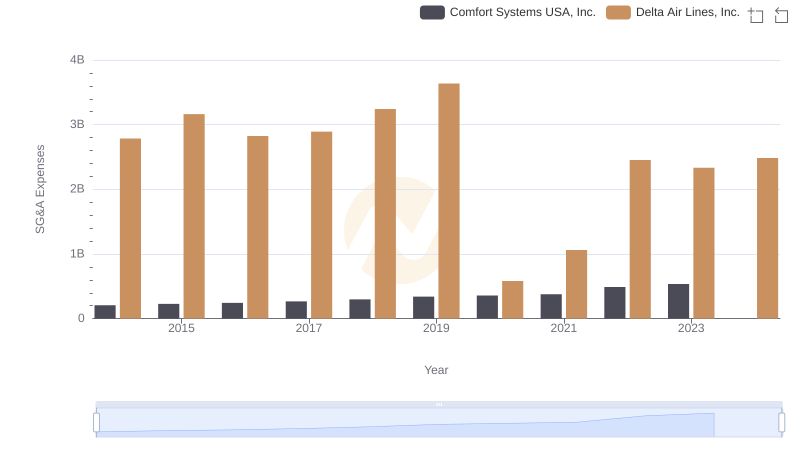

Cost Management Insights: SG&A Expenses for Delta Air Lines, Inc. and Comfort Systems USA, Inc.

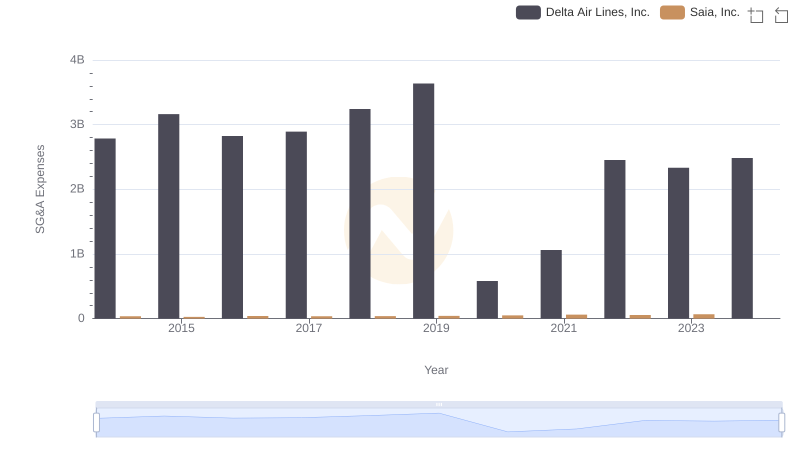

Comparing SG&A Expenses: Delta Air Lines, Inc. vs Saia, Inc. Trends and Insights

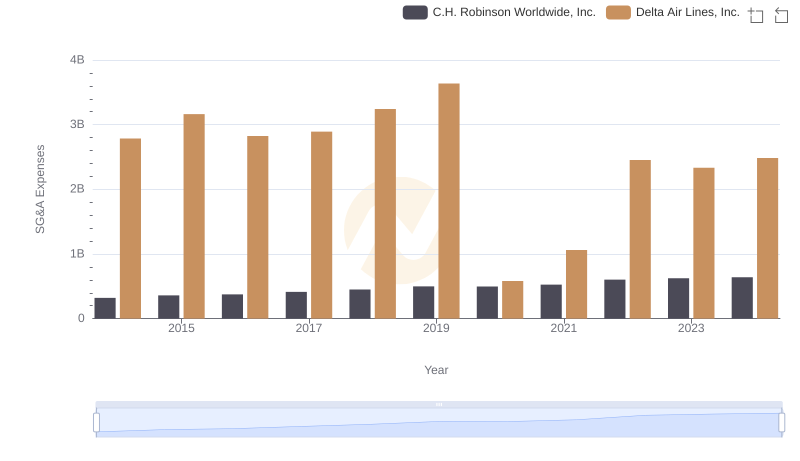

Comparing SG&A Expenses: Delta Air Lines, Inc. vs C.H. Robinson Worldwide, Inc. Trends and Insights

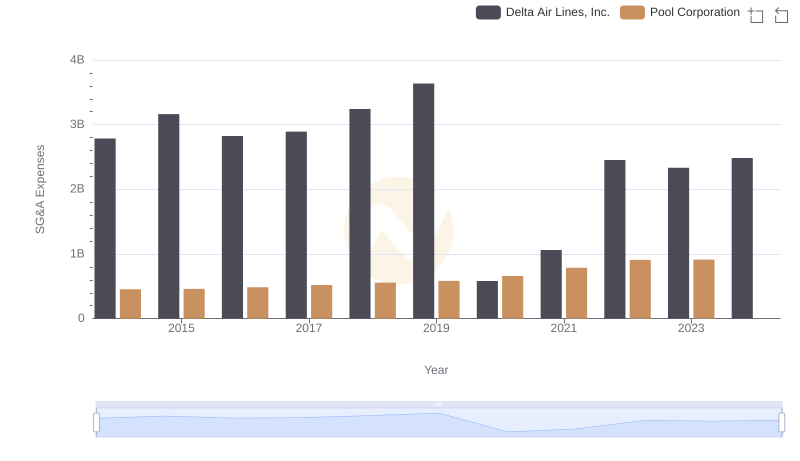

Who Optimizes SG&A Costs Better? Delta Air Lines, Inc. or Pool Corporation

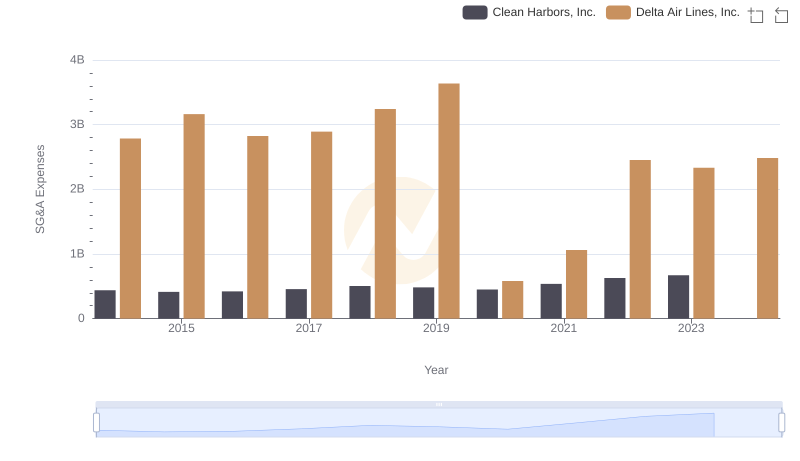

Comparing SG&A Expenses: Delta Air Lines, Inc. vs Clean Harbors, Inc. Trends and Insights

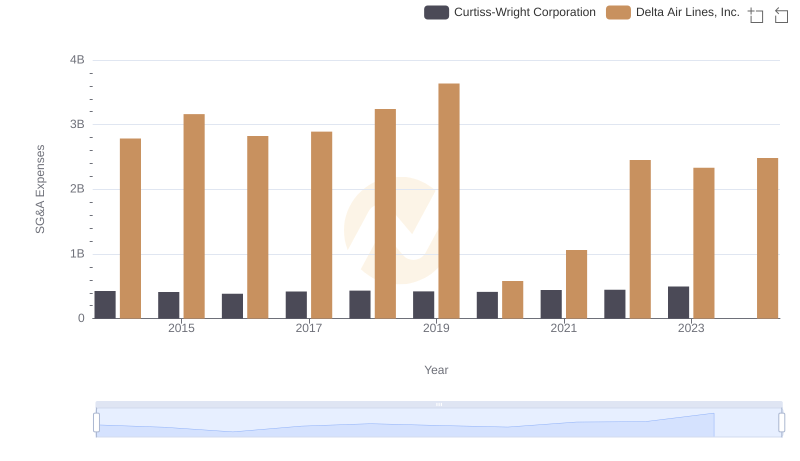

Delta Air Lines, Inc. or Curtiss-Wright Corporation: Who Manages SG&A Costs Better?