| __timestamp | Deere & Company | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3284400000 | 1570100000 |

| Thursday, January 1, 2015 | 2873300000 | 1506400000 |

| Friday, January 1, 2016 | 2763700000 | 1467400000 |

| Sunday, January 1, 2017 | 3066600000 | 1591500000 |

| Monday, January 1, 2018 | 3455500000 | 1599000000 |

| Tuesday, January 1, 2019 | 3551000000 | 1538500000 |

| Wednesday, January 1, 2020 | 3477000000 | 1479800000 |

| Friday, January 1, 2021 | 3383000000 | 1680000000 |

| Saturday, January 1, 2022 | 3863000000 | 1766700000 |

| Sunday, January 1, 2023 | 3601000000 | 2023700000 |

| Monday, January 1, 2024 | 4507000000 | 2002600000 |

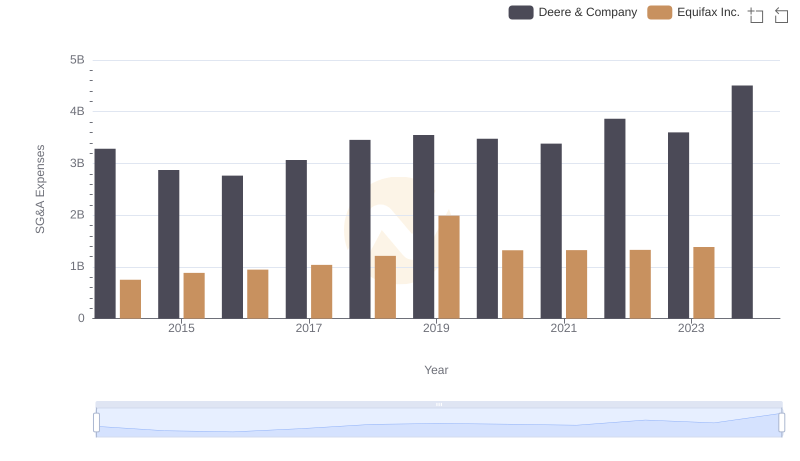

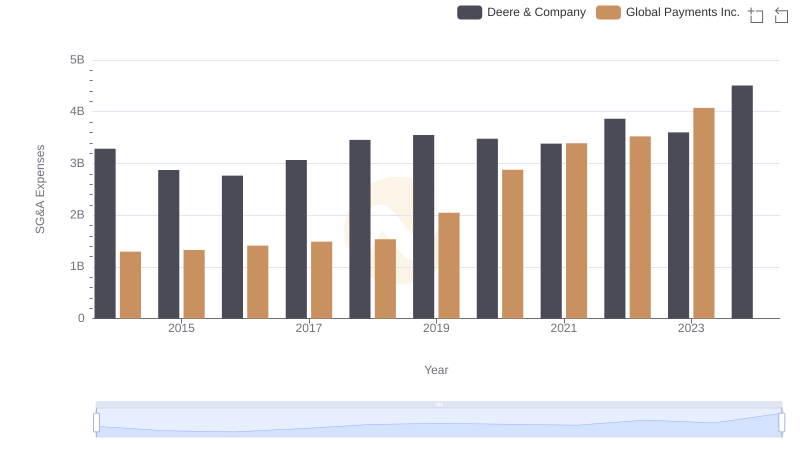

Unlocking the unknown

In the competitive landscape of industrial giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Deere & Company and Rockwell Automation, Inc. have demonstrated distinct strategies in optimizing these costs.

From 2014 to 2024, Deere & Company has seen a 37% increase in SG&A expenses, peaking in 2024. In contrast, Rockwell Automation, Inc. experienced a 28% rise, with a notable spike in 2023. Despite Deere's higher absolute expenses, their growth rate is more controlled compared to Rockwell's recent surge.

Deere's consistent expense management reflects a strategic focus on operational efficiency, while Rockwell's recent increase suggests potential investments in growth initiatives. Understanding these trends provides valuable insights into each company's financial health and strategic priorities.

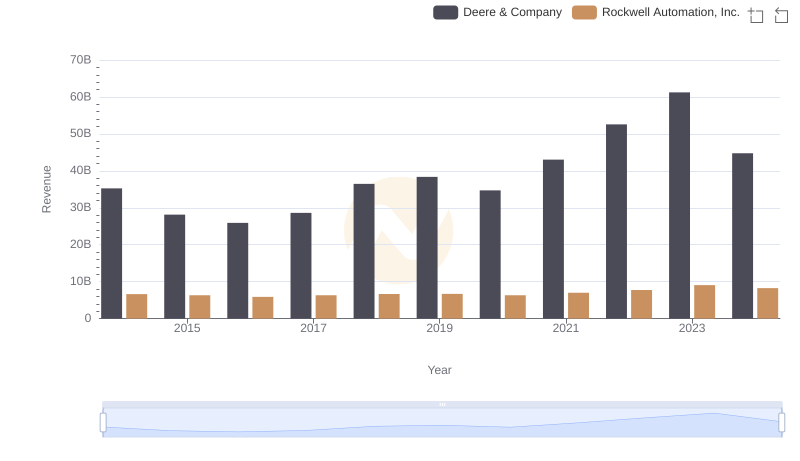

Deere & Company and Rockwell Automation, Inc.: A Comprehensive Revenue Analysis

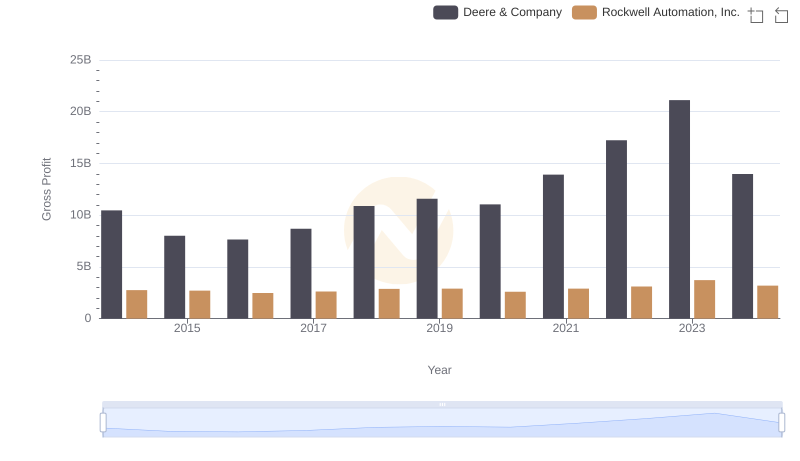

Deere & Company and Rockwell Automation, Inc.: A Detailed Gross Profit Analysis

Breaking Down SG&A Expenses: Deere & Company vs Equifax Inc.

Operational Costs Compared: SG&A Analysis of Deere & Company and Global Payments Inc.

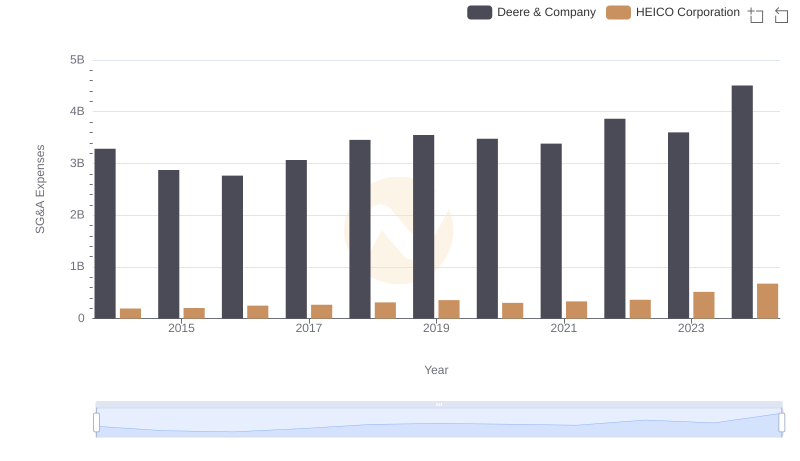

Deere & Company or HEICO Corporation: Who Manages SG&A Costs Better?

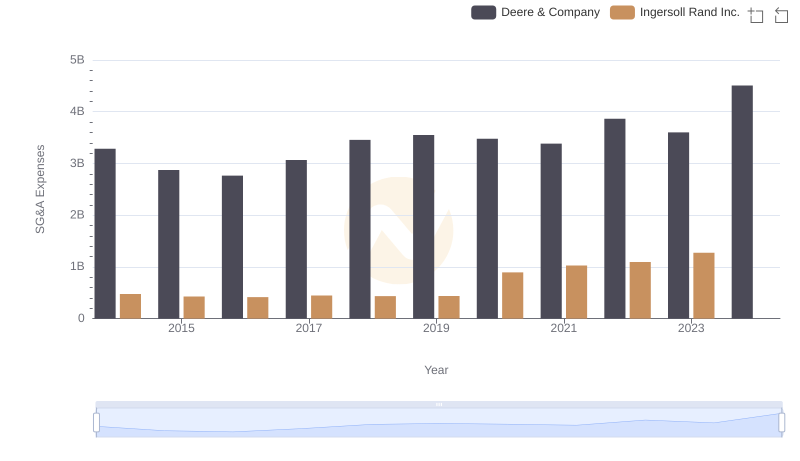

Deere & Company vs Ingersoll Rand Inc.: SG&A Expense Trends