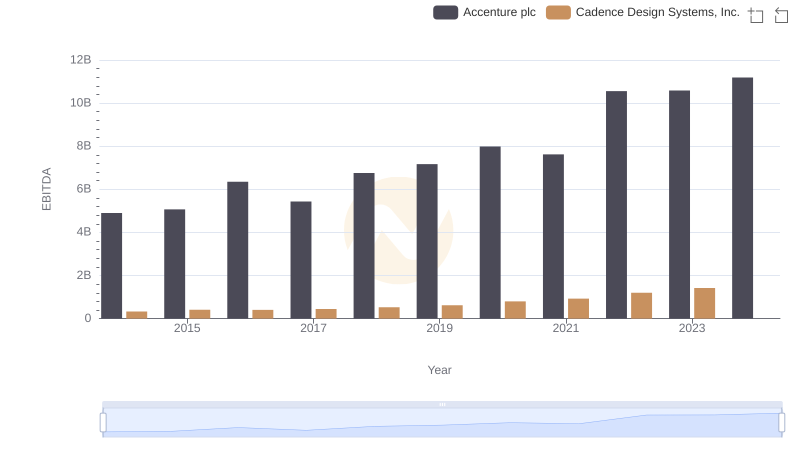

| __timestamp | Accenture plc | Cadence Design Systems, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5401969000 | 513307000 |

| Thursday, January 1, 2015 | 5373370000 | 512414000 |

| Friday, January 1, 2016 | 5466982000 | 520300000 |

| Sunday, January 1, 2017 | 6397883000 | 553342000 |

| Monday, January 1, 2018 | 6601872000 | 573075000 |

| Tuesday, January 1, 2019 | 7009614000 | 621479000 |

| Wednesday, January 1, 2020 | 7462514000 | 670885000 |

| Friday, January 1, 2021 | 8742599000 | 749280000 |

| Saturday, January 1, 2022 | 10334358000 | 846340000 |

| Sunday, January 1, 2023 | 10858572000 | 920649000 |

| Monday, January 1, 2024 | 11128030000 | 1039766000 |

Igniting the spark of knowledge

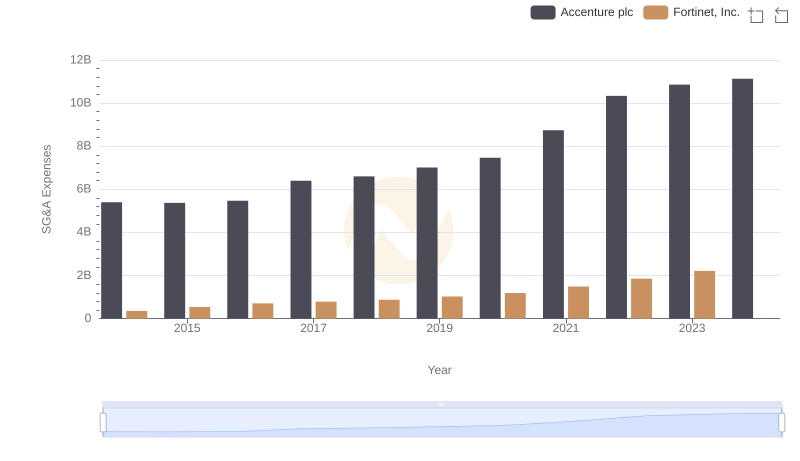

In the competitive world of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Accenture plc and Cadence Design Systems, Inc. have been at the forefront of this challenge since 2014. Over the past decade, Accenture has seen its SG&A expenses grow by approximately 106%, reaching a peak in 2024. In contrast, Cadence Design Systems has maintained a more modest increase of around 79% over the same period.

Accenture's expenses surged from 2014 to 2023, reflecting its expansive global operations and strategic investments. Meanwhile, Cadence's steady rise in SG&A costs highlights its focus on innovation and market expansion. Notably, data for 2024 is missing for Cadence, leaving room for speculation on its future trajectory. This comparison underscores the diverse strategies these companies employ to optimize costs while driving growth.

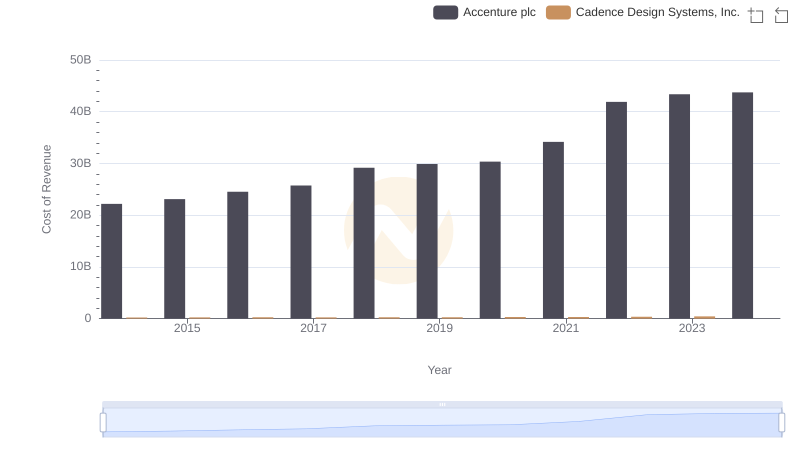

Cost of Revenue: Key Insights for Accenture plc and Cadence Design Systems, Inc.

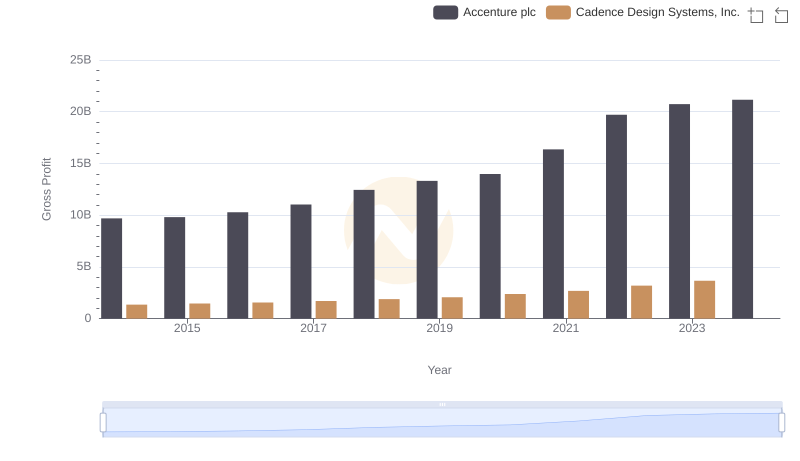

Accenture plc and Cadence Design Systems, Inc.: A Detailed Gross Profit Analysis

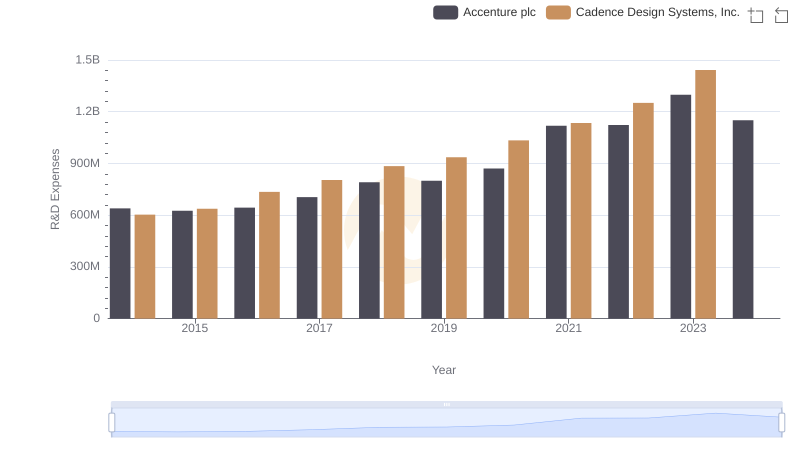

Research and Development Investment: Accenture plc vs Cadence Design Systems, Inc.

Accenture plc vs Fortinet, Inc.: SG&A Expense Trends

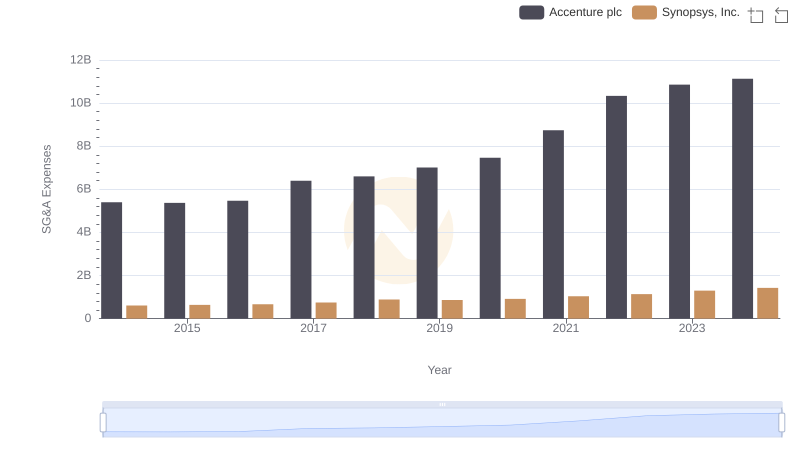

Comparing SG&A Expenses: Accenture plc vs Synopsys, Inc. Trends and Insights

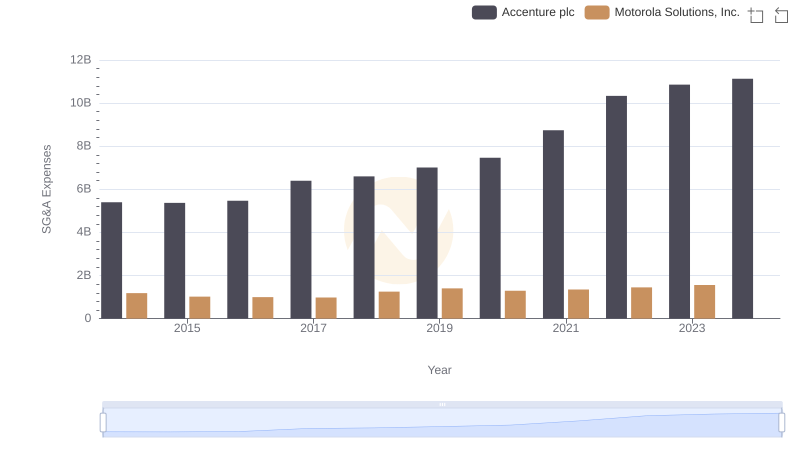

SG&A Efficiency Analysis: Comparing Accenture plc and Motorola Solutions, Inc.

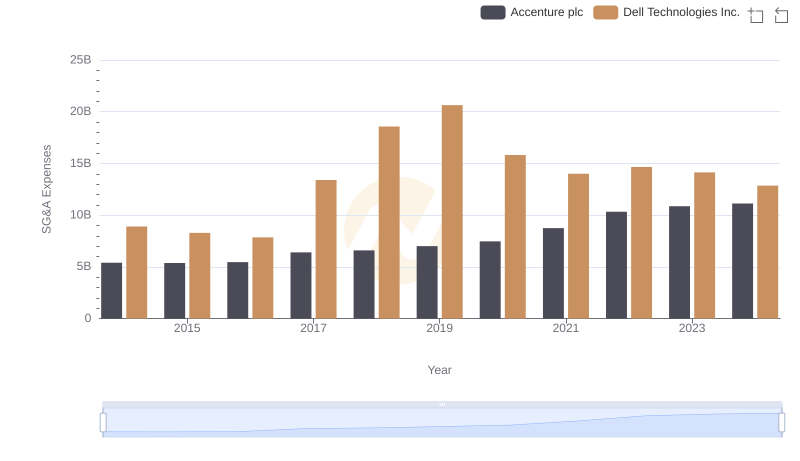

Accenture plc or Dell Technologies Inc.: Who Manages SG&A Costs Better?

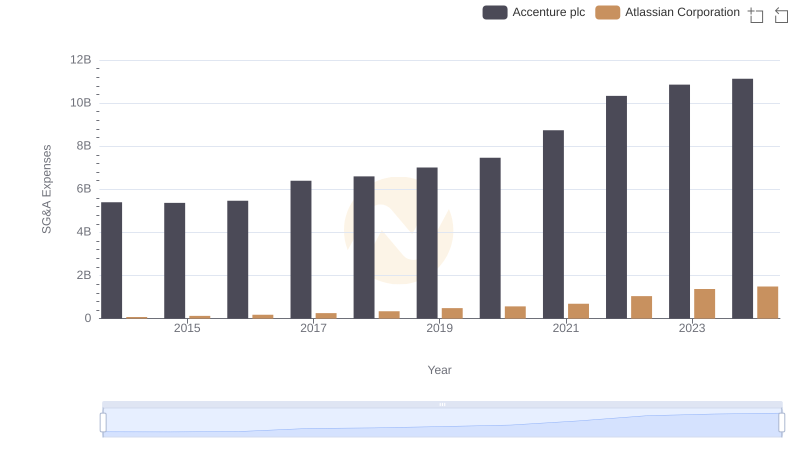

Accenture plc or Atlassian Corporation: Who Manages SG&A Costs Better?

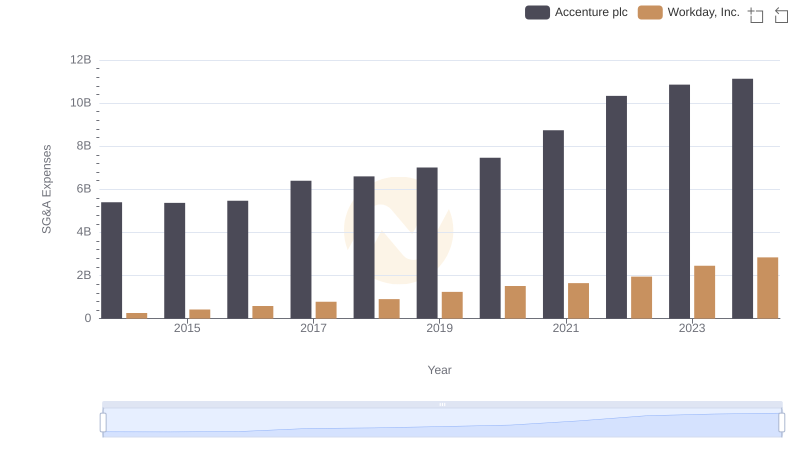

Who Optimizes SG&A Costs Better? Accenture plc or Workday, Inc.

Professional EBITDA Benchmarking: Accenture plc vs Cadence Design Systems, Inc.

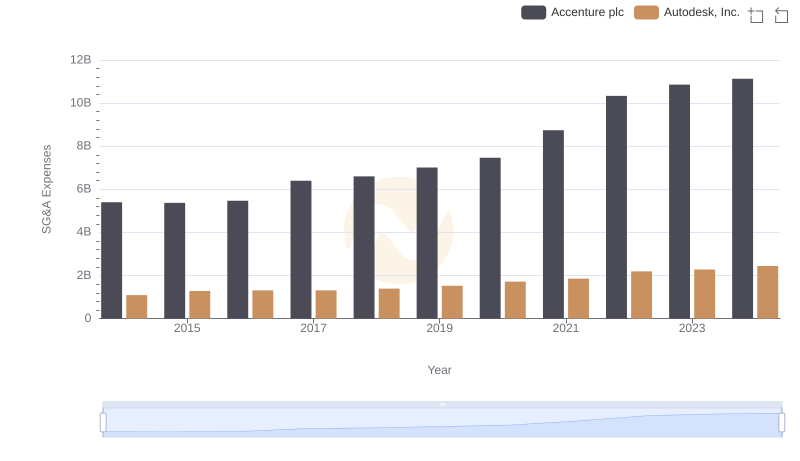

SG&A Efficiency Analysis: Comparing Accenture plc and Autodesk, Inc.