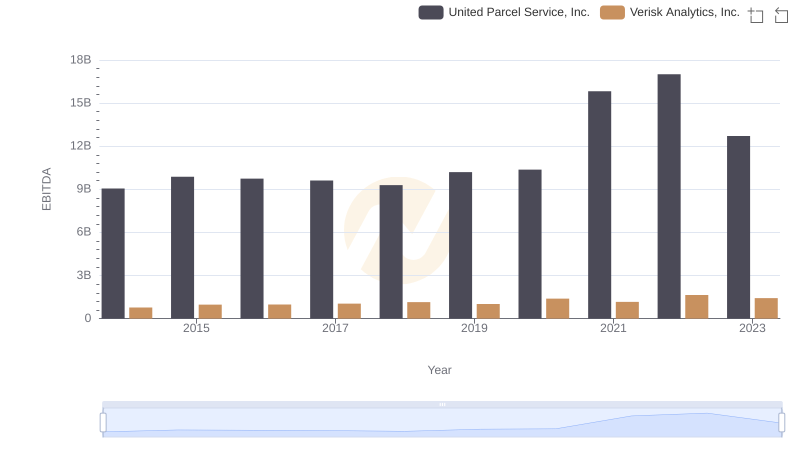

| __timestamp | United Parcel Service, Inc. | Verisk Analytics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 26187000000 | 1030128000 |

| Thursday, January 1, 2015 | 27335000000 | 1264736000 |

| Friday, January 1, 2016 | 5467000000 | 1280800000 |

| Sunday, January 1, 2017 | 7529000000 | 1361400000 |

| Monday, January 1, 2018 | 7024000000 | 1508900000 |

| Tuesday, January 1, 2019 | 7798000000 | 1630300000 |

| Wednesday, January 1, 2020 | 7814000000 | 1790700000 |

| Friday, January 1, 2021 | 12810000000 | 1940800000 |

| Saturday, January 1, 2022 | 13094000000 | 1672400000 |

| Sunday, January 1, 2023 | 17231000000 | 1804900000 |

| Monday, January 1, 2024 | 25022000000 |

Igniting the spark of knowledge

In the world of business, gross profit is a key indicator of a company's financial health. Over the past decade, United Parcel Service, Inc. (UPS) and Verisk Analytics, Inc. have showcased contrasting trajectories in this regard. From 2014 to 2023, UPS consistently outperformed Verisk Analytics, with its gross profit peaking at approximately $17.2 billion in 2023. This represents a staggering 550% increase from its lowest point in 2016. In contrast, Verisk Analytics saw a more modest growth, with its gross profit reaching around $1.8 billion in 2023, marking a 75% increase from 2014. This comparison highlights UPS's dominant position in the logistics sector, while Verisk Analytics continues to carve its niche in data analytics. As the global economy evolves, these trends offer valuable insights into the strategic maneuvers of these industry leaders.

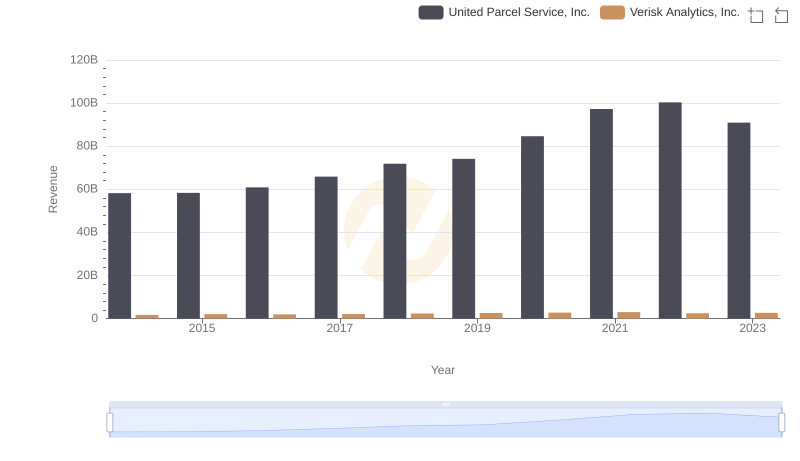

Revenue Showdown: United Parcel Service, Inc. vs Verisk Analytics, Inc.

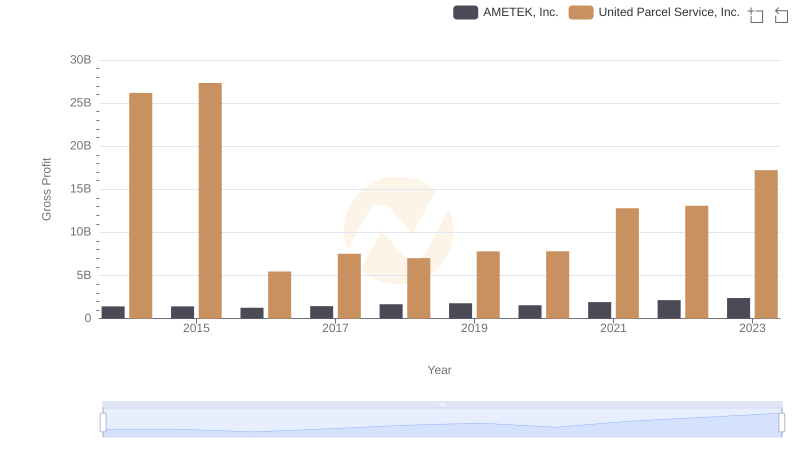

United Parcel Service, Inc. and AMETEK, Inc.: A Detailed Gross Profit Analysis

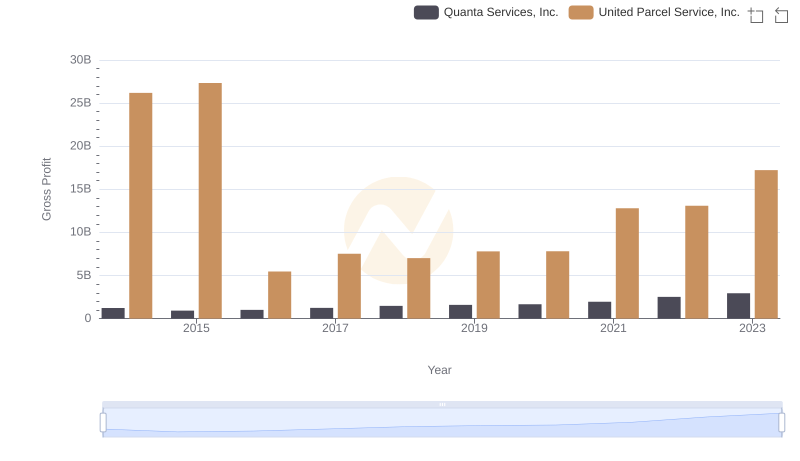

United Parcel Service, Inc. and Quanta Services, Inc.: A Detailed Gross Profit Analysis

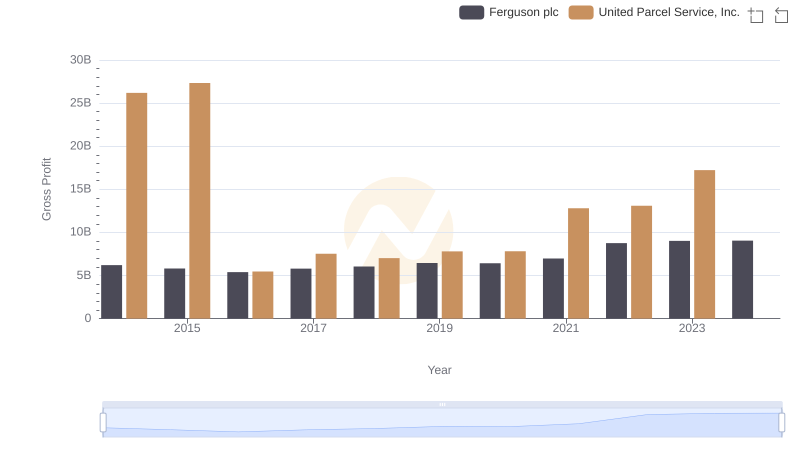

United Parcel Service, Inc. vs Ferguson plc: A Gross Profit Performance Breakdown

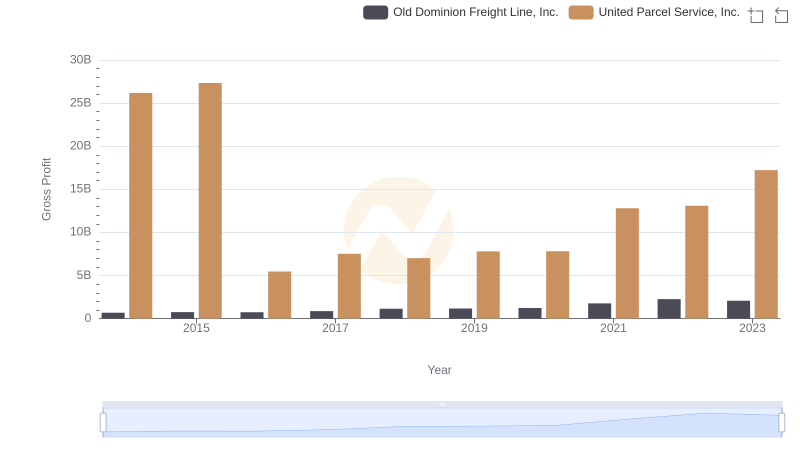

United Parcel Service, Inc. and Old Dominion Freight Line, Inc.: A Detailed Gross Profit Analysis

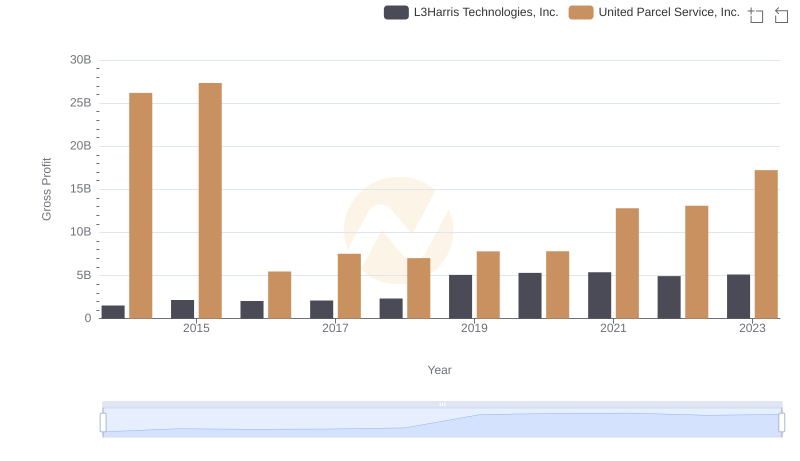

Gross Profit Trends Compared: United Parcel Service, Inc. vs L3Harris Technologies, Inc.

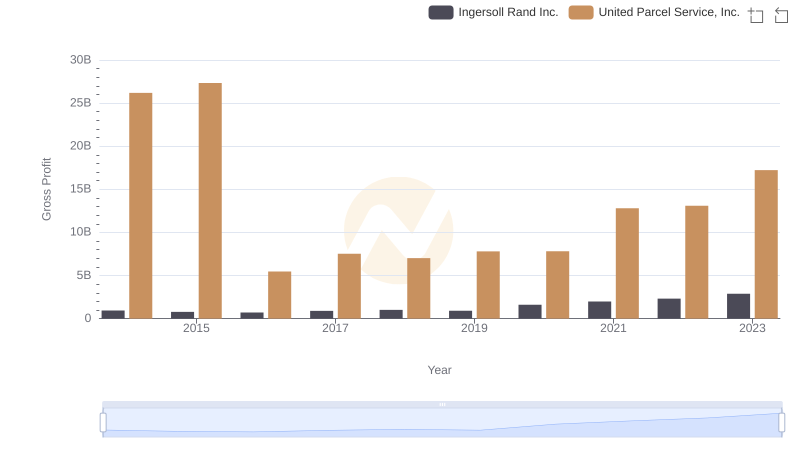

Gross Profit Trends Compared: United Parcel Service, Inc. vs Ingersoll Rand Inc.

United Parcel Service, Inc. vs Verisk Analytics, Inc.: In-Depth EBITDA Performance Comparison

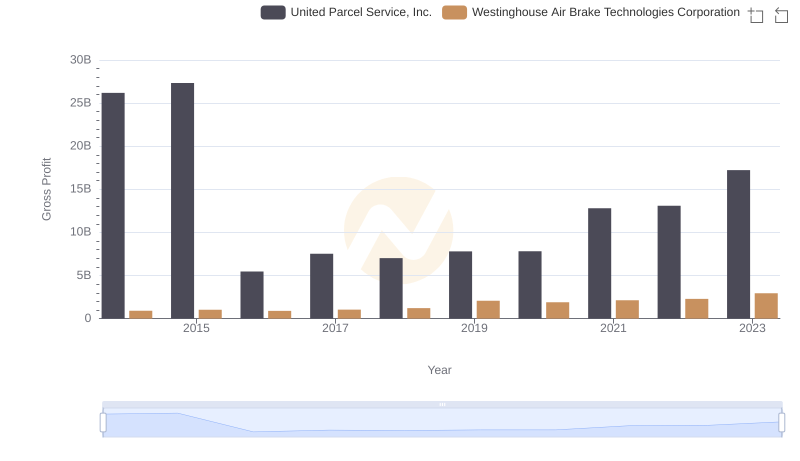

Key Insights on Gross Profit: United Parcel Service, Inc. vs Westinghouse Air Brake Technologies Corporation

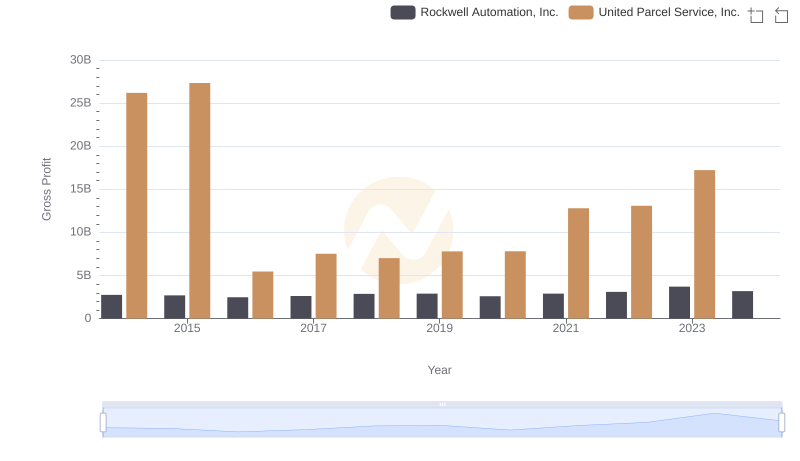

United Parcel Service, Inc. and Rockwell Automation, Inc.: A Detailed Gross Profit Analysis