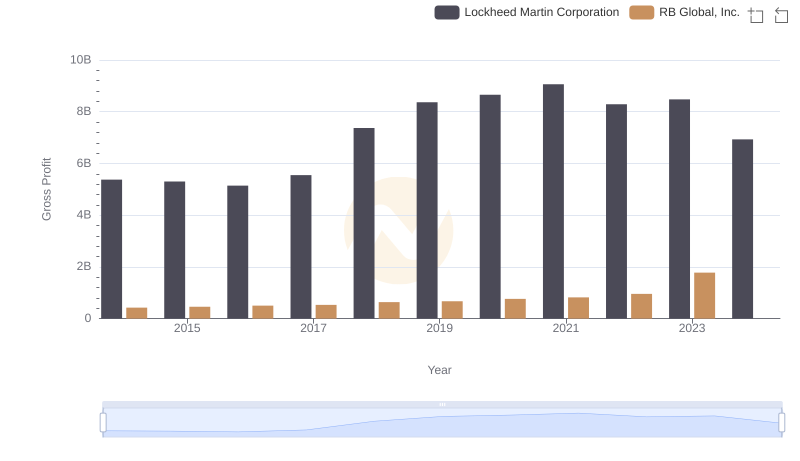

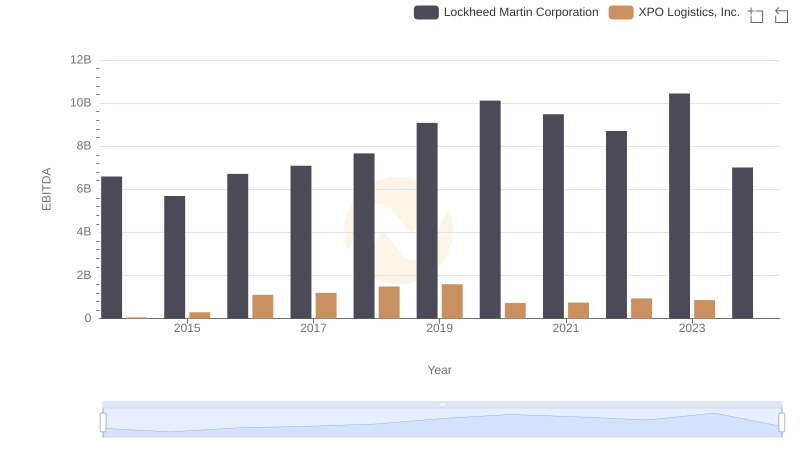

| __timestamp | Lockheed Martin Corporation | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5374000000 | 381600000 |

| Thursday, January 1, 2015 | 5302000000 | 1084800000 |

| Friday, January 1, 2016 | 5142000000 | 2139300000 |

| Sunday, January 1, 2017 | 5548000000 | 2279700000 |

| Monday, January 1, 2018 | 7370000000 | 2541000000 |

| Tuesday, January 1, 2019 | 8367000000 | 2666000000 |

| Wednesday, January 1, 2020 | 8654000000 | 2563000000 |

| Friday, January 1, 2021 | 9061000000 | 1994000000 |

| Saturday, January 1, 2022 | 8287000000 | 1227000000 |

| Sunday, January 1, 2023 | 8479000000 | 770000000 |

| Monday, January 1, 2024 | 6930000000 | 915000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of American industry, Lockheed Martin Corporation and XPO Logistics, Inc. stand as titans in their respective fields. Over the past decade, Lockheed Martin has consistently outperformed XPO Logistics in terms of gross profit. From 2014 to 2023, Lockheed Martin's gross profit surged by approximately 58%, peaking in 2021. In contrast, XPO Logistics saw a more modest increase of around 400% from 2014 to 2019, before experiencing a decline.

Lockheed Martin's dominance is evident, with its gross profit consistently surpassing XPO's by a significant margin. For instance, in 2023, Lockheed Martin's gross profit was over ten times that of XPO Logistics. This trend highlights Lockheed Martin's robust market position and strategic prowess. However, the data for 2024 is incomplete, leaving room for speculation on future dynamics.

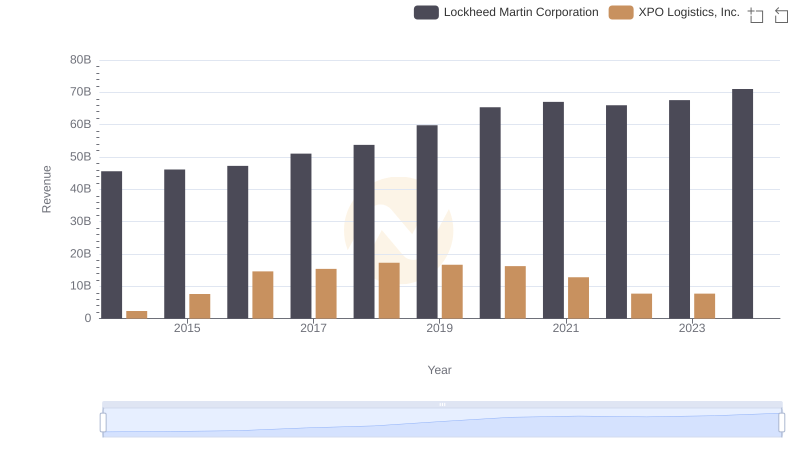

Who Generates More Revenue? Lockheed Martin Corporation or XPO Logistics, Inc.

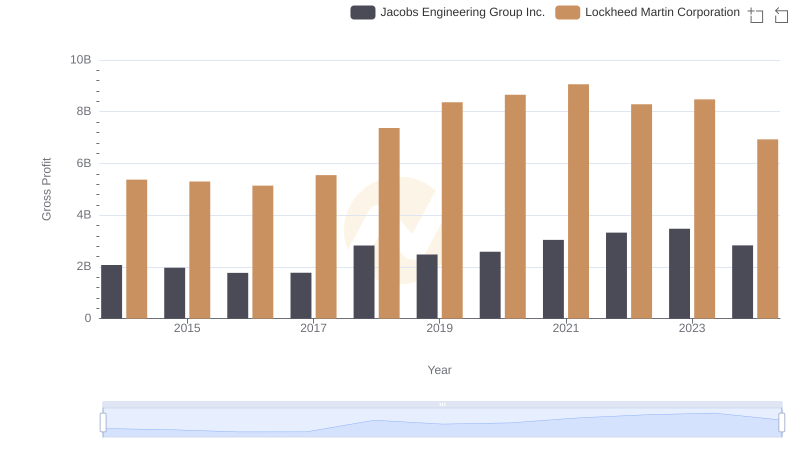

Lockheed Martin Corporation vs Jacobs Engineering Group Inc.: A Gross Profit Performance Breakdown

Key Insights on Gross Profit: Lockheed Martin Corporation vs RB Global, Inc.

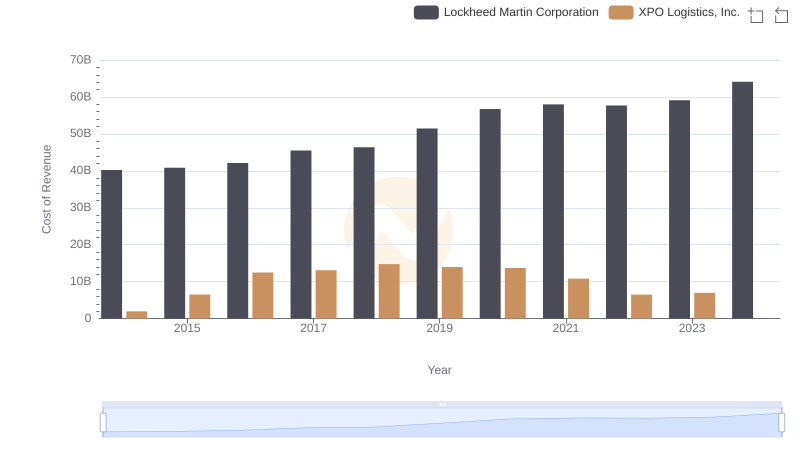

Cost of Revenue Comparison: Lockheed Martin Corporation vs XPO Logistics, Inc.

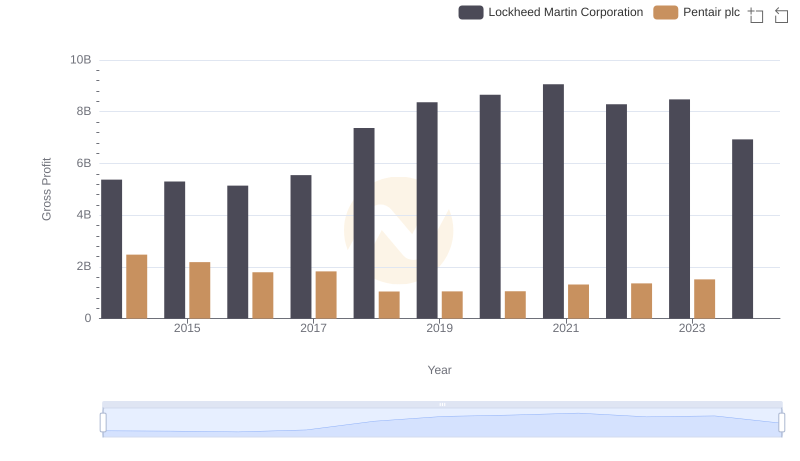

Gross Profit Comparison: Lockheed Martin Corporation and Pentair plc Trends

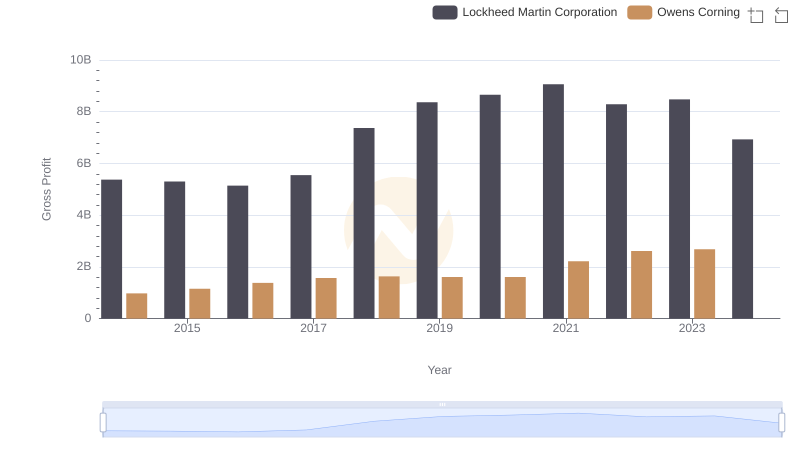

Gross Profit Analysis: Comparing Lockheed Martin Corporation and Owens Corning

Lockheed Martin Corporation and XPO Logistics, Inc.: A Detailed Examination of EBITDA Performance