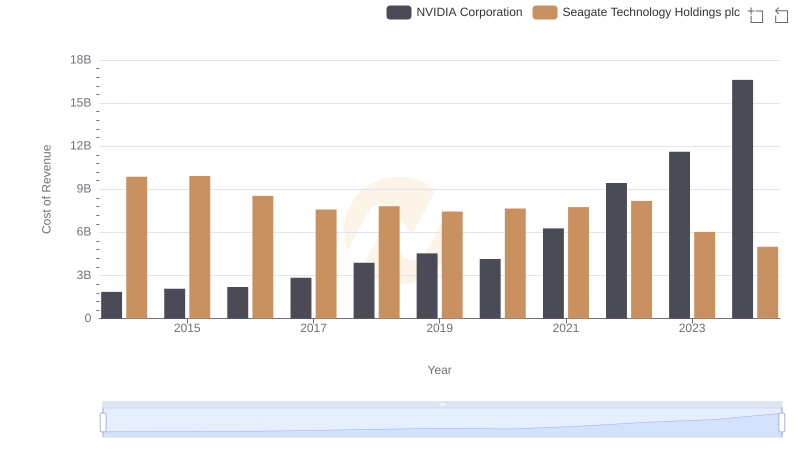

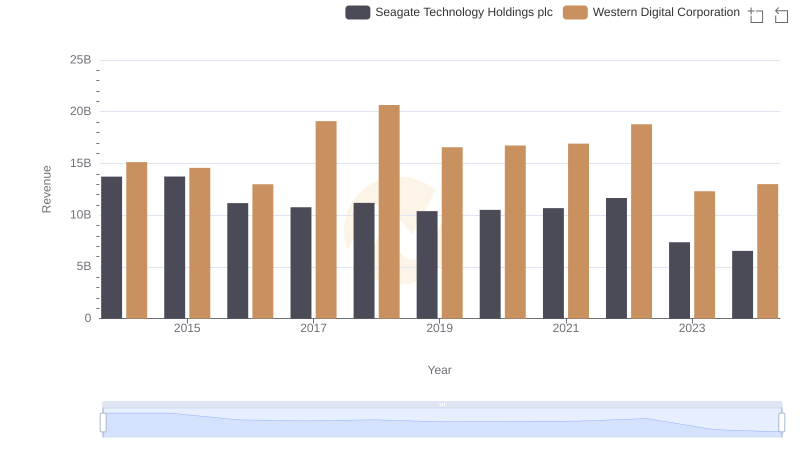

| __timestamp | Seagate Technology Holdings plc | Western Digital Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 9878000000 | 10770000000 |

| Thursday, January 1, 2015 | 9930000000 | 10351000000 |

| Friday, January 1, 2016 | 8545000000 | 9559000000 |

| Sunday, January 1, 2017 | 7597000000 | 13021000000 |

| Monday, January 1, 2018 | 7820000000 | 12942000000 |

| Tuesday, January 1, 2019 | 7458000000 | 12817000000 |

| Wednesday, January 1, 2020 | 7667000000 | 12955000000 |

| Friday, January 1, 2021 | 7764000000 | 12401000000 |

| Saturday, January 1, 2022 | 8192000000 | 12919000000 |

| Sunday, January 1, 2023 | 6033000000 | 10431000000 |

| Monday, January 1, 2024 | 5005000000 | 10058000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of data storage, Western Digital Corporation and Seagate Technology Holdings plc have been pivotal players. Over the past decade, these giants have navigated the complexities of cost management, particularly in their cost of revenue. From 2014 to 2024, Western Digital consistently maintained a higher cost of revenue, peaking at approximately $13 billion in 2017. In contrast, Seagate's cost of revenue saw a significant decline, dropping from nearly $10 billion in 2015 to just $5 billion in 2024, marking a 50% reduction.

This trend highlights Seagate's strategic efficiency improvements, while Western Digital's figures suggest a more stable, albeit higher, cost structure. As the digital storage market continues to expand, understanding these cost dynamics is crucial for investors and industry analysts alike. The data underscores the importance of cost management in maintaining competitive advantage in the tech industry.

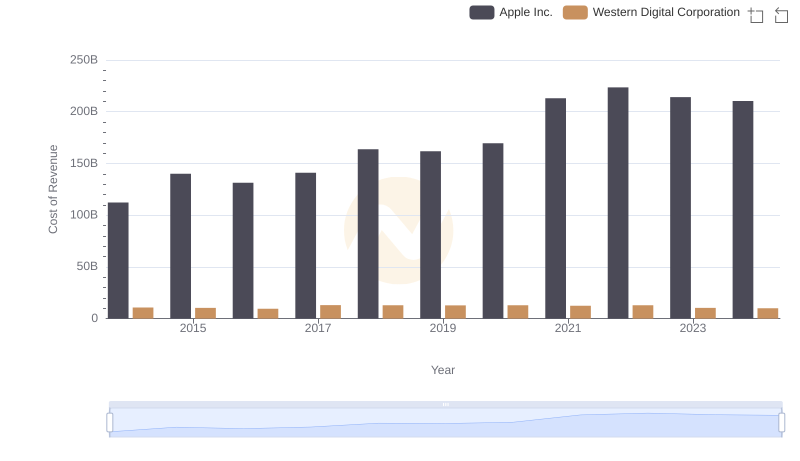

Cost Insights: Breaking Down Apple Inc. and Western Digital Corporation's Expenses

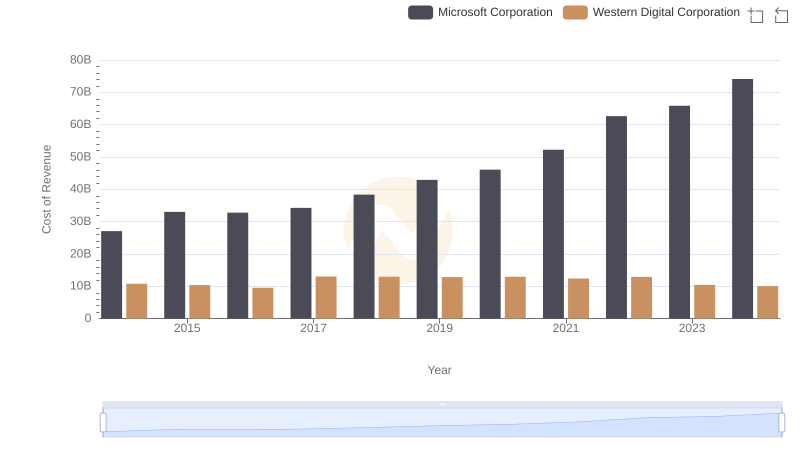

Cost of Revenue: Key Insights for Microsoft Corporation and Western Digital Corporation

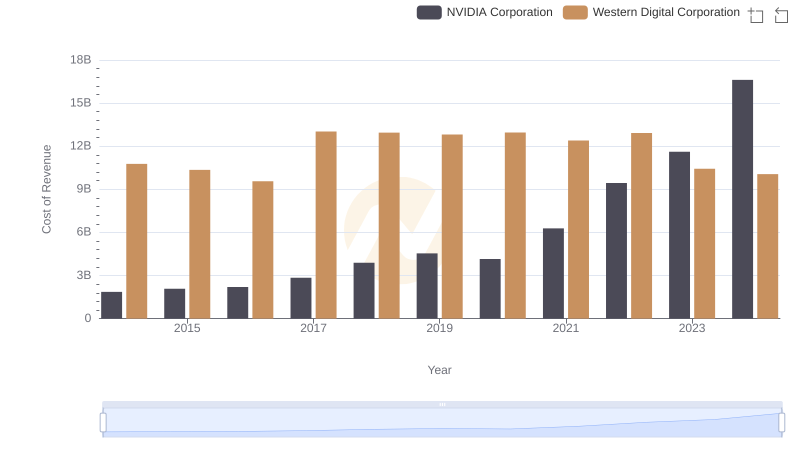

Cost of Revenue: Key Insights for NVIDIA Corporation and Western Digital Corporation

Cost of Revenue Comparison: NVIDIA Corporation vs Seagate Technology Holdings plc

Taiwan Semiconductor Manufacturing Company Limited vs Western Digital Corporation: Efficiency in Cost of Revenue Explored

Cost of Revenue: Key Insights for Taiwan Semiconductor Manufacturing Company Limited and Seagate Technology Holdings plc

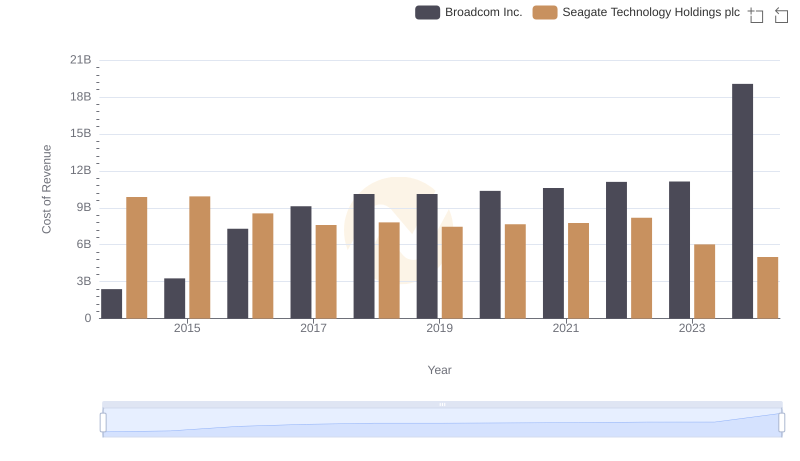

Cost of Revenue Comparison: Broadcom Inc. vs Seagate Technology Holdings plc

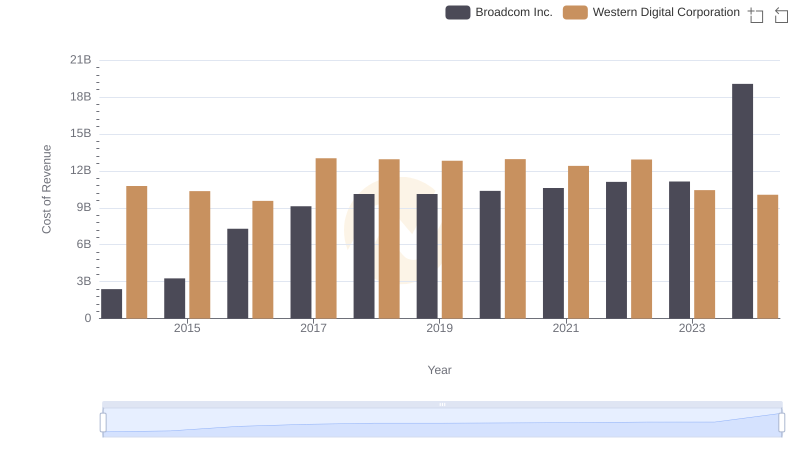

Analyzing Cost of Revenue: Broadcom Inc. and Western Digital Corporation

Breaking Down Revenue Trends: Western Digital Corporation vs Seagate Technology Holdings plc

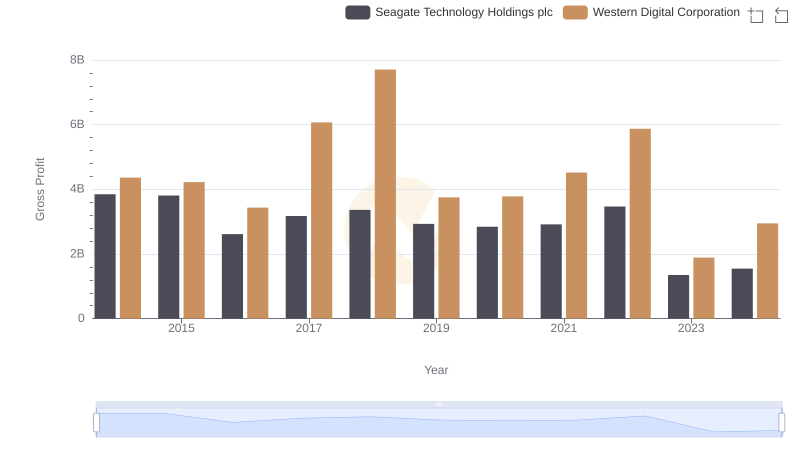

Gross Profit Comparison: Western Digital Corporation and Seagate Technology Holdings plc Trends

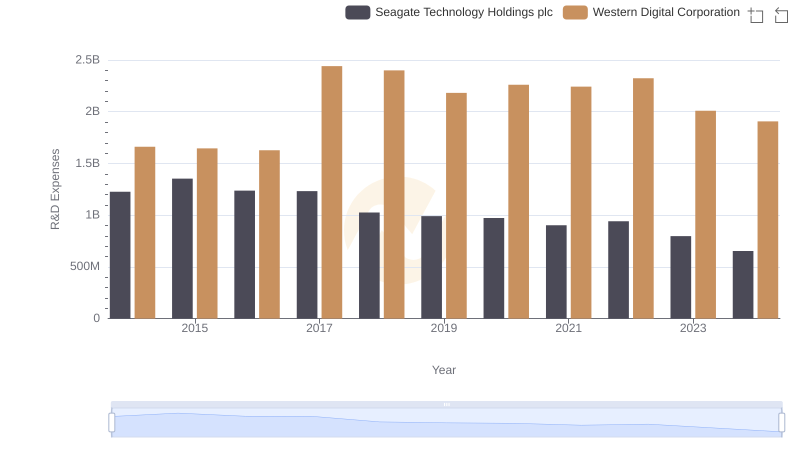

Western Digital Corporation or Seagate Technology Holdings plc: Who Invests More in Innovation?

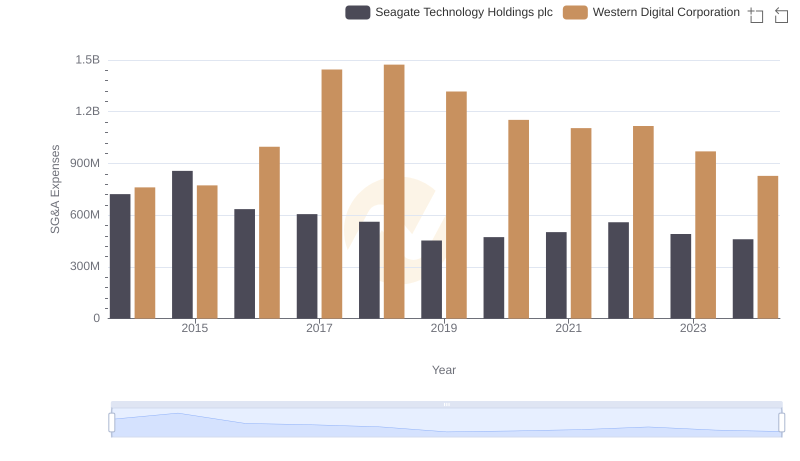

Western Digital Corporation and Seagate Technology Holdings plc: SG&A Spending Patterns Compared