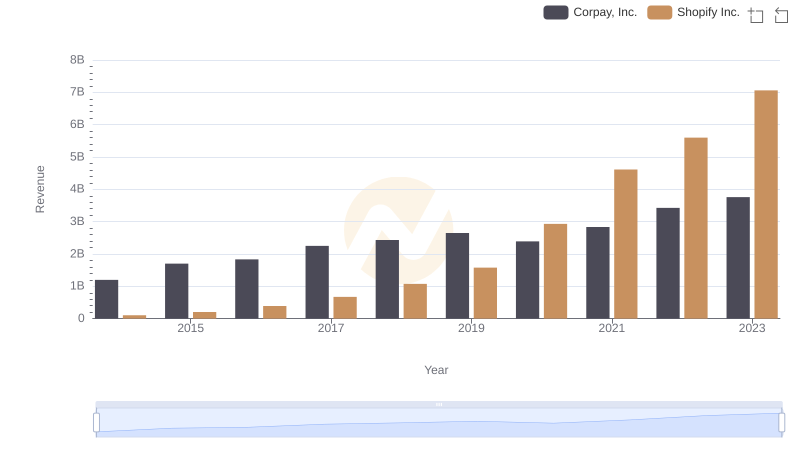

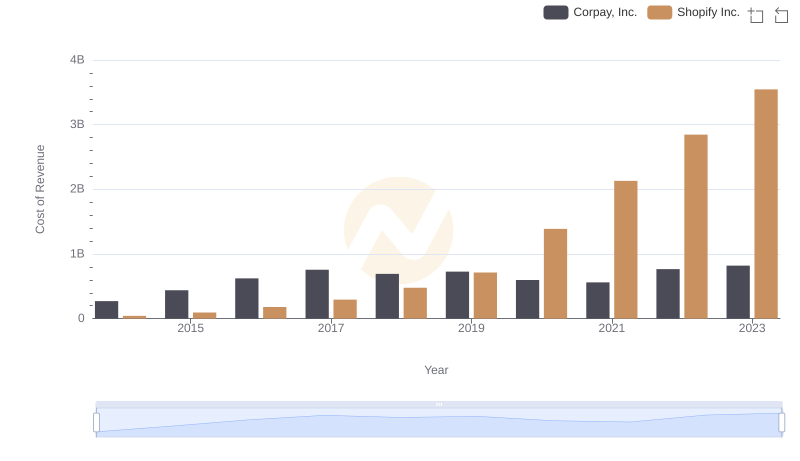

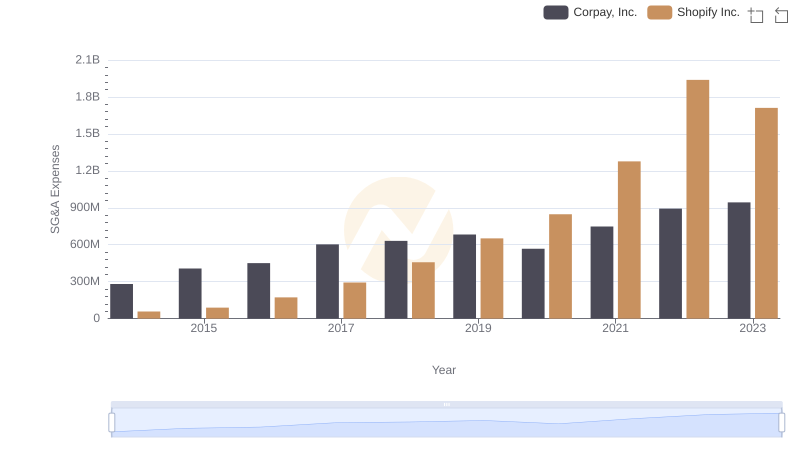

| __timestamp | Corpay, Inc. | Shopify Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 929799000 | 61795000 |

| Thursday, January 1, 2015 | 1263535000 | 111071000 |

| Friday, January 1, 2016 | 1209581000 | 209495000 |

| Sunday, January 1, 2017 | 1493201000 | 380253000 |

| Monday, January 1, 2018 | 1740908000 | 596267000 |

| Tuesday, January 1, 2019 | 1922804000 | 865643000 |

| Wednesday, January 1, 2020 | 1792492000 | 1541520000 |

| Friday, January 1, 2021 | 2273917000 | 2481144000 |

| Saturday, January 1, 2022 | 2662422000 | 2754119000 |

| Sunday, January 1, 2023 | 2937811000 | 3515000000 |

| Monday, January 1, 2024 | 3974589000 | 4472000000 |

Unleashing insights

In the ever-evolving landscape of e-commerce and financial services, Shopify Inc. and Corpay, Inc. have emerged as formidable players. Over the past decade, from 2014 to 2023, these companies have demonstrated remarkable growth in gross profit, reflecting their strategic prowess and market adaptability.

In 2014, Shopify's gross profit was a modest 6% of Corpay's. However, by 2023, Shopify's gross profit surged to surpass Corpay's by 20%, showcasing a compound annual growth rate that outpaced its competitor. This growth trajectory highlights Shopify's successful expansion and innovation in the digital commerce space.

Notably, 2020 marked a pivotal year for Shopify, with its gross profit more than doubling from the previous year, a testament to its resilience and adaptability during global economic shifts. Meanwhile, Corpay maintained steady growth, reflecting its stronghold in financial services.

This decade-long analysis underscores the dynamic nature of these industries and the strategic maneuvers that define market leaders.

Revenue Insights: Shopify Inc. and Corpay, Inc. Performance Compared

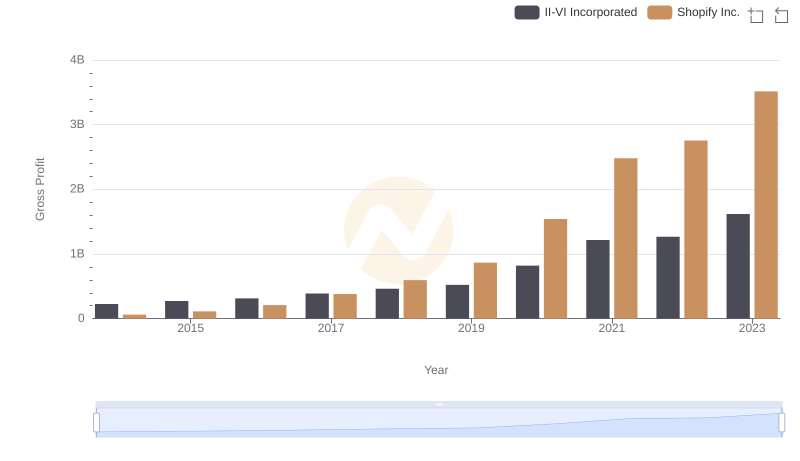

Gross Profit Trends Compared: Shopify Inc. vs II-VI Incorporated

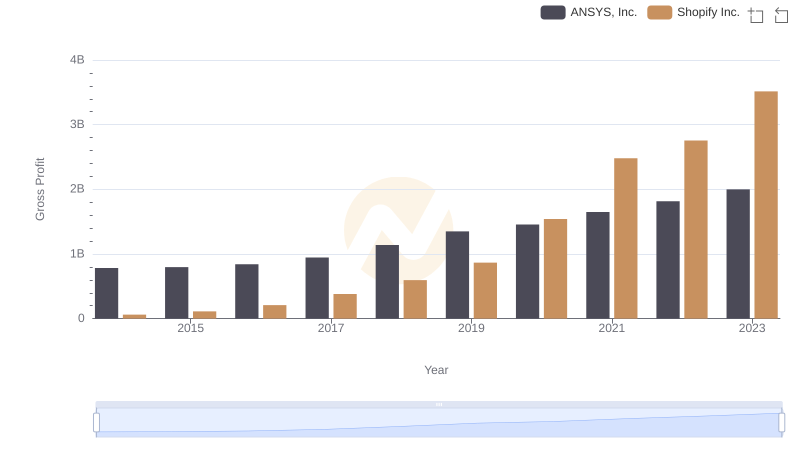

Shopify Inc. vs ANSYS, Inc.: A Gross Profit Performance Breakdown

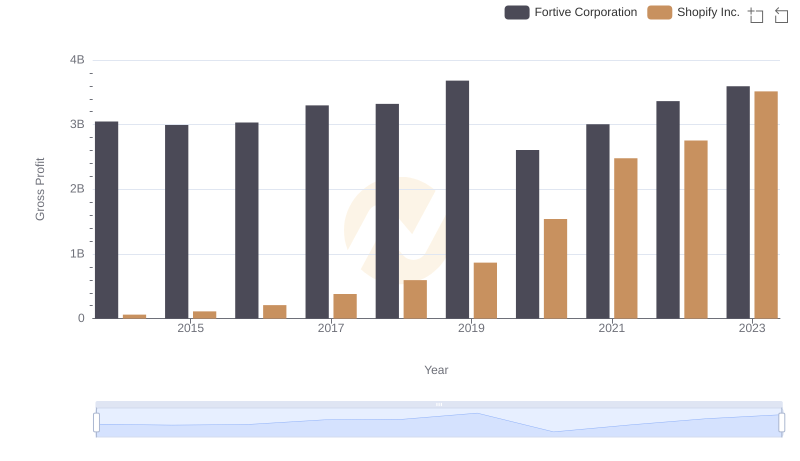

Gross Profit Analysis: Comparing Shopify Inc. and Fortive Corporation

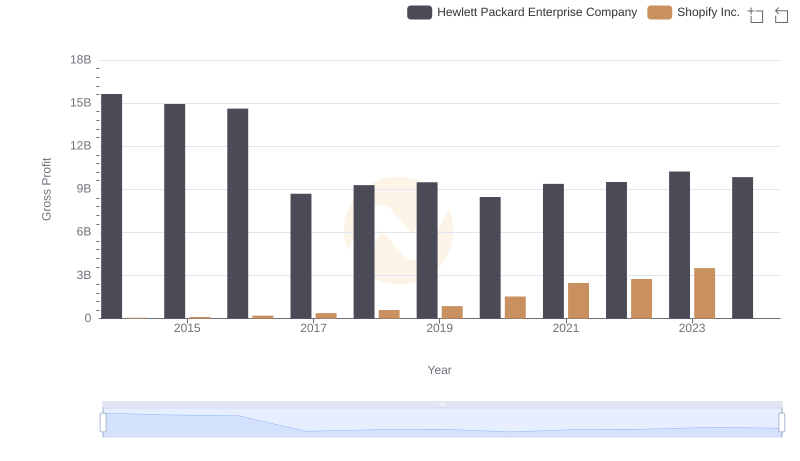

Gross Profit Comparison: Shopify Inc. and Hewlett Packard Enterprise Company Trends

Shopify Inc. vs Corpay, Inc.: Efficiency in Cost of Revenue Explored

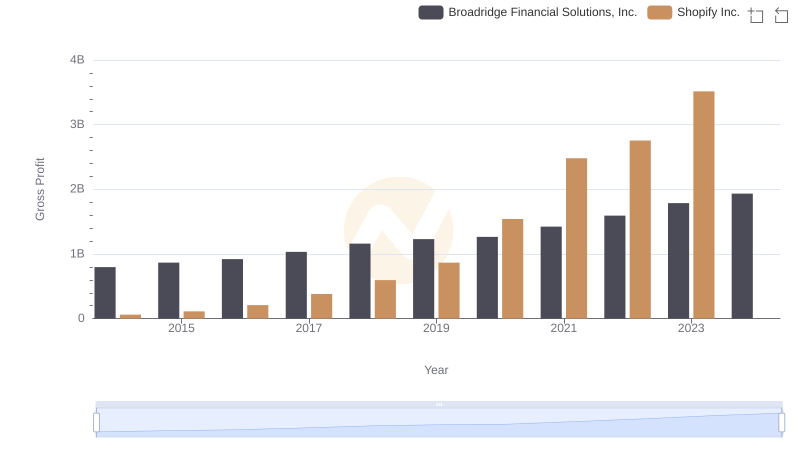

Gross Profit Analysis: Comparing Shopify Inc. and Broadridge Financial Solutions, Inc.

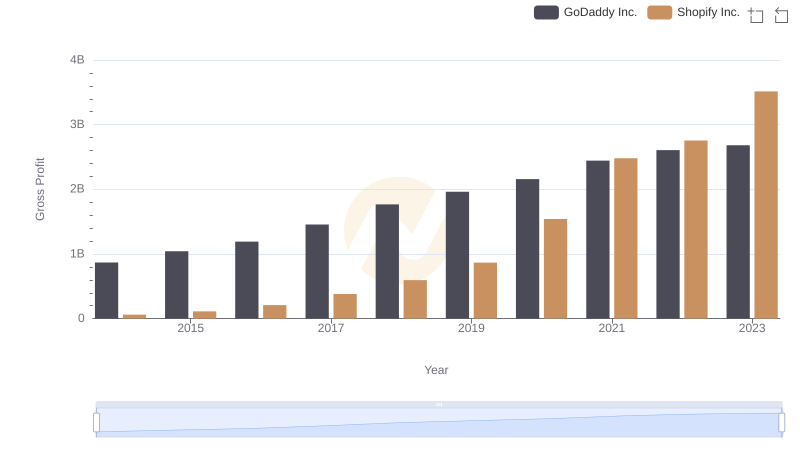

Who Generates Higher Gross Profit? Shopify Inc. or GoDaddy Inc.

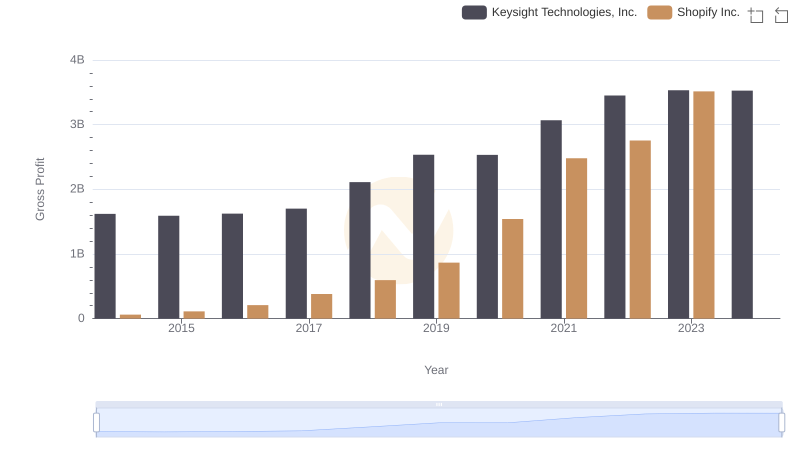

Gross Profit Analysis: Comparing Shopify Inc. and Keysight Technologies, Inc.

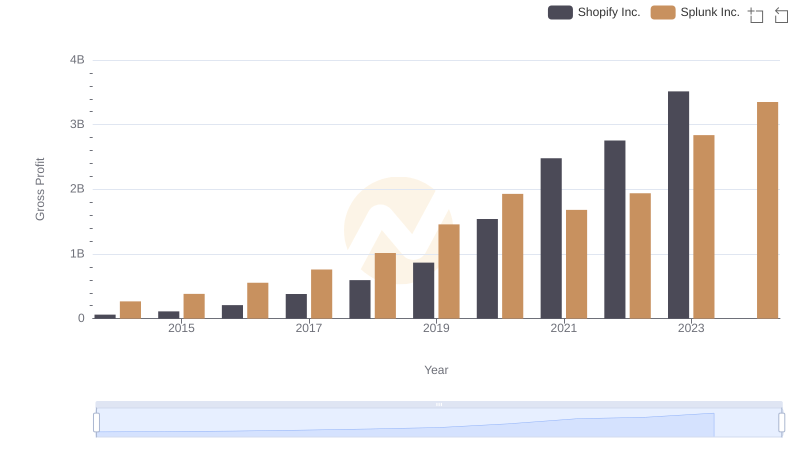

Gross Profit Comparison: Shopify Inc. and Splunk Inc. Trends

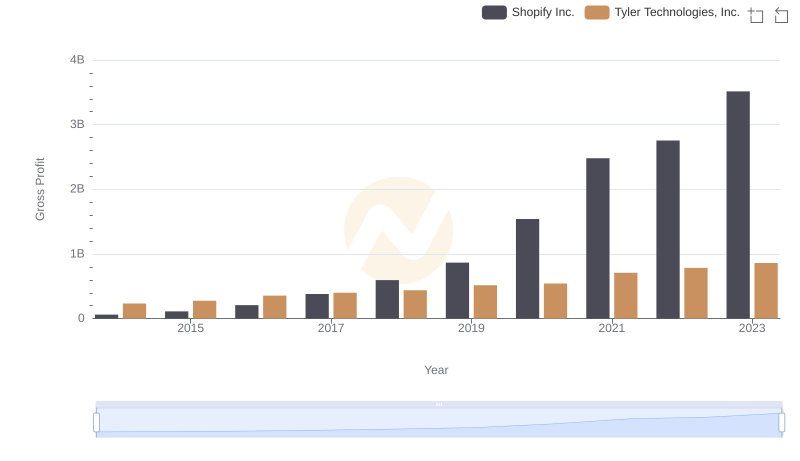

Shopify Inc. vs Tyler Technologies, Inc.: A Gross Profit Performance Breakdown

Comparing SG&A Expenses: Shopify Inc. vs Corpay, Inc. Trends and Insights