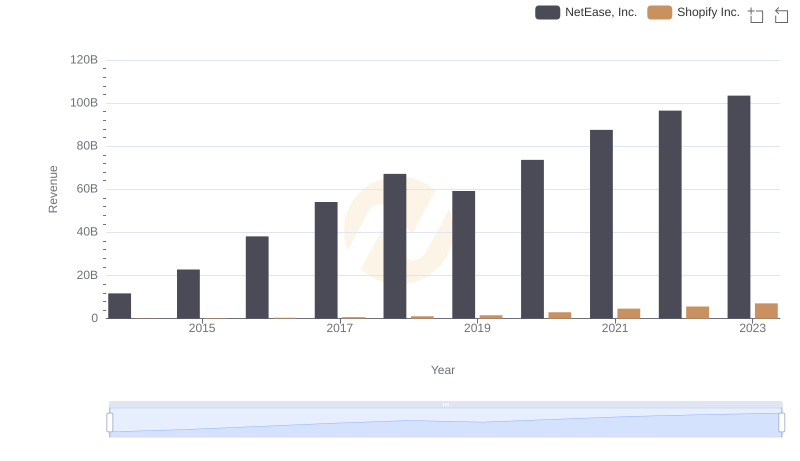

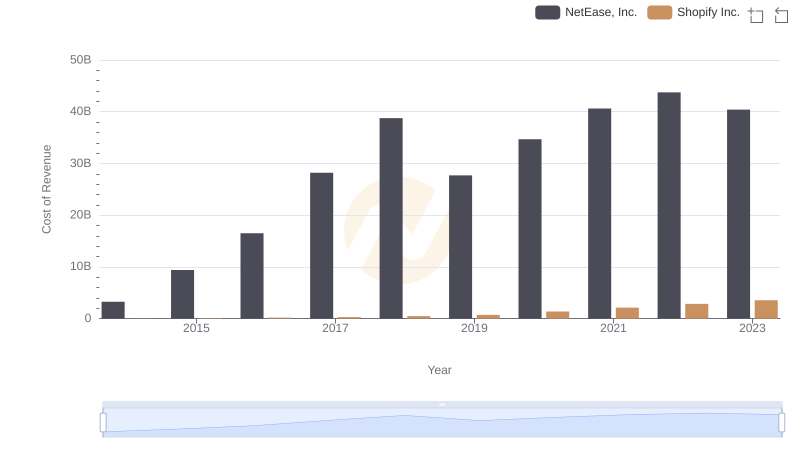

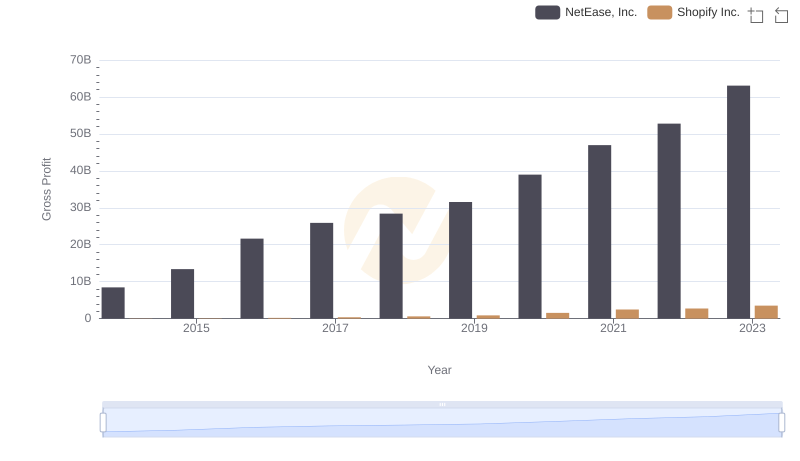

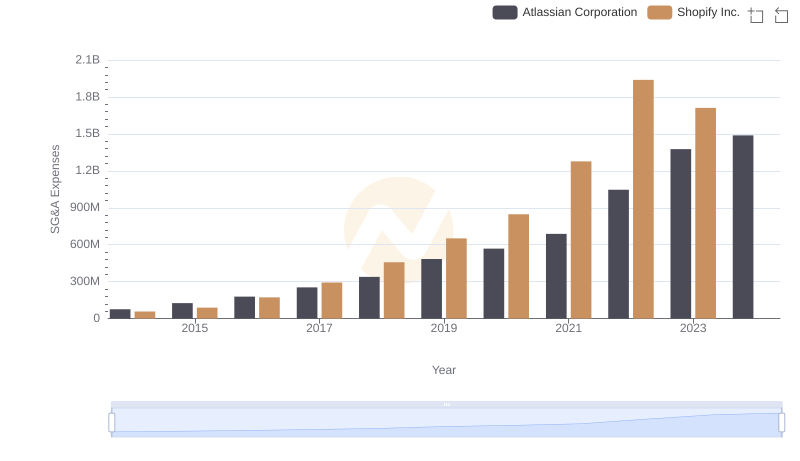

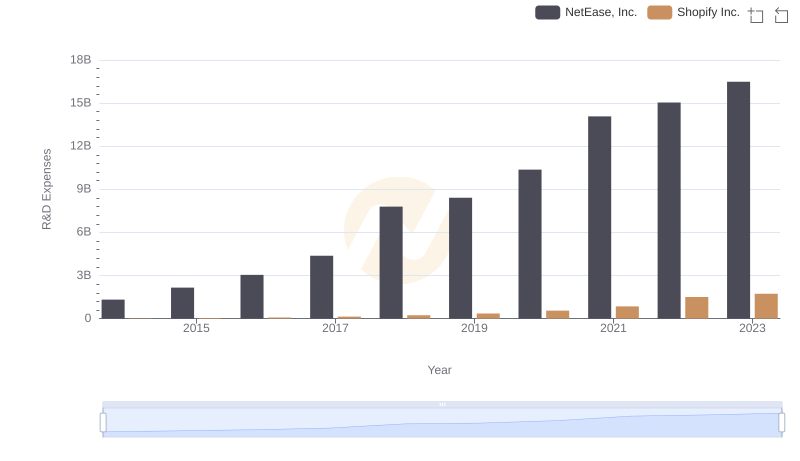

| __timestamp | NetEase, Inc. | Shopify Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2362667000 | 57495000 |

| Thursday, January 1, 2015 | 3972624000 | 89105000 |

| Friday, January 1, 2016 | 5987969000 | 172324000 |

| Sunday, January 1, 2017 | 9387454000 | 293413000 |

| Monday, January 1, 2018 | 12718007000 | 457513000 |

| Tuesday, January 1, 2019 | 9351425000 | 651775000 |

| Wednesday, January 1, 2020 | 14075615000 | 847391000 |

| Friday, January 1, 2021 | 16477740000 | 1276401000 |

| Saturday, January 1, 2022 | 18098519000 | 1938255000 |

| Sunday, January 1, 2023 | 18869340000 | 1711000000 |

| Monday, January 1, 2024 | 1796000000 |

In pursuit of knowledge

In the ever-evolving landscape of global commerce, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. From 2014 to 2023, NetEase, Inc. and Shopify Inc. have demonstrated contrasting approaches to SG&A cost management. NetEase, a titan in the Chinese internet industry, has seen its SG&A expenses grow by approximately 700%, peaking in 2023. Meanwhile, Shopify, a leader in e-commerce solutions, has experienced a staggering 2,900% increase in SG&A costs over the same period.

Despite Shopify's rapid growth, NetEase's SG&A expenses remain significantly higher, reflecting its expansive operations. However, Shopify's leaner cost structure relative to its revenue growth suggests a more efficient management strategy. As businesses navigate the complexities of global markets, understanding these dynamics offers valuable insights into strategic financial management.

Shopify Inc. vs NetEase, Inc.: Annual Revenue Growth Compared

Cost Insights: Breaking Down Shopify Inc. and NetEase, Inc.'s Expenses

Shopify Inc. vs NetEase, Inc.: A Gross Profit Performance Breakdown

Comparing SG&A Expenses: Shopify Inc. vs Atlassian Corporation Trends and Insights

Analyzing R&D Budgets: Shopify Inc. vs NetEase, Inc.

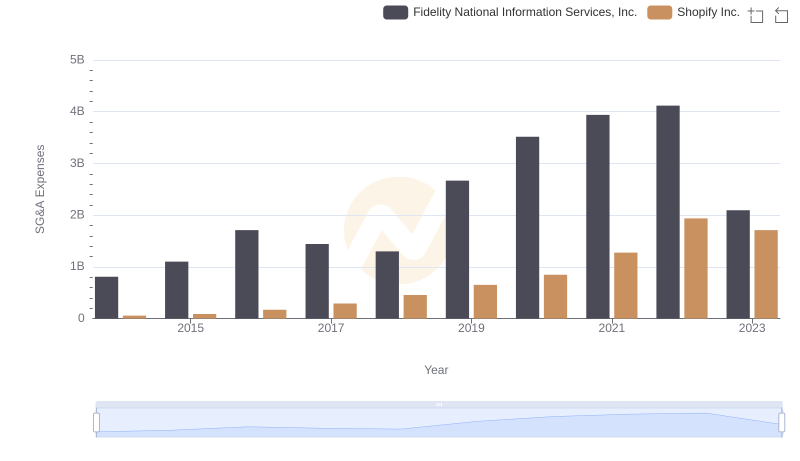

Selling, General, and Administrative Costs: Shopify Inc. vs Fidelity National Information Services, Inc.

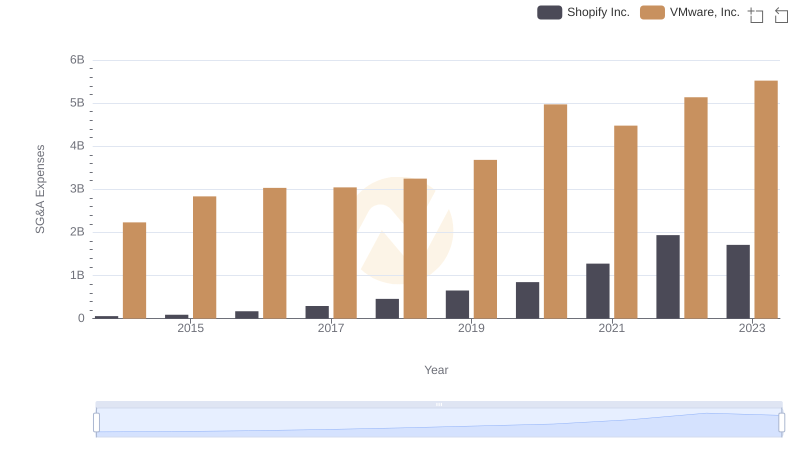

Shopify Inc. or VMware, Inc.: Who Manages SG&A Costs Better?

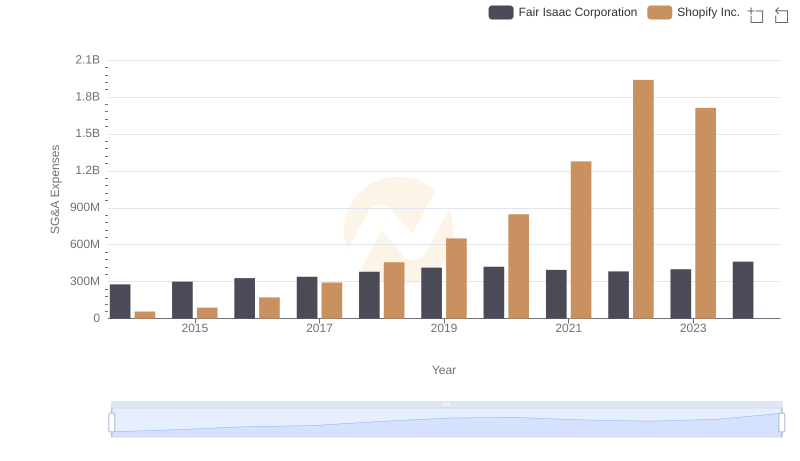

Operational Costs Compared: SG&A Analysis of Shopify Inc. and Fair Isaac Corporation

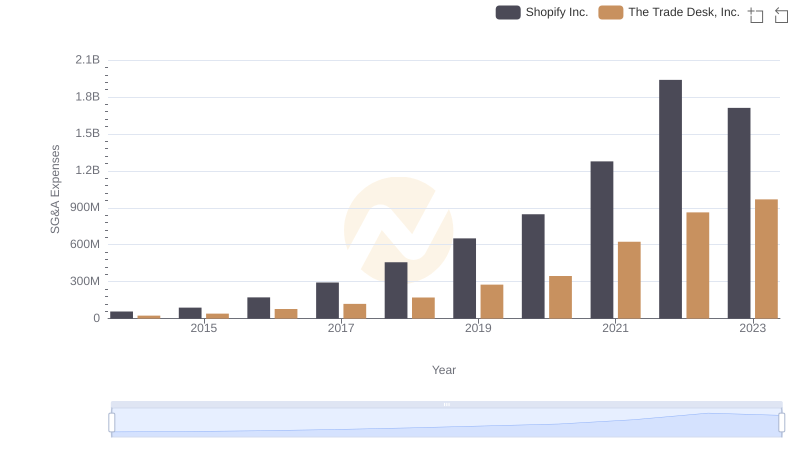

Shopify Inc. and The Trade Desk, Inc.: SG&A Spending Patterns Compared

Shopify Inc. vs NXP Semiconductors N.V.: SG&A Expense Trends

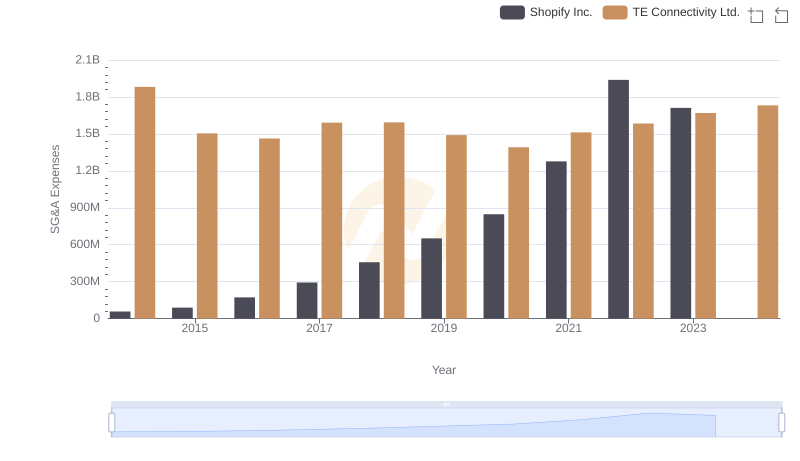

Comparing SG&A Expenses: Shopify Inc. vs TE Connectivity Ltd. Trends and Insights

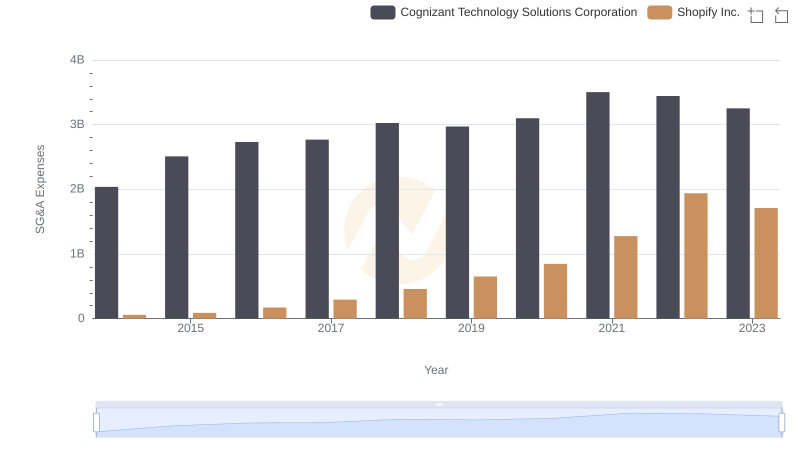

Operational Costs Compared: SG&A Analysis of Shopify Inc. and Cognizant Technology Solutions Corporation