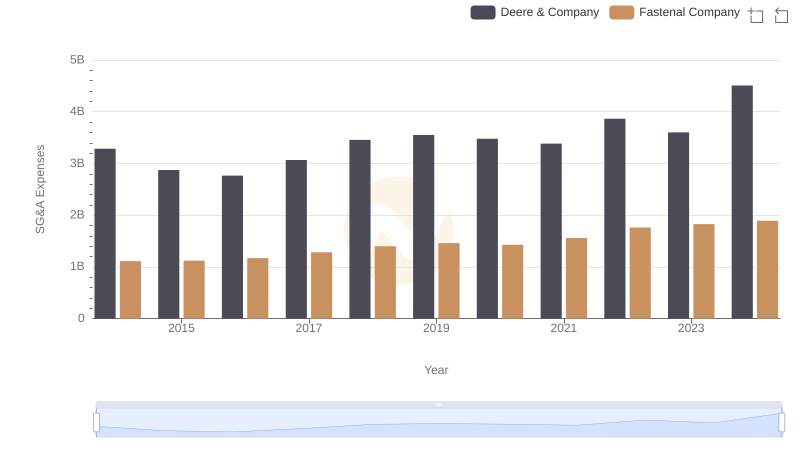

| __timestamp | Deere & Company | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3284400000 | 144817000 |

| Thursday, January 1, 2015 | 2873300000 | 153589000 |

| Friday, January 1, 2016 | 2763700000 | 152391000 |

| Sunday, January 1, 2017 | 3066600000 | 177205000 |

| Monday, January 1, 2018 | 3455500000 | 194368000 |

| Tuesday, January 1, 2019 | 3551000000 | 206125000 |

| Wednesday, January 1, 2020 | 3477000000 | 184185000 |

| Friday, January 1, 2021 | 3383000000 | 223757000 |

| Saturday, January 1, 2022 | 3863000000 | 258883000 |

| Sunday, January 1, 2023 | 3601000000 | 281053000 |

| Monday, January 1, 2024 | 4507000000 |

Unlocking the unknown

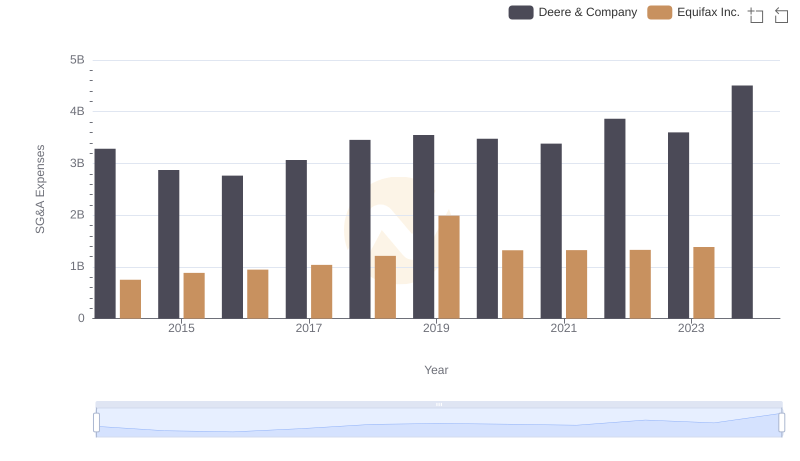

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of operational efficiency. This analysis compares the SG&A expenses of two industry titans: Deere & Company and Old Dominion Freight Line, Inc., from 2014 to 2023.

Deere & Company, a leader in agricultural machinery, has seen its SG&A expenses grow by approximately 37% over the past decade, peaking in 2024. This upward trend reflects its strategic investments in innovation and market expansion.

Conversely, Old Dominion Freight Line, Inc., a major player in the freight industry, has maintained a leaner SG&A profile. Despite a 94% increase from 2014 to 2023, its expenses remain a fraction of Deere's, showcasing its operational efficiency.

This comparison highlights the diverse strategies of these companies in managing their operational costs.

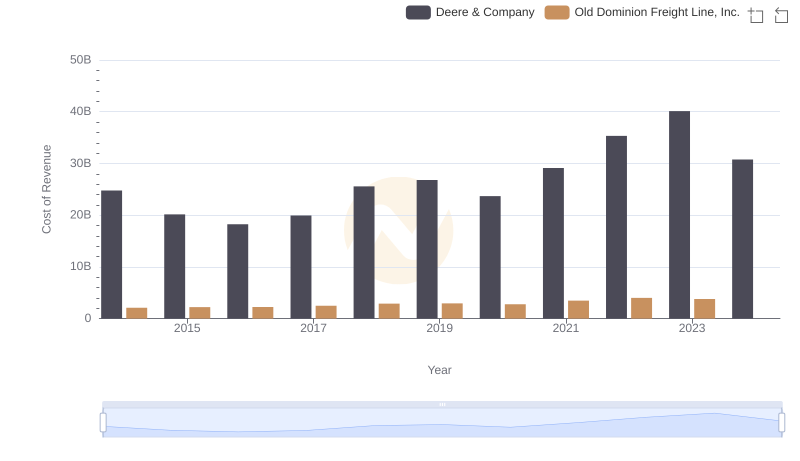

Comparing Cost of Revenue Efficiency: Deere & Company vs Old Dominion Freight Line, Inc.

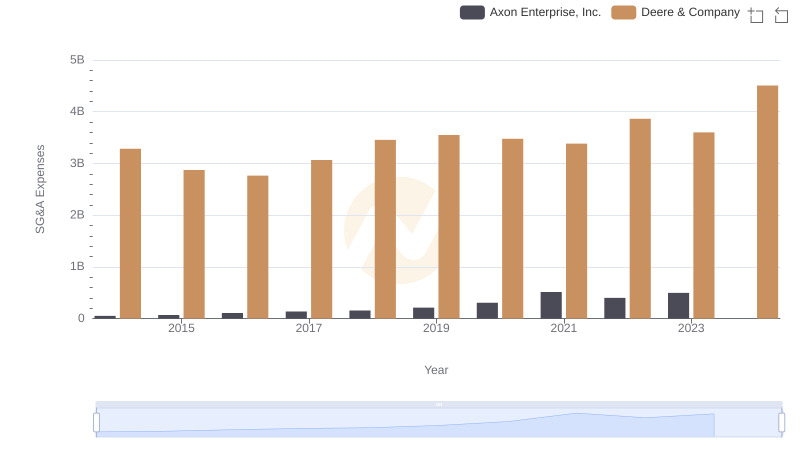

Deere & Company and Axon Enterprise, Inc.: SG&A Spending Patterns Compared

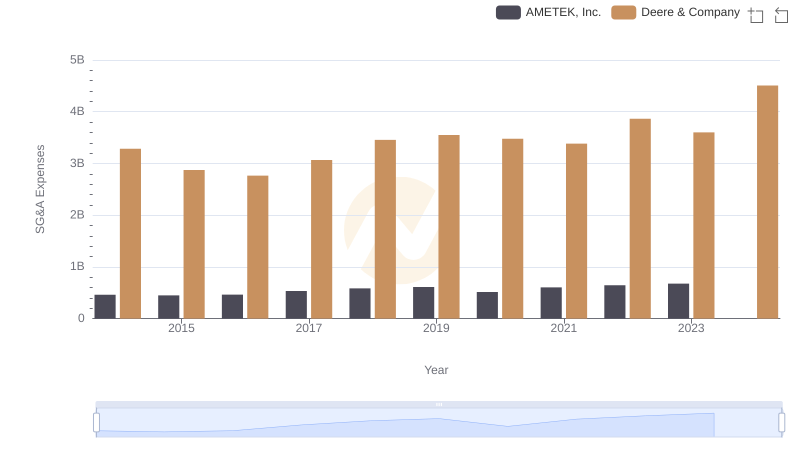

Who Optimizes SG&A Costs Better? Deere & Company or AMETEK, Inc.

Selling, General, and Administrative Costs: Deere & Company vs Fastenal Company

Breaking Down SG&A Expenses: Deere & Company vs United Airlines Holdings, Inc.

Deere & Company or Verisk Analytics, Inc.: Who Manages SG&A Costs Better?

Breaking Down SG&A Expenses: Deere & Company vs Equifax Inc.