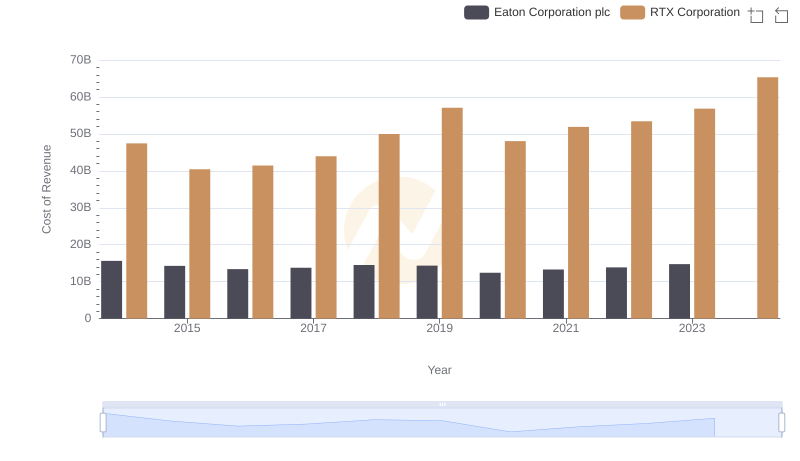

| __timestamp | Eaton Corporation plc | RTX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 647000000 | 2635000000 |

| Thursday, January 1, 2015 | 625000000 | 2279000000 |

| Friday, January 1, 2016 | 589000000 | 2337000000 |

| Sunday, January 1, 2017 | 584000000 | 2387000000 |

| Monday, January 1, 2018 | 584000000 | 2462000000 |

| Tuesday, January 1, 2019 | 606000000 | 3015000000 |

| Wednesday, January 1, 2020 | 551000000 | 2582000000 |

| Friday, January 1, 2021 | 616000000 | 2732000000 |

| Saturday, January 1, 2022 | 665000000 | 2711000000 |

| Sunday, January 1, 2023 | 754000000 | 2805000000 |

| Monday, January 1, 2024 | 794000000 | 2934000000 |

Infusing magic into the data realm

In the ever-evolving landscape of industrial innovation, research and development (R&D) spending is a critical indicator of a company's commitment to future growth. Over the past decade, RTX Corporation and Eaton Corporation plc have demonstrated distinct strategies in their R&D investments. From 2014 to 2023, RTX consistently allocated a significant portion of its resources to R&D, with expenditures peaking in 2019 at approximately 3 billion USD. This represents a robust 30% increase from its 2014 spending. In contrast, Eaton Corporation plc maintained a more conservative approach, with R&D expenses fluctuating around 600 million USD annually, culminating in a notable 16% rise by 2023. The data suggests that while both companies prioritize innovation, RTX's aggressive investment strategy may position it more favorably in the competitive industrial sector. However, the absence of data for Eaton in 2024 leaves room for speculation on its future trajectory.

Cost Insights: Breaking Down RTX Corporation and Eaton Corporation plc's Expenses

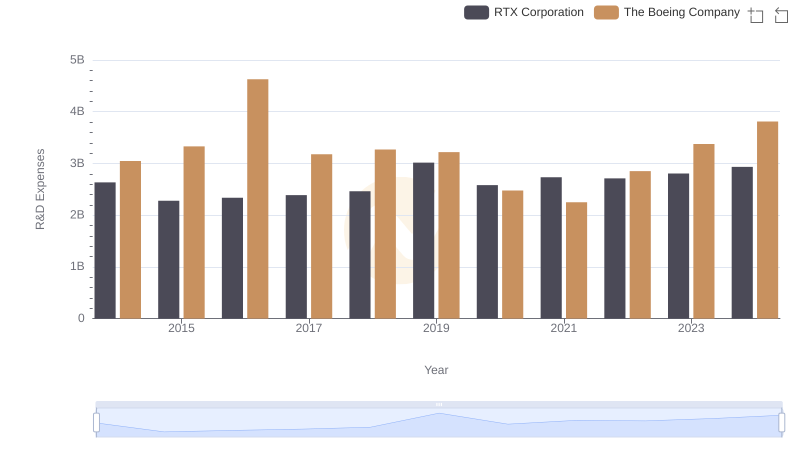

Comparing Innovation Spending: RTX Corporation and The Boeing Company

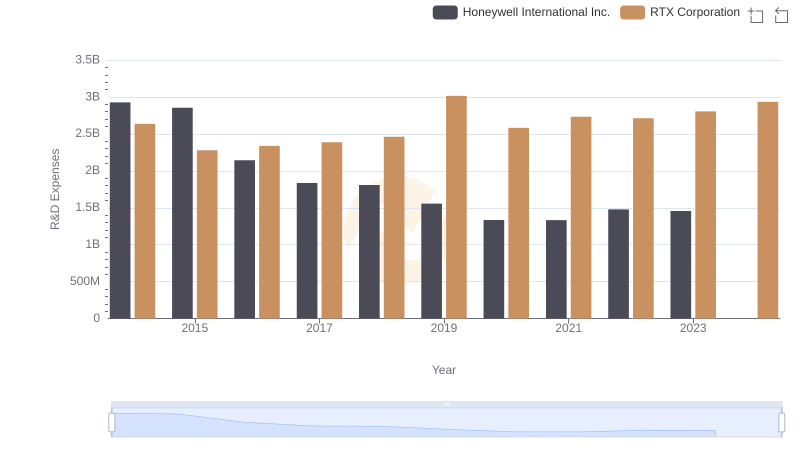

Research and Development: Comparing Key Metrics for RTX Corporation and Honeywell International Inc.

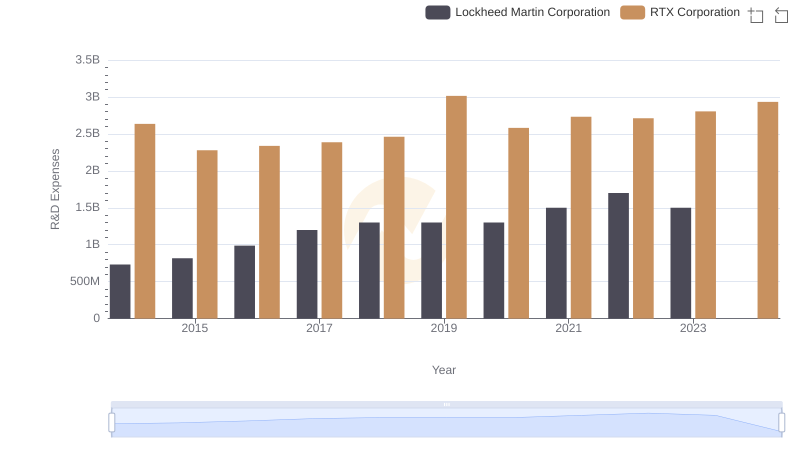

Research and Development Expenses Breakdown: RTX Corporation vs Lockheed Martin Corporation

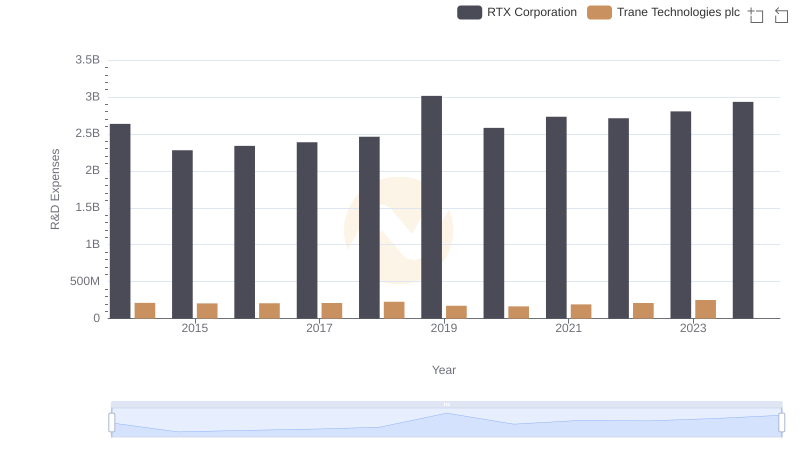

Analyzing R&D Budgets: RTX Corporation vs Trane Technologies plc

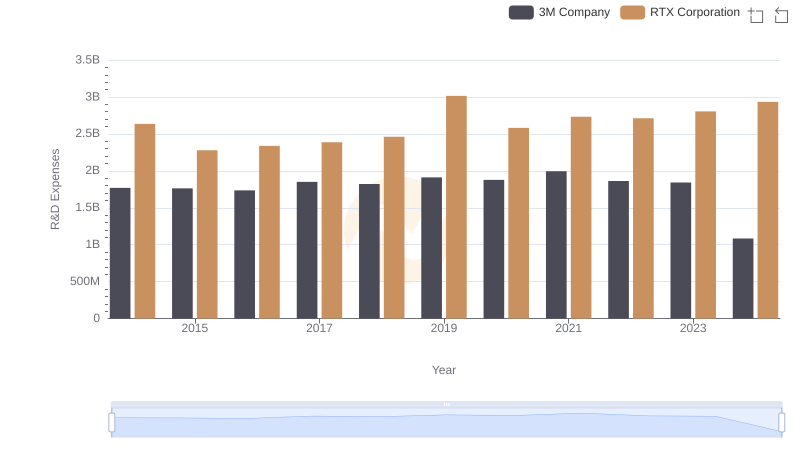

Research and Development Investment: RTX Corporation vs 3M Company