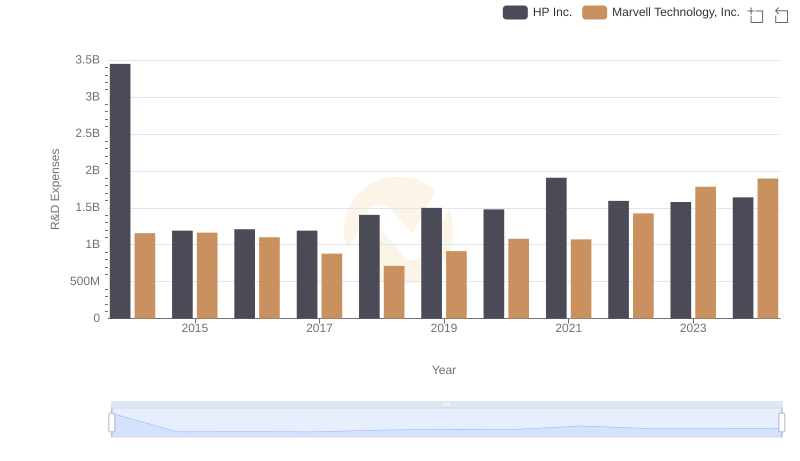

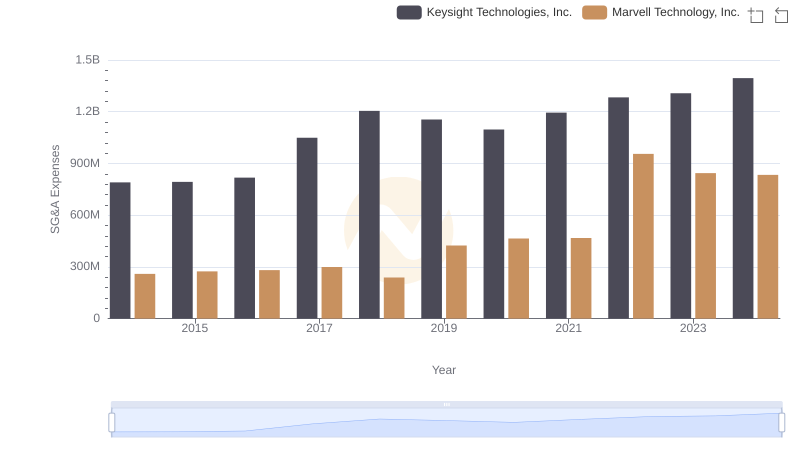

| __timestamp | Keysight Technologies, Inc. | Marvell Technology, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 361000000 | 1156885000 |

| Thursday, January 1, 2015 | 387000000 | 1164059000 |

| Friday, January 1, 2016 | 425000000 | 1101446000 |

| Sunday, January 1, 2017 | 498000000 | 880050000 |

| Monday, January 1, 2018 | 624000000 | 714444000 |

| Tuesday, January 1, 2019 | 688000000 | 914009000 |

| Wednesday, January 1, 2020 | 715000000 | 1080391000 |

| Friday, January 1, 2021 | 811000000 | 1072740000 |

| Saturday, January 1, 2022 | 841000000 | 1424306000 |

| Sunday, January 1, 2023 | 882000000 | 1784300000 |

| Monday, January 1, 2024 | 919000000 | 1896200000 |

Cracking the code

In the ever-evolving tech landscape, strategic investments in research and development (R&D) are pivotal for maintaining competitive advantage. Over the past decade, Marvell Technology, Inc. and Keysight Technologies, Inc. have demonstrated distinct approaches to R&D spending.

Marvell Technology has consistently prioritized R&D, with expenditures growing by approximately 64% from 2014 to 2024. This strategic focus has enabled Marvell to innovate and expand its market presence, particularly in the semiconductor industry.

Keysight Technologies, on the other hand, has shown a steady increase in R&D spending, with a 154% rise over the same period. This commitment underscores Keysight's dedication to advancing its electronic measurement solutions.

Both companies exemplify how targeted R&D investments can drive technological advancements and market leadership, albeit through different trajectories.

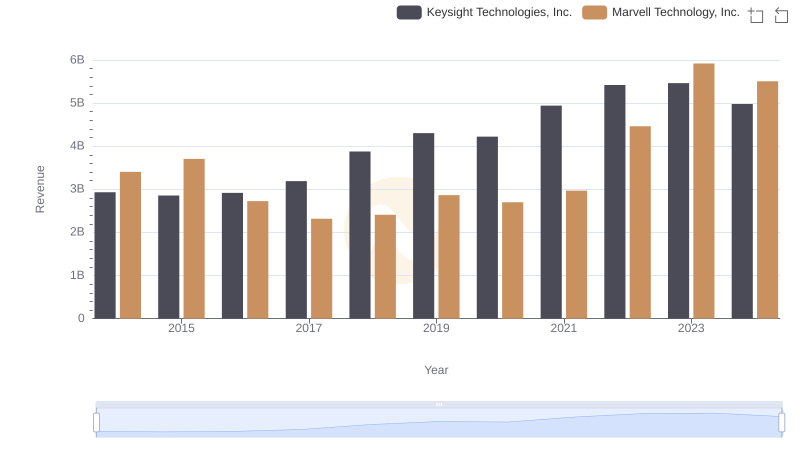

Revenue Showdown: Marvell Technology, Inc. vs Keysight Technologies, Inc.

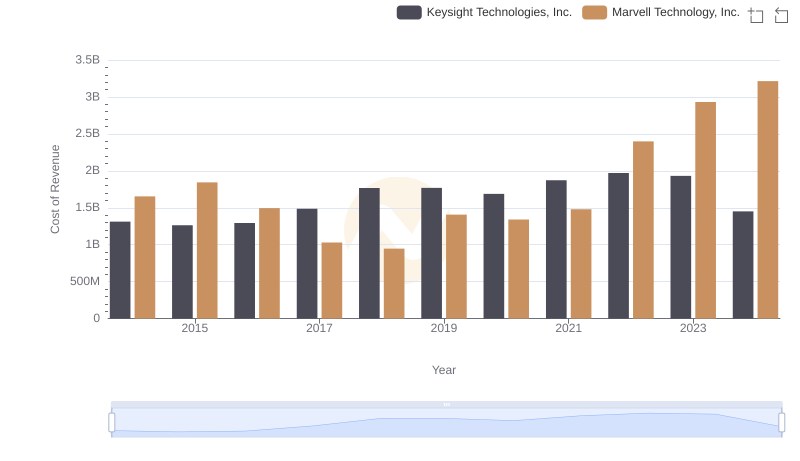

Cost of Revenue Trends: Marvell Technology, Inc. vs Keysight Technologies, Inc.

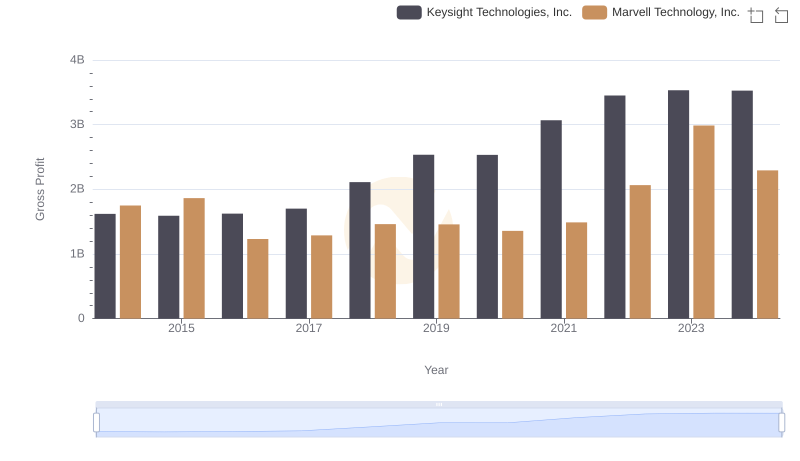

Key Insights on Gross Profit: Marvell Technology, Inc. vs Keysight Technologies, Inc.

Research and Development: Comparing Key Metrics for Marvell Technology, Inc. and HP Inc.

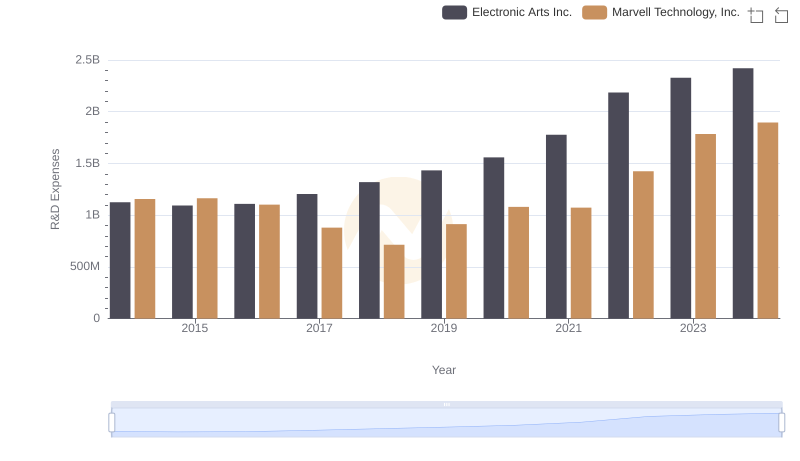

Marvell Technology, Inc. vs Electronic Arts Inc.: Strategic Focus on R&D Spending

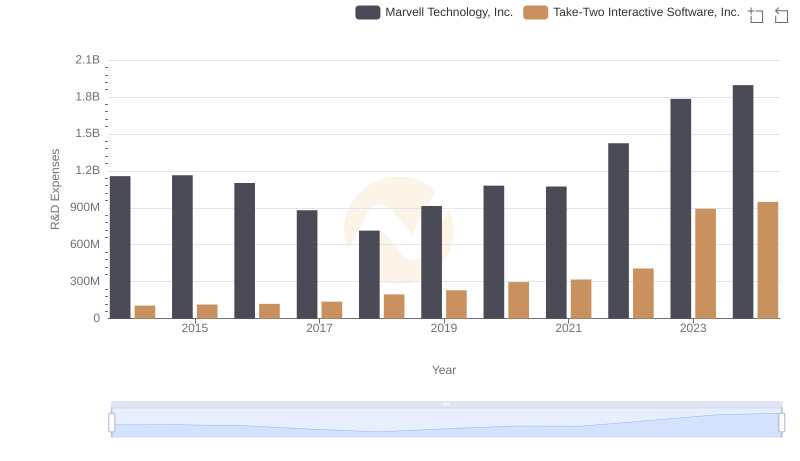

Who Prioritizes Innovation? R&D Spending Compared for Marvell Technology, Inc. and Take-Two Interactive Software, Inc.

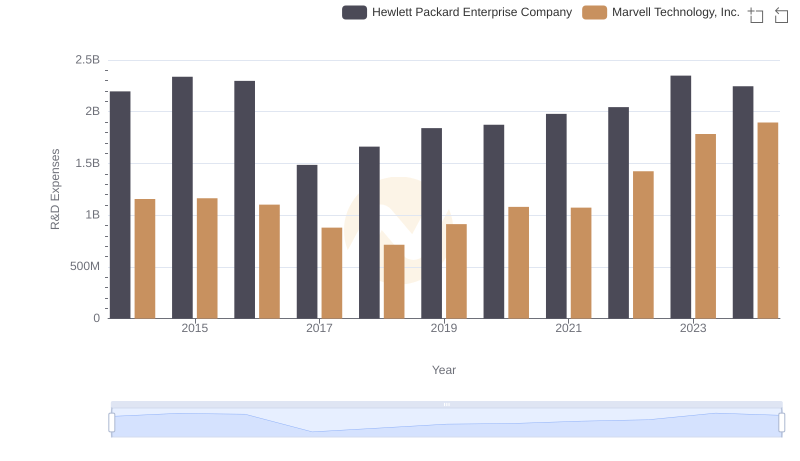

Research and Development Investment: Marvell Technology, Inc. vs Hewlett Packard Enterprise Company

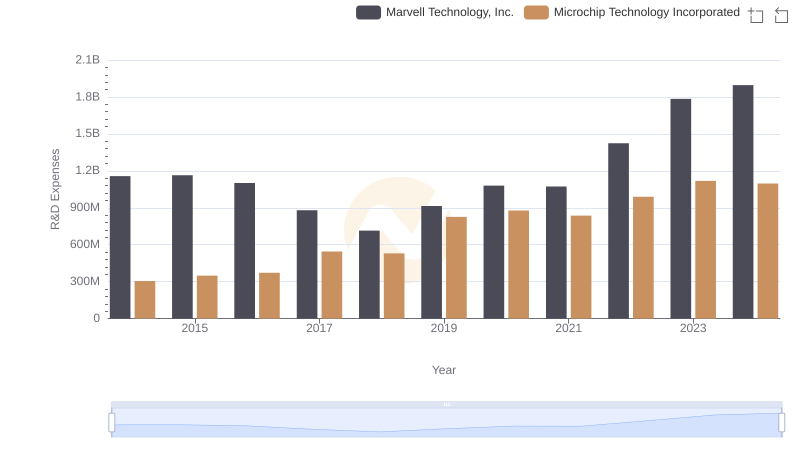

Research and Development Investment: Marvell Technology, Inc. vs Microchip Technology Incorporated

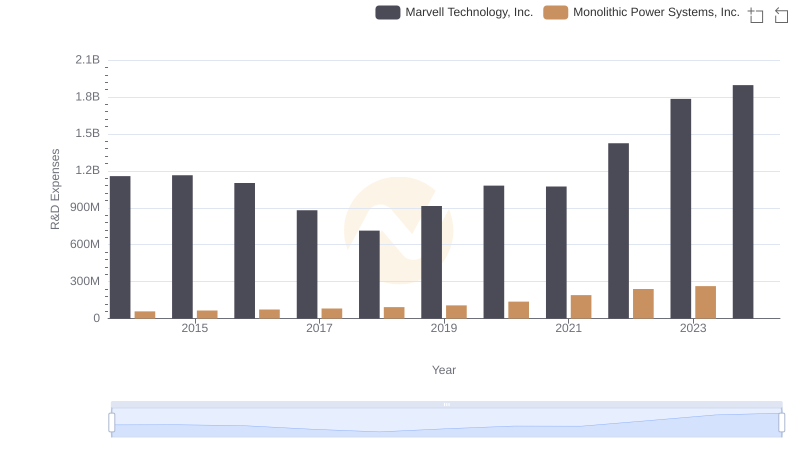

Research and Development Investment: Marvell Technology, Inc. vs Monolithic Power Systems, Inc.

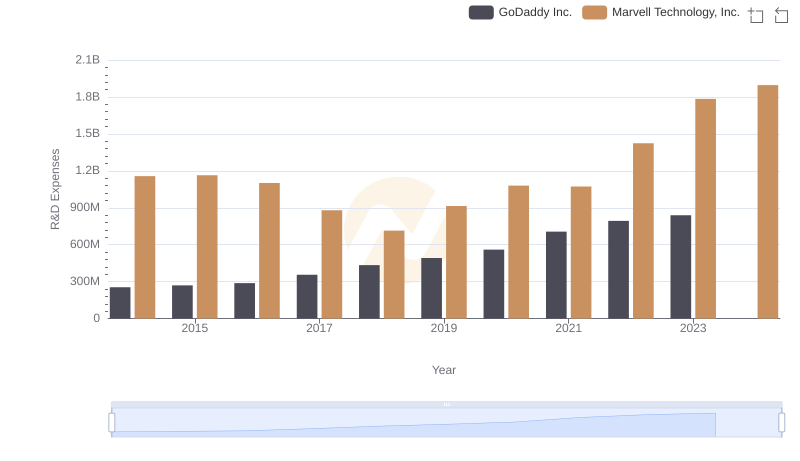

Research and Development: Comparing Key Metrics for Marvell Technology, Inc. and GoDaddy Inc.

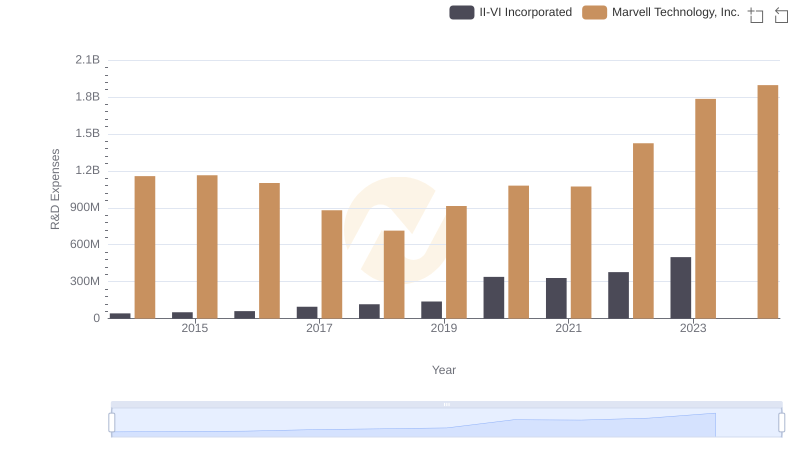

Analyzing R&D Budgets: Marvell Technology, Inc. vs II-VI Incorporated

Breaking Down SG&A Expenses: Marvell Technology, Inc. vs Keysight Technologies, Inc.