| __timestamp | ITT Inc. | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 866400000 | 1443300000 |

| Thursday, January 1, 2015 | 809100000 | 1448800000 |

| Friday, January 1, 2016 | 758200000 | 1792000000 |

| Sunday, January 1, 2017 | 817200000 | 1937400000 |

| Monday, January 1, 2018 | 887200000 | 1958100000 |

| Tuesday, January 1, 2019 | 910100000 | 577200000 |

| Wednesday, January 1, 2020 | 782200000 | 653000000 |

| Friday, January 1, 2021 | 899500000 | 714800000 |

| Saturday, January 1, 2022 | 922300000 | 977000000 |

| Sunday, January 1, 2023 | 1107300000 | 4448000000 |

| Monday, January 1, 2024 | 1247300000 |

Data in motion

In the competitive landscape of global business, Rentokil Initial plc and ITT Inc. have emerged as formidable players. Over the past decade, Rentokil Initial plc has consistently outperformed ITT Inc. in terms of gross profit. Notably, in 2023, Rentokil's gross profit surged to an impressive 4.4 billion, marking a staggering 355% increase from its 2019 low. In contrast, ITT Inc. demonstrated steady growth, peaking at 1.1 billion in 2023, a 28% rise from 2014. This trend highlights Rentokil's strategic prowess in navigating market challenges and capitalizing on opportunities. As we delve into these financial narratives, it becomes evident that Rentokil's aggressive expansion and innovative solutions have paid off, while ITT Inc.'s consistent performance underscores its resilience and stability. This analysis offers a glimpse into the dynamic world of corporate finance, where strategic decisions shape the future.

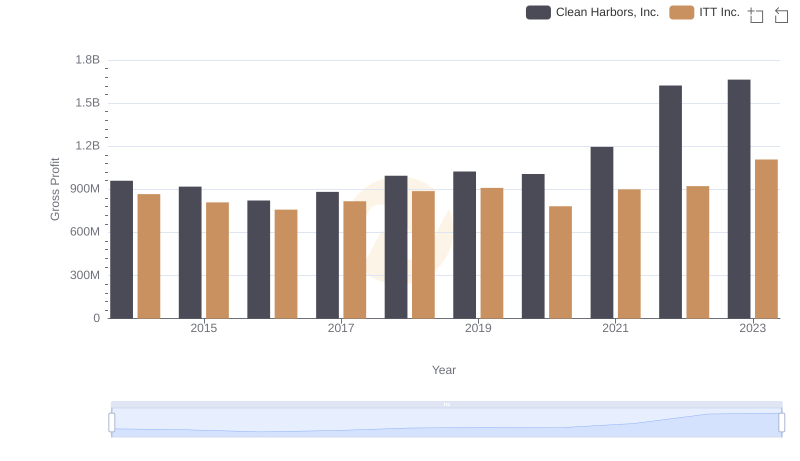

Clean Harbors, Inc. and ITT Inc.: A Detailed Gross Profit Analysis

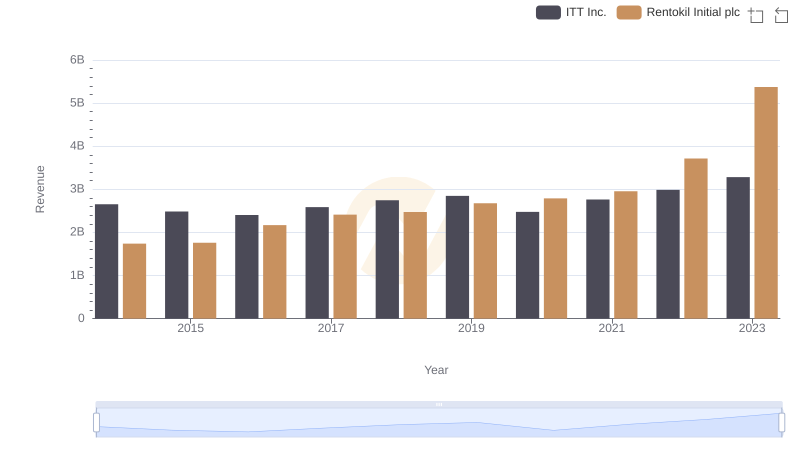

Breaking Down Revenue Trends: Rentokil Initial plc vs ITT Inc.

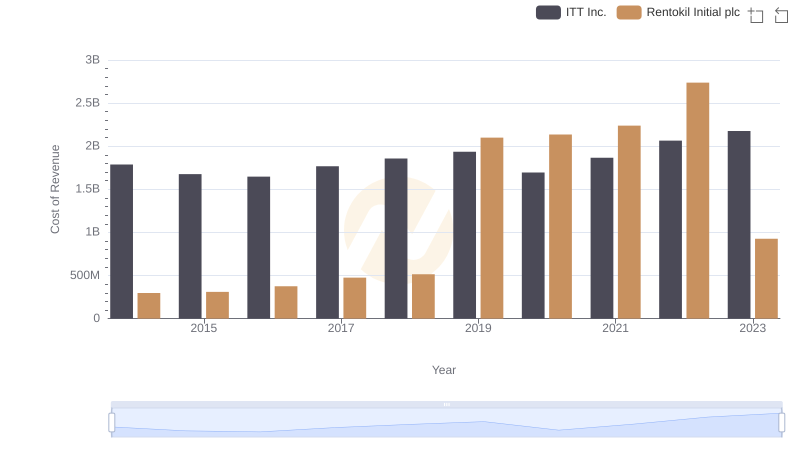

Comparing Cost of Revenue Efficiency: Rentokil Initial plc vs ITT Inc.

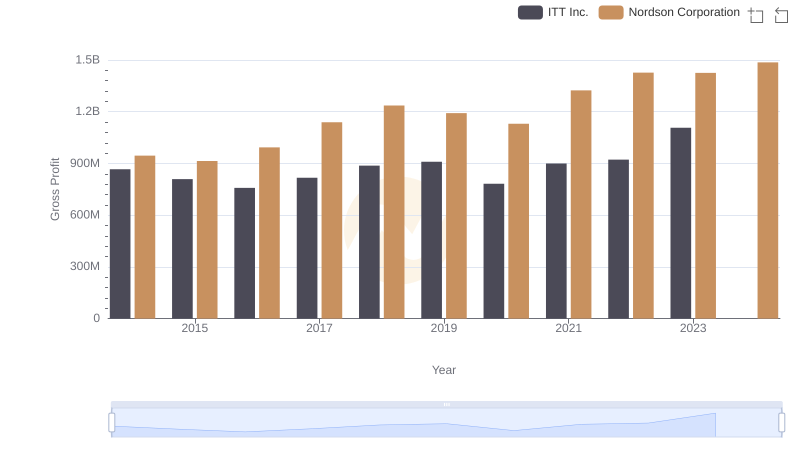

Who Generates Higher Gross Profit? Nordson Corporation or ITT Inc.

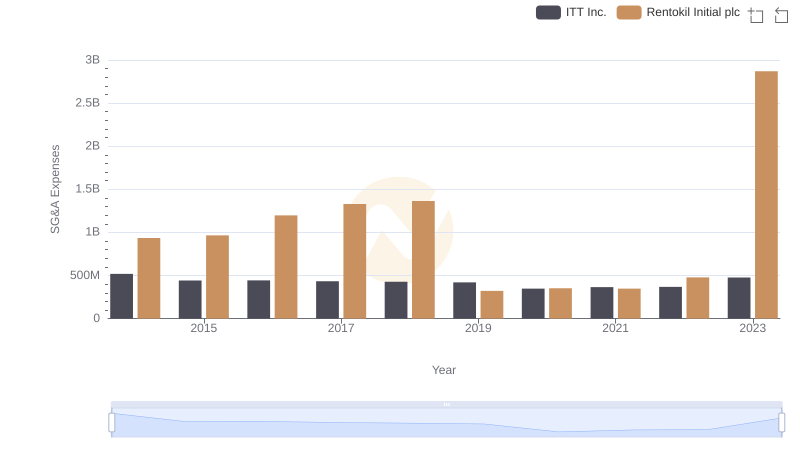

Breaking Down SG&A Expenses: Rentokil Initial plc vs ITT Inc.

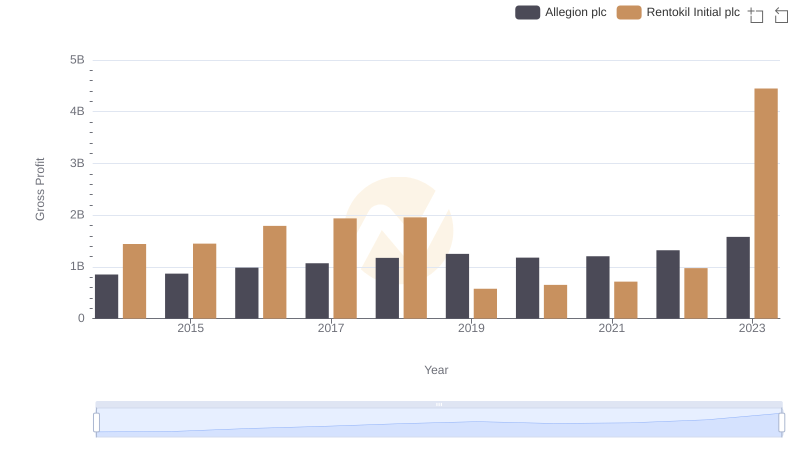

Gross Profit Trends Compared: Rentokil Initial plc vs Allegion plc

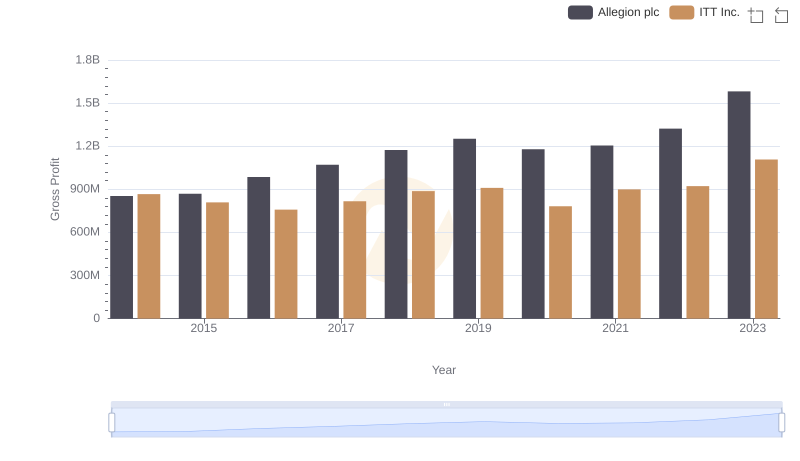

ITT Inc. and Allegion plc: A Detailed Gross Profit Analysis

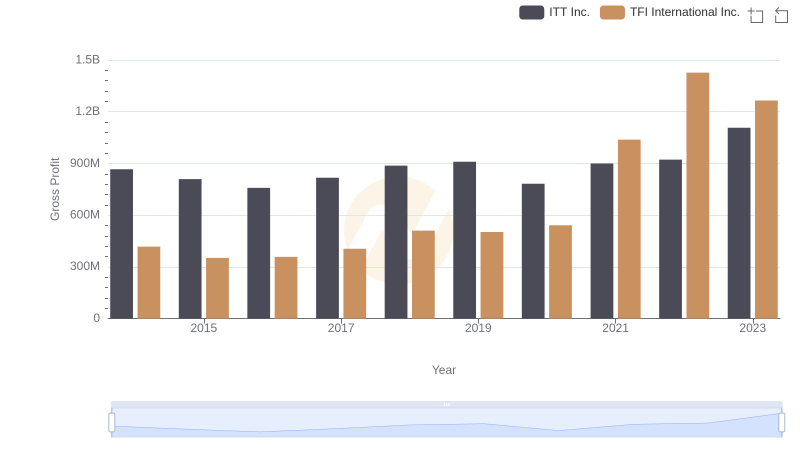

Gross Profit Trends Compared: ITT Inc. vs TFI International Inc.