| __timestamp | Block, Inc. | NetEase, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 226074000 | 8451290000 |

| Thursday, January 1, 2015 | 370030000 | 13403635000 |

| Friday, January 1, 2016 | 576038000 | 21663812000 |

| Sunday, January 1, 2017 | 839306000 | 25912693000 |

| Monday, January 1, 2018 | 1303700000 | 28403496000 |

| Tuesday, January 1, 2019 | 1889685000 | 31555300000 |

| Wednesday, January 1, 2020 | 2733409000 | 38983402000 |

| Friday, January 1, 2021 | 4419823000 | 46970801000 |

| Saturday, January 1, 2022 | 5991892000 | 52766126000 |

| Sunday, January 1, 2023 | 7504886000 | 63063394000 |

Unlocking the unknown

In the ever-evolving landscape of global technology, two giants, NetEase, Inc. and Block, Inc., have showcased remarkable growth in their gross profits over the past decade. From 2014 to 2023, NetEase, Inc. has consistently outperformed Block, Inc., with its gross profit soaring by approximately 646%, reaching a staggering $63 billion in 2023. In contrast, Block, Inc. has demonstrated a robust growth trajectory, with its gross profit increasing by over 3,200% to approximately $7.5 billion in the same period.

This comparison highlights the dynamic nature of the tech industry, where companies leverage innovation and strategic investments to drive financial success. As we delve into these trends, it becomes evident that while NetEase, Inc. maintains a commanding lead, Block, Inc.'s rapid growth underscores its potential to disrupt and redefine market dynamics in the coming years.

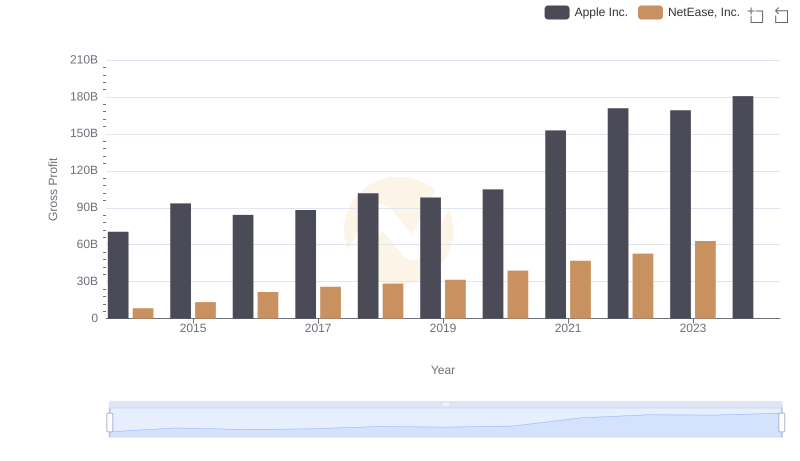

Gross Profit Analysis: Comparing Apple Inc. and NetEase, Inc.

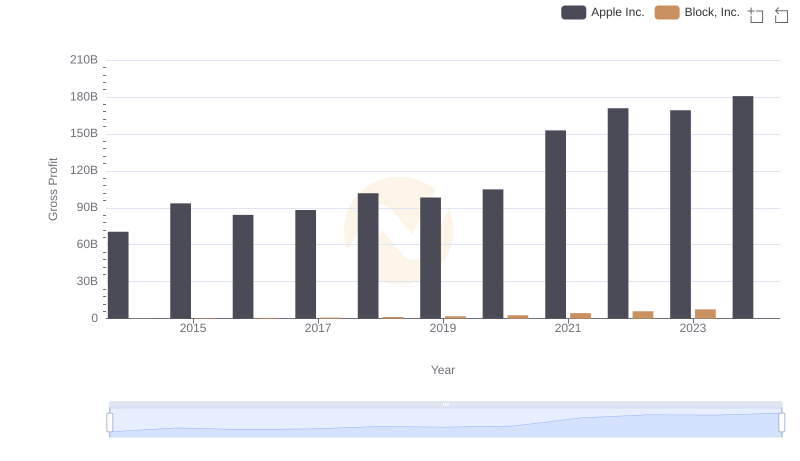

Gross Profit Trends Compared: Apple Inc. vs Block, Inc.

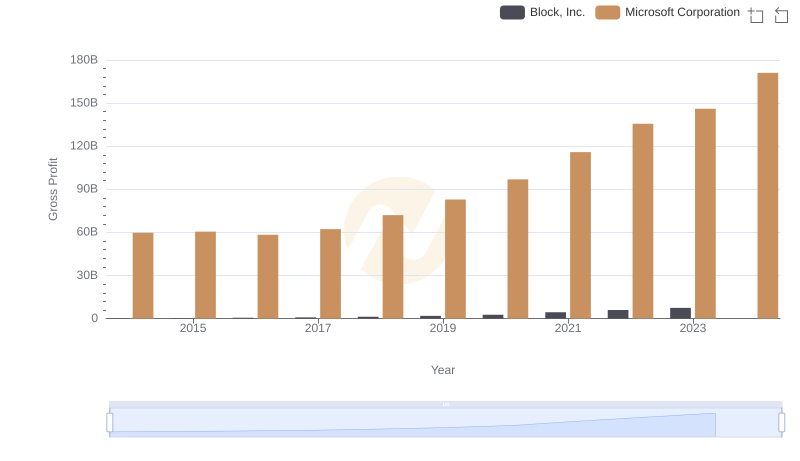

Microsoft Corporation and Block, Inc.: A Detailed Gross Profit Analysis

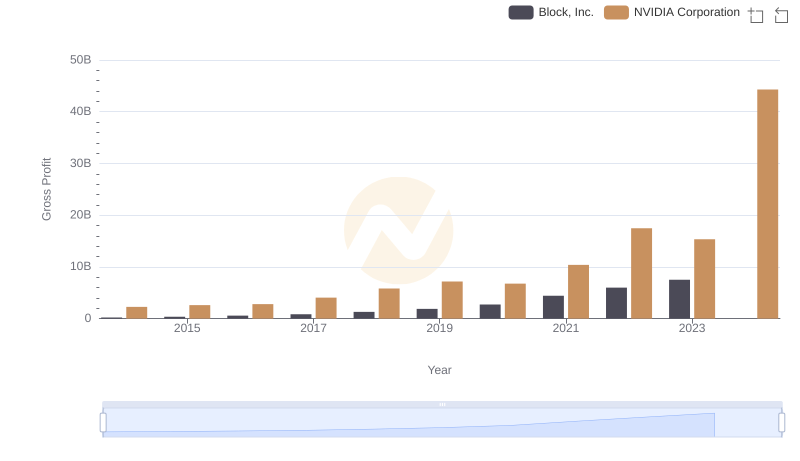

Gross Profit Analysis: Comparing NVIDIA Corporation and Block, Inc.

Who Generates Higher Gross Profit? Taiwan Semiconductor Manufacturing Company Limited or NetEase, Inc.

Taiwan Semiconductor Manufacturing Company Limited and Block, Inc.: A Detailed Gross Profit Analysis

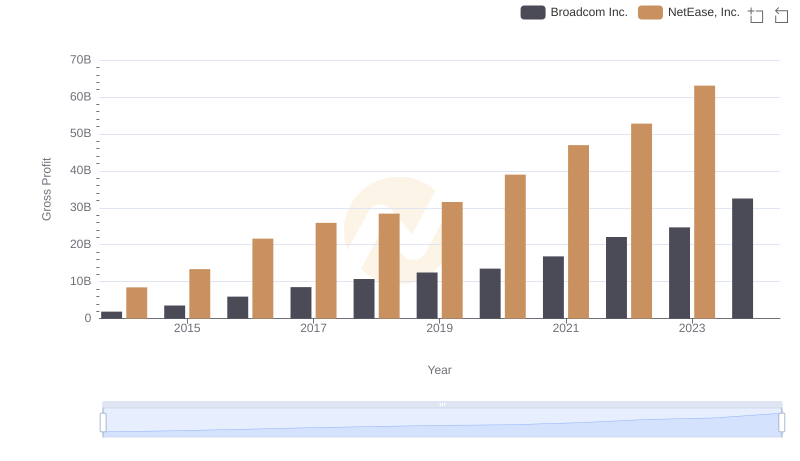

Key Insights on Gross Profit: Broadcom Inc. vs NetEase, Inc.

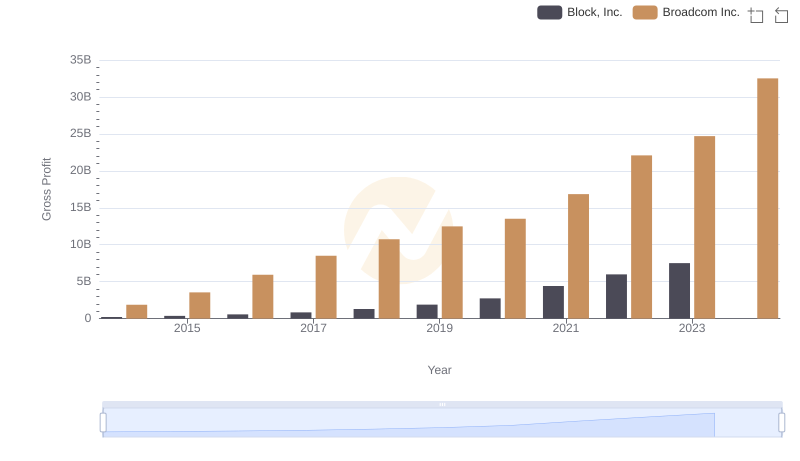

Gross Profit Comparison: Broadcom Inc. and Block, Inc. Trends

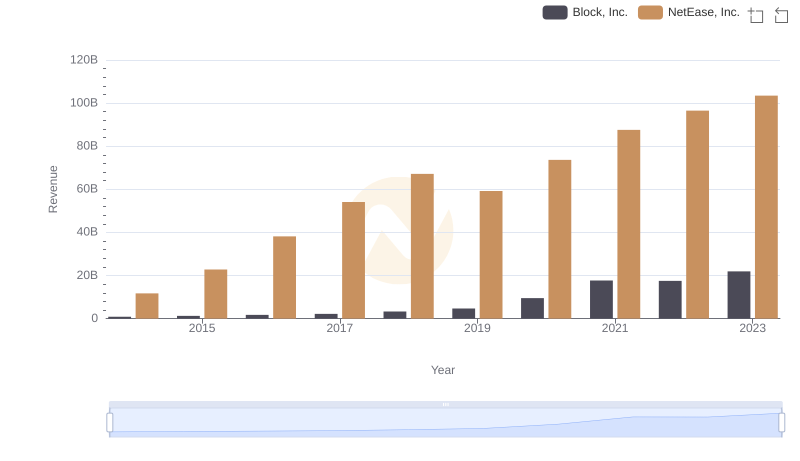

Annual Revenue Comparison: NetEase, Inc. vs Block, Inc.

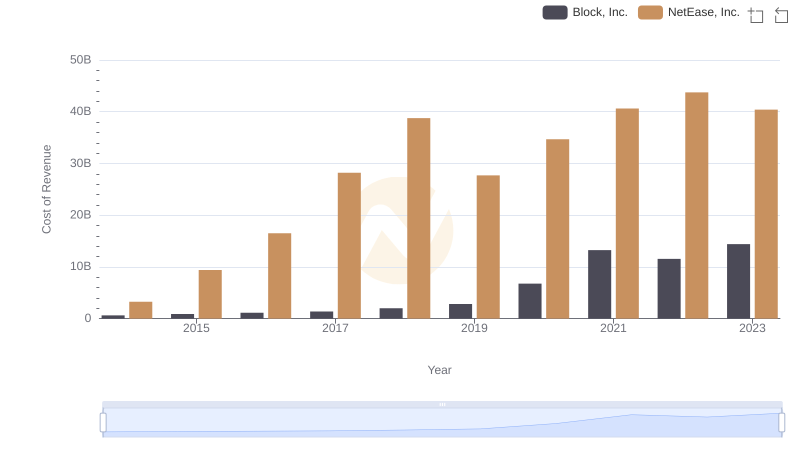

Cost of Revenue Trends: NetEase, Inc. vs Block, Inc.

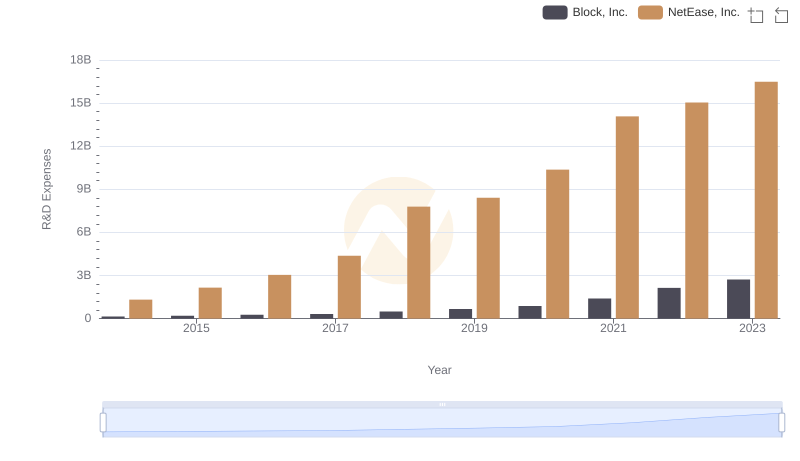

Comparing Innovation Spending: NetEase, Inc. and Block, Inc.

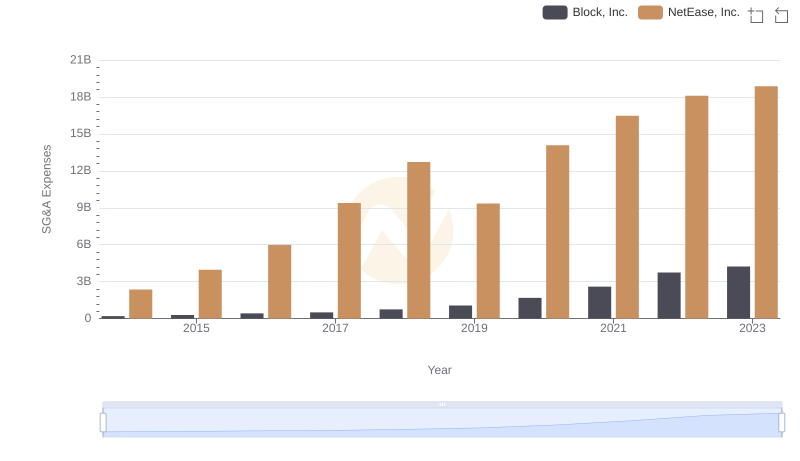

Selling, General, and Administrative Costs: NetEase, Inc. vs Block, Inc.