| __timestamp | United Parcel Service, Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 9055000000 | 323674000 |

| Thursday, January 1, 2015 | 9870000000 | 355865000 |

| Friday, January 1, 2016 | 9740000000 | 365698000 |

| Sunday, January 1, 2017 | 9611000000 | 375907000 |

| Monday, January 1, 2018 | 9292000000 | 394177000 |

| Tuesday, January 1, 2019 | 10194000000 | 391396000 |

| Wednesday, January 1, 2020 | 10366000000 | 426942000 |

| Friday, January 1, 2021 | 15821000000 | 656655000 |

| Saturday, January 1, 2022 | 17005000000 | 863261000 |

| Sunday, January 1, 2023 | 12714000000 | 829900000 |

| Monday, January 1, 2024 | 10185000000 | 781775000 |

Data in motion

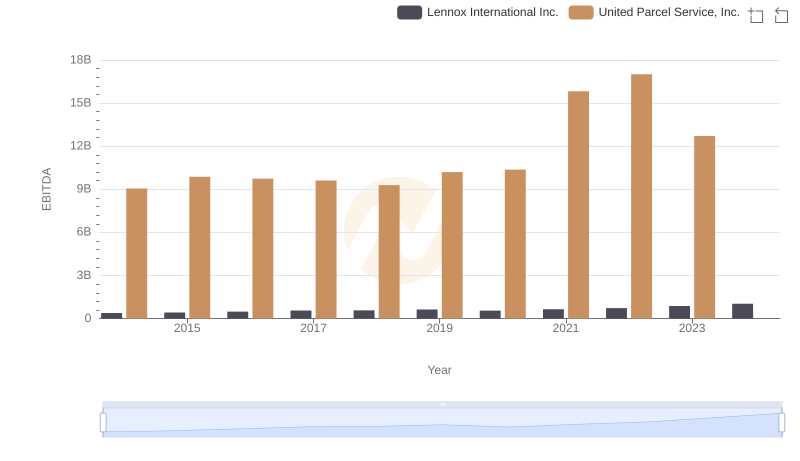

In the ever-evolving landscape of logistics and distribution, United Parcel Service, Inc. (UPS) and Watsco, Inc. have demonstrated contrasting financial trajectories over the past decade. From 2014 to 2023, UPS's EBITDA surged by approximately 40%, peaking in 2022 with a remarkable 17 billion USD. This growth underscores UPS's robust operational efficiency and strategic market positioning. In contrast, Watsco, Inc., a leader in HVAC distribution, experienced a more modest EBITDA growth of around 160%, reaching its zenith in 2022 with 863 million USD. This reflects Watsco's steady expansion and resilience in a competitive market. The data highlights UPS's dominance in scale, while Watsco's consistent growth showcases its niche market strength. As we look to the future, these trends offer valuable insights into the strategic directions and market dynamics of these industry giants.

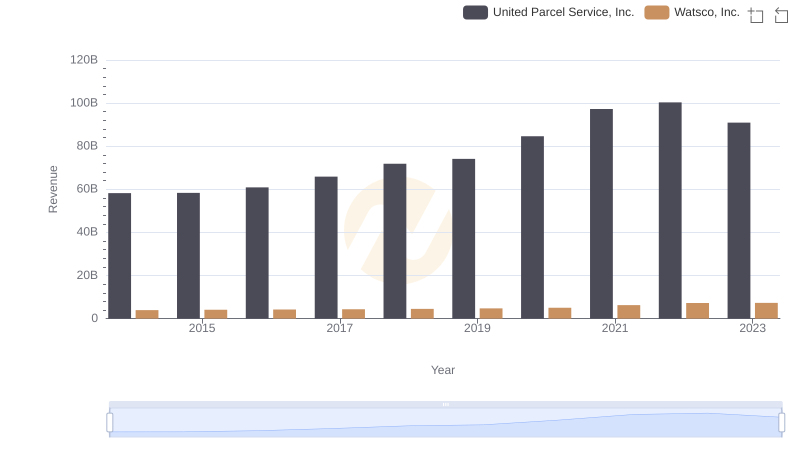

United Parcel Service, Inc. or Watsco, Inc.: Who Leads in Yearly Revenue?

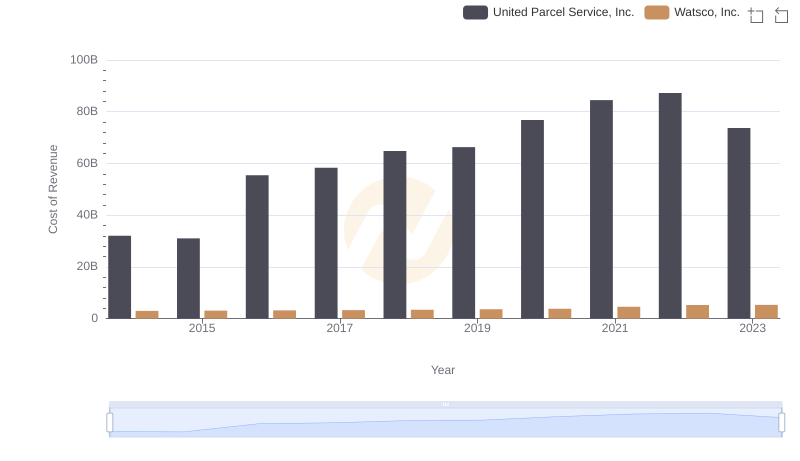

United Parcel Service, Inc. vs Watsco, Inc.: Efficiency in Cost of Revenue Explored

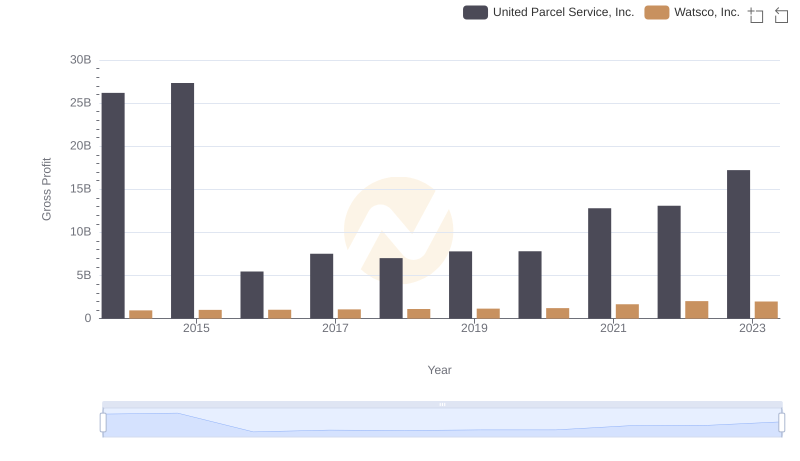

Gross Profit Comparison: United Parcel Service, Inc. and Watsco, Inc. Trends

Comprehensive EBITDA Comparison: United Parcel Service, Inc. vs TransUnion

EBITDA Metrics Evaluated: United Parcel Service, Inc. vs Lennox International Inc.

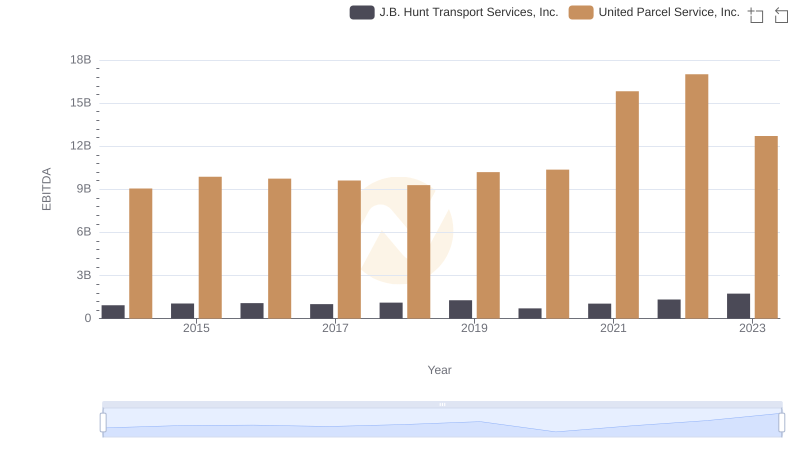

EBITDA Metrics Evaluated: United Parcel Service, Inc. vs J.B. Hunt Transport Services, Inc.

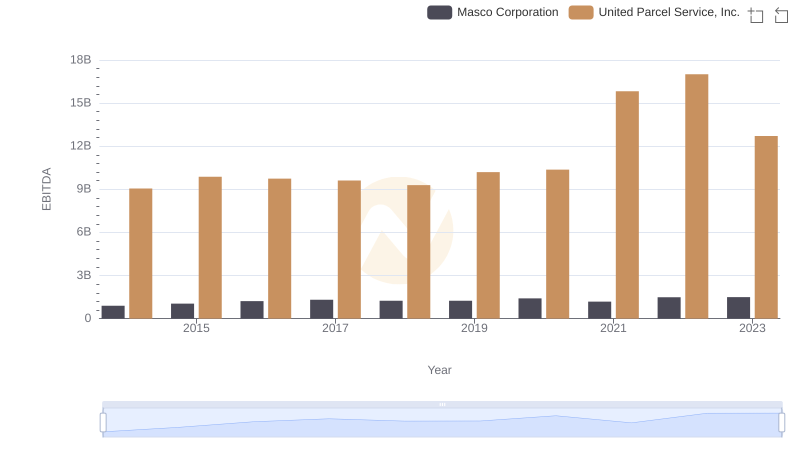

Comparative EBITDA Analysis: United Parcel Service, Inc. vs Masco Corporation

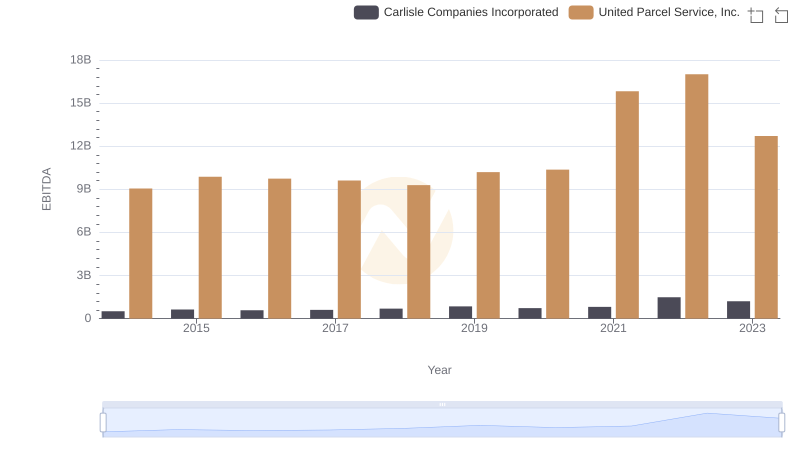

A Professional Review of EBITDA: United Parcel Service, Inc. Compared to Carlisle Companies Incorporated

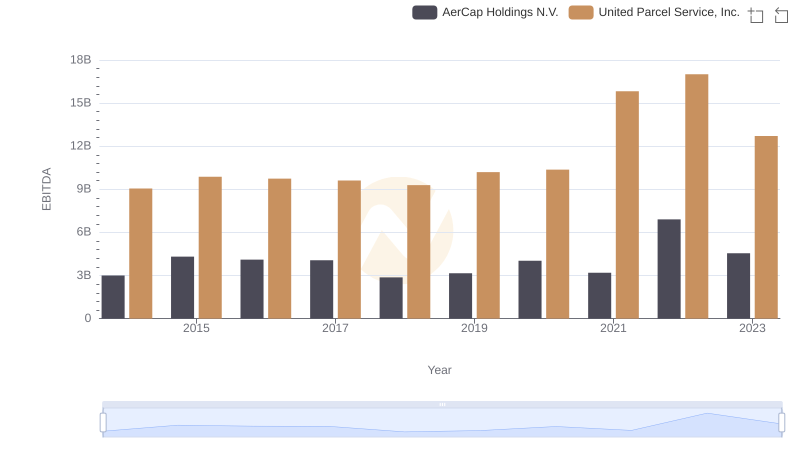

EBITDA Analysis: Evaluating United Parcel Service, Inc. Against AerCap Holdings N.V.

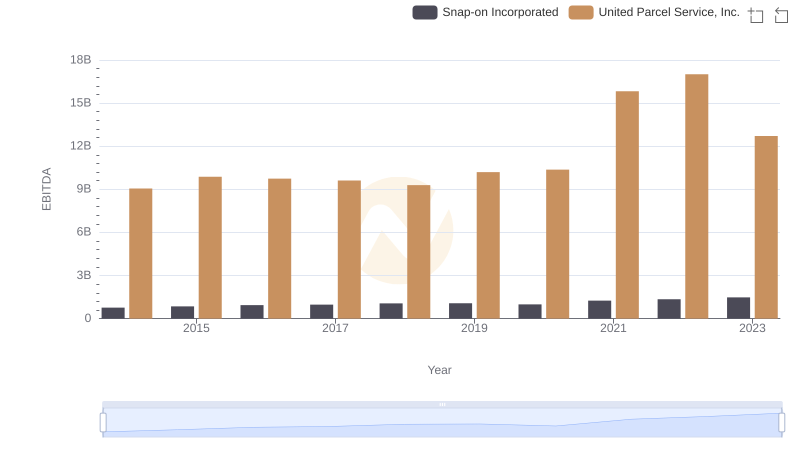

Comprehensive EBITDA Comparison: United Parcel Service, Inc. vs Snap-on Incorporated