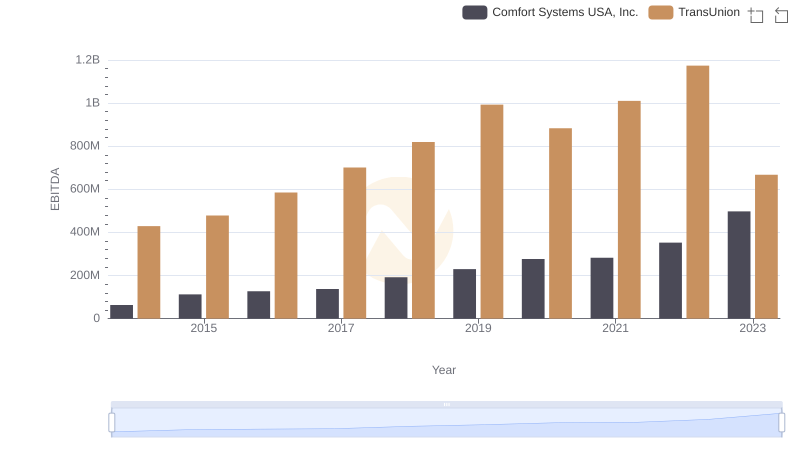

| __timestamp | Pool Corporation | TransUnion |

|---|---|---|

| Wednesday, January 1, 2014 | 204752000 | 429400000 |

| Thursday, January 1, 2015 | 233610000 | 478200000 |

| Friday, January 1, 2016 | 277836000 | 585300000 |

| Sunday, January 1, 2017 | 310096000 | 701100000 |

| Monday, January 1, 2018 | 341804000 | 819800000 |

| Tuesday, January 1, 2019 | 370520000 | 993200000 |

| Wednesday, January 1, 2020 | 493425000 | 883400000 |

| Friday, January 1, 2021 | 862810000 | 1010500000 |

| Saturday, January 1, 2022 | 1064808000 | 1173800000 |

| Sunday, January 1, 2023 | 786707000 | 667300000 |

| Monday, January 1, 2024 | 1204100000 |

In pursuit of knowledge

In the ever-evolving landscape of financial performance, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) serves as a crucial metric for evaluating a company's operational efficiency. Over the past decade, from 2014 to 2023, TransUnion and Pool Corporation have demonstrated intriguing trends in their EBITDA growth.

TransUnion, a global information and insights company, has shown a remarkable 173% increase in EBITDA from 2014 to 2022, peaking in 2022. However, 2023 saw a decline, with EBITDA dropping by approximately 43% from the previous year. Meanwhile, Pool Corporation, a leading distributor of swimming pool supplies, experienced a steady rise, with a 385% increase in EBITDA from 2014 to 2022, reaching its zenith in 2022. Despite a dip in 2023, Pool Corporation's EBITDA remained robust, underscoring its resilience.

These trends highlight the dynamic nature of financial performance, influenced by market conditions and strategic decisions.

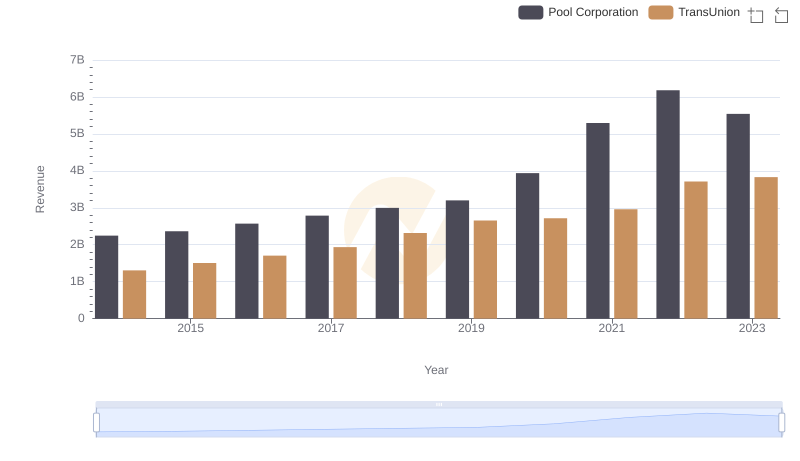

TransUnion vs Pool Corporation: Annual Revenue Growth Compared

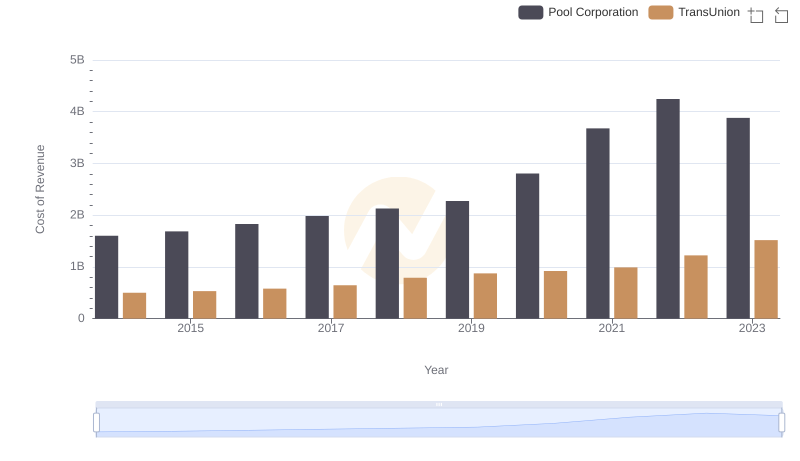

Cost of Revenue: Key Insights for TransUnion and Pool Corporation

Breaking Down SG&A Expenses: TransUnion vs Pool Corporation

Professional EBITDA Benchmarking: TransUnion vs Comfort Systems USA, Inc.

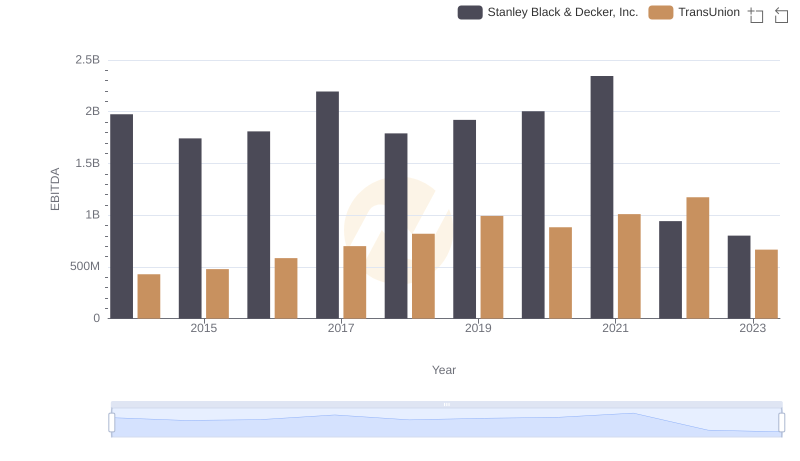

EBITDA Analysis: Evaluating TransUnion Against Stanley Black & Decker, Inc.

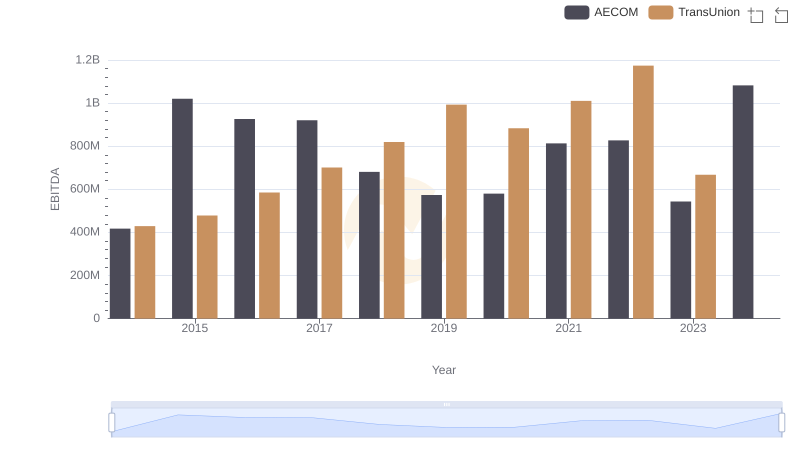

EBITDA Performance Review: TransUnion vs AECOM

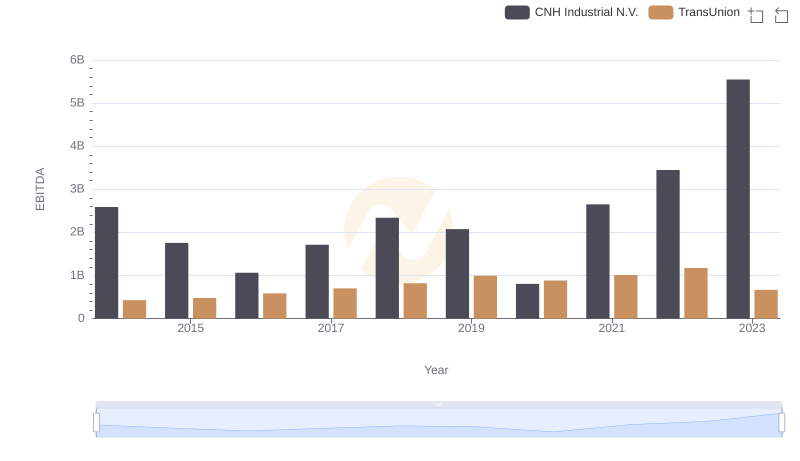

A Professional Review of EBITDA: TransUnion Compared to CNH Industrial N.V.

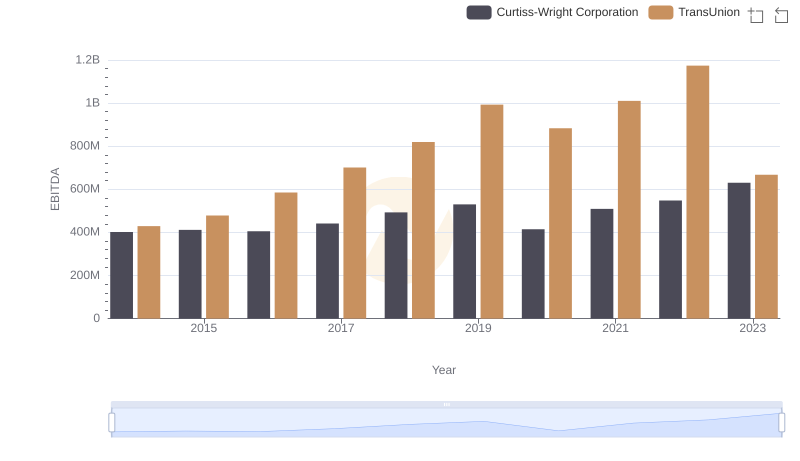

EBITDA Performance Review: TransUnion vs Curtiss-Wright Corporation

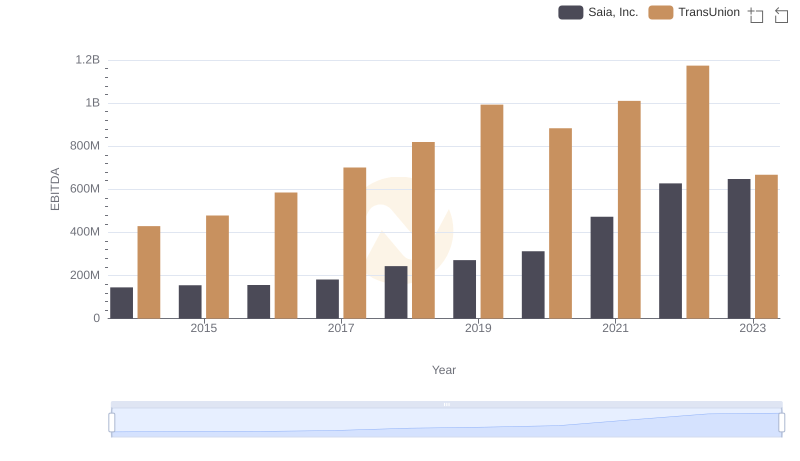

Professional EBITDA Benchmarking: TransUnion vs Saia, Inc.

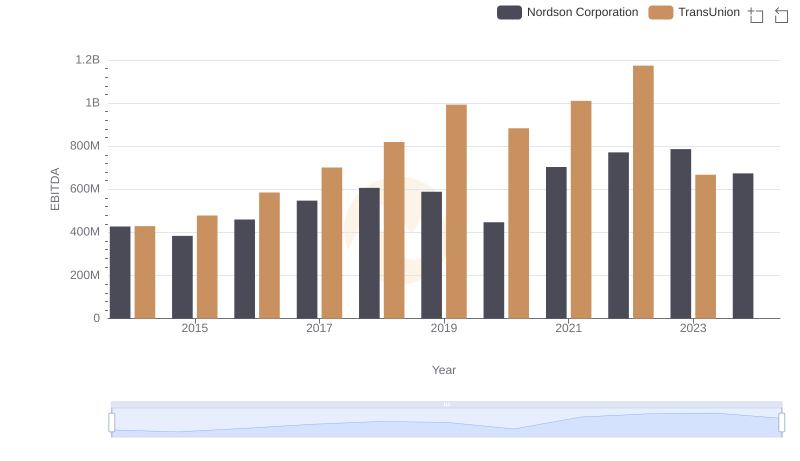

EBITDA Metrics Evaluated: TransUnion vs Nordson Corporation

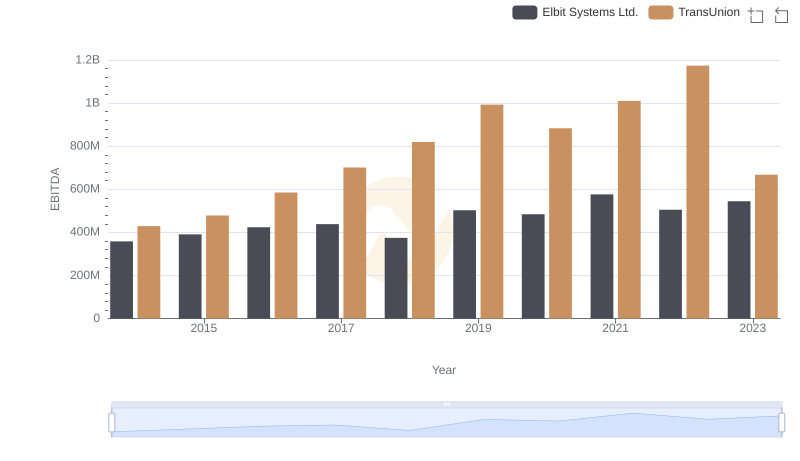

Comprehensive EBITDA Comparison: TransUnion vs Elbit Systems Ltd.