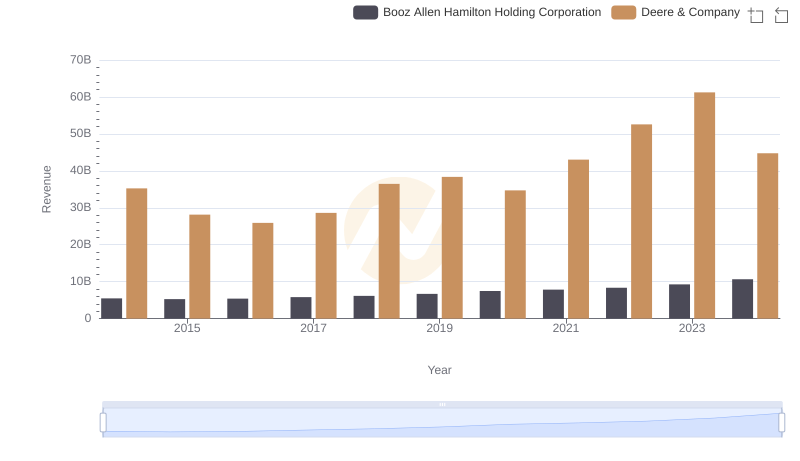

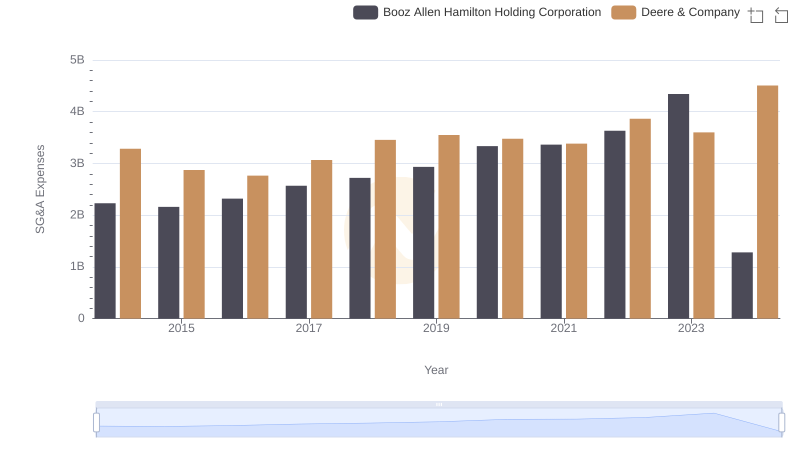

| __timestamp | Booz Allen Hamilton Holding Corporation | Deere & Company |

|---|---|---|

| Wednesday, January 1, 2014 | 2716113000 | 24775800000 |

| Thursday, January 1, 2015 | 2593849000 | 20143200000 |

| Friday, January 1, 2016 | 2580026000 | 18248900000 |

| Sunday, January 1, 2017 | 2691982000 | 19933500000 |

| Monday, January 1, 2018 | 2867103000 | 25571200000 |

| Tuesday, January 1, 2019 | 3100466000 | 26792000000 |

| Wednesday, January 1, 2020 | 3379180000 | 23677000000 |

| Friday, January 1, 2021 | 3657530000 | 29116000000 |

| Saturday, January 1, 2022 | 3899622000 | 35338000000 |

| Sunday, January 1, 2023 | 4304810000 | 40105000000 |

| Monday, January 1, 2024 | 8202847000 | 30775000000 |

Unleashing insights

In the ever-evolving landscape of corporate efficiency, understanding cost management is crucial. This analysis delves into the cost of revenue trends for two industry giants: Deere & Company and Booz Allen Hamilton Holding Corporation, from 2014 to 2024.

Deere & Company, a leader in agricultural machinery, consistently shows a higher cost of revenue, peaking at approximately $40 billion in 2023. This reflects its expansive operations and global reach. In contrast, Booz Allen Hamilton, a consulting powerhouse, maintains a more modest cost structure, with a notable spike to $8.2 billion in 2024, indicating strategic investments or expansions.

Over the decade, Deere's cost of revenue grew by about 62%, while Booz Allen's increased by 202%. This stark contrast highlights differing business models and market strategies, offering valuable insights into operational efficiency and financial management.

Deere & Company and Booz Allen Hamilton Holding Corporation: A Comprehensive Revenue Analysis

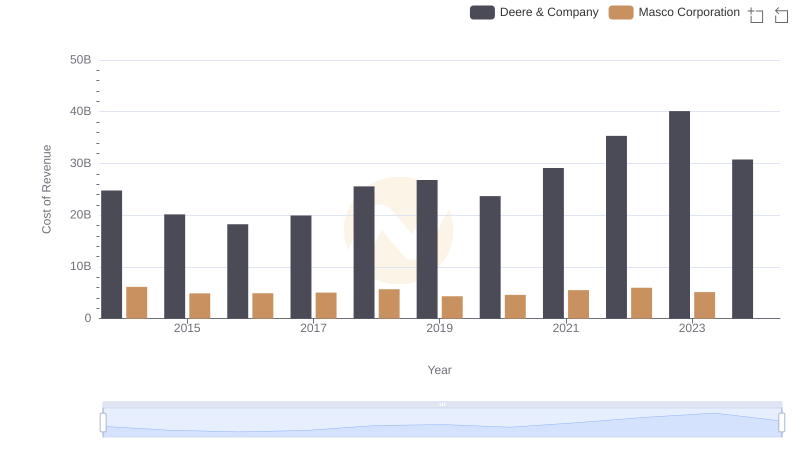

Deere & Company vs Masco Corporation: Efficiency in Cost of Revenue Explored

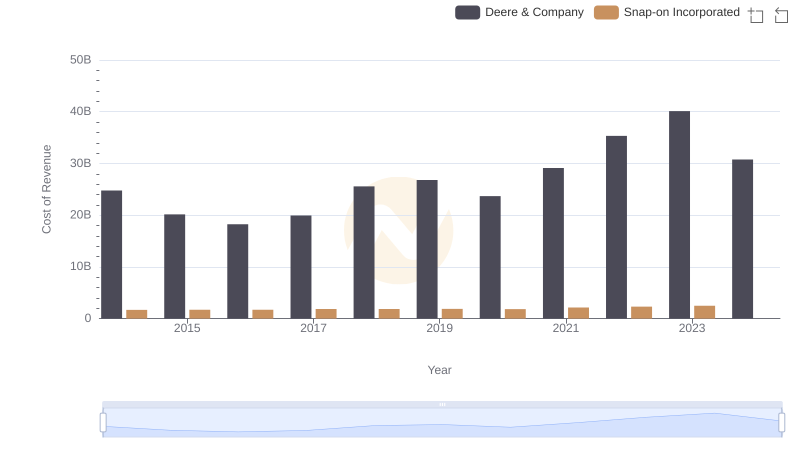

Comparing Cost of Revenue Efficiency: Deere & Company vs Snap-on Incorporated

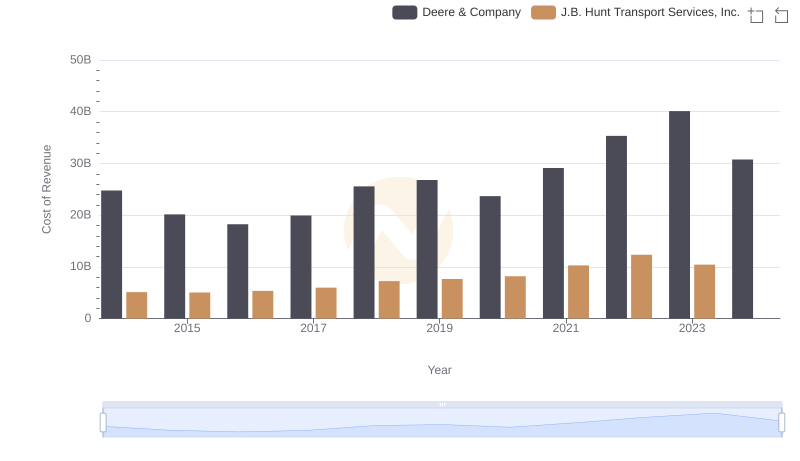

Cost of Revenue: Key Insights for Deere & Company and J.B. Hunt Transport Services, Inc.

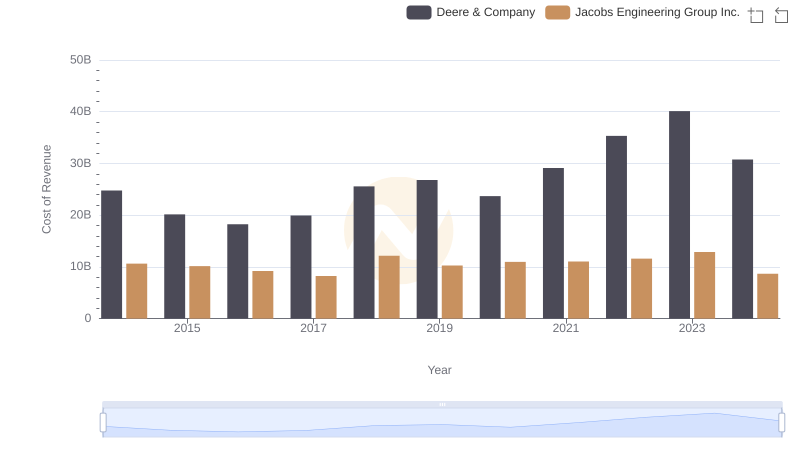

Cost Insights: Breaking Down Deere & Company and Jacobs Engineering Group Inc.'s Expenses

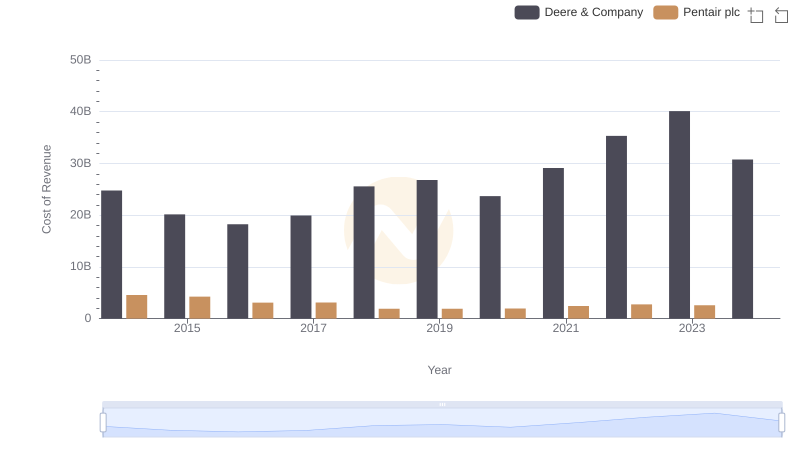

Cost of Revenue: Key Insights for Deere & Company and Pentair plc

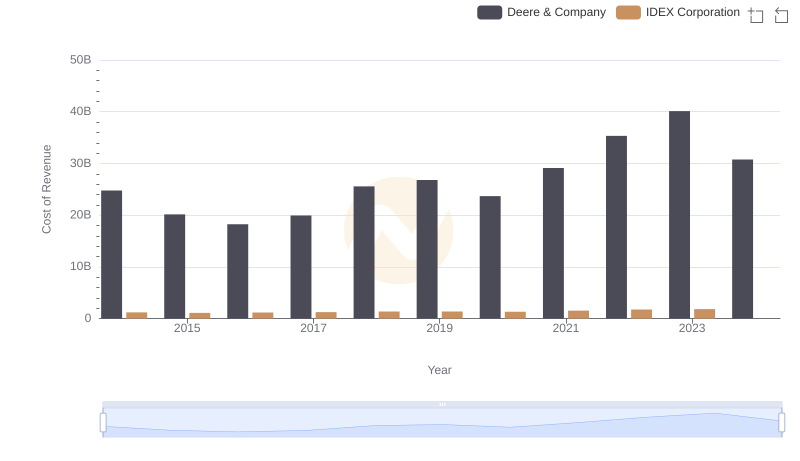

Comparing Cost of Revenue Efficiency: Deere & Company vs IDEX Corporation

Deere & Company and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared