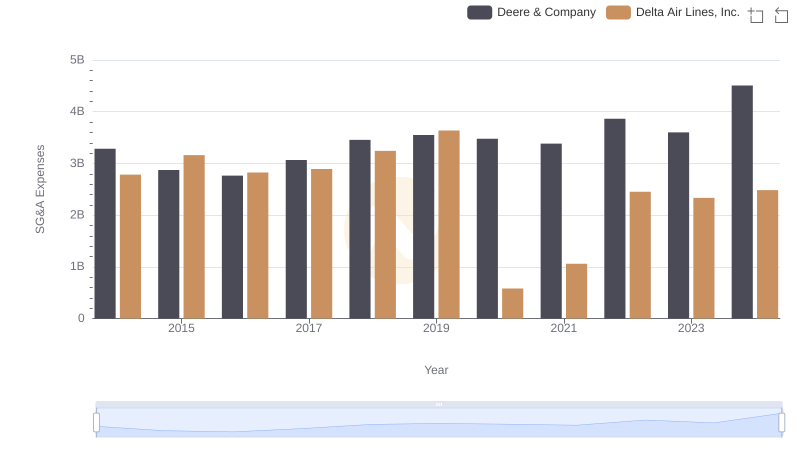

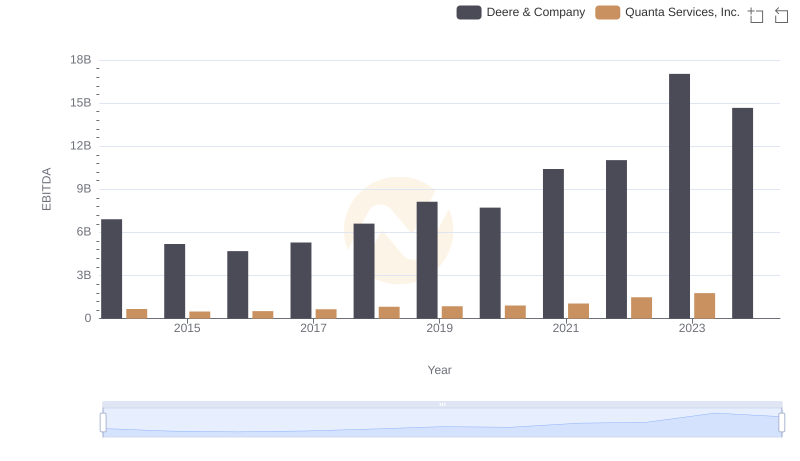

| __timestamp | Deere & Company | Quanta Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3284400000 | 580730000 |

| Thursday, January 1, 2015 | 2873300000 | 592863000 |

| Friday, January 1, 2016 | 2763700000 | 653338000 |

| Sunday, January 1, 2017 | 3066600000 | 777920000 |

| Monday, January 1, 2018 | 3455500000 | 857574000 |

| Tuesday, January 1, 2019 | 3551000000 | 955991000 |

| Wednesday, January 1, 2020 | 3477000000 | 975074000 |

| Friday, January 1, 2021 | 3383000000 | 1155956000 |

| Saturday, January 1, 2022 | 3863000000 | 1336711000 |

| Sunday, January 1, 2023 | 3601000000 | 1555137000 |

| Monday, January 1, 2024 | 4507000000 |

Data in motion

In the competitive landscape of industrial giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Deere & Company and Quanta Services, Inc. have showcased contrasting strategies in handling these costs. From 2014 to 2023, Deere & Company consistently reported higher SG&A expenses, peaking at approximately $4.5 billion in 2024. In contrast, Quanta Services, Inc. demonstrated a more conservative approach, with expenses rising from around $580 million in 2014 to $1.56 billion in 2023. This represents a 168% increase for Quanta, compared to a 37% increase for Deere over the same period. The data suggests that while Deere's expenses are higher, Quanta's rapid growth in SG&A costs could indicate aggressive expansion strategies. However, the absence of data for Quanta in 2024 leaves room for speculation on their future trajectory.

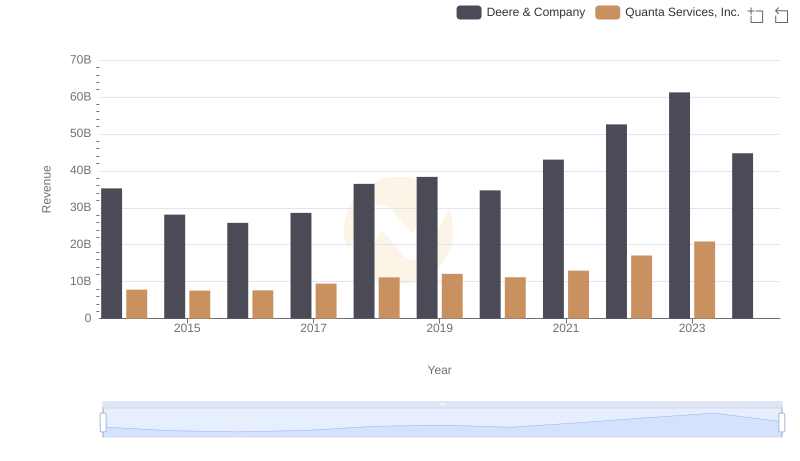

Deere & Company and Quanta Services, Inc.: A Comprehensive Revenue Analysis

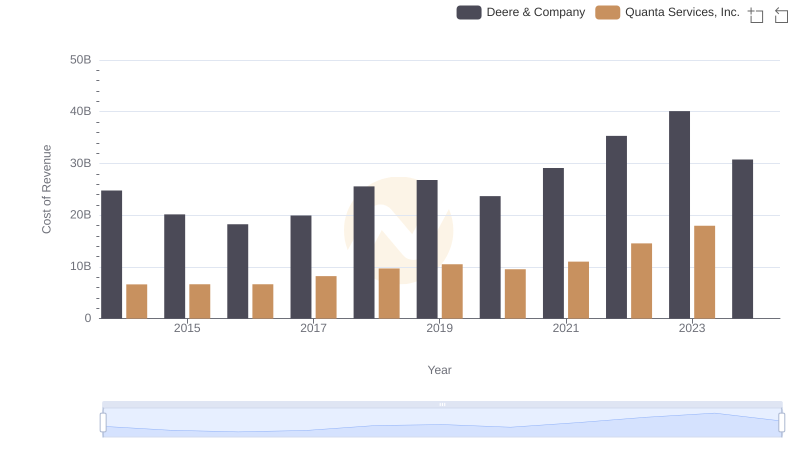

Cost of Revenue Comparison: Deere & Company vs Quanta Services, Inc.

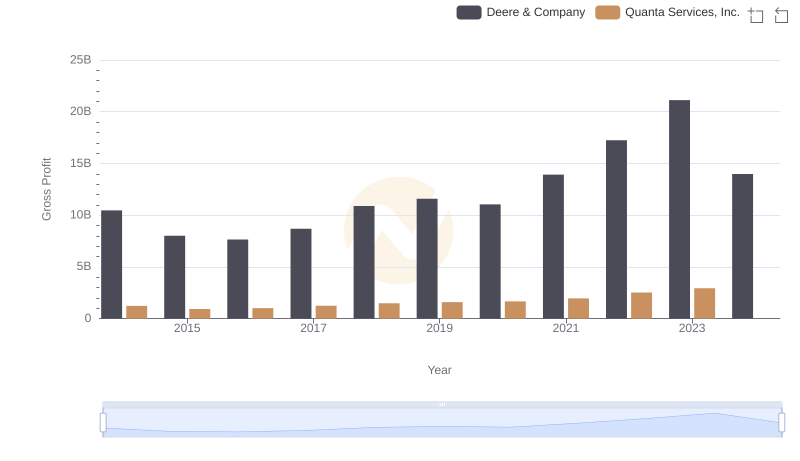

Gross Profit Comparison: Deere & Company and Quanta Services, Inc. Trends

Who Optimizes SG&A Costs Better? Deere & Company or Delta Air Lines, Inc.

Deere & Company or PACCAR Inc: Who Manages SG&A Costs Better?

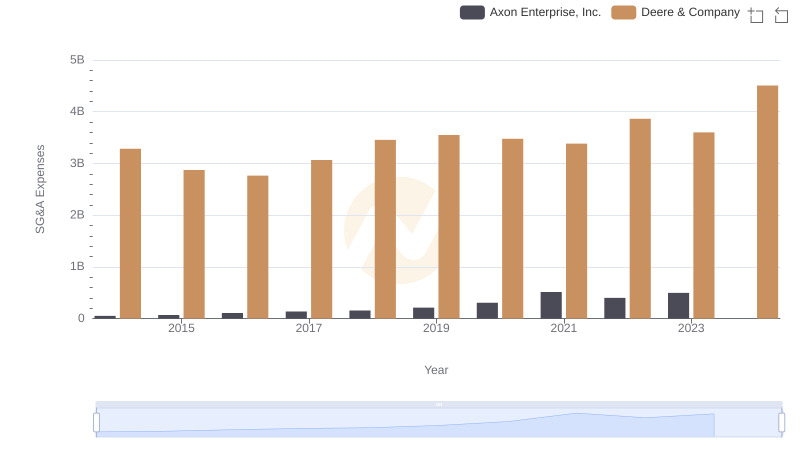

Deere & Company and Axon Enterprise, Inc.: SG&A Spending Patterns Compared

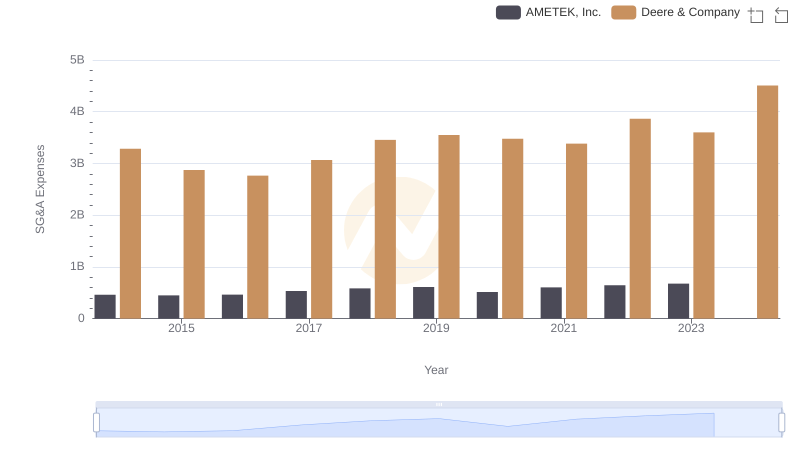

Who Optimizes SG&A Costs Better? Deere & Company or AMETEK, Inc.

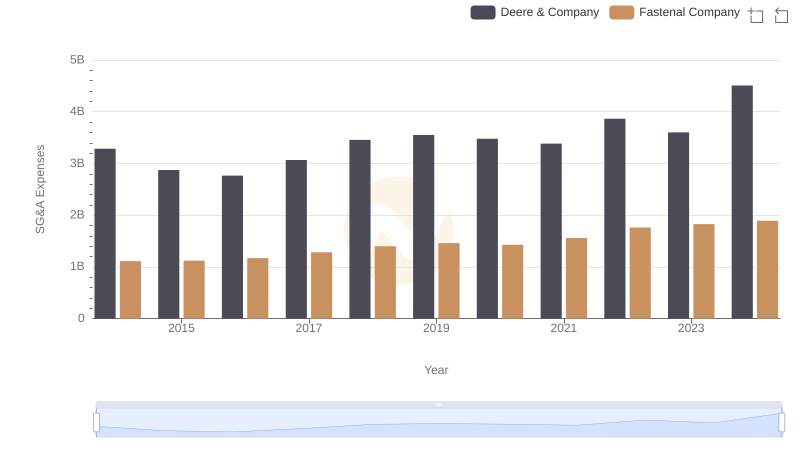

Selling, General, and Administrative Costs: Deere & Company vs Fastenal Company

EBITDA Performance Review: Deere & Company vs Quanta Services, Inc.