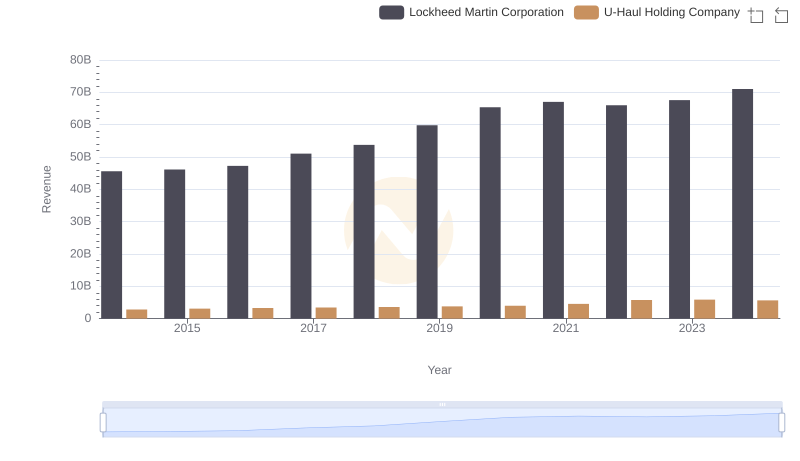

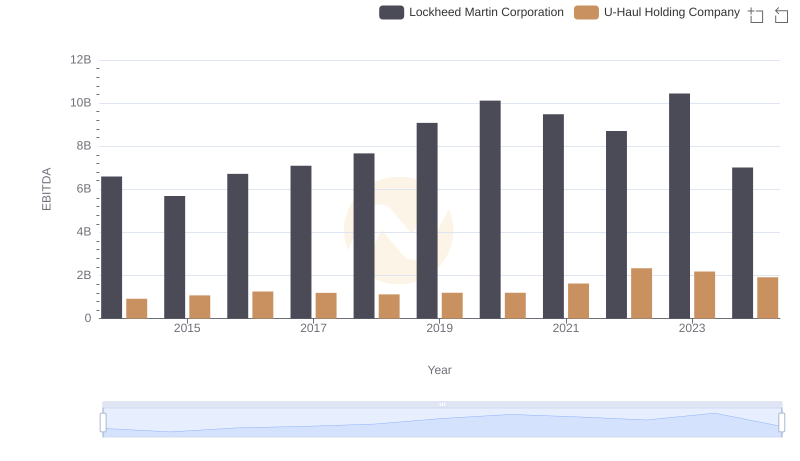

| __timestamp | Lockheed Martin Corporation | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 40226000000 | 127270000 |

| Thursday, January 1, 2015 | 40830000000 | 146072000 |

| Friday, January 1, 2016 | 42106000000 | 144990000 |

| Sunday, January 1, 2017 | 45500000000 | 152485000 |

| Monday, January 1, 2018 | 46392000000 | 160489000 |

| Tuesday, January 1, 2019 | 51445000000 | 162142000 |

| Wednesday, January 1, 2020 | 56744000000 | 164018000 |

| Friday, January 1, 2021 | 57983000000 | 214059000 |

| Saturday, January 1, 2022 | 57697000000 | 259585000 |

| Sunday, January 1, 2023 | 59092000000 | 844894000 |

| Monday, January 1, 2024 | 64113000000 | 3976040000 |

Cracking the code

In the world of aerospace and transportation, Lockheed Martin Corporation and U-Haul Holding Company stand as titans in their respective fields. Over the past decade, from 2014 to 2024, these companies have shown distinct trends in their cost of revenue, reflecting their unique business models and market dynamics.

Lockheed Martin, a leader in aerospace and defense, has seen a steady increase in its cost of revenue, growing by approximately 60% from 2014 to 2024. This growth underscores the company's expanding operations and increased demand for its cutting-edge technology and defense solutions.

Conversely, U-Haul, a household name in moving and storage, experienced a more volatile trend. Notably, from 2023 to 2024, U-Haul's cost of revenue surged by over 370%, indicating a significant shift in its operational scale or market strategy.

These trends highlight the diverse challenges and opportunities faced by companies in different sectors, offering valuable insights for investors and industry analysts alike.

Lockheed Martin Corporation vs U-Haul Holding Company: Examining Key Revenue Metrics

Cost of Revenue: Key Insights for Lockheed Martin Corporation and Comfort Systems USA, Inc.

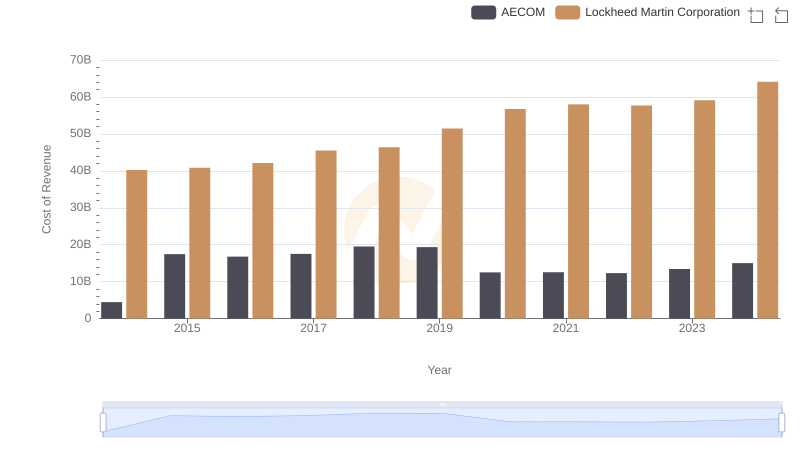

Cost of Revenue: Key Insights for Lockheed Martin Corporation and AECOM

Cost of Revenue Trends: Lockheed Martin Corporation vs Pool Corporation

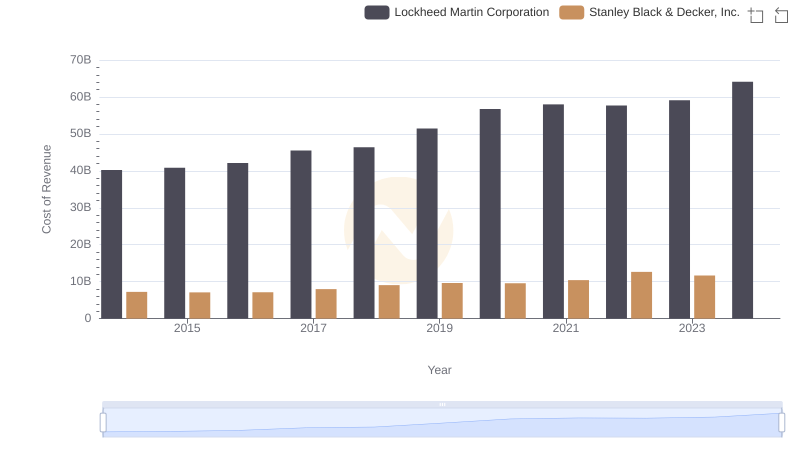

Cost Insights: Breaking Down Lockheed Martin Corporation and Stanley Black & Decker, Inc.'s Expenses

Lockheed Martin Corporation vs Elbit Systems Ltd.: Efficiency in Cost of Revenue Explored

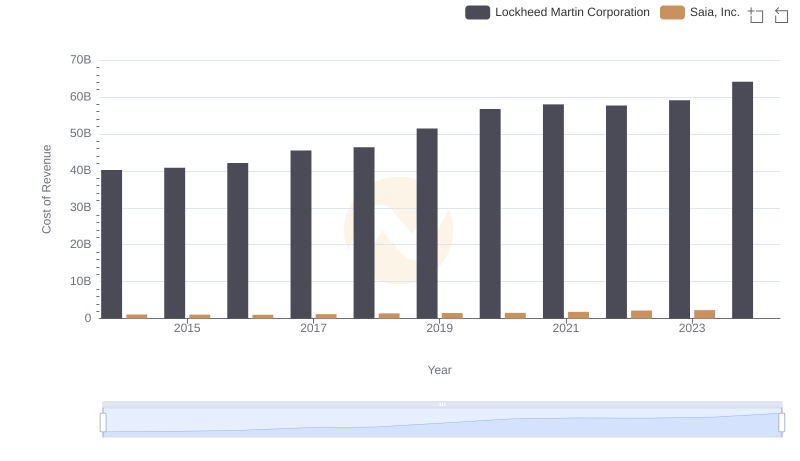

Comparing Cost of Revenue Efficiency: Lockheed Martin Corporation vs Saia, Inc.

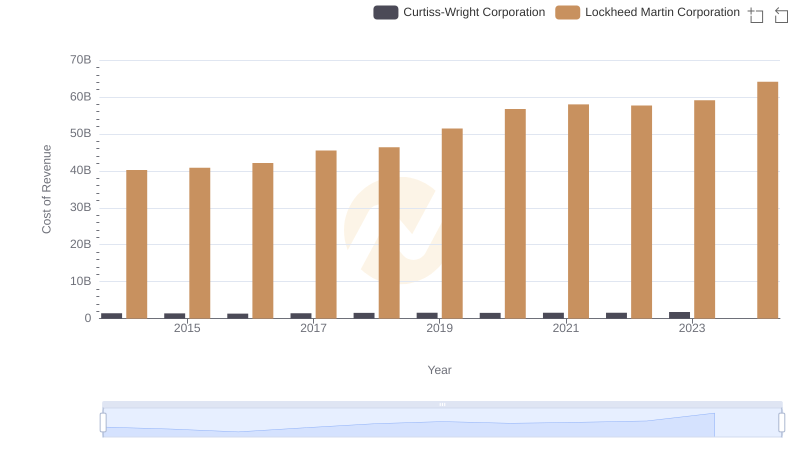

Analyzing Cost of Revenue: Lockheed Martin Corporation and Curtiss-Wright Corporation

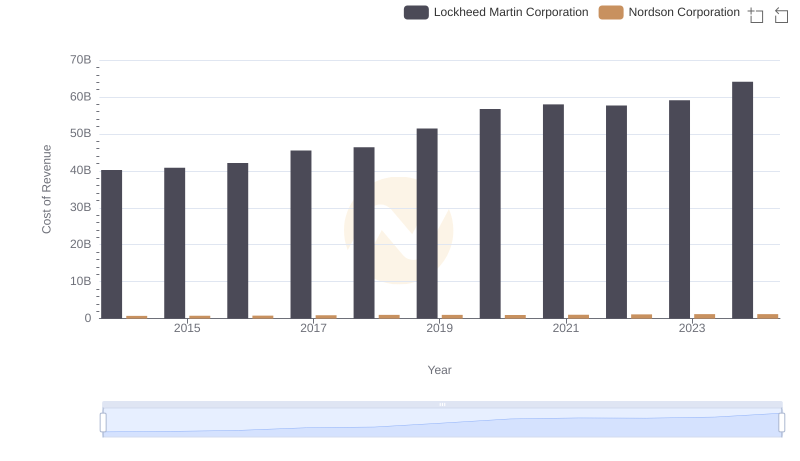

Cost Insights: Breaking Down Lockheed Martin Corporation and Nordson Corporation's Expenses

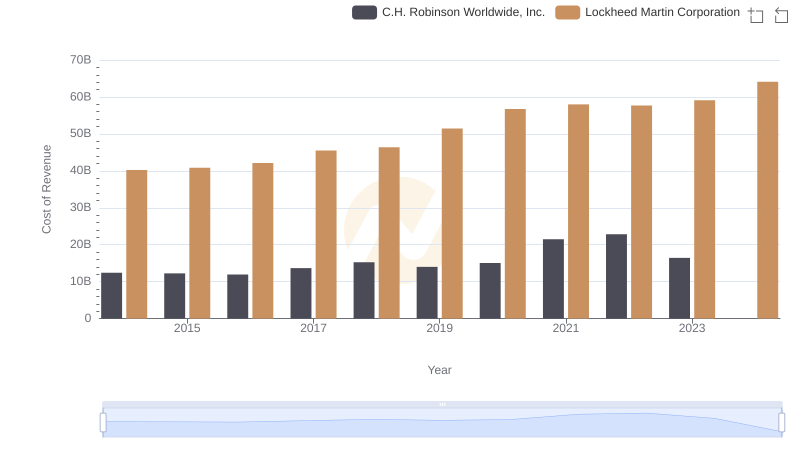

Cost Insights: Breaking Down Lockheed Martin Corporation and C.H. Robinson Worldwide, Inc.'s Expenses

EBITDA Metrics Evaluated: Lockheed Martin Corporation vs U-Haul Holding Company