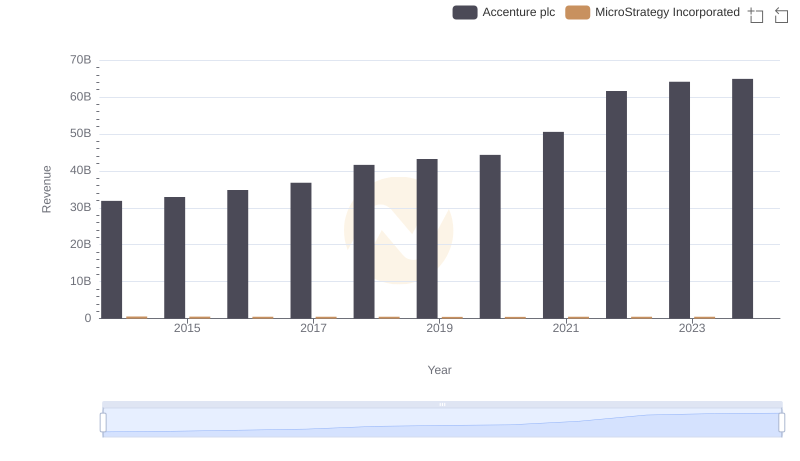

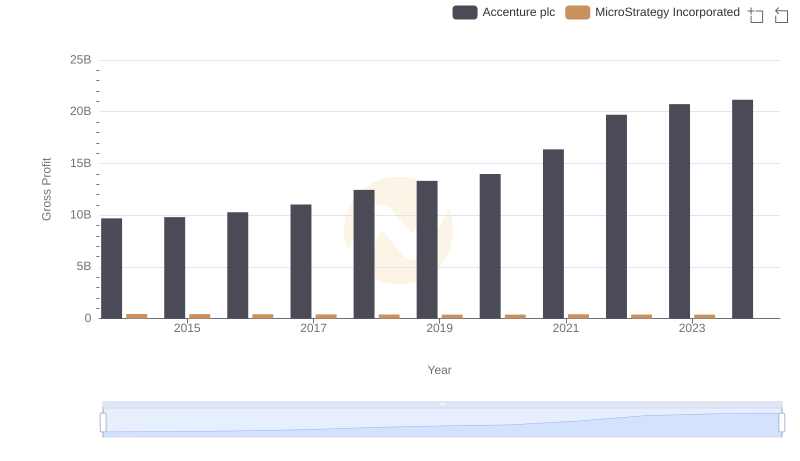

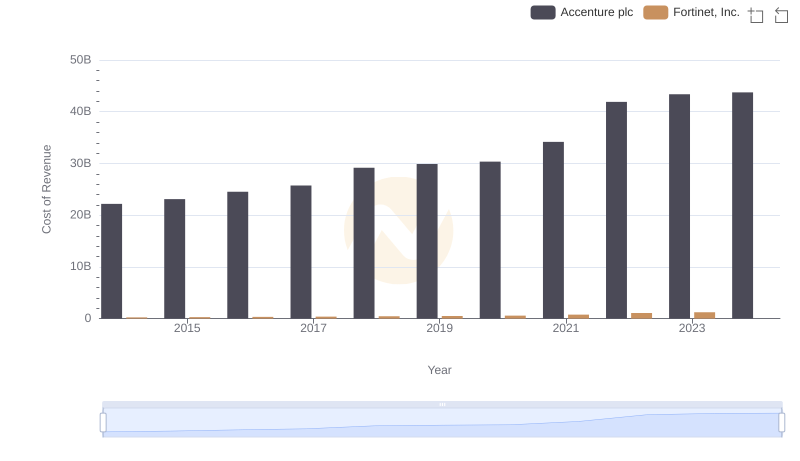

| __timestamp | Accenture plc | MicroStrategy Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 22190212000 | 135210000 |

| Thursday, January 1, 2015 | 23105185000 | 101108000 |

| Friday, January 1, 2016 | 24520234000 | 93147000 |

| Sunday, January 1, 2017 | 25734986000 | 96649000 |

| Monday, January 1, 2018 | 29160515000 | 99499000 |

| Tuesday, January 1, 2019 | 29900325000 | 99974000 |

| Wednesday, January 1, 2020 | 30350881000 | 91055000 |

| Friday, January 1, 2021 | 34169261000 | 91909000 |

| Saturday, January 1, 2022 | 41892766000 | 102989000 |

| Sunday, January 1, 2023 | 43380138000 | 109944000 |

| Monday, January 1, 2024 | 43734147000 | 129468000 |

In pursuit of knowledge

In the ever-evolving landscape of global business, understanding cost structures is crucial. Accenture plc, a leader in consulting and technology services, has seen its cost of revenue rise by nearly 97% from 2014 to 2023. This reflects its expanding operations and increased demand for digital transformation services. In contrast, MicroStrategy Incorporated, a prominent player in business intelligence, has maintained a relatively stable cost of revenue, with only a slight increase of about 2% over the same period.

These trends highlight the strategic differences between a consulting giant and a tech-focused firm.

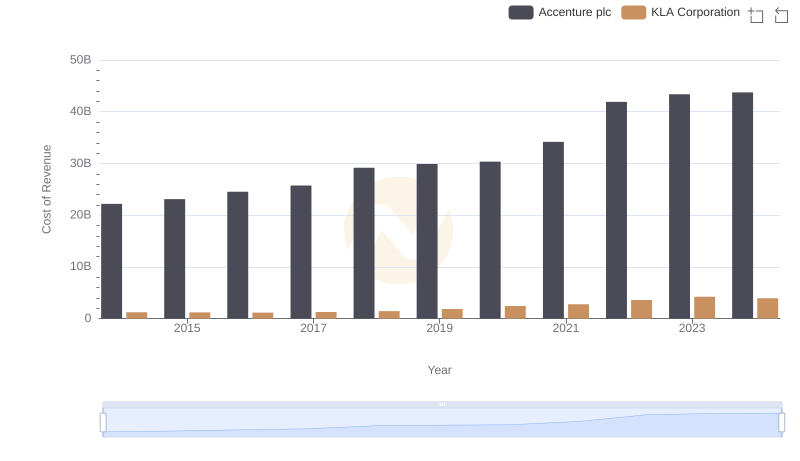

Cost of Revenue Trends: Accenture plc vs KLA Corporation

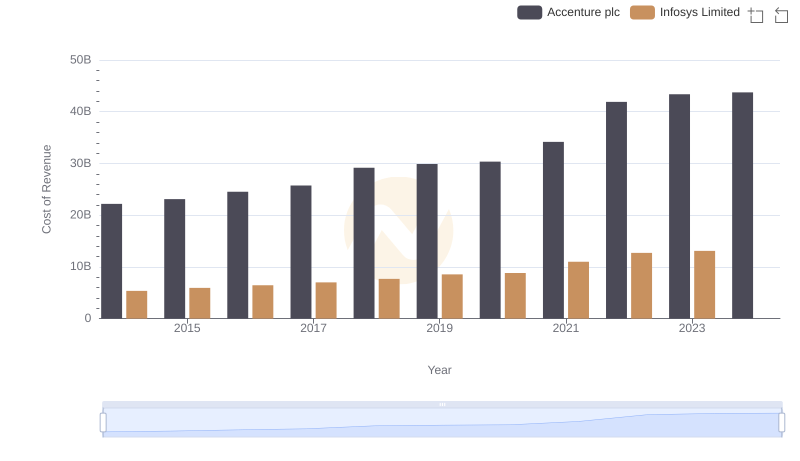

Cost of Revenue: Key Insights for Accenture plc and Infosys Limited

Accenture plc and MicroStrategy Incorporated: A Comprehensive Revenue Analysis

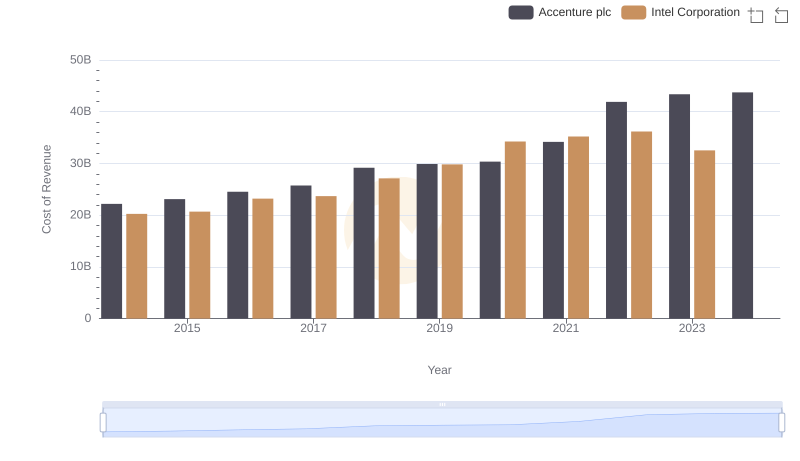

Cost Insights: Breaking Down Accenture plc and Intel Corporation's Expenses

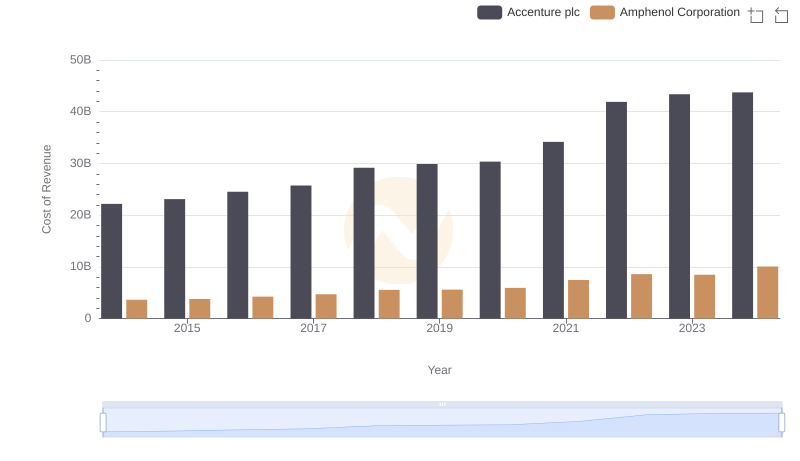

Accenture plc vs Amphenol Corporation: Efficiency in Cost of Revenue Explored

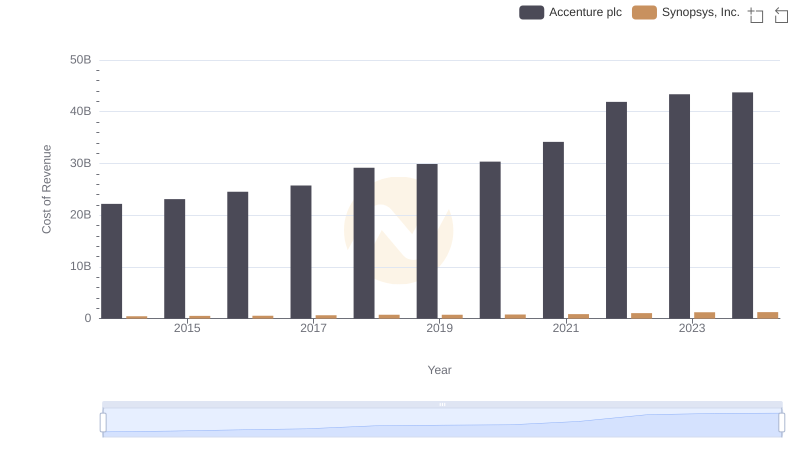

Comparing Cost of Revenue Efficiency: Accenture plc vs Synopsys, Inc.

Who Generates Higher Gross Profit? Accenture plc or MicroStrategy Incorporated

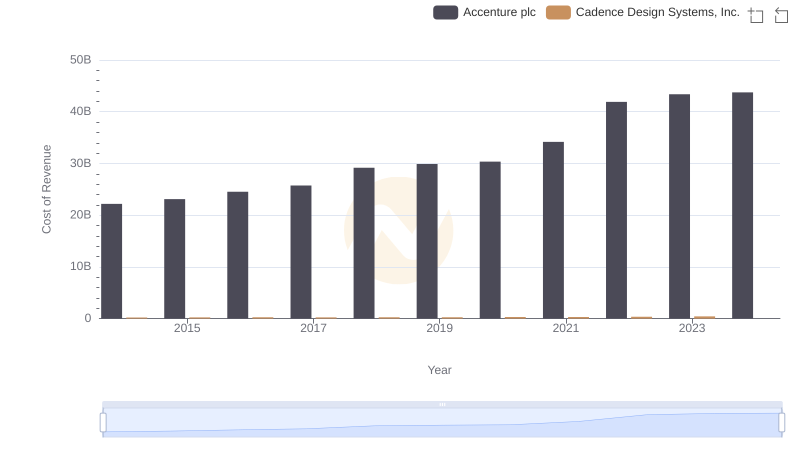

Cost of Revenue: Key Insights for Accenture plc and Cadence Design Systems, Inc.

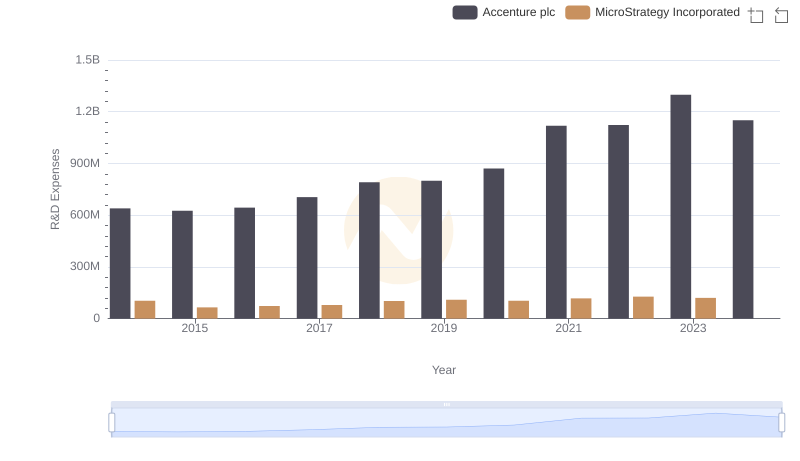

R&D Insights: How Accenture plc and MicroStrategy Incorporated Allocate Funds

Accenture plc vs Fortinet, Inc.: Efficiency in Cost of Revenue Explored

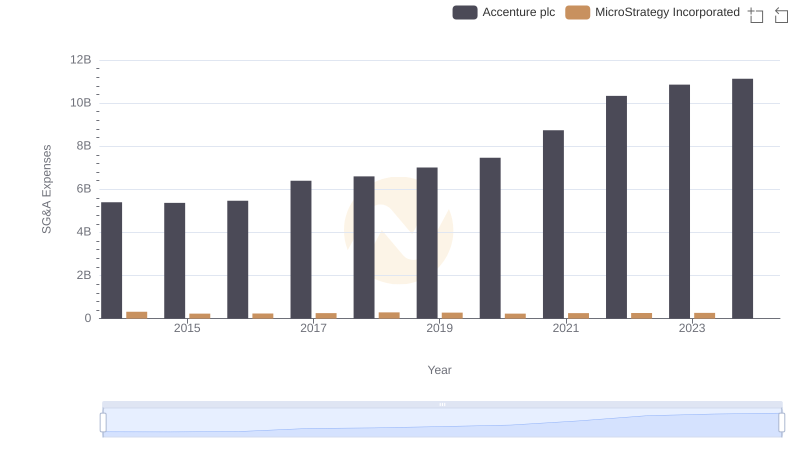

Cost Management Insights: SG&A Expenses for Accenture plc and MicroStrategy Incorporated